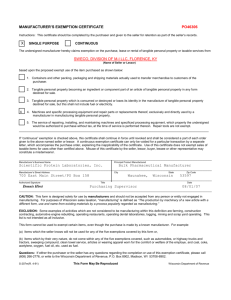

Form ST-5C - Grant Steel Company

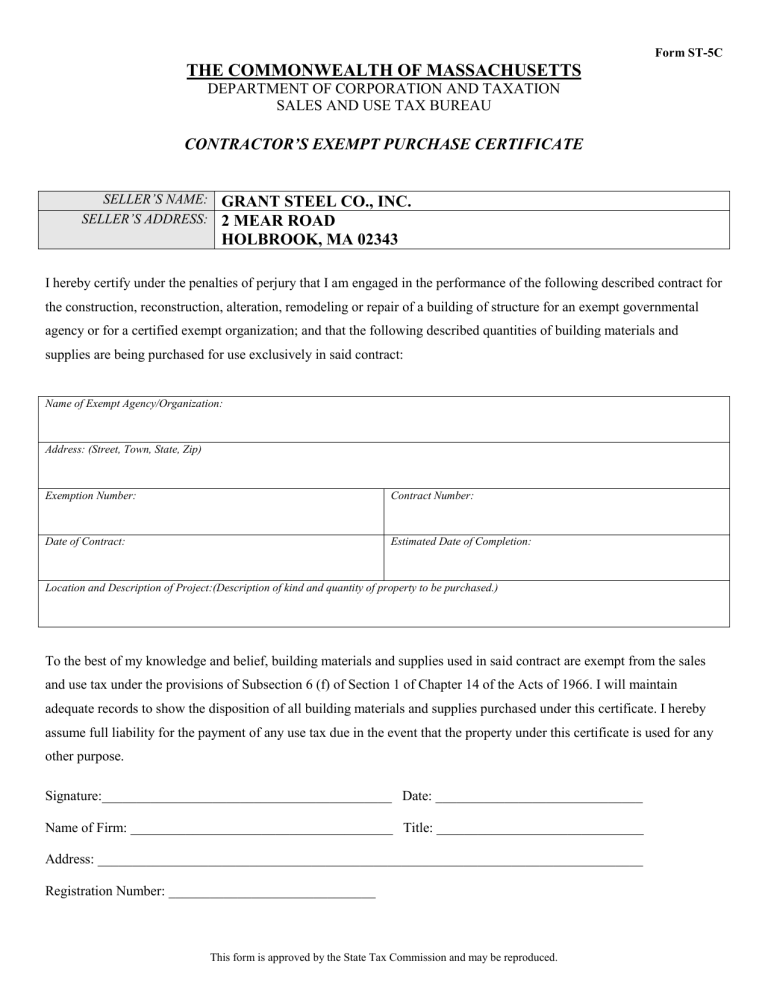

Form ST-5C

THE COMMONWEALTH OF MASSACHUSETTS

DEPARTMENT OF CORPORATION AND TAXATION

SALES AND USE TAX BUREAU

CONTRACTOR’S EXEMPT PURCHASE CERTIFICATE

SELLER’S NAME:

SELLER’S ADDRESS:

GRANT STEEL CO., INC.

2 MEAR ROAD

HOLBROOK, MA 02343

I hereby certify under the penalties of perjury that I am engaged in the performance of the following described contract for the construction, reconstruction, alteration, remodeling or repair of a building of structure for an exempt governmental agency or for a certified exempt organization; and that the following described quantities of building materials and supplies are being purchased for use exclusively in said contract:

Name of Exempt Agency/Organization:

Address: (Street, Town, State, Zip)

Exemption Number:

Date of Contract:

Contract Number:

Estimated Date of Completion:

Location and Description of Project:(Description of kind and quantity of property to be purchased.)

To the best of my knowledge and belief, building materials and supplies used in said contract are exempt from the sales and use tax under the provisions of Subsection 6 (f) of Section 1 of Chapter 14 of the Acts of 1966. I will maintain adequate records to show the disposition of all building materials and supplies purchased under this certificate. I hereby assume full liability for the payment of any use tax due in the event that the property under this certificate is used for any other purpose.

Signature:__________________________________________ Date: ______________________________

Name of Firm: ______________________________________ Title: ______________________________

Address: _______________________________________________________________________________

Registration Number: ______________________________

This form is approved by the State Tax Commission and may be reproduced.