Chapter 12 - Extras Springer

advertisement

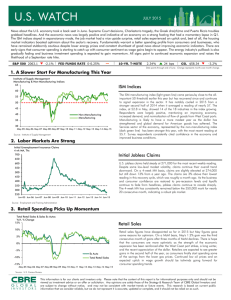

Session Plan Chapter Twelve: – – – – REITs as investment alternative QQD of REITs REIT Valuation Techniques The Send-Off Origins of REITs Massachusetts Trust (19th Century until 1935) – – Filled void for corporations owning RE No federal tax, & no distributions tax for shareholders!! Investment Company Act of 1940 – – Closed end mutual funds lobbied for equal treatment until tax law was amended in 1960 External management structure was required until 1986 Real Estate Investment Trusts (REITs) First established in US in 1960 – US Minimum Requirements – – – – 1971 Australia, 1985 Turkey, Canada 1993, Singapore 1999, Japan 2000, Hong Kong & France 2003, Germany in 2007 100 shareholders 75% of value of REIT assets in RE, cash, or gov’t securities 95% of gross income from dividends, interest, rents, or gains from sale of REIT assets Shareholder distributions at least 90% of REIT taxable income annually Additional European Requirements – – – Leverage is limited (50% in Germany, France, Spain; 20% for most Austrian REITs, a coverage ratio of 1.25x EBIT/Int in UK) Limits for size of any one property (15% in G-REIT, 40% in UK) EU REIT Strategies: Core/nuclear (low risk), Core-Plus/Value Added (medium risk) and Opportunity (high risk) REIT Organizational Structures UPREIT: Umbrella Partnership REIT – – – Established in 1992 to allow existing RE operating companies to bring property already owned under umbrella of REIT w/o capital gains tax REIT owns controlling interest in limited partnership that owns the real estate Owners of limited partnership can convert operating units into REIT shares, vote, & receive dividends REIT Organizational Structures Down REIT: – – – – Formed after REIT goes public Can own numerous partnerships at the same time Down REIT owns property directly in REIT, but holds some properties in partnership with others No tax liability until partnership units are converted into stock or sold REIT Incentive Issues UPREIT: – Management could be reluctant to sell if they own operating units rather than REIT shares Subject to tax when sold Down REIT: – If management does not own operating units, could become “trigger happy” with sales given the lack of tax consequences from sale REIT Taxation Shareholders pay taxes on dividends received via form 1099 721 Exchange: Like Kind Exchange for REITs – Limited Partners of Up and Down REITs can exchange partnership units for interests in other RE via like kind exchange Must be investment grade property Investors receive operating units rather than property Up and Down REITs have advantages for tax sensitive sellers Types of REITS Mortgage REITs – Equity REITs – Most common form today Hybrid REITs – Heyday in 1970s Invest in both mortgages and equity Mutual Fund REITs – Common for personal investors Mutual Fund REITs First mutual fund in Netherlands in 1774 Modern mutual funds began in US in 1924 – – – Was truly “mutual” as it was organized, operated, & managed by its own trustees Alpha Fund: shareholders own funds which own management company Omega Fund: Mgmt company shareholders own mgmt company which controls mutual fund owned by mutual fund shareholders Mgmt company shareholder interests are introduced Higher costs typically given competing goals of shareholder wealth creation & profit for external mgmt company REIT Historical Performance FTSE NAREIT US RE Index 1972-2011 80.00 70.00 60.00 50.00 30.00 20.00 10.00 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 -10.00 1974 0.00 1972 Return (%) 40.00 -20.00 -30.00 -40.00 -50.00 Total US NAREIT Index Year Equity REIT (no Timber) Mortgage REIT As you can see, mortgage REITs are historically more volatile than equity REITs “Portfolio Mix” Strategy Investors can review annual reports of REIT mutual funds to obtain information for how they allocate their investment dollars. REIT 1 REIT 2 Office 38% 17.5% Industrial 26% 5.9% Apartments 20% 15.3% Retail 15% 24.8% Other 1% 36.5% It looks like REIT 1 has more confidence in the office market but much less in retail than does REIT 2 “Quantity” Strategy This strategy involves maximizing the gross potential income by keeping overall portfolio vacancy rates as low as possible. REIT 1 REIT 2 Office 92% 92% Retail 86% 92% Industrial 87% 95% Apartments 96% 97% Weighted Avg. 91% 93% “Quality” Strategy Another portfolio diversification strategy is to concentrate on properties that have high quality, nationally known companies as tenants. Top 5 Tenants by Square Footage for REIT 1 Industrial Office Retail Wal-Mart BHP Petroleum Publix Supermarkets GE Deloitte & Touche Dick’s Sporting Goods Regal West Crowell & Moring Wal-Mart Restoration Hardware Bank of NY Mellon Ross Dress for Less Kuehne & Nagel Microsoft Belk See any problem companies here? “Durability” Strategy Let’s see how REIT 1 looks in terms of the durability of the lease income. Type 2011 2012 2013 2014 2015 2016 & Beyond Office 10.2% 6.8% 8.2% 11.9% 10.2% 38.3% Retail 9.8% 10.9% 10.2% 7.6% 8.5% 36.6% Industrial 12.9% 10.4% 17.3% 6.8% 22.1% 22.8% For Retail: low percentage of portfolio but long leases. “Geographic Dispersion” Strategy REITs (or wealthy investors) have the ability to reduce local market risk via diversification. Below is how REIT 1 is diversified in this way... East West South Midwest Foreign Office 24.5% 17.5% 10.4% 1.2% 2.7% Apartment 2.6% 6.2% 5.4% 0.0% 0.0% Industrial 1.3% 7.0% 4.1% 1.3% 0.0% Retail 3.2% 0.9% 8.5% 0.3% 2.4% Storage 0.2% 0.2% 0.1% 0.0% 0.0% “Geographic Dispersion” Strategy Continued Another method of viewing this type of portfolio risk smoothing is by Metropolitan Statistical Area (MSA): MSA % of Total 1 Washington-Arlington-Alexandria-DC-VA-MD-WV 10.6% 2 Boston-Quincy MA 5.5% 3 Los Angeles-Long Beach-Glendale CA 5.4% 4 San Francisco-San Mateo-Redwood City CA 5.0% 5 Houston-Bay Town-Sugar Land TX 4.8% REIT & The QQD Framework Quantity Strategy – Strong dividends, maximize GPI, growth orientation purchased at discount Quality Strategy – Focus strategy: less diversified Diversified: higher expenses Nationally known tenants, NNN REITs, Blue Chip REITs Durability Strategy – Tenant rollover risk, length of leases, geographic dispersion REIT & The QQD Framework Lease Rollover Risk – – Attempt to diversify via the duration of the income stream on associated properties. Also based on the lack of a high concentration on any particular tenant for the total revenue Business Risk – Attempt to diversify via the region or type of property in an effort to reduce concentration on one area or property type REIT Valuation Techniques Gordon Dividend Growth Model Funds from Operations (FFO) Multiple Net Asset Value (NAV) Gordon Dividend Growth Model Utilizes future dividend per share expected next year to calculate stock price as the present value of expected future dividends Constant dividend growth is assumed Begin with DCF based on projected revenue and expenses to estimate FFO for an assumed holding period – – Add in reversion to obtain PV of firm Divide by # of outstanding shares to obtain D1 V = D1 (k-g) $50.00 = $3.00 (0.10-0.04) FFO Multiple Similar to the Price to Earnings Ratio FFO: Net income (GAAP) excluding gains or losses from sales of property or debt restructuring adding back RE depreciation – Value = FFO/share * FFO Multiple Multiple: Historical multiple for REIT or peer group – Only as good as the comparables!! Net Asset Value (NAV) Value = Aggregate Stabilized NOI Blended Cap Rate – – – Blended cap rate is difficult for diversified assets Rather: Find value of specific properties and divide by property specific cap rates to obtain value of portfolio Once find value, subtract out debt to obtain NAV Shares quoted in terms of Net Asset Value (NAV) – Holding Period Return= NAVnow –NAVprior + Divholding period NAVprior Net Asset Value (NAV) NAV Revenue Op Ex NOI Cap Rate Value Debt NAV # of Shares $ $ $ Per Share 35,000,000 $ 12.73 15,000,000 $ 5.45 20,000,000 $ 7.27 9.50% 210,526,316 $ 76.56 75,000,000 $ 27.27 135,526,316 $ 49.28 2,750,000 REIT Valuation Issues Different classifications of recurring expenses for FFO – – – Tenant Improvements, Leasing Commissions If categorize as expense, subtract from FFO If categorize as capital improvement, amortized on balance sheet Adjusted FFO (AFFO) – – Adjusts FFO for expenses, while capitalized, which do not enhance property value Eliminates straight lining of rents FASB 13: Free rent or increases must be equalized (straightlined) over term of lease REIT Internationalization International RE Investment is becoming more of an area of study Historically International RE Investment focused on Blue Chip properties in well known cities RE Investment becoming more frequent in Emerging Markets RE Investment in Developing Countries typically centers around Tier I cities REITs have been embraced by Islamic Finance given the verifiable nature of the assets included in the investment pool The initial requirement for external management still exists in many countries… Internal External France Australia Turkey Japan Singapore Hong Kong Malaysia Both United States Canada Netherlands Belgium Germany Emerging Market Property Rights Heritage Foundation Index of Economic Freedom 1995-2011 80 Brazil 60 China 40 India Hong Kong 20 Year 11 20 10 20 09 20 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 0 19 Index Score 100 The End? “One repays a teacher badly if one always remains a pupil…” – Thus Spoke Zarathustra, On the Gift Giving Virtue, pg. 78 Go forth and invest in Real Estate!! Friedrich Nietzsche