Fair Value

advertisement

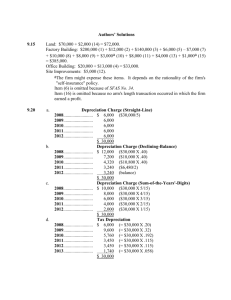

Year End Checklist The Accounting Standards require the review of a range of aspects of valuations as at the end of the year. These include the review of aspects impacting or indicators of – value depreciation impairment The following checklist provides a summary of key requirements and disclosures required by the various asset related standards as at the end of the financial reporting period. Please note that this checklist does not include ALL requirements of the various standards. It only includes those that relate to year end and specifically for the types of assets held by the public and Not-For-Profit sectors. Miscellaneous Considerations (All Standards) Requirements Were the underlying Asset Accounting Policies reviewed to ensure consistency, relevance and accuracy? Was there an internal review of the overall results and analysis for reasonableness, accuracy and compliance? Done? IFRS 13 ‘Fair Value’ IAS16 ‘Property Plant and Equipment’ IAS36 ‘Impairment’ Requirements Valuation and Impairment (IFRS13, IAS16, IAS36) Review of Market / Gross Value Was there a review of the underlying – Market Value (MV or Income Approach) Gross Replacement Cost This should include review of Unit Rates, indices, key assumptions, market information, etc. This should also be well documented and supported with appropriate audit evidence. Review of Level of Condition Was there a review done of the underlying condition of the assets? A change in condition will not impact the Gross Value but will impact the Fair Value. This should also be well documented and supported with appropriate audit evidence. Done? Assessing for Indicators of Impairment Are there any indicators of Impairment? If so, unless a revaluation was undertaken, the individual assets need to be adjusted to Recoverable Amount. Review of other Key Assumptions Were the following reviewed? Pattern of Consumption Residual Value Useful Life and RUL This should be well documented and supported with appropriate audit evidence. Determine whether difference between carrying amount and Fair Value is material Assuming the review of the key assumptions identified changes from those applied in the previous year was the difference between the carrying amount and the Fair value assessed for materiality? Revalue the entire Asset Class if impact is material If the impact of the difference between the carrying amount and the Fair Value was material…… was the asset class revalued? Adjusting for Impairment Assuming the net difference between the carrying amount and the Fair Value was not material but the carrying amount of individual assets were greater than the Fair Value…… were those affected assets written down to the recoverable Amount (Impairment)? Adjusting for reversal of Impairment If there were indicators that the impairment no longer exists …has the impairment been reversed? Impairment Journals Were all Impairment adjustments adjusted correctly? For assets valued at cost – directly to P&L and for revalued assets against Asset Revaluation Reserve (to the extent that it reversed a prior period revaluation increment). Depreciation Expense (IAS16) Prospectively Adjusting Depreciation Assuming the net difference between the carrying amount and the Fair Value was not material but there were differences in key assumptions (irrespective of whether the assets value was adjusted) ….. was the associated depreciation for the affected assets adjusted prospectively? Disclosures (IFRS13 Fair Value) Determination of Asset Classes Did the financial statement separate the assets into different asset classes based on – The nature, characteristics and risks of the asset and The level of the Fair Value Hierarchy within which the fair value measurement is categorised? Done? Transfers between levels of the fair value hierarchy Did the entity disclose and consistently follow its policy for determining when transfers between levels of the fair value hierarchy are deemed to have occurred? The policy about the timing of recognising transfers shall be the same for transfers into the levels as for transfers out of the levels. Examples of policies for determining the timing of transfers include the following: (a) the date of the event or change in circumstances that caused the transfer. (b) the beginning of the reporting period. (c) the end of the reporting period. Assets not measured at fair value but for which the fair value is disclosed Were the following disclosures provided – The level of fair value hierarchy For level 2 & 3 a description of the valuation techniques and inputs. If there has been a change the change and reason for the change A narrative description of the sensitivity of the fair value to changes in unobservable inputs. Tabular Format Were all quantitative disclosures provided in a tabular format (unless another format was more appropriate) Valuation Techniques and Inputs Were the valuation techniques and inputs used to determine Fair Value appropriately disclosed? Fair Value Measurement Were the fair value measurements reported (at the end of the reporting period) for all assets required to be measured at Fair Value? Fair Value Level of Input Hierarchy Were the fair values reported within which the fair value measurements are categorised in their entirety (Level 1, 2 or 3)? Recurring Fair Value Measurements Were the following disclosures provided – The amount of transfers between level 1 & 2 Description of the valuation techniques and inputs for levels 2 & 3. Including any changes and reasons for the change For level 3 – o Effect on measurement of P&L or other comprehensive income o Quantitative information about the significant unobservable inputs (except if they were not developed by the entity) o Reconciliation from opening balance to the closing balance o Amount of total gains or losses for the period attributable to the change in unrealised gains or losses relating to those assets and liabilities held at the end of the reporting period (at the line item level) o A description of the valuation processes used by the entity (including, for example, how an entity decides its valuation policies and procedures and analyses changes in fair value measurements from period to period). o A narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and if there are interrelationships between those inputs and other unobservable inputs a description of those interrelationships and of how they might magnify or mitigate the effect of changes in the unobservable inputs on the fair value measurement. o If the highest and best use of a non-financial asset differs from its current use that fact and why the non-financial asset is being used in a manner that differs from its highest and best use. Non-Recurring Fair Value Measurements Were the following disclosures provided – The reasons for the measurement (given that it is not required) Description of the valuation techniques and inputs for levels 2 & 3. Including any changes and reasons for the change For level 3 – o Quantitative information about the significant unobservable inputs (except if they were not developed by the entity) o A description of the valuation processes used by the entity (including, for example, how an entity decides its valuation policies and procedures and analyses changes in fair value measurements from period to period). Disclosures (IAS16 Property Plant and Equipment) Valuation Methodology and Assumptions For each class of Property, Plant and Equipment: the measurement bases used for determining the gross carrying amount; the depreciation methods used; the useful lives or the depreciation rates used; the gross carrying amount and the accumulated depreciation (aggregated with accumulated impairment losses) at the beginning and end of the period; and (e) a reconciliation of the carrying amount at the beginning and end of the period Done? Miscellaneous Disclosures Details about the existence and amounts of restrictions on title, and property, plant and equipment pledged as security for liabilities; the amount of expenditures recognised in the carrying amount of an item of property, plant and equipment in the course of its construction; the amount of contractual commitments for the acquisition of property, plant and equipment; and if it is not disclosed separately in the statement of comprehensive income, the amount of compensation from third parties for items of property, plant and equipment that were impaired, lost or given up that is included in profit or loss. Depreciation Methodology and Assumptions Details about the depreciation methodology including – the depreciation methods adopted the estimated useful lives or depreciation rates the amount of depreciation expense and accumulated depreciation information that allows users to review the policies selected by management and enables comparisons to be made with other entities. Changes in Accounting Estimates The nature and effect of a change in an accounting estimate that has an effect in the current period or is expected to have an effect in subsequent periods. This includes changes arising from changes in estimates with respect to: residual values; the estimated costs of dismantling, removing or restoring items of Property, Plant and Equipment; useful lives; and depreciation methods. Details about the valuation Including the effective date of the revaluation whether an independent valuer was involved the methods and significant assumptions applied in estimating the items’ fair values the extent to which the items’ fair values were determined directly by reference to observable prices in an active market or recent market transactions on arm’s length terms or were estimated using other valuation techniques for each revalued class of Property, Plant and Equipment, the carrying amount that would have been recognised had the assets been carried under the cost model (does not apply to Australian Not-For-Profit entities) and the revaluation surplus, indicating the change for the period and any restrictions on the distribution of the balance to shareholders. Optional Disclosures It is suggested that the following disclosures be provided the carrying amount of temporarily idle Property, Plant and Equipment; the gross carrying amount of any fully depreciated Property, Plant and Equipment that is still in use; the carrying amount of Property, Plant and Equipment retired from active use and not classified as held for sale in accordance with IFRS 5; and when the cost model is used, the fair value of Property, Plant and Equipment when this is materially different from the carrying amount. Disclosures (IAS36 Impairment) Impairment Amounts For each class of assets: (a) the amount of impairment losses recognised in profit or loss during the period and the line item(s) of the statement of comprehensive income in which those impairment losses are included. (b) the amount of reversals of impairment losses recognised in profit or loss during the period and the line item(s) of the statement of comprehensive income in which those impairment losses are reversed. (c) the amount of impairment losses on revalued assets recognised in other comprehensive income during the period. (d) the amount of reversals of impairment losses on revalued assets recognised in other comprehensive income during the period. Segment Disclosures For entities that reports segment information in accordance with IFRS 8 – for each reportable segment: (a) the amount of impairment losses recognised in profit or loss and in other comprehensive income during the period. (b) the amount of reversals of impairment losses recognised in profit or loss and in other comprehensive income during the period. Done? Material Impairment Transactions For each material impairment loss recognised or reversed during the period: (a) the events and circumstances that led to the recognition or reversal of the impairment loss. (b) the amount of the impairment loss recognised or reversed. (c) for an individual asset: (i) the nature of the asset; and (ii) if the entity reports segment information in accordance with IFRS 8, the reportable segment to which the asset belongs. (d) for a cash-generating unit: (i) a description of the cash-generating unit (such as whether it is a product line, a plant, a business operation, a geographical area, or a reportable segment as defined in IFRS 8); (ii) the amount of the impairment loss recognised or reversed by class of assets and, if the entity reports segment information in accordance with IFRS 8, by reportable segment; and (iii) if the aggregation of assets for identifying the cash-generating unit has changed since the previous estimate of the cash-generating unit’s recoverable amount (if any), a description of the current and former way of aggregating assets and the reasons for changing the way the cash-generating unit is identified. (e) whether the recoverable amount of the asset (cash-generating unit) is its fair value less costs to sell or its value in use. (f) if recoverable amount is fair value less costs to sell, the basis used to determine fair value less costs to sell (such as whether fair value was determined by reference to an active market). (g) if recoverable amount is value in use, the discount rate(s) used in the current estimate and previous estimate (if any) of value in use. Aggregate Impairment Results For transactions not disclosed as ‘material’ - information at the aggregate level for losses and reversals: (a) the main classes of assets affected by impairment losses and the main classes of assets affected by reversals of impairment losses. (b) the main events and circumstances that led to the recognition of these impairment losses and reversals of impairment losses. Goodwill If any portion of the goodwill acquired in a business combination during the period has not been allocated to a cash-generating unit (group of units) at the end of the reporting period, the amount of the unallocated goodwill shall be disclosed together with the reasons why that amount remains unallocated. Recoverable amounts of cash-generating units containing goodwill or intangible assets with indefinite useful lives Have the various disclosures included in paragraphs 134 & 135 been provided? Asset Held for Sale (IFRS5) Requirements Classification Were ‘assets held for sale’ recongised as a separate Asset Class in the Statement of Financial Position? Depreciation Did depreciation cease from the time the assets were defined as being ‘held for sale’ Reassessment Were the asset previously ‘held for sale’ assessed to see whether they still satisfied the definition? Journals Were appropriate journals processed for assets that are no longer considered ‘held for sale’? Done? Requirements Cash Generating Units with Goodwill or Intangible Assets Have the disclosures required in paragraph 134 been provided? These include - Done? (a) the carrying amount of goodwill (b) the carrying amount of intangible assets with indefinite useful lives (c) the basis on which the recoverable amount has been determined (d) if based on value in use: (i) a description of each key assumption. (ii) a description of management’s approach to determining the value. (iii) the period over which management has projected cash flows. (iv) the growth rate used to extrapolate cash flow projections. (v) the discount rate(s) applied to the cash flow projections. (e) if the recoverable amount is based on fair value less costs to sell, the methodology used to determine fair value less costs to sell and if not determined using an observable market price: (i) a description of each key assumption. (ii) a description of management’s approach to determining the value. (iii) the period over which management has projected cash flows. (iv) the growth rate used to extrapolate cash flow projections. (v) the discount rate(s) applied to the cash flow projections. (f) if a reasonably possible change in a key assumption on which management has based its determination of the unit’s (group of units’) recoverable amount would cause the unit’s (group of units’) carrying amount to exceed its recoverable amount: (i) the amount by which the unit’s (group of units’) recoverable amount exceeds its carrying amount. (ii) the value assigned to the key assumption. (iii) the amount by which the value assigned to the key assumption must change, after incorporating any consequential effects of that change on the other variables used to measure recoverable amount, in order for the unit’s (group of units’) recoverable amount to be equal to its carrying amount. Investment Property (IAS40) Requirements Unless the accounting policy is to record these assets at ‘cost’ …. Have all investment properties been revalued at the end of the financial reporting period? If there was a revaluation….was the net movement taken directly to the P&L? If the assets were valued at cost and were also not classified as ‘held for sale’….was depreciation expense calculated in accordance with IAS16? Done? Disclosures (IAS40 Investment Property) Valuation Model Whether investment properties are valued on either the fair value model or the cost model. Done? Fair Value – Operating Leases If using the fair value model, whether, and in what circumstances, property interests held under operating leases are classified and accounted for as investment property. Classification is Difficult When classification is difficult (see paragraph 14), the criteria it uses to distinguish investment property from owner-occupied property and from property held for sale in the ordinary course of business. Methods and significant assumptions The methods and significant assumptions applied in determining the fair value of investment property, including a statement whether the determination of fair value was supported by market evidence or was more heavily based on other factors (which the entity shall disclose) because of the nature of the property and lack of comparable market data. Qualifications of the Valuer The extent to which the fair value of investment property (as measured or disclosed in the financial statements) is based on a valuation by an independent valuer who holds a recognised and relevant professional qualification and has recent experience in the location and category of the investment property being valued. If there has been no such valuation, that fact shall be disclosed. Associated Income and Expenses The amounts recognised in profit or loss for: (i) rental income from investment property; (ii) direct operating expenses (including repairs and maintenance) arising from investment property that generated rental income during the period; and (iii) direct operating expenses (including repairs and maintenance) arising from investment property that did not generate rental income during the period. (iv) the cumulative change in fair value recognised in profit or loss on a sale of investment property from a pool of assets in which the cost model is used into a pool in which the fair value model is used (see paragraph 32C). Restrictions The existence and amounts of restrictions on the realisability of investment property or the remittance of income nd proceeds of disposal. Contractual Obligations Contractual obligations to purchase, construct or develop investment property or for repairs, maintenance or enhancements. Fair Value Model Disclosures In addition to the disclosures required by paragraph 75 – a reconciliation between the carrying amounts of investment property at the beginning and end of the period When a valuation obtained for investment property is adjusted significantly for the purpose of the financial statements a reconciliation between the valuation obtained and the adjusted valuation included in the financial statements In the exceptional cases where there is an inability to determine Fair Value reliably the reconciliation between opening and closing balance shall disclose amounts relating to that investment property separately from amounts relating to other investment property. In addition, an entity shall disclose: (a) a description of the investment property; (b) an explanation of why fair value cannot be determined reliably; (c) if possible, the range of estimates within which fair value is highly likely to lie; and (d) on disposal of investment property not carried at fair value: (i) the fact that the entity has disposed of investment property not carried at fair value; (ii) the carrying amount of that investment property at the time of sale; and (iii) the amount of gain or loss recognised. Cost Model Disclosures In addition to the disclosures required by paragraph 75 (a) the depreciation methods used; (b) the useful lives or the depreciation rates used; (c) the gross carrying amount and the accumulated depreciation (aggregated with accumulated impairment losses) at the beginning and end of the period; (d) a reconciliation of the carrying amount of investment property at the beginning and end of the period, showing the following: (i) additions, disclosing separately those additions resulting from acquisitions and those resulting from subsequent expenditure recognised as an asset; (ii) additions resulting from acquisitions through business combinations; (iii) assets classified as held for sale or included in a disposal group classified as held for sale in accordance with IFRS 5 and other disposals; (iv) depreciation; (v) the amount of impairment losses recognised, and the amount of impairment losses reversed, during the period in accordance with IAS 36; (vi) the net exchange differences arising on the translation of the financial statements into a different presentation currency, and on translation of a foreign operation into the presentation currency of the reporting entity; (vii) transfers to and from inventories and owner-occupied property; and (viii) other changes; and (e) the fair value of investment property. In the exceptional cases described in paragraph 53, when an entity cannot determine the fair value of the investment property reliably, it shall disclose: (i) a description of the investment property; (ii) an explanation of why fair value cannot be determined reliably; and (iii) if possible, the range of estimates within which fair value is highly likely to lie. Leases (IAS17) Disclosures (IAS17 Leases) Lessees – Financial Leases In addition to meeting the requirements of IFRS 7 Financial Instruments (a) for each class of asset, the net carrying amount at the end of the reporting period. (b) a reconciliation between the total of future minimum lease payments at the end of the reporting period, and their present value. In addition, an entity shall disclose the total of future minimum lease payments at the end of the reporting period, and their present value, for each of the following periods: (i) not later than one year; (ii) later than one year and not later than five years; (iii) later than five years. (c) contingent rents recognised as an expense in the period. (d) the total of future minimum sublease payments expected to be received under non-cancellable subleases at the end of the reporting period. (e) a general description of the lessee’s material leasing arrangements including, but not limited to, the following: (i) the basis on which contingent rent payable is determined; (ii) the existence and terms of renewal or purchase options and escalation clauses; and (iii) restrictions imposed by lease arrangements, such as those concerning dividends, additional debt, and further leasing. Lessees – Operating Leases In addition to meeting the requirements of IFRS 7 (a) the total of future minimum lease payments under non-cancellable operating leases for each of the following periods: (i) not later than one year; (ii) later than one year and not later than five years; (iii) later than five years. (b) the total of future minimum sublease payments expected to be received under non-cancellable subleases at the end of the reporting period. (c) lease and sublease payments recognised as an expense in the period, with separate amounts for minimum lease payments, contingent rents, and sublease payments. (d) a general description of the lessee’s significant leasing arrangements including, but not limited to, the following: (i) the basis on which contingent rent payable is determined; (ii) the existence and terms of renewal or purchase options and escalation clauses; and (iii) restrictions imposed by lease arrangements, such as those concerning dividends, additional debt and further leasing. Done? Lessors – Financial Leases In addition to meeting the requirements in IFRS 7 (a) a reconciliation between the gross investment in the lease at the end of the reporting period, and the present value of minimum lease payments receivable at the end of the reporting period. In addition, an entity shall disclose the gross investment in the lease and the present value of minimum lease payments receivable at the end of the reporting period, for each of the following periods: (i) not later than one year; (ii) later than one year and not later than five years; (iii) later than five years. (b) unearned finance income. (c) the unguaranteed residual values accruing to the benefit of the lessor. (d) the accumulated allowance for uncollectible minimum lease payments receivable. (e) contingent rents recognised as income in the period. (f) a general description of the lessor’s material leasing arrangements. Lessors – Operating Leases In addition to meeting the requirements of IFRS 7 (a) the future minimum lease payments under non-cancellable operating leases in the aggregate and for each of the following periods: (i) not later than one year; (ii) later than one year and not later than five years; (iii) later than five years. (b) total contingent rents recognised as income in the period. (c) a general description of the lessor’s leasing arrangements. Intangible Assets (IAS38) Requirements Done? Review Amortisation Period and Method Has the amortisation period and method for an intangible asset with a finite useful life been reviewed at the end of the financial year and any changes accounted for as changes in accounting estimates in accordance with IAS 8. Impairment Testing In accordance with IAS 36, have all intangible assets with an indefinite useful life been tested for impairment by comparing its recoverable amount with its carrying amount. Review of assets with Indefinite Useful Life Have assets deemed to have an indefinite useful life (and therefore not being amotised) been reviewed to determine whether events and circumstances continue to support an indefinite useful life assessment for that asset? If they do not, the change in the useful life assessment from indefinite to finite shall be accounted for as a change in an accounting estimate in accordance with IAS 8. Disclosures (IAS38 Intangibles) General Disclosures Distinguishing between internally generated intangible assets and other intangible assets (a) whether the useful lives are indefinite or finite and, if finite, the useful lives or the amortisation rates used; (b) the amortisation methods used for intangible assets with finite useful lives; (c) the gross carrying amount and any accumulated amortisation (aggregated with accumulated impairment losses) at the beginning and end of the period; (d) the line item(s) of the statement of comprehensive income in which any amortisation of intangible assets is included; (e) a reconciliation of the carrying amount at the beginning and end of the period Changes in Accounting Estimates which have a material effect The nature and amount of a change in an accounting estimate that has a material effect in the current period or is expected to have a material effect in subsequent periods. Such disclosure may arise from changes in: (a) the assessment of an intangible asset’s useful life; (b) the amortisation method; or (c) residual values. Done? Specific Disclosures Have the following been disclosed where relevant (a) for an intangible asset assessed as having an indefinite useful life, the carrying amount of that asset and the reasons supporting the assessment of an indefinite useful life. (b) a description, the carrying amount and remaining amortisation period of any individual intangible asset that is material to the entity’s financial statements. (c) for intangible assets acquired by way of a government grant and initially recognised at fair value (see paragraph 44): (i) the fair value initially recognised for these assets; (ii) their carrying amount; and (iii) whether they are measured after recognition under the cost model or the revaluation model. (d) the existence and carrying amounts of intangible assets whose title is restricted and the carrying amounts of intangible assets pledged as security for liabilities. (e) the amount of contractual commitments for the acquisition of intangible assets. Intangible assets measured after recognition using the revaluation model The following: (a) by class of intangible assets: (i) the effective date of the revaluation; (ii) the carrying amount of revalued intangible assets; and (iii) the carrying amount that would have been recognised had the revalued class of intangible assets been measured after recognition using the cost model in paragraph 74; (b) the amount of the revaluation surplus that relates to intangible assets at the beginning and end of the period, indicating the changes during the period and any restrictions on the distribution of the balance to shareholders; and (c) the methods and significant assumptions applied in estimating the assets’ fair values. Research and development expenditure The aggregate amount of research and development expenditure recognised as an expense during the period. Optional additional information These disclosures are encouraged, but not required, to be disclosed (a) a description of any fully amortised intangible asset that is still in use; and (b) a brief description of significant intangible assets controlled by the entity but not recognised as assets because they did not meet the recognition criteria in this Standard or because they were acquired or generated before the version of IAS 38 Intangible Assets issued in 1998 was effective. Inventories (IAS2) Disclosures (IAS2 Inventories) Policies and Results Were the following disclosed (a) the accounting policies adopted in measuring inventories, including the cost formula used; (b) the total carrying amount of inventories and the carrying amount in classifications appropriate to the entity; (c) the carrying amount of inventories carried at fair value less costs to sell; (d) the amount of inventories recognised as an expense during the period; (e) the amount of any write-down of inventories recognised as an expense in the period in accordance with paragraph 34; (f) the amount of any reversal of any write-down that is recognised as a reduction in the amount of inventories recognised as expense in the period in accordance with paragraph 34; (g) the circumstances or events that led to the reversal of a write-down of inventories in accordance with paragraph 34; and (h) the carrying amount of inventories pledged as security for liabilities. Done? Agriculture (IAS41) Disclosures (IAS41 Agricutlure) Aggregate Gain or Loss The aggregate gain or loss arising during the current period on initial recognition of biological assets and agricultural produce and from the change in fair value less costs to sell of biological assets. Description of each Group A description of each group of biological assets. Nature of and Estimates of Quantities If not disclosed elsewhere in information published with the financial statements (a) the nature of its activities involving each group of biological assets; and (b) non-financial measures or estimates of the physical quantities of: (i) each group of the entity’s biological assets at the end of the period; and (ii) output of agricultural produce during the period. Methods and Assumptions The methods and significant assumptions applied in determining the fair value of each group of agricultural produce at the point of harvest and each group of biological assets. Fair Value less Cost to Sell The fair value less costs to sell of agricultural produce harvested during the period, determined at the point of harvest. Restrictions, Commitments and Risk Management Strategies Details about (a) the existence and carrying amounts of biological assets whose title is restricted, and the carrying amounts of biological assets pledged as security for liabilities; (b) the amount of commitments for the development or acquisition of biological assets; and (c) financial risk management strategies related to agricultural activity. Reconciliation in Movements A reconciliation of changes in the carrying amount of biological assets between the beginning and the end of the current period. The reconciliation shall include: (a) the gain or loss arising from changes in fair value less costs to sell; (b) increases due to purchases; (c) decreases attributable to sales and biological assets classified as held for sale (or included in a disposal group that is classified as held for sale) in accordance with IFRS 5; (d) decreases due to harvest; (e) increases resulting from business combinations; (f) net exchange differences arising on the translation of financial statements into a different presentation currency, and on the translation of a foreign operation into the presentation currency of the reporting entity; and (g) other changes. Done? Where fair value cannot be measured reliably – General Disclosures Where an entity measures biological assets at their cost less any accumulated depreciation and any accumulated impairment losses (see paragraph 30) at the end of the period, the entity shall disclose for such biological assets: (a) a description of the biological assets; (b) an explanation of why fair value cannot be measured reliably; (c) if possible, the range of estimates within which fair value is highly likely to lie; (d) the depreciation method used; (e) the useful lives or the depreciation rates used; and (f) the gross carrying amount and the accumulated depreciation (aggregated with accumulated impairment losses) at the beginning and end of the period. Where fair value cannot be measured reliably – Disposals If, during the current period, an entity measures biological assets at their cost less any accumulated depreciation and any accumulated impairment losses (see paragraph 30), an entity shall disclose any gain or loss recognised on disposal of such biological assets and the reconciliation required by paragraph 50 shall disclose amounts related to such biological assets separately. In addition, the reconciliation shall include the following amounts included in profit or loss related to those biological assets: (a) impairment losses; (b) reversals of impairment losses; and (c) depreciation. Where fair value previously could not be measured reliably – but has become reliably measurable If the fair value of biological assets previously measured at their cost less any accumulated depreciation and any accumulated impairment losses becomes reliably measurable during the current period, an entity shall disclose for those biological assets: (a) a description of the biological assets; (b) an explanation of why fair value has become reliably measurable; and (c) the effect of the change. Government grants The following related to agricultural activity covered by this Standard: (a) the nature and extent of government grants recognised in the financial statements; (b) unfulfilled conditions and other contingencies attaching to government grants; and (c) significant decreases expected in the level of government grants.