Presentation Subject - Steel Manufacturers Association

advertisement

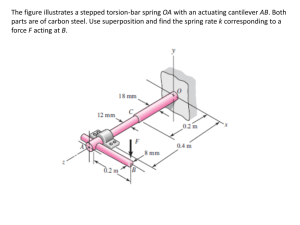

Steel Market Intelligence Steel Trade – Dealing From the Bottom of a Stacked Deck Michelle Applebaum May 19, 2009 847-433-8517 admin@michelleapplebaum.com Steel Trade – Dealing From the Bottom of a Stacked Deck Protectionism and Buy America – Search Volume Indices Source: Google and Steel Market Intelligence Steel Market Intelligence 1 Steel Trade – Dealing From the Bottom of a Stacked Deck Trade Restrictiveness Indices by Country, 2005/2006 Hong Kong Canada US South Africa Switzerland Australia Turkey Tariffs Only Tariffs & NTBs EU New Zealand Japan Poland Thailand China Russia Brazil Mexico India Egypt 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 Note: Red bars show tariff and non-tariff barriers to trade, blue bars show tariffs only. Source: World Bank and Steel Market Intelligence Steel Market Intelligence 2 Steel Trade – Dealing From the Bottom of a Stacked Deck Current Account Balances (in $Billions), 2004-2008 2008 2007 2006 2005 2004 -1000 -800 -600 -400 China Russia -200 Germany 0 Japan 200 400 600 United States Source: International Monetary Fund and Steel Market Intelligence Steel Market Intelligence 3 Steel Trade – Dealing From the Bottom of a Stacked Deck Steel Market Intelligence 4 Steel Trade – Dealing From the Bottom of a Stacked Deck Smoot-Hawley – Cheap Shot “du jour” – average tariff levels went from 5% to 20% on some 70% of imports – NOT EVEN CLOSE! Source: Clemens and Williamson (2004), Journal of Economic Growth and Morgan Stanley Steel Market Intelligence 5 Steel Trade – Dealing From the Bottom of a Stacked Deck WTO Complaints, 2H 2008 1 WTO Complaints, 2002-2007 1 90 8.0 80 7.0 70 6.0 60 5.0 50 4.0 40 3.0 30 20 2.0 10 1.0 Mexico Korea Canada Colombia US Pakistan Ukraine Indonesia EC Turkey China Argentina Brazil Japan Canada India Mexico China US India 0 0.0 1 Annualized Source: WTO,” Report to the TPRB from the Director-General,” March 26, 2009 and Steel Market Intelligence Steel Market Intelligence 6 Steel Trade – Dealing From the Bottom of a Stacked Deck WHY WE NEED BUY AMERICA PART 1. The impact of the Reagan-era trade suits – Imports were running at a 20% share of the market when the first trade cases were filed in January 1982. During the intervening years, imports peaked at 32% of the market in July 1984, and the VRAs brought imported steel back to around 20% of the market. Monthly US Import Market Share, 1981-1986 35.0% 160 VRAs Enforced - 5/85 140 Bethlehem and USW File 201Petition - 2/84 30.0% LTV Bankruptcy - 7/86 120 25.0% 100 20.0% Voluntary Restraint Agreements (VRA) Announced - 9/84 80 15.0% Bethlehem Files AD and CVD Petitions against EEC - 1/82 Plaza Accord - 9/85 60 10.0% 40 5.0% 20 Import Market Share Nov-86 Jul-86 Sep-86 May-86 Jan-86 Mar-86 Nov-85 Jul-85 Sep-85 May-85 Jan-85 Mar-85 Nov-84 Jul-84 Sep-84 May-84 Jan-84 Mar-84 Nov-83 Jul-83 Sep-83 May-83 Jan-83 Mar-83 Nov-82 Jul-82 Sep-82 May-82 Jan-82 Mar-82 Nov-81 Jul-81 Sep-81 May-81 Jan-81 0 Mar-81 0.0% US Trade Weighted Dollar Source: Steel Market Intelligence and SteelFacts; including AISI and US Department of Commerce Steel Market Intelligence 7 Steel Trade – Dealing From the Bottom of a Stacked Deck WHY WE NEED BUY AMERICA PART 2. Front Running – Why We DO NOT Talk About Trade Cases – Chinese OCTG shipments nearly TRIPLED in the six months after trade cases became apparent. Monthly Chinese OCTG Market Share, 2005-Current 60.0% EU Duties on OCTG - 4/09 50.0% 40.0% Canadian Duties on OCTG 3/08 30.0% 20.0% US Files OCTG Case - 4/09 10.0% Jan-05 Feb-05 Mar-05 Apr-05 May-05 Jun-05 Jul-05 Aug-05 Sep-05 Oct-05 Nov-05 Dec-05 Jan-06 Feb-06 Mar-06 Apr-06 May-06 Jun-06 Jul-06 Aug-06 Sep-06 Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 Apr-07 May-07 Jun-07 Jul-07 Aug-07 Sep-07 Oct-07 Nov-07 Dec-07 Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09 Apr-09 0.0% Source: Steel Market Intelligence, Canadian International Trade Tribunal, American Metal Market and SteelFacts; including AISI and US Department of Commerce Steel Market Intelligence 8 Steel Trade – Dealing From the Bottom of a Stacked Deck Global Differences - Processes for Trade Remedies – Administrative Processes are LESS VISIBLE and CHEAPER TOO!!!!! Europe – Administrative process; provisional duties can be imposed 60 days after initiation of a trade complaint. Target regions can appeal; the investigation normally takes less than a year but must be completed in 15 months. Provisional duties can last 6-9 months. US – Legal process; Commerce determines whether or not dumping/subsidy has occurred while ITC determines injury or threat of injury. Final antidumping duties usually take 280390 days from the date of petition while countervailing duties normally take 205-270 days. Source: European Commission, Canadian International Trade Tribunal, US ITC and Steel Market Intelligence Steel Market Intelligence 9 Steel Trade – Dealing From the Bottom of a Stacked Deck Steel - New “Protective” Measures Since September 2008 China – Beijing eliminated export duties ranging from 5-15% on hot-rolled sheet, plate, strip, heavy sections, coated wire, some alloy steels and welded pipe effective December 1, 2008. – China increased the export tax rebate to 13% from 5% for cold-rolled sheet, hot-dipped galvanized steel, electrical steels, some alloy steels, and high speed bars, rods and wire effective April 1, 2009. India – On October 31, India withdrew a 15% export tax on semi-finished steel. – In November, the Indian government imposed a 5% import duty on imports of pig iron, semi-finished steel, flat and long products. Steel products were also given export incentives of 4-5%. – The government decided to launch an antidumping investigation on Chinese imports of hot-rolled coil in December. – India eliminated the 15% export tax on iron ore fines in December and reduced the export duty on iron ore lump to 5% from 15%. – Introduced licensing requirements for imports of certain steel products – some requirements were removed between December 2008 and January 2009. Russia – In January, the Russian government announced plans to raise import tariffs on construction steel rod and pipe and tube products. – In April, the Russian ministry of industry and trade extended its antidumping investigation until July 21, 2009 for imports of pre-painted steel from China, South Korea, Belgium, Finland and Kazakhstan. European Union – The European Commission (EC) decided to investigate imports of hollow structural sections from Turkey in December. – The EC decided to put dumping duties on imports of welded tubes and pipes from Belarus, China, Russia, Thailand and Ukraine in late December. – In January, the Commission decided to impose temporary duties on imports of bars and rods, hot-rolled, in irregularly wounds coils, of iron, non-alloy steel or alloy steel other than stainless steel from China and Moldova. – The EC imposed provisional dumping duties ranging from 15-51% on Chinese imports of seamless pipe in April. Source: American Metal Market, Steel Business Briefing, WTO,” Report to the TPRB from the Director-General,” March 26, 2009 and Steel Market Intelligence Steel Market Intelligence 10 Steel Trade – Dealing From the Bottom of a Stacked Deck Steel - New “Protective” Measures Since September 2008 Canada – In September, the Canadian International Trade Tribunal (CITT) issued antidumping and countervailing duties against imports of carbon steel welded pipe from China. – In January, the CITT decided to keep antidumping duties against plate imports from Bulgaria, the Czech Republic and Romania. – In December, the CITT came to a decision to maintain antidumping duties on imports of carbon and alloy hollow structural sections from South Korea, South Africa and Turkey. Brazil – In February, the Brazilian government launched an antidumping investigation into imports of certain flat-rolled steel products. The investigation will scrutinize imports; especially from Asian countries. Ukraine – The government eliminated a natural gas surcharge used by steel companies on October 1, 2008. – The ministry of transport froze a tariff for cargo transportation for 1H 2009 while prices of electricity supplied to mining and steel mills are frozen through June 2009. Australia – In December, Australia launched an investigation against imports of welded pipe from China. Philippines – The Tariff Commission is investigating a safeguard petition that was filed by producers of angled bars this month. – Introduced a new “mineral ore export permit” for the transport/shipment of mineral ores. Source: American Metal Market, Steel Business Briefing, WTO,” Report to the TPRB from the Director-General,” March 26, 2009 and Steel Market Intelligence Steel Market Intelligence 11 Steel Trade – Dealing From the Bottom of a Stacked Deck Steel - New “Protective” Measures Since September 2008 Vietnam – Decided to impose a 10% duty on imports of boron-added long products in mid April to ensure that imports from China do not evade the import duty for construction long products which is 15%. Alloy products quality for a 0% duty in the country. – Increased import tariffs on semi-finished products of iron or non-alloy steel. Egypt – In February, the Egyptian government imposed temporary import duties on imports of cold-rolled sheet, galvanized sheet and plastic-coated sheet. Turkey – In January, the Turkish government increased import duties on hot-rolled wide strip and plate, cold-rolled plate and sheet, hot and cold-rolled strip, tinplate and coated products from 5-7% to 13-15%. Indonesia – The Indonesian Anti-Dumping (AD) Committee opened an investigation into alleged dumping of hot-rolled plate from Taiwan, China and Malaysia in November. – In April, the AD Committee issued a pre-notification to the governments of Korea and Malaysia saying that it will initiate an investigation into alleged dumping of HRC. – Introduction of mandatory standards for steel products (hot-rolled steel sheets and coils and zinc-aluminium alloy coated steel sheets and coils). Argentina – Introduced non-automatic import licensing requirement, covering steel and metallurgical products. Malaysia – Introduced new technical regulations for 57 steel products, requiring certificates of approval for conformity with Malaysian Standards. Source: American Metal Market, Steel Business Briefing, WTO,” Report to the TPRB from the Director-General,” March 26, 2009 and Steel Market Intelligence Steel Market Intelligence 12 Steel Trade – Dealing From the Bottom of a Stacked Deck Steel Market Intelligence 13 Steel Trade – Dealing from the Bottom of a Stacked Deck Myths and Realities – Currency Trade Bill Is foreign currency “management” a protectionist act? The currency reform bill would classify foreign currency “misalignment” as a trade subsidy. There is a lot of noise & misinformation on the currency bill. Myths Realities • Protecting against currency management is protectionist. • Currency management is protectionist. Duties would disappear when management does. Free-trade restoring. • Asian countries punished/esp. China. • Duties neutralize the protectionist subsidy. • Risk of poking finger at our banker. • It is not targeted at any country; all countries “level playing field.” • Diplomacy works better. • Currently are a half dozen countries who would be impacted. • WTO Consistent? • • Starting a trade war? Foreign countries own our currency for stability & safety – NOT because we’re nice to them. • Diplomacy is a great idea but the process has been exhausted over many, many years. • Bill is completely consistent with WTO. • Holding trading partners accountable to their agreements and standing up for our own rights should not be a basis for retaliation; otherwise the concept of “rules-based” free trade is plowed under mercantilism. Source: Coalition for a Prosperous America, Tradereform.org and Steel Market Intelligence Steel Market Intelligence 14 Steel Trade – Dealing From the Bottom of a Stacked Deck Source: Oanda.com and Steel Market Intelligence Steel Market Intelligence 15 Steel Trade – Dealing From the Bottom of a Stacked Deck India – Accusations of “Green” Protectionism NEW DELHI, May 15 (Bernama) -- India Thursday asked the BRIC members to unitedly oppose the developed countries' move to impose environmental taxes on the developing nations in the name of "green protectionism" to tackle climate change, the Press Trust of India (PTI) reported. Ahead of the first BRIC summit next month in Russia, Shyam Saran, special envoy to Prime Minister Manmohan Singh on climate change, warned that "green should not become a label 'protection' (for the developed nations)". "We are concerned that green is becoming a new label for protection. We are now seeing on the grounds of level-playing field and maintaining competitiveness, the developing nations will be forced to take up binding commitment on emissions reduction or pay tariff," he said. Source: Bloomberg and Steel Market Intelligence Steel Market Intelligence 16 Steel Trade – Dealing From the Bottom of a Stacked Deck Lobbying – Financial Services/Real Estate and Steel, 1990 and 2008 1990 2008 $3,564,212 $755,402 Financial Services and Real Estate Steel $60,475,025 $463,472,524 Source: OpenSecrets.org and Steel Market Intelligence Steel Market Intelligence 17 Steel Trade – Dealing From the Bottom of a Stacked Deck Op-Eds – Buy American – Pro vs. Con 5 4 4 3 3 3 2 2 2 1 1 1 1 Steel Market Intelligence Fo x N ew s B C M SN C N N es rb Fo G os t B W as Source: Steel Market Intelligence on to n hi ng rk Yo ew N lo Po st es Ti m rn al tJ ou ee tr lS W al be 0 Pro Con 18 Steel Market Intelligence 2 1 2 1 1 1 1 1 Pro 2 1 1 e 2 m 2 Ti U W SA al lS To tr da ee y tJ N o ew ur na Y Lo or l k s Ti A m ng es el es Ti N m ew es Yo W rk as Po hi ng st to C Sa n hi Po ca n Fr st go an Tr ci ib sc un o e C hr on ic le Fo Th rt un e Ec e on B o us m is in t es U S s N W ew ee s k an B a d rr W on or 's ld R ep or A t B C N ew s M SN B C Fo x N ew s Steel Trade – Dealing From the Bottom of a Stacked Deck Editorials – Buy American – Pro vs. Con 4 3 3 2 2 2 1 1 0 Con Source: Steel Market Intelligence 19 Steel Trade – Dealing From the Bottom of a Stacked Deck Public Opinion of Trade, 2002 vs. 2007 US Italy Argentina Indonesia Brazil Japan Turkey 2007 2002 Mexico Poland France Britain Russia Canada Germany S. Korea S. Africa India China 0 10 20 30 40 50 60 70 80 90 100 Note: Bars show percentage of respondents agreeing with the statement that trade is good for their country. Source: Pew Research Center and Steel Market Intelligence Steel Market Intelligence 20 Steel Trade – Dealing From the Bottom of a Stacked Deck US – Respondents Agree “Free Trade is Good for our Economy” 2002 78% 2007 59% Source: Pew Research Center and Steel Market Intelligence Steel Market Intelligence 21 Steel Trade – Dealing From the Bottom of a Stacked Deck EU Countries - Respondents Agree “Free Trade is Good for our Economy” 2002 85% 2007 80% Source: Pew Research Center and Steel Market Intelligence Steel Market Intelligence 22 Steel Trade – Dealing From the Bottom of a Stacked Deck India - Respondents Agree “Free Trade is Good for our Economy” 2002 88% 2007 89% Source: Pew Research Center and Steel Market Intelligence Steel Market Intelligence 23 Steel Trade – Dealing From the Bottom of a Stacked Deck China - Respondents Agree “Free Trade is Good for our Economy” 2002 90% 2007 91% Source: Pew Research Center and Steel Market Intelligence Steel Market Intelligence 24 Steel Trade – Dealing From the Bottom of a Stacked Deck Joint Effort – Eight Global Steel Trade Associations • Unprecedented – Eight global steel trade associations from 3 continents submitted comments to the Chinese Steel Authority suggesting compliance with WTO agreements as well as : • The Chinese steel industry should be governed by market principles • Chinese steel mercantilist interventions are distorting global trade flows based on comparative advantage trading principles • Subsidies create artificial competitiveness • Raw material export control creates artificial cost structure Steel Market Intelligence 25 Steel Trade – Dealing From the Bottom of a Stacked Deck China’s Steel Market Distortions – China subsidizes its domestic steel industry causing excess high-cost capacity that gets exported to others’ markets Chinese Steel Subsidies and Government Support Practices – A Selection Grants, equity infusions, unpaid dividends and other preferential access to capital • Government infusions (18 bn RMB Ma’anshan) • Debt-equity swap (27.5 bn RMB Anshan, Baosteel, Lanzhou, Shougang, Taiyuan) • Government foregoing dividend payment (industry profit around 190 bn RMB in 2007) • ‘In-kind’ contribution: Government provides productive assets to another company through govenmentmandated merger (51% stake in 3 MT E’cheng to Wuhan at no cost) Source: Eurofer and Steel Market Intelligence Steel Market Intelligence Access to policy-driven lending at favorable rates • 47 companies benefited from preferential lending through State Key Technology Renovation Project Fund including Anshan, Baosteel and Panzhihua (75 bn RMB) • Low cost loans ($3.4 bn for major listed steel companies such as Baosteel, Wuhan, Anshan and Shougang) • China Development Bank committed to provide Anshan with 18 bn RMB loan including 10 bn at preferential rates, to promote strategic development of the company Preferential tax programs • Transparency on central government programmes only, not on local level (tax refunds, tax breaks and tax cuts foregoing tax collection worth 7.6 bn RMB from listed steelmakers) Preferential access to inputs, land and energy • Free use of land or at less than adequate remuneration (Baosteel, Anshang, Xinyu) • State-owned steel companies provide steel substrate (HR) to rerollers at significantly low price levels 26 Steel Trade – Dealing From the Bottom of a Stacked Deck China has significant disadvantages in steelmaking Plus – Dynamic domestic demand – Low labor costs – Very competitive leaders – Domestic coal supply Minus – Dependence on iron ore imports – High energy cost – Low grade product – Small producers, non-competitive – Inland industrial network – Environmental issues – Transportation costs – High capital cost – Fragmented and inefficient supply chain Source: ArcelorMittal and Steel Market Intelligence Steel Market Intelligence 27 Steel Trade – Dealing From the Bottom of a Stacked Deck China’s Golden Opportunity Beijing’s “Silver Lining” Opportunity to Restructure Chinese Steel Industry Currently 50% of Global Capacity but 70% of World’s Growth Industry of Two Halves – Modern Efficient Co-Exists with Backwards and Polluting North American Echo – North American Restructuring Took 20 Years Entrenched Stakeholders – Unions, Vendors, Political Interests Supported High Cost Players According to the China Iron & Steel Association, Chinese steelmakers lost 3.3B Yuan ($483M) in 1Q 2009 and 1.8B Yuan ($262M) alone in March. Some 20 out of 72 (34%) large and medium sized steelmakers reported losses during the quarter. Steel Market Intelligence 28 Steel Trade – Dealing From the Bottom of a Stacked Deck Chinese Market Share of U.S. Imports 2009 YTD 2008 2003 2.8% 16.5% 15.1% 83.5% 84.9% 97.2% China Rest of the World China Rest of the World China Rest of the World Source: Steel Market Intelligence, Import Administration and SteelFacts; including AISI and US Department of Commerce. Steel Market Intelligence 29 0.4 0.7 Q .I/ 2 Q 00 .II 3 /2 Q 00 .II I 3 Q /20 .IV 03 /2 Q 003 .I/ 2 Q 00 .II 4 /2 Q 00 .II I 4 Q /20 .IV 04 /2 Q 004 .I/ 2 Q 00 .II 5 /2 Q 00 .II I 5 Q /20 .IV 05 /2 Q 005 .I/ 2 Q 00 .II 6 / Q 200 .II I/2 6 Q .IV 006 /2 Q 006 .I/ 2 Q 00 .II 7 / Q 200 .II I/2 7 Q .IV 007 /2 Q 007 .I/ 2 Q 00 .II 8 / Q 200 .II I/2 8 Q .IV 008 /2 00 8 20 03 20 04 20 05 20 06 20 07 20 08 Steel Trade – Dealing From the Bottom of a Stacked Deck Chinese Steel Export Surges EU 27 Imports from China 3288 9.7 2439 2214 2211 2061 1941 6.5 1653 5.0 837 546 1.1 49 23 31 28 39 22 65 Steel Market Intelligence 108 1854 1317 930 330 492 138126 Source: Eurofer and Steel Market Intelligence 30 Steel Trade – Dealing From the Bottom of a Stacked Deck Chinese Net Imports Turned into Exports Chinese Steel Trade Balance, 1994-2012E (Tonnes in Millions) % of Chinese Consumption 40 13.3% 30 19.1% 10.8% 10.5% 20 8.1% 8.4% 10 4.0% 4.3% 6.9% 5.9% 4.1% NM -8.5% -11.9% -9.8% 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 0 -10 -20 -30 -40 -50 -60 Source: World Steel Association and Steel Market Intelligence Steel Market Intelligence 31 Steel Trade – Dealing From the Bottom of a Stacked Deck Chinese steel consumption growth has outpaced steel capacity growth – most of the time Chinese Steel Consumption vs. Production (Tonnes in Millions) – Assuming Consumption Drops 10% 300 300 250 250 200 200 150 150 100 100 50 50 0 0 Consumption ? 350 2008 350 2007 400 2006 400 2005 450 2004 450 2003 500 2002 500 2001 550 2000 550 1999 600 1998 600 1997 650 1996 650 1995 700 1994 700 Production Source: World Steel Association, National Bureau of Statistics of China and Steel Market Intelligence Steel Market Intelligence 32 Steel Trade – Dealing From the Bottom of a Stacked Deck The “homeless” steel in the global market would have a tsunami effect – the impact of a 10% Decline in Chinese Steel Consumption – 50MT!!! 28% of Asian Market 120% of Korean Market 71% of Japanese Market 26% of International Trade Source: World Steel Association and Steel Market Intelligence Steel Market Intelligence 33 Steel Market Intelligence Steel Trade – Dealing From the Bottom of a Stacked Deck Michelle Applebaum May 19, 2009 847-433-8517 admin@michelleapplebaum.com