Libertas

Wealth Management Ideas Forum:

SMSFs and ETFs

Paul Chin:

Julie Scurfield:

Senior Investment Analyst

Business Development Manager NSW

For institutional use only. Not for distribution to retail investors.

A business to partner with

Global strength & resources

Australian footprint

The Vanguard Group founded in 1975

Headquarters in Melbourne

Over A$3 trillion global funds under

Offices in Sydney, Brisbane & Perth

management

48 investment crew

Index pioneer

45 traditional managed funds and ETFs

> 13,500 crew

Vanguard Global Funds Under

Management: as at 31 Dec 2013

33%

67%

For institutional use only. Not for distribution to retail investors.

*As at 31 December 2013

2

Vanguard’s ownership structure makes us different

•

Alignment of interests

The Vanguard Group Inc. cost advantage

Average expense ratios†

•

Low cost investment solutions

All funds

††

1.11%

1.50%

1.25%

1.08%

1.00%

0.75%

0.50%

0.89%

Vanguard

0.19%

0.25%

0.00%

1975

2012

Expense ratios as at 31 December 2012. Vanguard expense ratios range

from 0.02 to 1.71%.

† Represented as a percentage of net assets.

†† Sources: 1975–1977 Weisenberger Panorama; and Lipper Inc. thereafter.

‡ Source: Lipper, Inc.

Note: Information displayed is in reference to US-domiciled Vanguard funds.

For institutional use only. Not for distribution to retail investors.

3

Vanguard’s low-cost advantage

The average expense ratio for Vanguard ETFs is 17 basis points, while the Australian

industry average is 31 basis points*

Average ETF management cost in Australia

0.31%

0.17%

Vanguard ETFs

Industry

Source: ASX with Vanguard calculations, weighted by funds under management as at 31 December 2013.

For institutional use only. Not for distribution to retail investors.

4

SMSFs: changing the world one fund at a time

$506 billion in assets and 963,000 individual

trustees

• Average of 26,000 new funds a year since June

2008

• Key drivers:

– Control

– Cost

– Tax/franking credits

Number of SMSFs

(Source: APRA Quarterly Superannuation Performance Report)

550,000

500,000

450,000

400,000

366k

353k359k

347k

339k

350,000

503k

498k

488k

477k

469k

460k

453k

443k

435k

428k

421k

413k

407k

402k

396k

392k

386k

380k

374k

320k

313k

307k

301k

300,000

M

ar

-0

Ju 6

nSe 06

pD 06

ec

M 06

ar

-0

Ju 7

nSe 07

pD 07

ec

M 07

ar

-0

Ju 8

nSe 08

pD 08

ec

M 08

ar

-0

Ju 9

nSe 09

pD 09

ec

M 09

ar

-1

Ju 0

nSe 10

pD 10

ec

M 10

ar

-1

Ju 1

nSe 11

pD 11

ec

M 11

ar

-1

Ju 2

nSe 12

pD 12

ec

M 12

ar

-1

3

• There are now 509,000+ SMSFs in existence* with

Which is challenging the industry on a number of fronts…

•

Industry funds

− Heavy outflows in pension mode

− High account balance clients deserting funds

− Launching member-directed investment options to retain

members/assets

•

Adviser platforms

− Adds high cost layer

− Accountants entering adviser licensing regime

5

For institutional use only. Not for distribution to retail investors.

* ATO SMSF statistical bulletin June 2013

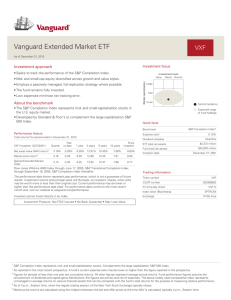

Typical Allocation of SMSF* versus Vanguard diversified funds

* Investment Trends, “April 2013 Self

Managed Super Fund: Investor Report”,

vol. 2, p. 251, June 2013.

Asset Class

(proxy for simulation)

For institutional use only. Not for distribution to retail investors.

6

The obvious risks … and the known unknowns

Trustee overconfidence

•

Cash allocations protected many

SMSFs through the GFC (skill vs. luck?)

Pursuit of high yield

•

•

Tax value of franking credits

High yield hybrid offers

The SMSF challenge:

Uncovering the risk vs return profile within 509,000

portfolios…

Asset allocation

•

•

Concentration risk ( no. of shares)

Lack of diversification

−

−

−

International (equities and FI)

Domestic fixed income

Residential property

For institutional use only. Not for distribution to retail investors.

7

Vanguard ISG Methodology for SMSF Simulations

… a random walk

• Constructed portfolios of randomly selected securities that matched

allocation of typical self-managed super funds (SMSFs),

determined from survey of 1,305 SMSF investors

• Generated 1000 simulated SMSFs using historical returns

• Investigated return paths & risk profiles of these simulated SMSF

returns

• Investigated three different compositions for equity portion of

simulated SMSFs:

1. All equities selected from S&P/ASX 300

2. Most equities selected from large-cap stocks

3. Most equities selected from high-yielding stocks

• Used conservative approach to simulations, true risks even higher

For institutional use only. Not for distribution to retail investors.

8

Broad-based equity portfolio:

Return paths for 1000 simulated portfolios of typical SMSFs

45% equity allocation in

equally weighted securities:

- 18 equities from S&P/ASX 300

• Large spread of potential return

paths

• Return path volatility of

simulated SMSFs higher than

for diversified growth fund

• Significant potential for very

poor performance

Source: Vanguard, Bloomberg, and FactSet Oct 2013

For institutional use only. Not for distribution to retail investors.

9

Simulated risk for typical SMSF:

Broad-based equity portfolio

Risk of typical SMSF

in turbulent times

almost double risk of

diversified growth fund

Source: Vanguard, Bloomberg, and FactSet Oct 2013

For institutional use only. Not for distribution to retail investors.

10

High-yielding equity portfolio:

Returns paths for 1000 simulated portfolio of typical SMSFs:

45% equity allocation in

equally weighted securities: -15

equities high-yielding

& 3 equities from S&P/ASX 300

• High-yield membership

calculated by ranking 6-month

yield calc 1-year prior &

selecting top quartile equities

• Lower spread of returns than

broad-based index simulation

Source: Vanguard, Bloomberg, and FactSet Oct 2013

For institutional use only. Not for distribution to retail investors.

11

Simulated risk for typical SMSF:

High-yielding equities

Risk of typical SMSF

in turbulent times

almost double risk of

diversified growth fund

Source: Vanguard, Bloomberg, and FactSet Oct 2013

For institutional use only. Not for distribution to retail investors.

12

Efficient Frontier Relative to Typical SMSF:

equities selected from broad-based index

We looked at Vanguard diversified funds

vs. typical SMSF relative to efficient

frontier

•

Vanguard diversified funds located

close to theoretically optimal portfolios

defined by efficient frontier

•

Typical SMSF far from efficient

frontier (i.e., additional risk not

compensated by extra returns)

•

Large risk-return spread in cloud of

SMSF returns arises from selection

risk

Source: Vanguard, Bloomberg, and FactSet Oct 2013

For institutional use only. Not for distribution to retail investors.

13

What do the risk and returns simulations tell us?

•

Typical SMSF performed well during GFC – so why the high risk profile?

•

Key drivers of risk are:

•

Selection risk - leads to large spread of return paths

•

Equity concentration risk – no. of securities; home country bias, low levels of international

exposure

•

Typical SMSF inefficient from risk-adjusted return perspective

(cash drag reduces return & equity concentration, home country bias

increases risk)

•

Are trustees conscious of risk within typical portfolio profiles?

•

Conversation starter for brokers/advisers with clients on risk (vs reward) and value of strategic

asset allocation and diversification

•

What is the solution?

For institutional use only. Not for distribution to retail investors.

14

Vanguard ETFs on the ASX

For institutional use only. Not for distribution to retail investors.

15

Vanguard’s current range of ETFs

FIXED INCOME

PROPERTY

AUSTRALIAN SHARES

INTERNATIONAL SHARES

Vanguard

Fixed

Interest

Index ETF

Vanguard

Australian

Government

Bond Index

ETF

Vanguard

Australian

Property

Securities

Index ETF

Vanguard

Australian

Shares

Index ETF

Vanguard

Australian

Shares

High Yield

ETF

Vanguard

MSCI

Australian

Large

Companies

Index ETF

Vanguard

MSCI

Australian

Small

Companies

Index ETF

Vanguard

US Total

Market

Shares

Index ETF

Vanguard

All-World

ex-US

Shares

Index ETF

Vanguard

FTSE

Emerging

Markets

Shares ETF

ASX

code

VAF

VAF

VGB

VAP

VAP

VAS

VAS

VHY

VHY

VLC

VLC

VSO

VTS

VTS

VEU

VGE

VGE

MER p.a.

0.20%

0.20%

0.25%

0.15%

0.25%

0.20%

0.30%

0.05%

0.15%

0.48%

Index

UBS

Composite

Bond

Index™

UBS

Government

Bond Index

S&P/ASX

300 A-REIT

Index

S&P/ASX

300 Index

FTSE

ASFA

Australia

High

Dividend

Yield Index

MSCI

Australian

Shares

Large Cap

Index

MSCI

Australian

Shares

Small Cap

Index

CRSP US

Total

Market

Index

(AUD)

FTSE

All-World

ex-US

Index

(AUD)

FTSE

Emerging

Index

(AUD)

ETF

name

Data as at 21 March 2014

For institutional use only. Not for distribution to retail investors.

16

Building an international equity portfolio in two ASX trades

VTS

50%

VEU

50%

Two trades:

• Build out a major asset class

• Over 5,800 securities

• Over 40 developed and emerging market

• Exxon, Apple, Microsoft, Johnson & Johnson,

Nestle, HSBC, General Electric

• Weighted Management costs of 10 bps

economies

Source: MSCI Inc. and Vanguard Australia

For institutional use only. Not for distribution to retail investors.

17

Lowering portfolio risk, increasing diversification

22.0

21.5

VTS

20%

VEU

20%

21.0

Australian

large caps

60%

20.5

20.0

19.5

19.0

18.5

18.0

7

8

9

10

11

12

13

• 2yr standard deviation falls 27%

• Expanded value proposition

• Build out fixed income, property, small ords, high yield…

For institutional use only. Not for distribution to retail investors.

Source: Morningstar Direct and Vanguard Australia. As at March 31 2014.

18

Lowering portfolio risk, increasing diversification

11.0

MSCI ACWI

20%

Australian

large

caps

UBS Comp

60%

20%

10.5

Australian

large caps

60%

10.0

9.5

9.0

7

8

9

10

11

12

13

14

• 3yr standard deviation falls 36%

• Expanded value proposition

• Build out property, small ords, high yield…

19

For institutional use only. Not for distribution to retail investors.

Source: Morningstar Direct and Vanguard Australia

Vanguard ETF talking points

For institutional use only. Not for distribution to retail investors.

20

Australian shares – small companies

ETF name

Vanguard MSCI Australian Small

Companies Index ETF

(ASX Code: VSO.AXW)

Index

MSCI Australian Shares Small Cap

Index

Management costs

0.30% p.a.

Average spread

0.18%

ASX listing date

26 May 2011

AUM

$40.9m

No. Securities in ETF

166

Top 5 holdings

Challenger, Bluescope Steel,

Ansell, Commonwealth Property

Office, Duet Group

Distribution. (DRP?)

Semi-annually (DRP)

Large cap %

0.00

Mid cap %

64.06

Small cap %

35.94

1 year return

1.09%

1 year index return

1.23%

Cash

International

fixed interest

VHY

Australian

Australian

Australian

Shares

Shares

Shares

Australian

fixed interest

VSO

Emerging

markets

Listed property

International

shares

Note: The asset allocations in this diagram are examples only and do not represent

a recommendation

All data as at 31 March 2014.

For institutional use only. Not for distribution to retail investors.

21

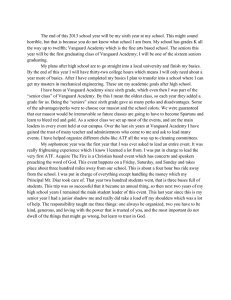

International shares - US shares

ETF name

Vanguard US Total Market

Shares Index ETF

(ASX code: VTS.AXW)

Index

CRSP US Total Market Index

Management costs

0.05% p.a.

Average spread

0.19%

ASX listing date

12 May 2009

AUM (ETF/fund)

A$44.7b (A$349.3b)

No. Securities in ETF

3,698

Top 5 holdings

Apple Inc., Exxon Mobil Corp,

Google Inc., Microsoft Corp.,

General Electric Co.

Distribution. (DRP?)

Quarterly (No DRP)

Large cap %

72.09

Medium cap %

19.28

Small cap %

8.63

1 year return

38.00%

1 year index return

38.02%

3 year return

18.91% p.a.

Cash

International

fixed interest

Australian

Shares

Australian

fixed interest

VSO

Emerging

markets

Listed property

VTS

International

shares

Note: The asset allocations in this diagram are examples only and

do not represent a recommendation

For institutional use only. Not for distribution to retail investors.

All data as at 31 March 2014.

22

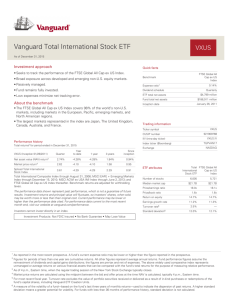

VTS advantage: achieve broad diversification at lower cost

VTS

CRSP US Total

Markets Index

(broad)

IVV

S&P500

MER % p.a

VTS

IVV

0.05

0.07

Index

CRSP US

Total Market

S&P 500

Annualised return

9.32%

8.54%

Annualised risk

14.9%

14.3%

Market coverage

99.5%

81%

•

•

•

•

•

Large cap

Mid cap

Small cap

Micro cap

Large cap

US broad, large, mid and small cap calendar year performance from 2000 to 2013

For institutional use only. Not for distribution to retail investors.

Summary performance statistics from May 2003 to December 2013. (May 2003 is when the CRSP index’s inception)

Summary performance statistics from May 2003 to December 2013. (May 2003 is when the CRSP index’s inception)

23

Australian property securities

ETF name

Vanguard Australian Property

Securities Index ETF

(ASX code: VAP.AXW)

Index

S&P/ASX 300 A-REIT Index

Management costs

0.25% p.a.

Average spread

0.13%

ASX listing date

15 October 2010

AUM (ETF/fund)

$166.9m ($2,892.9m)

No. Securities in ETF

28

Top 5 holdings

Westfield, Westfield,Retail Trust,

Stockland, Goodman Group, Mirvac

Distribution. (DRP?)

Quarterly (DRP)

Large cap %

61.04

Mid cap %

34.50

Small cap %

4.46

1 year return

4.86%

1 year index return

4.96%

Cash

International

fixed interest

Australian

Australian

Shares

Shares

Australian

fixed interest

VSO

VAP

Emerging

markets

Listed property

International

shares

All data as at 31 March 2014.

For institutional use only. Not for distribution to retail investors.

Note: The asset allocations in this diagram are examples only and do not

represent a recommendation

24

Australian fixed interest

ETF name

Vanguard Australian Fixed

Interest Index Fund

(ASX code: VAF.AXW)

Index

UBS Composite Bond Index

Management costs

0.20% p.a.

Average spread

0.27%

ASX listing date

31 October 2012

AUM (ETF/fund)

$31.3m ($3,686.3m)

No. Securities in ETF

422

No. Issuers in ETF

154

Distribution. (DRP?)

Quarterly (DRP)

Yield to maturity

3.61%

Effective duration (yrs)

4.16

1 year return

3.18%

1 year index return

3.33%

Cash

International

fixed interest

Australian

fixed interest

VAF

Australian

Shares

VSO

Emerging

markets

Listed property

International

shares

Note: The asset allocations in this diagram are examples only and do not represent

a recommendation

All data as at 31 March 2014.

For institutional use only. Not for distribution to retail investors.

4,314 stocks and bonds in 4 trades

25

Next steps…

For institutional use only. Not for distribution to retail investors.

26

Next steps…

• Vanguard has the largest financial adviser support team in Australia

• We can help you:

– have the ‘why Vanguard’ conversation with clients

– discuss the benefits of ETFs in investment portfolios

– articulate talking points on individual Vanguard ETF exposures

For institutional use only. Not for distribution to retail investors.

27

Appendix

For institutional use only. Not for distribution to retail investors.

28

Trading tips

• Do your homework

– What is the iNAV?

– What are typical spreads?

– What are spreads for the managed fund?

• Don’t trade during market open and market close

• Use “limit” orders

• On-screen volume is an indication of price, not the additional liquidity available

For ETF trade execution assistance,

contact our ETF Help Desk:

1300 655 888

For institutional use only. Not for distribution to retail investors.

29

A starting point: The iNAV

Product

iNAV Code

VAS.AXW

VASINAV.ETF

VHY.AXW

VHYINAV.ETF

VLC.AXW

VLCINAV.ETF

VSO.AXW

VSOINAV.ETF

VAP.AXW

VAPINAV.ETF

VGB.AXW

VGBINAV.ETF

For institutional use only. Not for distribution to retail investors.

30

Disclosures – General advice warning

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (“Vanguard”) is the product

issuer.

This presentation contains general information and is intended to assist you. We have not taken anybody's

circumstances into account so the information may not be applicable to your circumstances or those of any other

person. This presentation was prepared in good faith and we accept no liability for any errors or omissions.

You should consider your circumstances or those of any other relevant person, and the relevant Product

Disclosure Statement (PDS), before making an investment decision or recommendation. You can access our

PDS at www.vanguard.com.au or by calling 1300 655 102.

Past performance is not an indication of future performance. Unless otherwise indicated, Vanguard pays a fee for

access to the data used in this presentation but did not commission the research.

"Vanguard", "Vanguard Investments", and the ship logo are the trademarks of The Vanguard Group, Inc.

© 2014 Vanguard Investments Australia Ltd. All rights reserved.

For institutional use only. Not for distribution to retail investors.

31

Important information

This presentation contains general information and is intended to assist you. In preparing the above information, individual circumstances, for example tax implications, have not

been taken into account and it may, therefore, not be applicable to an individual’s situation. Before making an investment decision, you should consider your circumstances and

whether the above information is applicable to your situation.

Past performance is not an indication of future performance. Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (“Vanguard”) is the issuer of the

Vanguard® Australian ETFs. Vanguard is the issuer of the Prospectus on behalf of the US listed ETFs described in the Prospectus. Vanguard has arranged for interests in the US

ETFs to be made available to Australian investors via CHESS Depositary Interests that are quoted on the AQUA market of the Australian Securities Exchange (“ASX”).

Vanguard ETFs will only be issued to Authorised Participants, that is persons who have entered into an Authorised Participant Agreement with Vanguard. Retail investors can

transact in Vanguard ETFs through a stockbroker or financial adviser on the secondary market.

Investors should consider the relevant Prospectus and/or Product Disclosure Statement (“PDS”) in deciding whether to acquire Vanguard ETFs. Retail investors can only use the

Prospectus and PDS for informational purposes. You can access the PDS and/or Prospectus at vanguard.com.au

Vanguard is not offering the Vanguard FTSE Emerging Markets Shares ETF in the United States and this presentation does not constitute an offer or an invitation to apply for or

acquire any interests in the International ETFs in the United States. The information contained in this presentation is not intended for US persons as defined in Regulation S under

the US Securities Act.

Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P") and ASX® is a registered trademark of the Australian Securities

Exchange Limited (“ASX”). These trademarks have been licensed for use by The Vanguard Group, Inc. Vanguard's ETFs are not sponsored, endorsed, sold or promoted by S&P or

ASX, and S&P and ASX make no representation, warranty or condition regarding the advisability of buying, selling or holding units/shares in the Vanguard ETFs.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities. For any such

funds or securities, the Prospectus contains a more detailed description of the limited relationship MSCI has with Vanguard and any related funds.

“FTSE®” is a trademark of the London Stock Exchange Group companies (LSEG) and is used by FTSE International Limited under license. "All-World" is a trade mark of FTSE

International Limited. The FTSE All-World ex US Index and the FTSE Emerging Index are calculated by FTSE. FTSE does not sponsor, endorse or promote this product and is not in

any way connected to it; and does not accept any liability in relation to its issue, operation and trading. All rights in the FTSE ASFA Australia High Dividend Yield Index (the “Index”)

vest in FTSE International Limited (“FTSE”) and The Association of Superannuation Funds of Australia (“ASFA”). “ASFA™”is a trade mark of ASFA. The Vanguard Australian Shares

High Yield ETF, the Vanguard All-World ex-US Shares Index ETF and the Vanguard FTSE Emerging Markets Shares ETF (the “Products") have been developed solely by

Vanguard. The Indices are calculated by FTSE or its agent. Neither FTSE nor its licensors are connected to and do not sponsor, advise, recommend, endorse or promote the ETF

and do not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the ETF. Neither FTSE

nor ASFA make any claim, prediction, warranty or representation either as to the results to be obtained from the ETF or the suitability of the Index for the purpose to which it is being

put by Vanguard.

The marks and names "UBS Government Bond Index"and "UBS Composite Bond Index™" a are proprietary to UBS AG ("UBS"). Any use of these indices or the index names must

be with the express written consent of UBS AG acting through its Australia Branch. UBS has agreed to the use of, and reference to the "UBS Government Bond Index" and "UBS

Composite Bond Index™" ("Indices") by us in connection with the Vanguard funds and ETFs and the website material but no Vanguard fund or ETF is in any way sponsored,

endorsed or promoted by UBS. UBS assumes no responsibility for this website material or the ETFs. Vanguard assumes sole responsibility for producing this website material, which

has not been reviewed by UBS AG.

© 2014 Vanguard Investments Australia. All rights reserved.

For institutional use only. Not for distribution to retail investors.

32