Microsoft Word Document / Unit 15 Assignment

advertisement

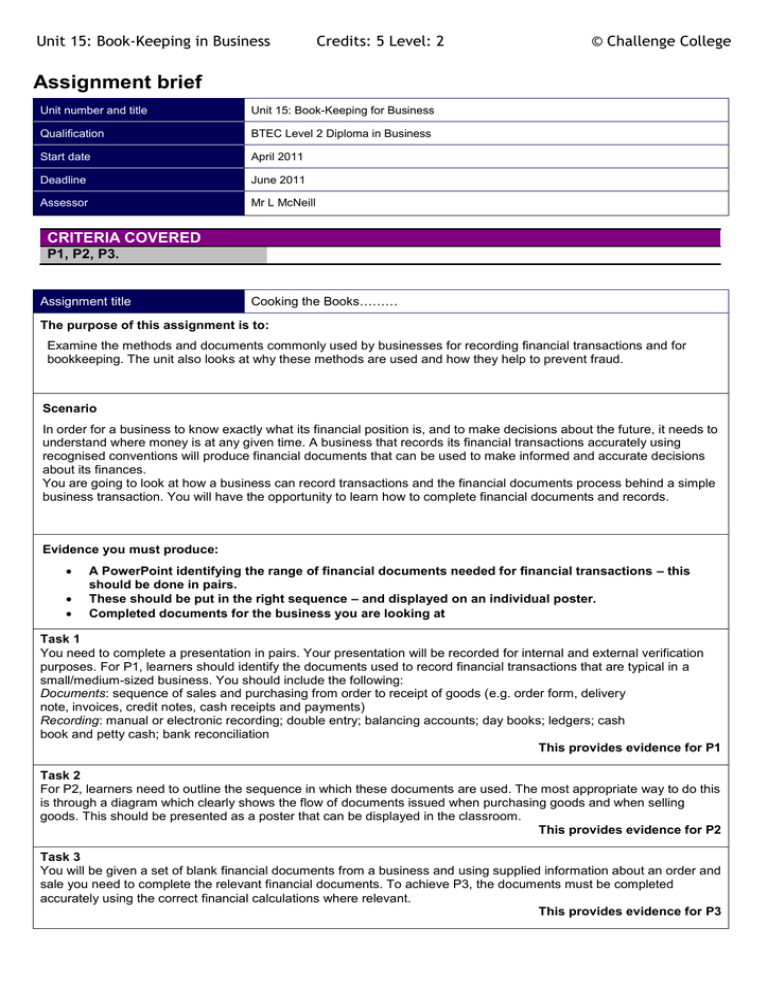

Unit 15: Book-Keeping in Business Credits: 5 Level: 2 © Challenge College Assignment brief Unit number and title Unit 15: Book-Keeping for Business Qualification BTEC Level 2 Diploma in Business Start date April 2011 Deadline June 2011 Assessor Mr L McNeill CRITERIA COVERED P1, P2, P3. Assignment title Cooking the Books……… The purpose of this assignment is to: Examine the methods and documents commonly used by businesses for recording financial transactions and for bookkeeping. The unit also looks at why these methods are used and how they help to prevent fraud. Scenario In order for a business to know exactly what its financial position is, and to make decisions about the future, it needs to understand where money is at any given time. A business that records its financial transactions accurately using recognised conventions will produce financial documents that can be used to make informed and accurate decisions about its finances. You are going to look at how a business can record transactions and the financial documents process behind a simple business transaction. You will have the opportunity to learn how to complete financial documents and records. Evidence you must produce: A PowerPoint identifying the range of financial documents needed for financial transactions – this should be done in pairs. These should be put in the right sequence – and displayed on an individual poster. Completed documents for the business you are looking at Task 1 You need to complete a presentation in pairs. Your presentation will be recorded for internal and external verification purposes. For P1, learners should identify the documents used to record financial transactions that are typical in a small/medium-sized business. You should include the following: Documents: sequence of sales and purchasing from order to receipt of goods (e.g. order form, delivery note, invoices, credit notes, cash receipts and payments) Recording: manual or electronic recording; double entry; balancing accounts; day books; ledgers; cash book and petty cash; bank reconciliation This provides evidence for P1 Task 2 For P2, learners need to outline the sequence in which these documents are used. The most appropriate way to do this is through a diagram which clearly shows the flow of documents issued when purchasing goods and when selling goods. This should be presented as a poster that can be displayed in the classroom. This provides evidence for P2 Task 3 You will be given a set of blank financial documents from a business and using supplied information about an order and sale you need to complete the relevant financial documents. To achieve P3, the documents must be completed accurately using the correct financial calculations where relevant. This provides evidence for P3 Unit 15: Book-Keeping in Business Credits: 5 Level: 2 © Challenge College Sources of information Textbooks Anderton A – GCSE Business Studies (Causeway Press, 2004) ISBN 1873929846 Carysforth C and Neild M – BTEC First Business (Heinemann, 2006) ISBN 0435499076 Carysforth C and Neild M – GCSE Applied Business AQA: Student Book (Heinemann, 2002) ISBN 0435446908 Fardon M, Nuttall C and Prokopiw J – GCSE Applied Business (Osborne Books, 2002) ISBN 1872962327 Wales J and Wall N – Nuffield – BP Business and Economics for GCSE, 2nd Edition (Collins, 2001) ISBN 000711639X Journal Business Review Websites www.bized.co.uk Business Education on the internet (Bized) www.thetimes100.co.uk Times 100 www.tutor2u.net Tutor 2 U This brief has been verified as being fit for purpose Assessor Signature Date Internal verifier Signature P1 identify the documents used to record financial transactions [IE] P2 outline the sequence in which these documents are used P3 complete documents to record financial transactions Date