Canadian Airlines (AC and Westjet)

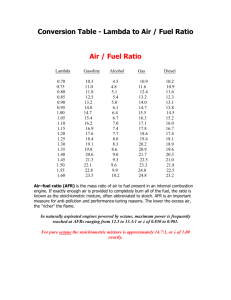

advertisement

Canadian Airlines BUS 419 Presented by: Lin Chiu Wilson Lam Joti Muker Xueming Yang Cindy Yu S Agenda S Airline Industry Analysis S Services S Revenue S Cost Structure S Regulations S Current Challenges S Air Canada Business Strategy S West Jet Strategy S Risks S Air Canada S West Jet Industry Segmentation Industry Analysis Services S Scheduled Flights / Chartered Flights: S Transnational S Regional S International S Cargo Revenue S There are two sources of revenue for Airlines: S Passengers S Charters and cargos Cost structure S Fuel Expenses S Wages & Salaries S Airport / Navigation Fees S Depreciation & Amortization S Maintenance S Food, Beverages, Supplies S Communications and Information Technology S Aircraft Rentals Regulations S In the past few decades, government deregulation has dramatically increased competition and allowed the emergence of “low-cost carriers” S Some regulations still in place: S Federal Aviation Authority (FAA) S Airline Safety and Security S Environmental Concerns Challenges S In recent years, the airline industry has been affected by: S Terrorism attacks & increased security costs S Epidemic diseases (SARs, Swine Flu) S Economic Crisis S Fuel Prices Canadian Market S The industry is slowly recovering from its decline in 2009 S The compound annual growth rate of the industry volume in the period 2008-2013 is predicted to be 4.7%. Market Value Forecast Strategies S Implementing cost reduction initiatives S Reducing company sizes S Reducing operations S Entering into agreements with supplier S Airline alliances S Apply hedging programs Air Canada Strategies S Cost Reduction: S Corporate downsizing S Capacity management S Fleet renewal programs S Customer Driven Revenue: S Multi-tiered Fares S Web Platforms S Employee Incentives WestJet Strategy S Four-pillars: S People and Culture S Guest Experience and Performance S Revenue and Growth S Cost and Margins Risks S Operational S Strategic S Financial: S Fuel Prices S Foreign Exchange Rates S Interest Rates S Hazards Airline Risk Factors S Founded April 11, 1936 (as Trans-Canada Airlines) S David Richardson (Chairman) S Calin Rovinescu (President & CEO) S Headquarters in Montreal, Quebec S Subsidiaries S Air Canada Cargo (operating division) S Air Canada Jetz(operating division) S Air Canada Vacations S Destinations: 178 S Company slogan: GO FAR Profitability in 4 year Interval In thousands of Canadian dollars Financial Statements S Reasons to Hedge S Should the Company Hedge ? YES! S WHY? S Fuel price changes have a significant impact on income S Foreign exchange rate impact earnings and operating costs S Interest rate changes effect borrowing costs Risk Management S Hedging Strategy S Michael Rousseau Executive Vice President & CFO, since 2007 S Prior Position: S Executive Vice-President & CFO in Hudson’s Bay Company (HBC) Since 2001 S Executive Financial positions in Moore Corporation, Silcorp Limited & The UCS Group S Education background: S BBA degree from York University S Member of the Ontario Institute of Chartered Accountants since 1983 Risk Exposures & Strategy Risk Factors: Strategy Market Risk Derivative Instruments. Credit Risk Review credit ratings on regular basis and sets credit limit. Liquidity Risk Cash from operation & financing. Fuel Price Risk Enter in derivative contracts: call, put options, swaps, collars. Adjust the strategy with market Interest Risk Portfolio basis & swaps Foreign Exchange rate Forward foreign currency contracts and option agreements, swaps. Try to get positive CF on Mark-toMarket Fuel Price Risk S Air Canada’s Cost Structure Fuel Price Risk Exposure Sensitivity on Operating Income S Estimated operating income impact from US$1/barrel increase in WTI – ($25 Million) estimates are derived from 2008 levels of activity and make use of management estimates. S A 1% increase in Jet fuel prices (CAD cents/litre) has an estimated operating income impact of ($35 Million) S Fuel Expenses – 31% of 2008 total operating expense, 25% of 2007 total operating expense Hedging Ratio For 2009: S 35% of anticipated purchases of fuel S The contracts to hedge anticipated jet fuel purchases over 2009 is comprised of jet fuel, heating oil and crude oil – based contracts For 2010: S 14% of of anticipated purchases of fuel Hedging Strategy Dec 2008 Hedge Strategy Jan 2009 How much did they make/lose off fuel hedges? Comprehensive Income (Loss) Operating Income/Expenses Gain (Loss) on Financial Instruments Interest Rate Risk S Interest Risk High level of Leveraging rate of 2008==$4691/$762 =615.616% Section of Balance sheet: Section of Cash Flow: Interest Risk: Contractual Obligations: Sensitivity Analysis Interest Risk Exposure S Fixed rate debt S Floating rate debt S Lease on assets based on changes in short-term interest rates S Aircraft financing agreements Interest Rate Risk S Objectives: S Minimize the potential changes in cash flows from changes in interest rates S Long term objective: 60% fixed and 40% floating debt S Dec 31,2009 – 59% fixed and 41% floating S Dec 31,2008 – 58% fixed and 42% floating S Designed to maintain flexibility in the Air Canada’s capital structure Hedging Strategy Cont S Use of Derivatives S 3 cross-currency interest rate swap, financing Boeing 777 worth 300 million S S 2 Interest rate swap, financing Boeing 767 S S Terminated on Oct 1,2008, 4 million Gain 14 million gain 19 forward interest rate to manage risks associated US and Canada interest rate market S No gain or loss recorded Foreign Exchange Risk S Foreign Exchange Rate Risk S Cash flow structure: S Inflows primarily in Canadian dollars S Large portion of outflows in US dollars S Majority of outstanding debt is US dollars S US dollar debt act as an economic hedge against the related aircraft S Foreign exchange risk on foreign currency denominated trade receivables and foreign currency denominated net cash flows Foreign Exchange Rate Risk Section of Cash Flow Statement: Section of Income Statement: Foreign Exchange Rate Risk S Foreign Currency Forward Contract / Option Agreements - USD to CAD(US$516 M)2009, Euro to CAD(EUR$3M)2010$64 M - Gain , $327 M recorded in foreign exchange gain related to these derivatives S Foreign Currency Forward Contract / Option Agreements - USD to CAD(US$297 M)1009, Euro to CAD(EUR$3 M)2010 - $51M Gain S Currency Swap Agreements on operating leases (2007,2011) - $78 M notional amount. Summary of Gain (loss) on Financial Instruments Fuel Risk Interest Risk Forex Risk Gains/losses Loss Gain Loss Reported Amounts (208) 18 (655) Effective? S Company Background • WestJet began service on Feb 29, 1996. – founded in 1996 by the team of Calgary entrepreneurs • Canada’s leading high-value low fare airline. • WestJet flies an average of 383 flights everyday Profitability in 4 Year Interval In Thousands of Canadian Dollars Operating Expenses Risk Exposures & Strategy Risk Factors: Strategy Market Risk Try to accurately predict market movements Cash and cash equivalent Credit Risk Liquidity Risk Maintain current ratio > 1 Fuel Price Risk Enter in derivative contracts: costless collars and swaps. Adjust to market expectations Interest Risk Canadian dollar fixed interest rate debt Foreign Exchange rate Forward foreign currency contracts and option agreements, swaps Outline of Risk Factors Related to Derivative Securities • Jet Fuel Price Risk • Changes in crude oil and fuel prices • Foreign Currency Risk • Canadian-US dollar exchange rate • Interest Rate Risk • Interest rate fluctuations Income Statement Cash Flow Statement Reasons to Hedge S Should the Company Hedge ? YES! S WHY? S Dependent on jet fuel and prices are volatile S Currencies exchange rates fluctuations causing the value of assets and liabilities and/or future cash flows change S Interest rate fluctuations changes the value of financial assets and liabilities and/or future cash flow Fuel Risk S Jet Fuel S Consumed 210,090,434 litres of fuel in 2008 S Every $1 USD Δ per barrel of crude oil ≈ $ 7 million annual Δ in fuel costs S Every 0.01¢ Δ per litre of fuel ≈ $ 9 million annual Δ in fuel costs Jet Fuel Hedging Philosophy As approved by the Board of Directors: S Hedge a portion of anticipated jet fuel purchases S Established maximum hedging limits S Up to 36 months S Using crude-oil based commodities Average Market Price of Jet Fuel Basis risk Jet Fuel Price Hedging Strategy S Mixture of fixed swap agreements S Costless collar structures in Canadian-dollar WTI crude oil derivative contracts S Short position in call option S Long position in put option S 2008 hedge ratio: 30 percent S 2009 hedge ratio: 14 percent S 2010 hedge ratio: 32 percent As of December, 2008 Fuel Hedge Derivative Holdings Fuel Cost 2008 Balance Sheet and Income Statement~ Note 11 Interest Rate Risk S Interest Rate Hedging Strategy S 85 % of borrowing is done at low interest through debt guaranteed by Export-Import Bank in the US S Borrow 1.3 billion CANADIAN S Fixed interest rates S Borrow in Canadian funds- use Canadian cash inflows to pay Canadian outflows Contractual Obligations and Commitments Foreign Exchange Risk S Foreign Currency Exchange Risk S Arising risks S Fluctuations in exchange rates on US-dollar denominated asset and operating expenditures S Aircraft fuel, leasing expense, maintenance costs and a portion of airport operations costs. S US $99.5 million in 2008 S Between 2008 and 2009 S The average US exchange rate increase from 1.0651 to 1.1425 Foreign Currency Exchange Hedging Strategy S To reduce foreign exchange risk: S Hold US-denominated cash and short term investment S Foreign exchange forward contracts S In 2010 S US 7.3 million per month for the period of Feb to Oct S US $65.4 million at a weighted average contract rate of 1.0671 per US dollar Foreign Currency Exchange Risk S Foreign Exchange Forward Contact S average contracted rate on the forward contracts was 1.0671 (2008 – 1.0519) US dollars to Canadian dollars, S average forward rate used in determining the fair value was 1.0512 (2008 – 1.2178) US dollars to Canadian dollars 2008 2009 Average contracted rate on the forward contracts 1.0519 1.0671 Average forward rate used in determining the fair value 1.2178 1.0512 Foreign Currency Exchange Risk S Impact of foreign exchanging hedging S Every one-cent change in the value of the Canadian dollar versus the US dollar will have an approximate $9 million impact on our annual operating costs S $9million =($6 million for fuel, $3 million related to other US dollars denominated expense) Five Year Foreign Exchange Graph Foreign Currency Exchange Risk 2008 S In 2007, lose 12.8 million S In 2008, gain 31 million S In 2009, lose 12.3 million 2007 Summary of Derivative Instruments Carry Amount Future Outlook S Expect a economic recovery S Jet fuel prices stabilized and decreased in 2009 S Do not expect to see the same relief on costs going forward S Hedged about 32 % of anticipated fuel requirements for 2010 S 35 % of the total volume hedge using costless collars S 65% of the total volume hedge using fixed swap agreements Summary (2008) West Jet Air Canada Market Share 36% 57% Gain (Loss) on Jet Fuel Hedging ($18 millions) ($92 millions) Gain (Loss) on Foreign Exchange Hedging $31 millions ($822 millions) Gain (Loss) on Interest Rate Hedging $18 millions Questions ? Thank you