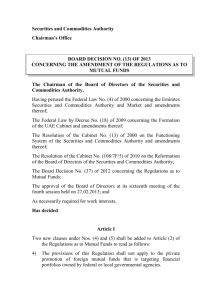

CHAPTER 3

advertisement

CHAPTER 4 NON-DEPOSITORY INSTITUTIONS INSURANCE COMPANIES • They provide insurance policies • They promise to pay specified amounts contingent on the occurance of future events. • They are risk bearers. • They accept risk in return of insurance premium • Their major task (underwriting Process): – Deciding which applications for insurance they should accept or reject. – Determine how much to charge for insurance if they accept the application. INSURANCE COMPANIES There are two kinds of sources for the insurance companies; • Initial Underwriting Income (Insurance Premium) • Investment income INSURANCE COMPANIES • TYPES OF INSURANCE COMPANIES in Turkey – Life Insurance Companies • Term Insurance • Whole Life Insurance • Other Life Insurer activities; – Private pension funds – Accident and health insurance – Group insurance: providing health insurance coverage to corporate employees. INSURANCE COMPANIES – Non-life Insurance Companies • • • • • • fire transport accident engineering agriculture health INSURANCE COMPANIES Differences of non-life insurance from life insurance; • Non-life insurance covers a wide variety of activities. However, life insurance is more focused. • Non-life insurance policies often last for a short-term (one year or less) as opposite to the long-term and even permanent life insurance policies. INVESTMENT COMPANIES • They are financial intermediaries that sell funds to the public and invest the proceeds in a diversified portfolio of securities. • This portfolio is managed by the investment company on the behalf of its shareholders. TYPES OF INVESTMENT COMPANIES in U.S • Mutual Funds • Closed-end Funds • Unit Investment Trusts (UITs) – Real Estate Inv. Trusts (REITS) – Real Estate Mortgage Conduits (REMICs) MUTUAL FUNDS • Funds comprised of various types of securities. Such as common stock, bonds, MM instruments and combination of them. • Since each investor may sell their shares or buy new shares each business day, they are called as “open-end investment companies”. • Each mutual fund has a manager or investment advisor. • The price of each share is Net Asset Value (NAV): • NAV = Mrk. Value of the port – Liabilities Nr. Of shares outstanding • NAV is determined only once in day , at the close of the day) Closed-End Funds • The shares of closed –end funds are like the shares of the common stock. • The new shares of the closed end fund are initially issued by an underwriter for the fund. • After the new issue the number of shares are remains constant Unit Trust • They are like closed-end funds in that the number of unit certificates are fixed. • They specialize in bonds. Differences btw Open-end Funds (Companies) (Mutual Funds) and Closed-end Funds (Companies) • Purchase its shares from the fund. • Redeemable • Shares are being sold on a continues basis • More liquid securities Traded in the secondary market. Not redeemable They do not continuously offer their shares for sale They are permitted to invest in a greater amount of “illiquid” secutities than mutual funds Similarities of the open-end and closed-end funds • Both funds are managed by seperate entities known as “investment advisors” that are registered by the SEC. • Both can come in many varities. • They are subject to SEC registration and regulation and are subject to numerous requirements imposed for the protection of investors. Differences btw Unit Inv. Trusts (UITs) and Mutual Funds • Have a termination date • Make a one-time public offering of fixed amount of units Never expire No fixed amount. Diversification is essencial . It must hold a min. Nr. of diff. Securities • Can not buy or sell securities frequently. Can sell and buy securities frequently. • Does not have an inv. Advisor Have an inv. advisor • You can buy or sell at any time Buy or sell at the end of the trading day. • Buy and hold a fixed portfolio of stocks, bonds etc. concentrated in a particular industry. Have shares of stocks of a few companies. (Dogs of Dow Approach) Similarities of the Mutual Funds and UITs • Their shares are both redeemable. Closed-end funds are not redeemable. • They must both calculate the NAV at least once every business day after the major US exchanges are closed. Closed-end funds are not subject to this requirement. • The share price of them are based on; – Per share NAV+fees at purchase (sales load, purchase fees) • The price the investors receive at redemption; – app. NAV-fees (deferred sales loads or redemption fees) Fund Sales Charges and Annual Operating Expenses • There are two types of costs for the mutual fund investors; – Shareholder fee (sales charge): One –time charge for a specific trensaction such as purchase, redemption and etc. – Annual operating expenses (expense ratio): is debited annually from the investor’s fund balance by the fund sponsor such as management fee, investment advisory fee and etc. Economic Motivation for Funds 1. Risk reduction through diversification. 2. Lower costs of contaracting and processing information. 3. Professional portfolio management. 4. Liquidity. 5. Variety. 6. A payment mechanism. Types of Funds by Investment Objective • Main categories; – – – – Stock funds Bond Funds MM Funds Others. • Other clasification; – U.S only funds – International funds (No U.S) – Global funds (U.S and International) • Another clasification; – Passive funds (Indexed funds) – Active funds. • Acc. to market capitalization; – Small cap – Mid cap – Large cap • Acc. to style; – Value – Growth • Acc. to sector specialization; – Technology – Utilities – Go on.... • Funds in funds. Common objective of the mutual funds – Long-term growth – High current income – Preservation of principal Types of mutual funds in U.S • Stock funds; – – – – Equity income funds (conservative) Growth funds-value funds (mainstream) Small company funds (aggressive) International funds (aggressive) • Bonds (by maturity); – Short-term bonds – Intermediate bonds – Long-term bonds • Bonds (by creditworthiness of issuers) – – – – Government bonds Corporations High yield corporations Investment grade • Asset Allocation funds, Exchange Traded Funds • They consist of investment companies that are similar to mutual funds but trade like stocks on an exchange. • Even-though they are open-end funds, ETFs are similar to closed-end funds which have small premiums or discounts from their NAV. • They are based on stock indices or subindices, not actively managed portfolios. Exchange-traded funds in US • SPDRS, Spider, Spyders – Traded as SPY on AmEx. – Tracks S&P 500 index • Qube – QQQ on AmEx – 2.5% of the NASDAQ 100 Index • DIAMONDS – DIA on AmEx – 1% of the DJIA REITs and REMICs • They are pass-through securities. – REITs specializes in investing in mortgages, property or real estate company shares offering their investors an apportunity to participate in real estate profits and tax benefits – REMICs must invest only in mortgages not real estate. • There are 3 institutions that sell these securities guaranteed and issued by the government; – Government National Mortgage Association, Ginnie Mae – Federal Home Loan Mortgage Corporation; Freddie Mac – Federal National Mortgage Association; Fannie Mae. PENSION FUNDS • It is a fund established by private employers govenments, or unions for the payment of retirement benefits. HEDGE FUNDS (Private Limited Partnership) • Private inv. tool that invests all or most of their assets in publicly traded securities. • Make inv.s in CS, bonds, commodities and currencies and using some tools such as leverage, derivatives and arbitrage. • Structured as limited partnerships. • They are unregulated. • Hedge fund fees (management fee or performance fee); US hedge funds charge the standard “one-to-twenty”. HEDGE FUNDS • Min inv. For one share is 250,000 $ • Accredited investor; professional, sophisticated, institutional investor who has net worth of 1 million $ or more. • Qualified purchasers; super accredited investors who has net worth of 5 million $ or more. • The most famous hedge funds are; – Quantom Fund (George Saros) – L-T Credit Management CM Entities in Turkey • There are several participants in the capital markets. The new Turkish Law 6362 refers to 11 of them, which are titled “capital market institutions” in the article 35 as follows: • Investment firms (Yatırım Kuruluşları) • Collective investment firms (Kolektif Yat. Kuruluşları) • Auditing, rating, scoring firms(Bağımsız denetim, değerleme ve derecelendirme kuruluşları) • Portfolio management corporations (Portföy yönetim şirketleri) • Mortgage finance corporations( İpotek Finansmanı kuruluşları) • Housing finance and asset finance mutual funds (Konut finansmanı ve varlık finansmanı fonları) • Asset leasing corporations (for Islamic Bonds.ie., Sukuku İcara) (Varlık kiralama şirketleri) • Central Clearing houses (Merkezi takas kuruluşları) • Custodian houses (Merkezi saklama kuruluşları) • Data storage houses (Trade repositories)(Veri depolama kuruluşları) • Others (Diğer sermaye piyasası kurumları) 1. Investment Institutions (Yatırım Kuruluşları) According to the Law 6362, 3 (v), investment institutions consist of; - Investment firms (Aracı kurumlar) - Banks Investment Institutions • MiFID (Markets in Financial Instruments Directive) refers to “banks and investment firms” as “providing investment services such as brokerage, advice, dealing, portfolio management, underwriting, et al”. • We may deduce two things out of this: – Investment firms and banks are considered together in providing investment services – Dealers and brokers are only part of the investment firms Investment Institutions • The Law 6362, likewise, refers to investment firms and banks as “investment institutions” (yatırım kuruluşu) in its sub article (v) of the article 3. • In the USA “dealer” means any person who engages either for all part of his time, directly or indirectly, as agent, broker, or principal, in the business of offering, buying, selling. Or otherwise dealing or trading in securities issued by another person (Securities Act 1933 – 2/12). “Broker” means any person engaged in the business of affecting transactions in securities for the accounts of others (Securities Exchange Act 1934-4/A). Investment Institutions • Broker does business for the others only, yet dealers may do business either in his name or account, or for the others. • In Turkish regulations, however, there is no reference to “dealer” or “broker”, these words are in use, and be it erroneously. • Turkish capital markets call the customer representative at the counters of banks or intermediary institution “aracı kurum” as “dealer”, and those who are seated in front of the monitors at the Borsa Istanbul as “brokers”! Investment Institutions • Investment services and activities of Investment institutions in Turkey – They receive and send orders for the capital market instruments – They realize orders in their name and in their own account or in their name and in their customers’ account – They buy or sell capital market instruments from their own account. – They intervene public offerings of capital market instruments through underwring. – They intervene public offerings through best efford selling. 2. Collective investment firms • These are definitions that the old Capital Markets Act of Turkey had no reference. • Collective investment firms are made up of the “mutual funds” (yatırım fonları), and “unit investment trusts” (yatırım ortaklıkları) (6362 3/m). • Previously, in Turkey for example, banks, investment firms (brokers/dealers), insurance companies as well as pension funds were allowed, subject of course to the Capital Markets Board’s approval, to set up “mutual funds”. Henceforth, the authorized “portfolio management companies” only will have this right. Collective investment firms • The adjective “collective” is, again, a new defining attribute. • These institutions are for portfolio management on the very basic principle of risk diversification. But the new regulations, MiFID of the EU and Turkish 6362, do not make reference to this previous “diversification” principle. 2.1. Mutual Funds • As in the old Capital Markets Act (2499), the new one (6362) gives the definition for the mutual fund as portfolio management entities that are not incorporated, meaning with separate assets, on the basis of fiduciary ownership. • Portfolio management companies are earmarked to set up, manage and represent; and even audit the mutual funds (6362/52-3) Mutual Funds The basics of the definition for mutual funds are; • They are set up for the sole purpose of portfolio management • They are unincorporated entities (no legal identities) • They are set up and managed and even audited by portfolio management companies on behalf of investors on the following bases: – Management is based on fiduciary ownership (İnançlı mülkiyet) – Management is based on proxy relationship (Vekalet ilişkisi) (Turkish Code of Obligation articles 502 & 514 applicable in case of ambiguity) – Management has to be strictly in line with the fund’s bylaw (Fon İç Tüzüğü) Types of the Mutual Funds in Turkey • A Type Fund: These funds are accounted for by at least 25% stock of companies that are founded and operate in Turkey. • B Type Fund: These funds are “the other types” than A type funds that do not have any limitations. Names of the Mutual Funds in Turkey • If at least 51% of the portfolio consists of; – – – – – • bonds and bills, it is called as bonds and bills fund common stocks, it is called as common stock fund foreign securities, it is called as foreign securities fund gold and other precious metal, it is called as gold and other precious metals fund the securities of the main company and its sub-companies, it is called as group fund If the whole fund consist of ; – At least two of the following instruments; common stock, bond, bills, gold and other precious metals and other capital market instruments and also the value of investment in each instrument at most 20% of the fund value, it is called as mixed fund – financial instruments which has at least 90 days maturities, it is called as liquid fund. • If the 80% of the portfolio consist of the securities of an index, it is called as index fund. 2.2. Exchange-Traded Funds • These intermediaries are on the rise everywhere. Turkey could not have stayed away from this trend. Turkish exchangetraded funds (borsa yatırım fonları) are now traded on the “Borsa Istanbul Fund Market”. 2.2. Exchange-Traded Funds • DJIST: Dow Jones İstanbul 20 A Type ETF GOLDIST: İstanbul Gold B Type Gold ETF FBIST: FTSE İstanbul Bono B Type ETF BANKA: Turkish Banks with High Market Capitalization Rates A Type ETF IST30: BİST-30 A Type ETF DOLAR: Dollar B Type ETF GÜMÜŞ: İstanbul Silver B Type ETF 2.2. Exchange-Traded Funds • The asset distribution is announced daily in exchange traded funds that enables the investors to follow up all the content of their investments transparently on a daily basis. • They combine the possibility of availability for purchase and sale easily with high liquidity of the equities and the following features of the mutual funds; distributing risk and letting the investors benefit from yields of the markets in which they invest. • ETFs enable the investors to invest in index by purchasing only one product. 2.2. Exchange-Traded Funds • ETFs can be purchased and sold as easily as the equities during BIST session period. • Management fees of the ETFs are lower compared to the other mutual funds. • The purchase and sale of ETF participation certificates, deemed suitable for being traded on the Exchange, are carried out with a feature code (F) on the Fund Market of the Equity Market. • Purchase and sale transactions are executed in the trading hours of the market where securities forming the underlying index of ETF are traded. • The base price is determined by rounding the weighted average of the transactions of the previous session to the nearest price tick as with the stocks. 2.3. Hedge funds • In Turkey, new announcements are expected to emerge out of the Turkish Capital Market Board (CMB) under the new Law 6362. • Present legislation about the hedge funds is the Communique of the CMB Serial VII No. 10. It defines these funds as free funds (Serbest Yatırım Fonu), and “Serbest Yatırım Fonları are for the “qualified investors” only”. • Nonetheless Turkish regulations require that these funds should develop their risk management systems. • The participation certificates of these funds do not trade at exchanges in Turkey. 2.3. Hedge funds • Said Communique gives the definition for the “qualified investor” as follows: 2.4. Housing finance funds (HFFs) • Housing finance funds (HFFs) are portfolios of investors: – Made up of “mortgage-backed securities” – Unincorporated portfolios (no legal identity) – Run (managed) by the founders on the bases of: • Fiduciary ownership • Proxy relationship 2.4. Housing finance funds (HFFs) (Konut Finansmanı Fonları) • Housing Finance Funds (HFFs) are portfolios of investors consisting of “mortgage-backed securities. • HFFs are set up by the fund’s bylaw (Fon İç Tüzüğü). • Fund assets are under the protection of the Law 6362 against collateralization as well as mortgaging by the fund managements. • Fund Management Teams are held responsible by the Law for the custody and safekeeping. 2.5. Assets finance funds (AFFs) • Asset finance funds (AFFs) are portfolios of investors consisting of “asset-backed securities”. • This is the basic distinction that differentiates them from the HFFs. The rest are same as above. 2.6. Unit investment trusts • Unit investment trusts (UITs) are corporations are set up to manage portfolios consisting of: – – – – Capital market instruments Real estates Venture-capital investments Other assets and rights to be designated by the Capital Market Board of Turkey • As a momentous change UITs can now be open-ended or close-ended. 2.6. Unit investment trusts • Prerequisites for new UITs are: – A registered-capital system – Compliance with the minimum initial capital amount – Fully-paid capital at setting-up – Clear reference to UIT in the title – Openly stated custodian 2.6. Unit investment trusts • Publicly-held -shareholding ratios, lines of business, types, share transfers, registry statements, asset custody alignments, preferred share issues, dividend distributions, share-call procedures, liquidation and termination of the corporation methods are all to be subject to the Capital Market Board decisions. • Open-ended UITs’ capital will always be same as their net-assets-value, which will be equal to the difference between the assets and liabilities. • Finally, UITs are required to seek the management services of portfolio management corporations. 2.7. Open-ended investment trusts • These are new types of investment trusts in the form of joint stock companies for Turkey. Previously Turkey had semi-open-ended investment trusts, for which “right issues” (capital increases) were subject to the Turkish Commercial Code. • With these type of investment trusts a new and hybrid kind of joint stock companies emerge. They are a combination of mutual funds and unit investment trusts. 2.7. Open-ended investment trusts • The stocks of these companies will be the total of investor shares and to-the-name founder shares. The shares of openended investment trusts will not have par values. Net asset values of these companies will be the net of assets and liabilities. • An important point is that the founder shares will not provide management prerogatives to the founders. 3. Auditing, rating, and scoring entities • Auditing (independent auditing in the regulatory jargon) has to be carried out by auditors listed by the “Public Oversight - Accounting and Auditing Standards Authority” of Turkey (simply KGK). • They not only conduct auditing but also authorized to give rating and scoring to the entities within the Law 6362. • For your attention, there are; – Certified Public Accountants (Bağımsız Denetim Kuruluşları) – Chartered accountants (Yeminli Mali Müşavir) – Certified Consultants and Accountants (Serbest Muhasebeci Mali Müşavir) 3. Auditing, rating, and scoring entities • In the new Turkish Commercial Code, they are all authorized to conduct auditing and reporting. • One thing that we know is that these entities will be equally responsible in any kind of harm that can be cause by auditing inefficiencies. 4. Portfolio Management Corporations • Portfolios management corporations are defined and described in the articles 55 and 56 of the Law 6362. • As far as asset management companies are concerned, the point is that in Turkey, with the advent of the new Law 6362, mutual funds will only be set up by them, and will have to be managed, and audited by them. Unit investment trusts will have to receive management services from these corporations. 5. Mortgage finance institutions (İpotek Finansmanı Kuruluşları) • The terminology on; – Housing finance – Mortgage finance – Asset finance • is a little confusing. We have touched on the “housing finance funds” and “asset finance funds” previously as they fall outright under the category of “mutual funds”. Now, let us try to give you the distinction among them in summary. 5. Mortgage finance institutions (İpotek Finansmanı Kuruluşları) • • Housing finance corporations These are solely: – – – – Banks, Leasing corporations and Consumer finance corporations All of whom solely engage in housing loans and/or real estate rental activities. 5. Mortgage finance institutions (İpotek Finansmanı Kuruluşları) • • Asset financing activities Asset financing is asset-backed or assetcollateralized financial activities. Asset-backed finance is made up of the “asset finance funds” as explained previously and asset collateralized financing. • Latter is also categorized as credit derivatives, among which the commonest ones are CDOs (Collateralized debt obligations). 5. Mortgage finance institutions (İpotek Finansmanı Kuruluşları) • Mortgage vehicles consist of; – Mortgage-collateralized vehicles, – Mortgage-backed vehicles, made up of housing finance funds – Asset-collateralized vehicles, consisting of SIVs (Structured investment vehicles) – Asset-backed vehicles, made up mostly of asset finance funds. 5. Mortgage finance institutions (İpotek Finansmanı Kuruluşları) • Collateralized debt obligations (CDOs) are a type of structured asset-backed security with multiple "tranches" that are issued by special purpose entities and collateralized by debt obligations including bonds and loans. • A structured investment vehicle (SIV) was an operating finance company established to earn a spread between its assets and liabilities like a traditional bank. The strategy of SIVs was to borrow money by issuing shortterm securities at low interest rates and then lend that money by buying longer term securities at higher interest rates, with the difference in rates going to investors as profit. 6. Asset leasing corporations (Varlık Kiralama Şirketleri) • In order to tap certain segments of the oilrich Gulf markets “asset leasing corporations” a new set of market rules were laid down in Turkey in 2012. • The new system makes it possible to pay return to investors as rental instead of interest. Turkish Treasury issued in October 2012 the guidelines for this new system as follows: 6. Asset leasing corporations (Varlık Kiralama Şirketleri) • The procedure will be explained during the course of the Course. 6. Asset leasing corporations (Varlık Kiralama Şirketleri)