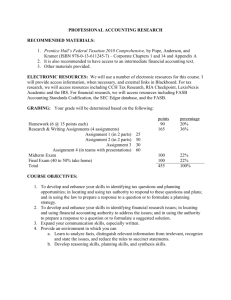

Intermediate-nbj-ch0.. - Ho & Associates, CPA, Inc.

advertisement

Chapter 1 The Environment of Financial Reporting Intermediate Accounting 11th edition Nikolai Bazley Jones An electronic presentation By Norman Sunderman and Kenneth Buchanan Angelo State University COPYRIGHT © 2010 South-Western/Cengage Learning 2 Printing PowerPoint The options for printing are Color, Grayscale, and Pure Black and White. For best results, select PURE BLACK AND WHITE on the print page. 3 Objectives 1. Understand capital markets and decision making. 2. Know what is included in financial reporting. 3. Explain generally accepted accounting principles (GAAP) and the sources of GAAP. 4. Identify the types of pronouncements issued by the Financial Accounting Standards Board (FASB). 5. Understand how the FASB operates. 4 Objectives 6. Describe the relationship between the Securities and Exchange Commission (SEC) and the FASB. 7. Use ethical models for decision making about ethical dilemmas. 8. Understand creative and critical thinking. 9. Describe the joint convergence project of the FASB and the IASB (Appendix). 10. Understand SEC reporting under U.S. GAAP and IFRS (Appendix). 5 More Accountants Needed New accounting rules pose challenges for financial accounting and projections point to increased hiring of accounting graduates. 6 Estimated Hiring Increase Accounting firms of all sizes plan to increase future hiring. 7 Capital Markets Companies need large amounts of capital for operations 8 Capital Markets Companies may obtain capital by issuing capital stock... Stock Exchange 9 Capital Markets …or by borrowing from lenders Bank 10 Capital Markets 11 Accounting Information: Economic Activities and Decision Making 12 External and Internal Users 1. Buy. A potential investor decides to purchase a particular security on the basis of communicated accounting information. 2. Hold. An actual investor decides to retain a particular security on the basis of communicated accounting information. 3. Sell. An actual investor decides to dispose of a particular security on the basis of communicated accounting information. 13 Comparison of Financial and Managerial Accounting Sources of Authority Financial Accounting Managerial Accounting Internal needs GAAP 14 Comparison of Financial and Managerial Accounting Time Frame of Reported Information Financial Accounting Primarily historical Managerial Accounting Present and future 15 Comparison of Financial and Managerial Accounting Scope Financial Accounting Total company Managerial Accounting Individual departments, divisions, and total company 16 Comparison of Financial and Managerial Accounting Type of Information Financial Accounting Managerial Accounting Primarily quantitative Qualitative as well as quantitative 17 Comparison of Financial and Managerial Accounting Statement Format Financial Accounting Managerial Accounting Prescribed by GAAP; oriented toward investment and credit decisions Determined by company; focused upon specific decisions being made 18 Comparison of Financial and Managerial Accounting Decision Focus Financial Accounting Managerial Accounting External Internal 19 Comparison of Financial and Managerial Accounting The company’s accountants prepare both the financial and the managerial accounting reports… …and the information comes from the same information system. 20 Financial Reporting Financial reporting is the process of communicating financial accounting information about a company to external users. 21 Financial Reporting Companies present at least three major financial statements: 1. The balance sheet (or statement of financial position), which summarizes a company’s financial position at a given date. 2. The income statement, which summarizes the results of a company’s income-producing activities for a period of time. 3. The statement of cash flows, which summarizes a company’s cash inflows and outflows for a period of time. 22 Financial Reporting A statement of changes in stockholders’ equity is also included by many companies. 23 Financial Reporting This statement summarizes the changes in each item of stockholders’ equity for a period. 24 Generally Accepted Accounting Principles (GAAP) GAAP are the guidelines, procedures, and practices that a company is required to use in recording and reporting the accounting information in its audited financial statements. They are like laws and are the rules that must be followed in financial reporting. 25 FASB Accounting Standards Codification Currently, there is no single document that includes all the accounting standards. However, the FASB has released its FASB Accounting Standards Codification for verification by its constituents. When finalized, this Codification will be electronic and will integrate and topically organize U.S. accounting standards. 26 Hierarchy of Sources of GAAP Categories A Authoritative Sources FASB Statements of Financial Accounting Standards and Interpretations, FASB Statement 133 Implementation Issues, FASB Staff Positions, and APB Opinions and CAP (AICPA) Accounting Research Bulletins not superceded by actions of the FASB (as well as SEC releases such as Regulation S-X, Financial Reporting Releases, and Staff Accounting Bulletins for companies that file with the SEC) Continued 27 Hierarchy of Sources of GAAP Categories B C Authoritative Sources FASB Technical Bulletins, and, if cleared by the FASB, AICPA Industry Audit and Accounting Guides, and AICPA Statements of Position FASB Emerging Issues Task Force Consensus Positions, Topics discussed in Appendix D of EITF Abstracts, and, if cleared by the FASB, AICPA Practice Bulletins Continued 28 Hierarchy of Sources of GAAP Categories D Authoritative Sources FASB Q’s and A’s (Implementation Guides), AICPA Accounting Interpretations, AICPA Industry and Audit Guides, and AICPA Statements of Position not cleared by the FASB, and practices that are widely recognized and prevalent either generally or in the industry (e.g., AICPA Accounting Trends and Techniques) There are electronic databases such as the FASB Financial Accounting Research System (FARS) that include most accounting standards 29 FASB Accounting Standards Codification The Codification does not change GAAP. Instead, it reorganizes the many pronouncements on U.S. GAAP into about 90 accounting topics, organized in a consistent structure. 30 FASB Accounting Standards Codification The FASB expects the Codification to: Reduce the amount of time and effort needed to solve an accounting research issue. Improve the usability of the accounting literature, thereby reducing the chances of not complying with GAAP. Provide real-time updates as new standards are issued. 31 FASB Accounting Standards Codification The FASB expects to approve the Codification in 2009. At that time, the Codification will supercede all then-existing non-SEC standards. Once the Codification has been approved, the FASB will not issue separate new pronouncements. Instead, any new standards will be structured in a way to update the Codification. 32 History of GAAP in the Private Sector 33 Committee on Accounting Procedure (CAP) In 1938, the AICPA formed the Committee on Accounting Procedure (CAP). This group issued pronouncements known as Accounting Research Bulletins (ARB), but the CAP did not have authority to enforce its pronouncements and application was optional. The CAP was criticized because its members were all CPAs and application was optional, so the AICPA formed the Accounting Principles Board (APB) in 1959 to replace the Committee on Accounting Procedure. 34 Reasons for Forming the APB 1. To alleviate criticism about the process of formulating accounting principles, which included wider representation. 2. To create a policy-making body whose rules would be binding on companies rather than optional. The APB was comprised 17 to 21 members, selected primarily from the accounting profession. 35 Criticisms of the APB 1. Independence. The members of the APB were part-time volunteers whose major responsibilities were to the business, governmental, or academic organizations employing them. 2. Representation. The public accounting firms and the AICPA were too closely associated with the development of accounting standards. 3. Response time. Emerging problems were not solved quickly enough by the part-time members of the APB. 36 Structure of FASB 37 Types of Pronouncements Issued by the FASB 1. 2. 3. 4. 5. Statements of Financial Accounting Standards Interpretations Staff Positions Technical Bulletins Statements of Financial Accounting Concepts 6. Other Pronouncements 38 FASB Operating Procedures 39 Other Organizations Impacting GAAP Securities and Exchange Commission (SEC) – The SEC is a governmental agency that has the legal authority to prescribe accounting principles and reporting practices for all corporations issuing publicly traded securities. American Institute of Certified Public Accountants (AICPA) – The AICPA is the professional organization for all certified public accountants in the United States. To be a member of the AICPA, an individual must have passed the Uniform CPA Examination, hold a CPA certificate, agree to abide by its bylaws and Code of Professional Ethics, and have 150 hours of higher education. Continued 40 Other Organizations Impacting GAAP FASB Emerging Issues Task Force (EITF) – The primary objectives of the EITF are (1) to identify significant emerging accounting issues (i.e., unique transactions and accounting problems) that it feels the FASB should address and (2) to develop consensus positions on the implementation issues involving the application of standards. International Accounting Standards Board (IASB) – The IASB issues International Financial Reporting Standards (IFRS) and includes 12 full-time members (and 2 part-time members) from various countries. To date IASB has issued 49 Standards. Continued 41 Other Organizations Impacting GAAP Governmental Accounting Standards Board (GASB) – The GASB’s responsibility is to establish financial accounting standards for certain state and local governmental entities. Public Company Accounting Oversight Board (PCAOB) – The PCAOB is a non-profit corporation that was created by Congress in the Sarbanes-Oxley Act of 2002. Its purpose is to protect the interests of investors by overseeing auditors of public companies in the preparation of informative, accurate, and independent audit reports for companies that sell securities to the public. Continued 42 Other Organizations Impacting GAAP Cost Accounting Standards Board (CASB) – The CASB is responsible only for negotiated federal contracts and subcontracts exceeding $500,000. Internal Revenue Service (IRS) – The IRS administers the Internal Revenue Code enacted by Congress. American Accounting Association (AAA) – The AAA is an organization primarily of academics and practicing accountants. Continued 43 Other Organizations Impacting GAAP Financial Executives International (FEI) – The FEI consists primarily of high-level financial executives (such as financial vice-presidents, treasures, and controllers) of major corporations. The FEI publishes a monthly journal called the Financial Executive. Institute of Management Accountants (IMA) – The primary focus of the IMA is on management accounting and financial accounting issues. The IMA publishes a monthly journal called Strategic Finance. Continued 44 Other Organizations Impacting GAAP CFA Institute (CFAI) – Members of the CFAI are financial analysts who use accounting information in various investment management and security analysis decisions. 45 Participants in the Development of GAAP 46 Principles of the AICPA Code of Professional Conduct Responsibilities In carrying out their responsibilities as professionals, members should exercise sensitive professional and moral judgments in all their activities. 47 Principles of the AICPA Code of Professional Conduct The Public Interest Members should accept the obligation to act in a way that will serve the public interest, honor the public trust, and demonstrate commitment to professionalism. 48 Principles of the AICPA Code of Professional Conduct Integrity To maintain and broaden public confidence, members should perform all professional responsibilities with the highest sense of integrity. 49 Principles of the AICPA Code of Professional Conduct Objectivity and Independence A member should maintain objectivity and be free from conflicts of interest in discharging professional responsibilities. A member in public practice should be independent in fact and appearance. 50 Principles of the AICPA Code of Professional Conduct Due Care A member should observe the profession’s technical and ethical standards, strive continually to improve competence and the quality of services, and discharge the professional responsibility to the best of the member’s ability. 51 Principles of the AICPA Code of Professional Conduct Scope and Nature of Service A member in public practice should observe the Principles of the CPC in determining the scope and nature of services to be provided. 52 An Ethicist’s Basic Approaches to Moral Reasoning 1. The utilitarian model, which evaluates actions based on the “greatest good for the greatest number.” 2. The rights model, which embraces actions that protect individual moral rights. 3. The justice model, which emphasizes a fair distribution of benefits and burdens. 53 Creative and Critical Thinking: Impact on Problem Solving 54 IFRS and U.S. GAAP Many companies have become “globalized”. Currently, U.S. corporations are subject to the accounting standards established by the FASB, while foreign corporations are subject to international financial reporting standards (IFRS) established by the IASB or by accounting standards set by their national accounting standards board. These differences in accounting standards have led to differences among U.S. and foreign corporations’ financial statements. These differences, in turn, have made it difficult for investors and creditors to make valid comparisons across corporations and to make effective buy-sell-hold decisions in the U.S. and foreign capital markets. 55 IFRS and U.S. GAAP To resolve this issue, FASB and the IASB entered into an agreement to develop high-quality, compatible accounting standards that could be used for both “domestic” and “cross-border” financial reporting. To achieve this compatibility, the Boards agreed to work together to achieve “short-term” convergence on a number of individual differences between U.S. and international accounting standards. 56 Chapter 1 Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc.