Creating the Secondary Mortgage Market * Players and History

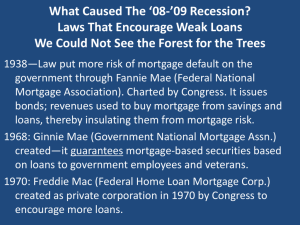

advertisement

Erica Liu Secondary Mortgage Market The market for the sale of securities or bonds collateralized by the value of mortgage loans Ensure liquidity in the market Redistribute funds across the nation National Housing Act of 1934 Franklin Roosevelt’s New Deal Relief, Recovery, and Reform after Great Depression Make housing and home mortgages more affordable Protect lenders from the risk of default Federal Housing Administration Assist in the construction, acquisition, and/or rehabilitation of residential properties Regulate rate of interest and terms of mortgages Insure mortgages Increase the number of people who can afford down payment and monthly mortgage payments Increase the size of market for single family homes Federal National Mortgage Association 1938 – Founded as a government agency Establish a secondary mortgage market Bought FHA insured loans from private lenders Lenders more inclined to extend mortgage credit Equalize supply and demand of funds in capital rich and capital poor areas World War II 1944 - Servicemen's Readjustment Act (GI "Bill of Rights”) 1949 – Fannie Mae authorized to purchase mortgages insured by the Veteran’s Administration VA Home Loan Program End of WW II, troops returned home from overseas Increased demand for housing and financing Designed to help members of the U.S. armed forces readjust to civilian life after war Federally guaranteed home loans to help veterans buy houses and reestablish good credit Housing and Urban Development Act of 1968 Fannie Mae becomes a government sponsored enterprise (GSE) sold to private shareholders Fannie Mae split into two organizations Government National Mortgage Association Government-owned corporation within the Department of Housing and Urban Development Securitize loans insured by the FHA and VA Government maintains control over secondary market for federally insured mortgages Mortgage Backed Securities Agency pass through securities Issued by approved lenders Agency guarantees timely payment Ginnie Mae - only MBS to carry the “full faith and credit guaranty” of the United States government Federal Home Loan Mortgage Corporation 1970 - Emergency Home Finance Act Publicly owned GSE Expand secondary mortgage market and eliminate perceived monopoly of Fannie Mae Role of GSE’s 1972 – Fannie Mae and Freddie Mac began purchasing “conventional” mortgages Mortgages not guaranteed by FHA or VA Loans required insurance from new Private Mortgage Insurance companies Can buy or sell any type of residential mortgage Mortgages packaged into securities are restricted to government loans and those that satisfy underwriting guidelines (conforming conventional loans) What’s The Difference? GSE’s purchase mortgages Freddie Mac - purchase loans from savings and loan associations Fannie Mae -focused on banks and other mortgage finance companies Ginnie Mae only issues guarantee Sources http://www.ginniemae.gov/about/history.asp?Section=About http://www.fundinguniverse.com/company-histories/Fannie-Mae-CompanyHistory.html http://www.cbo.gov/ftpdocs/120xx/doc12032/12-23-FannieFreddie.pdf http://www.encyclopedia.com/topic/Federal_National_Mortgage_Association.aspx http://www.referenceforbusiness.com/history2/27/Freddie-Mac.html http://www.themonticellogroup.com/American_Mortgage_Market.pdf http://www.va-home-loans.com/history_VA_loan.htm Questions?