Part Five

Fundamentals

of Financial

Institutions

Chapter 15

Why Do Financial

Institutions Exist?

Chapter Preview

A vibrant economy requires a financial

system that moves funds from savers to

borrowers. But how does it ensure that

your hard-earned dollars are used by those

with the best productive investment

opportunities?

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-3

Chapter Preview

In this chapter, we take a closer look at why

financial institutions exist and how they promote

economic efficiency. Topics include:

– Basic Facts About Financial Structure Throughout

the World

– Transaction Costs

– Asymmetric Information: Adverse Selection and

Moral Hazard

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-4

Chapter Preview (cont.)

– The Lemons Problem: How Adverse Selection

Influences Financial Structure

– How Moral Hazard Affects the Choice Between

Debt and Equity Contracts

– How Moral Hazard Influences Financial

Structure in Debt Markets

– Financial Crises and Aggregate

Economy Activity

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-5

Basic Facts About Financial Structure

Throughout the World

• The financial system is a complex structure

including many different financial

institutions: banks, insurance companies,

mutual funds, stock and bonds

markets, etc.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-6

Basic Facts About Financial Structure

Throughout the World

• The chart on the next slide show how

nonfinancial business attain external

funding in the U.S., Germany, Japan, and

Canada. Notice that, although many

aspects of these countries are quite

different, the sources of financing are

somewhat consistent, with the U.S. being

different in its focus on debt.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-7

Sources of Foreign External Finance

15-8

Data Source:China Annual Report on Financial and Futures Markets

9

Overall Scale to Be Further Enlarged

At the end of 2006, the total value of securities assets constituted only 22% of China’s total financial assets

Although this had increased to 37% by Sep 2007, the ratio remained relatively low and the overall scale of

China’s capital market is till small

10

Structure to Be Further Optimized

Relative size of bond and stock markets for selected countries (2007)

11

Facts of Financial Structure

1. Stocks are not the most important source

of external financing for businesses.

2. Issuing marketable debt and equity

securities is not the primary way in which

businesses finance their operations.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-12

Facts of Financial Structure

3. Indirect finance, which involves the activities of

financial intermediaries, is many times more

important than direct finance, in which

businesses raise funds directly from lenders in

financial markets.

4. Financial intermediaries, particularly banks, are

the most important source of external funds

used to finance businesses.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-13

Facts of Financial Structure

5. The financial system is among the most

heavily regulated sectors of economy.

6. Only large, well-established corporations

have easy access to securities markets to

finance their activities.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-14

Facts of Financial Structure

7. Collateral is a prevalent feature of debt

contracts for both households

and businesses.

8. Debt contracts are typically extremely

complicated legal documents that place

substantial restrictions on the behavior of

the borrowers.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-15

Transactions Costs

• Transaction costs: costs involved in doing

transactions; it includes information cost,

monitoring cost, contracting costs, and trading

costs such as commissions, bid-ask price spread,

and security transaction taxes.

• Transaction costs can hinder flow of funds to

people with productive investment opportunities

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-16

Transactions Costs

• Financial intermediaries make profits by

reducing transactions costs

1. Take advantage of economies of scale

(example: mutual funds)

2. Develop expertise to lower

transactions costs

• which explains Fact # 3, the importance of

indirect finance (slide 15-10)

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-17

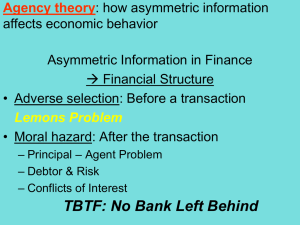

Asymmetric Information: Adverse

Selection and Moral Hazard

• In your introductory finance course, you

probably assumed a world of symmetric

information—the case where all parties to a

transaction or contract have the same

information, be that little or a lot

• In many situations, this is not the case. We

refer to this as asymmetric information.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-18

Asymmetric Information: Adverse

Selection and Moral Hazard

• Asymmetric information can take on many

forms, and is quite complicated. However,

to begin to understand the implications of

asymmetric information, we will focus on

two specific forms:

– Adverse selection

– Moral hazard

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-19

Asymmetric Information: Adverse

Selection and Moral Hazard

• Adverse Selection

1. Occurs when one party in a transaction has

better information than the other party

2. Before transaction occurs

3. Potential borrowers most likely to produce

adverse outcome are ones most likely to

seek loan and be selected

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-20

Asymmetric Information: Adverse

Selection and Moral Hazard

• Moral Hazard

1. Occurs when one party has an incentive to

behave differently once an agreement is

made between parties

2. After transaction occurs

3. Hazard that borrower has incentives to

engage in undesirable (immoral) activities

making it more likely that won't pay

loan back

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-21

Asymmetric Information: Adverse

Selection and Moral Hazard

• The analysis of how asymmetric

information problems affect behavior is

known as agency theory.

• We will now use these ideas of adverse

selection and moral hazard to explain how

they influence financial structure.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-22

The Lemons Problem: How Adverse Selection

Influences Financial Structure

•

Lemons Problem in Used Cars

1. If we can't distinguish between “good” and

“bad” (lemons) used cars, we are willing pay

only an average of good and bad car values

2. Result: Good cars won’t be sold, and the

used car market will function inefficiently.

•

What helps us avoid this problem with

used cars?

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-23

The Lemons Problem: How Adverse Selection

Influences Financial Structure

•

Lemons Problem in Securities Markets

1. If we can't distinguish between good and bad

securities, willing pay only average of good

and bad securities’ value

2. Result: Good securities undervalued and

firms won't issue them; bad securities

overvalued so too many issued

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-24

The Lemons Problem: How Adverse Selection

Influences Financial Structure

•

Lemons Problem in Securities Markets

3. Investors won't want buy bad securities, so

market won't function well

–

Explains Fact # 1 stocks and bonds are not

the most important source of financing and #

2 the importance of bank finance (slide 15-9)

–

Also explains Fact # 6 (slide 15-11): Less

asymmetric info for well known firms, so

smaller lemons problem

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-25

Tools to Help Solve Adverse Selection

(Lemons) Problems

1. Private Production and Sale of Information

– Free-rider problem interferes with this solution

2. Government Regulation to Increase Information

(explains Fact # 5, financial sector is most

regulated, slide 15-11)

– For example, annual audits of public corporations

(although Enron is a shining example of why this

does not eliminate the problem – we’ll discuss that

briefly)

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-26

Tools to Help Solve Adverse Selection

(Lemons) Problems

3. Financial Intermediation

– Analogy to solution to lemons problem

provided by used car dealers

– Avoid free-rider problem by making private

loans (explains Fact # 3 and # 4, the

importance of indirect finance such as

banks, slide 15-10)

– Also explains fact #6 – large firms are more

likely to use direct instead of indirect

financing

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-27

Tools to Help Solve Adverse Selection

(Lemons) Problems

4. Collateral and Net Worth

– Explains Fact # 7, the importance of

collateral in debt, slide 15-12

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-28

How Moral Hazard Affects the Choice

Between Debt and Equity Contracts

•

Moral Hazard in Equity Contracts:

the Principal-Agent Problem

1. Result of separation of ownership by

stockholders (principals) from control by

managers (agents)

2. Managers act in their own rather than

stockholders' interest

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-29

How Moral Hazard Affects the Choice

Between Debt and Equity Contracts

An example of this problem is useful.

Suppose you become a silent partner in

an ice cream store, providing 90% of the

equity capital ($9,000). The other owner,

Steve, provides the remaining $1,000 and

will act as the manager. If Steve works

hard, the store will make $50,000 after

expenses, and you are entitled to $45,000

of it.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-30

How Moral Hazard Affects the Choice

Between Debt and Equity Contracts

However, Steve doesn’t really value the

$5,000 (his part), so he goes to the

beach, relaxes, and even spends some of

the “profit” on art for his office. How do

you, as a 90% owner, give Steve the

proper incentives to work hard?

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-31

How Moral Hazard Affects the Choice

Between Debt and Equity Contracts

• Tools to Help Solve the Principal-Agent Problem

1.Production of Information: Monitoring

2.Government Regulation to Increase Information

3.Financial Intermediation (e.g, venture capital)

4.Debt Contracts

• Explains Fact # 1, slide 15-9: Why debt is used

more than equity

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-32

How Moral Hazard Influences Financial

Structure in Debt Markets

• Even with the advantages just described,

debt is still subject to moral hazard. In fact,

debt may create an incentive to take on

very risky projects. This is important to

understand. Let’s looks at a simple

example.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-33

How Moral Hazard Influences Financial

Structure in Debt Markets

• Most debt contracts require the borrower to pay a

fixed amount (interest) and keep any cash flow

above this amount.

• For example, what if a firm owes $100 in interest,

but only has $90? It is essentially bankrupt. The

firm “has nothing to lose” by looking for “risky”

projects to raise the needed cash.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-34

How Moral Hazard Influences Financial

Structure in Debt Markets

•

Tools to Help Solve Moral Hazard in

Debt Contracts

1. Net Worth

2. Monitoring and Enforcement of

Restrictive Covenants. Examples are covenants

that …

1.

discourage undesirable behavior

2.

encourage desirable behavior

3.

keep collateral valuable

4.

provide information

5.

Dividend restrictions

6.

Restrictions on new debt issuing

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-35

How Moral Hazard Influences Financial

Structure in Debt Markets

•

Tools to Help Solve Moral Hazard in

Debt Contracts

3. Financial Intermediation—banks and other

intermediaries have special advantages

in monitoring

•

Explains Facts # 1–4, stocks are not the most important

sources of financing, debt and banks are more

important, slides 15-9 & 15-10

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-36

Asymmetric Information Problems and

Tools to Solve Them

15-37

Financial Crises and Aggregate

Economic Activity

Our analysis of the effects of adverse

selection and moral hazard can also assist

us in understanding financial crises, major

disruptions in financial markets. Then end

result of most financial crises is the inability

of markets to channel funds from savers to

productive investment opportunities.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-38

Financial Crises and Aggregate

Economic Activity

•

Factors Causing Financial Crises

1. Problems in banking sector

2. Government Fiscal Imbalances and resulting higher

interest rate

3. Balance of payments problems

4. Burst of asset bubbles

•

As shown in the next slide, most U.S. financial crises

have begun with a deterioration in banks’ balance

sheets.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-39

Case: U.S. Financial Crisis

• The U.S. has a long history of banking and

financial crises, dating back to 1819. Our

analysis can explain why these took place

and why they were so damaging.

• The next figure outlines the events leading

to a financial crisis.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-40

Case: The Great Depression

• In 1928 and 1929, stock prices doubled in the

U.S. The Fed tried to curb this period of

excessive speculation with a tight monetary

policy. But this lead to a collapse of stock market

more than 60% in October of 1929.

• Further, between 1930 and 1933, one-third of

U.S. banks went out of business

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-42

Case: The Great Depression

• Adverse selection and moral hazard in

credit markets became severe. Firms with

productive uses of funds were unable to get

financing. The prolonged economic

contraction lead to an unemployment rate

around 25%.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-43

Asian Financial Crisis

• High short-term foreign debt used to finance longterm domestic projects (double mis-match)

• High leverage and asset bubbles

• Governance problems in both public sector and

private sector

• Serious real impact: lost of output, Japan, 17.6%,

Malaysia, 50%, South Korea 50.1%, Indonesia

67.9%, Thailand 97.7% of 1997 GDP

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-44

Asian Financial Crisis: Hong Kong

• Linked Exchange Rate System since 1983

• Strong economy but asset bubbles

• Attack of hedge funds such as Quantum

Funds of George Soros

• Defense of HK government

– Initial stage: raise inter-bank lending rate

– Second stage: direct intervention in stock

market

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-45

Asian Financial Crisis: China

• Similar problems such as weakness in

financial systems, high leverage in

corporations, large non-performing loans,

lax regulations

• But relative less short-term foreign debt

• Restrictions on capital account

• Not devaluate its RMB during the crisis and

played a stable role

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

15-46

2007-credit crisis

• Started in the beginning of 2007 and deepened

in September 2008

• From sub-prime crisis to credit crisis

Sub-prime

MBS

AAA Bond

Sold worldwide

$1.3 triilion,total

home loan 12

trillion,GDP 14

trillion

CDS

Rating Company

CDS

market 65

trilion

• Declining real estate price since 2006 due to higher

interest since 2004

Factors contribute to the crisis

1.

Policy failures

-lax monetary policy since 2001

-Government intervention in real estate market

*Freddie Mac and Fannie Mae dominates MBS

* Interest deduction for home loans

* American dream, encourage home ownership, even for low-income people

-Deregulation since Regan years

2. Market failures

-“Greedy bankers” excessive lending

-excessive financial engineering and innovations

* 400 trillion derivatives market, including 65 trillion CDS market, while the total corporate

bond market is 26 trillion

* AIG insures about 440 billion CDS

* Although Bear Stearns only has 190 billion debt, the CDS for it is 2 trillion

-corporate governance in financial institutions: conflict of interests between shareholders(principal)

and managers (agent)