An Economic Analysis of

Financial Structure

Why do Financial Institutions Exist?

(Why is Indirect Finance so Important?)

Chapter 8

Chapter Preview

Look at why financial institutions exist and how

they promote economic efficiency.

Topics include:

• Some Basic Facts About Financial Structure

• Transaction Costs

• Asymmetric Information: Adverse Selection and

Moral Hazard

Basic Facts About Financial Structure

Throughout the World

• The chart on the next slide shows how

non-financial business get external

funding in the U.S., Germany, Japan, and

Canada.

Sources of External Finance for Nonfinancial Businesses

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

Mishkin Presents Eight Basic Facts of

Financial Structure

1. Stocks (direct finance) are not the most

important source of external financing for

businesses

2. Issuing marketable debt and equity

securities (direct finance) is not the

primary way in which businesses finance

their operations

Mishkin’s Eight Basic Facts of Financial

Structure

3. Indirect finance, which involves the

activities of financial intermediaries, is

many times more important than direct

finance, in which businesses raise funds

directly from lenders in financial markets.

4. Financial intermediaries, particularly banks,

are the most important source of external

funds used to finance businesses.

Eight Basic Facts of Financial Structure

5. The financial system is among the most

heavily regulated sectors of economy.

6. Only large, well-established corporations

have easy access to securities markets

(direct finance) to finance their activities.

Eight Basic Facts of Financial Structure

7. Collateral is a prevalent feature of debt

contracts for both households and

businesses.

8. Debt contracts are typically extremely

complicated legal documents that place

substantial restrictions on the behavior of

the borrowers.

Why is Indirect Finance so Important?

• Transactions Costs

• Information Costs

• Shades of Chapter 2

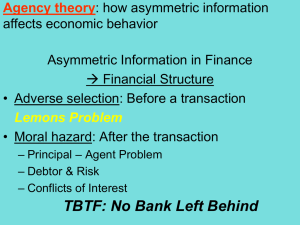

Information Costs - Asymmetric Information

• symmetric information—the case where all

parties to a transaction or contract have the

same information.

• In many situations, this is not the case.

Information is not the same. We refer to this

imbalance in information as asymmetric

information.

Asymmetric Information:

Adverse Selection and Moral Hazard

• Adverse Selection

1.

Occurs when one party in a transaction

has better information than the other party

2.

Occurs before transaction occurs

3.

In financial markets, potential borrowers

most likely to produce adverse outcome

are the ones most likely to seek loan

The Lemons Problem: How Adverse

Selection Influences Financial Structure

• If quality cannot be assessed, the buyer is willing

to pay at most a price that reflects the average

quality

• Sellers of good quality items will not want to sell at

the price for average quality

• Bad quality pushes good quality from the

market because of an information gap is

known as "adverse selection”

The Classic Example - The Lemons Problem

• Suppose that used cars come in two types:

those that are in good repair (peaches) and

bad shape (lemons). The sellers know the

quality of the cars.

• Suppose further that used-car shoppers

would be prepared to pay $20,000 for a good

one and $10,000 for a lemon.

• If buyers had the information to tell good from

bad, they could strike fair trades with the

sellers, $20,000 for good car and $10,000 for

the lemon.

Asymmetric Information - The Lemons Problem

• If buyers do not have good information and

cannot tell the quality difference, there will be

only one market for all used cars.

buyers will pay only the average price of a good car and a

lemon, or $15,000

• This is below the $20,000 that good-car

owners require; so they will exit the market,

leaving only bad cars.

• This result, when bad quality pushes good

quality from the market because of an

information gap, is known as "adverse

selection".

Adverse Selection and Financial Structure

Lemons Problem in Securities Markets

• Suppose investors cannot distinguish between

good and bad securities, willing to pay only the

average of the good and bad securities’ values.

• Result: Good securities undervalued and firms

won’t issue them; bad securities overvalued, so

too many issued.

Actions to Help Solve Adverse Selection

Problems

• Government Regulation to Increase

Information (explains Fact # 5)

Actions to Help Solve Adverse Selection

Problems

• Financial Intermediation

FIs fill the information gap

Analogy to solution to lemons problem

provided by used car dealers

FIs avoid free-rider problem. Make private

loans and keep information private (explains

Fact # 3 and # 4)

Also explains fact #6 - large firms are more

likely to use direct instead of indirect

financing

Actions to Help Solve Adverse Selection

Problems

• Collateral and Net Worth

Explains Fact # 7

• Private Production and Sale of

Information

Free-rider problem interferes with this

solution

Asymmetric Information: Adverse

Selection and Moral Hazard

• Moral Hazard

1.

Occurs when one party has an incentive to

behave differently once an agreement is

made between parties

2.

Occurs after transaction occurs

3.

For example, Hazard that borrower has

incentives to engage in undesirable (immoral)

activities making it more likely that won't pay

loan back

How Moral Hazard Affects the Choice

Between Debt and Equity Contracts

• With equity, have Principal-Agent Problem

Separation of ownership and control

of the firm

Principal (stockholder) has less information

Agent (manager) has more information

Managers pursue personal benefits and power

rather than the profitability of the firm

Actions to help solve the PrincipalAgent Problem:

• Monitoring of managers

Expensive

• Use debt rather than equity

Reduces the need to monitor as long as borrower is

performing. Explains Fact 1, why debt is used more

than equity

• Government regulation to increase information

Fact 5

• Financial Intermediation

Venture capital firms provide the equity and place

there own people in management

Moral Hazard Influence in Debt Markets

• Even with the advantages just described, debt

is still subject to moral hazard.

Debt may create an incentive to take on very risky

projects.

• Example:

suppose a firm owes $100, but only has $90? It

is essentially bankrupt. The firm “has nothing to

lose” by looking for “risky” projects to raise the

needed cash. Know as “Gambling for

Resurrection”.

Lenders need to find ways ensure that

borrower’s do not take on too much risk.

A good legal contract

Bonds and loans often carry restrictive

covenants

• Restrict how funds are used

Require minimum net worth, collateral, bank

balance, credit rating.

• Financial Intermediaries have special advantages

in monitoring[Facts 3 and 4]

STOP HERE!!