FCRA_and_CORI_training_jb

advertisement

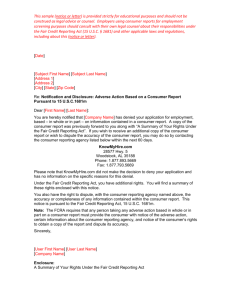

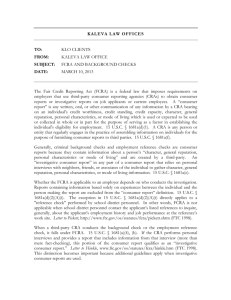

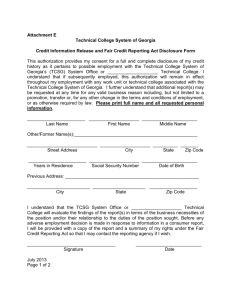

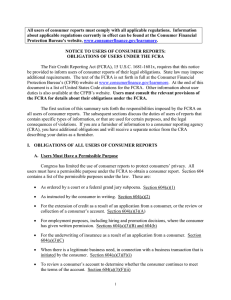

Employment Screening: CORI and Private Background Checks Presented by the Massachusetts Law Reform Institute 99 Chauncy St., Suite 500, Boston, MA 02111 617-357-0700 www.mlri.org The Fair Credit Reporting Act • Fair Credit Reporting Act (FCRA), 15 U.S.C. § § 1681 et seq. • Enforced by the Federal Trade Commission, state Attorney General. Many provisions can be enforced by private litigants • Regulates employment background checks and other types of background checks (“consumer reports”) by private companies (or “consumer reporting agencies”) Some definitions… • What is a “consumer report’? • What is a “consumer reporting agency”? Consumer Report • “Consumer report” is the name of the background check document. A consumer report includes more information than traditional credit reports. • A consumer report is a document containing information that bears on a consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living • Under the FCRA, these reports may be used to establish the consumer's or applicant’s eligibility for: – credit or insurance to be used primarily for personal, family, or household purposes; – employment; or – other purposes allowed by the FCRA (snooping is not allowed) Consumer Report, continued • The consumer report may include arrest information, criminal records from other states, aliases, employment termination reports, and addresses and phone numbers used by the applicant. • The report must also contain a summary of the rights that the report’s subject may exercise, under the FCRA • Consumer reports must exclude most adverse information which is more 7 years old. Arrest records must be excluded if more than 7 years old. • Exceptions: – Criminal convictions can be included, no matter how old – Bankruptcies which are less than 10 years old may be included – Any negative information can be included if the employee will earn $75,000 per year or more INVESTIGATIVE CONSUMER REPORTS • INVESTIGATIVE REPORTS: Employers may have investigators interview people who know the applicant, to collect information about behavior, lifestyle, etc. Consumer must be notified first and information must be verified. • EXCEPTION: Protections do not apply to employee misconduct investigation reports ( if report is only provided to employer, government agency, or regulatory organization). CORI Report . . . or Consumer Report? • Massachusetts only • Contains criminal charges filed in Mass. Courts • Employer must apply to the CHSB to be certified to receive CORI • One or more states, and can be nationwide • Available from private companies such as ChoicePoint, Equifax, Experian, etc. (credit reporting agencies) • In addition to criminal charges, may include arrests that did not lead to any charges, traffic violations, financial information, and other information • The employer (or “user”) who buys the report must use it for legal or permissible purposes Sample CORI Report Sample Consumer Report Sample Consumer Report page 2 Sample Consumer Report page 3 Sample Consumer Report page 4 Consumer Reporting Agency (CRA) Any entity which: • “for monetary fees, dues, or on a cooperative nonprofit basis” • “regularly engages in . . . assembling or evaluating consumer credit information or other information on consumers” • “for the purpose of furnishing consumer reports to third parties” 15 U.S.C. §1681a(f) The “Big Three” major nationwide CRA’s: Equifax 1-800-525-6285 Experian 1-888-EXPERIAN (397-3742) TransUnion 1-800-680-7289 Another big CRA and provider of employment reports: ChoicePoint 1-888-497-0011 CHSB . . . or CRA? • Massachusetts state agency • Governing statute at M.G.L. c. 6, §§168 et seq. • State statutes and regulations set limits on access to CORI and give the CORI subject some legal protections (e.g., due process rights, law prohibiting unlawful disclosure) • Private companies • Regulated by federal law, mainly the FCRA • Some state laws may also apply (in Massachusetts, some sections of M.G.L. c. 93), but most are pre-empted by federal law Rights and Responsibilities under the FCRA • Users of Consumer Reports (e.g., employers, landlords) • Consumer Reporting Agencies • Furnishers of information (e.g., courts and other sources of criminal record information, employers) • Consumers – job applicants, employees, or other subjects of consumer reports Users of consumer reports – duties under the FCRA Generally: • Employers and other users must get written permission from the individual before ordering a report. Blanket authorizations which don’t expire are allowed. • The report must be used only for purposes permitted under the FCRA (which include employment screening). Users of consumer reports – duties under the FCRA If taking adverse action based on the report, the employer or other user must: • Notify the subject of the report of the adverse action • Provide the contact information for the consumer reporting agency, while explaining that the consumer reporting agency did not make the decision to deny the individual’s application • Let the individual know that he or she has a right to dispute the information in the report, and to get a free copy of the report within the next 60 days • Employers must provide a copy of the report that the adverse action was based upon. Users of consumer reports – duties under the FCRA Employers must certify that: • the employer disclosed that he or she would seek a consumer report, • the employee or applicant gave written permission for the employer to purchase the report, • the report will not be used in violation of any equal employment opportunity laws, and • the employee or applicant has been given a summary of his or her rights under the FCRA Consumer Reporting Agencies – duties under the FCRA If a report is being created for employment screening purposes, and public record information included in the report is likely to harm the applicant’s prospects of being hired, then the consumer reporting agency must do either of the following: – Notify the applicant that the potentially damaging public record information is being released, and to whom, or – Maintain “strict procedures” to insure that the public record information is accurate and up to date. The information is considered to be up to date if the report includes a note about the current status of the information at the time the report was generated. Consumer Rights – Access to Consumer Reports • Under the FCRA, free copy of the individual’s own consumer report: – – – – – – – Once per year (for everyone), plus When an adverse action is taken When the consumer is the victim of identity theft If the file contains inaccurate information due to fraud If the consumer is receiving public assistance If the consumer is unemployed and plans to apply for a job within the next 60 days Free reports from the big three nationwide bureaus can be ordered at www.AnnualCreditReport.com. For all other CRA’s, free reports should be ordered by contacting the CRA directly • Massachusetts law: – One free report per year – Additional reports available for $8 or less – CRA must also provide someone to help the consumer interpret the information in the credit file Consumer Rights Under the FCRA • Consumers are entitled to a list of all employers and others who requested a consumer report for employment purposes in the last 2 years, or within the past year for other purposes • Consumers who are victims of identity theft may place a “fraud alert” in the files kept by the big three CRA’s (to keep thieves from opening fraudulent accounts) • Consumers have a right to dispute inaccurate information in their reports Consumer’s Right to Dispute Inaccurate Information • Consumer notifies consumer reporting agency of the dispute, in writing. • The consumer reporting agency must investigate and resolve the complaint within 30 days (15-day extension may be available). The investigation must involve the furnisher of information. The furnisher has its own obligations to conduct an investigation. The disputed information must be corrected or removed within that time, if it cannot be verified by the consumer reporting agency. • Consumer may ask the consumer reporting agency to tell the employer that the disputed information has been removed. • Only a dispute sent to the CRA gives rise to a cause of action if a reasonable investigation is not conducted. If the employee or consumer sends a dispute directly to a furnisher of information, then there is no private remedy for failure to investigate the dispute. Disputing the accuracy of information at its source • Furnishers may only report information that they know is accurate or have reasonable cause to believe is accurate. • If the furnisher finds the information is inaccurate, the furnisher must notify the CRA and provide the accurate information. • In a dispute with a furnisher, the consumer may notify the furnisher of the erroneous information that it is inaccurate or incomplete, and the furnisher must include a notice of the dispute with any future disclosures of the information to CRAs. • There is no private right of action against furnishers except for failure to investigate a dispute sent to a CRA. • Do state agencies have liability as furnishers under the FCRA? The Eleventh Amendment may be a bar to liability. If dispute is not resolved to the consumer’s satisfaction . . . • If dispute with a CRA is not resolved, the consumer may write a statement that must be included in the file for future reports. • A furnisher must also include a notice of a dispute with any future disclosures of the information to CRAs, as noted previously. Further remedies for consumers • Consumers may file civil suit in federal court for certain violations of the FCRA. To find a private attorney who handles FCRA cases: www.naca.net • The Federal Trade Commission (FTC) or state attorney general may seek civil or criminal penalties for violations of the FCRA. • Consumers can file complaints with the FTC at www.ftc.gov. The agency may investigate and refer the consumer, but the FTC does not resolve individual consumer complaints. • Additional information available in the book Fair Credit Reporting, by the National Consumer Law Center. • Massachusetts Law Reform Institute, www.mlri.org.