The Fair Credit and Reporting Act and Criminal Background

advertisement

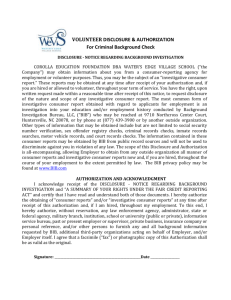

The Fair Credit and Reporting Act and Criminal Background Checks STEPHEN P. POSTALAKIS BLAUGRUND, HERBERT, KESSLER, MILLER, MYERS & POSTALAKIS, INCORPORATED SPP@BHMLAW.COM OHIO ASSOCIATION OF COUNTY BOARDS SERVING PEOPLE WITH DEVELOPMENTAL DISABILITIES PERSONNEL COUNCIL SEPTEMBER 29, 2010 The FCRA and Criminal Background Checks -- Overview The FCRA imposes specific procedural requirements on employers that wish to obtain consumer reports (“Reports”) from a third-party consumer reporting agency (“CRA”). A CRA is “any person which, for monetary fees, dues, or on a cooperative nonprofit basis, regularly engages in whole or in part in the practice of assembling or evaluating consumer credit information or other information on consumers for the purpose of furnishing consumer reports to third parties.” Background checks are considered Reports under the FCRA. FCRA Requirements for Employers If a Report is deemed a consumer or investigative report under the FCRA, and it comes from a CRA, then the employer: Must obtain written consent from and provide written disclosure to applicants or employees in a “clear and conspicuous” stand-alone document, that a Report has been requested. FTC says this can be accomplished using a combined consent/disclosure form. Prior to taking any adverse action based on the information in the Report, Employer must provide the individual with a copy of the report and a copy of the FTC’s Summary of Rights document, and allow the individual a reasonable period of time to dispute the accuracy of the information. FCRA Requirements for Employers Employer must issue an adverse-action letter when implementing any adverse action—i.e. denial of employment or denial of promotion. During “Pre-Adverse Action” stage, Employer should carefully structure conversations and correspondence to make it clear to employee that no adverse decision has yet been made and the employee has the right to contest the accuracy of the findings. Make it clear to employee that no final decision has been made at the time you are presenting adverse Report finding. Background Check requirements (ORC §5126.28/OAC 5123:2-2-01) ORC §5126.28: Must perform a criminal background check (BCII) with respect to any applicant who has applied to the County Board for employment in any position. OAC 5123:2-2-01: Background check for Superintendent and direct service employees every three (3) years Medicaid HCBS and Medicaid Supported Living If applicant not a resident for previous 5 years prior to application, County Board must request FBI check. Are BCII and FBI considered “consumer reporting agencies” under the FCRA? No. RESULT: County Boards need not comply with the notice and disclosure requirements of the FCRA with respect to reports received from Ohio BCII or from the FBI. What about reference checks? If the reference check is performed by personnel of the Board (rather than a third party), AND It only concerns communication by a previous employer about the applicant’s job performance, THEN, the FCRA does not apply. If rely on third parties to investigate, they will be a CRA and FCRA will apply. Employee Misconduct Investigations Employee misconduct investigation conducted by an outside investigator are not subject to the FCRA’s disclosure and authorization requirements. When do the FCRA notice and disclosure requirements apply? Any consumer report obtained from a consumer reporting agency: Examples of consumer reporting agencies: Credit reports (Equifax, Experian, Trans Union). Background investigations and/or screening performed by an independent third party (private investigator, detective, or private company that verifies past education, references, and past employment). Drug Tests Drug tests are not consumer reports under the FCRA when they are provided directly to the employer. If drug test is provided by a CRA, then the employer must follow notice and disclosure requirements of the FCRA. Questions? Thanks for attending!