Chapter 4 Designing Channel Networks

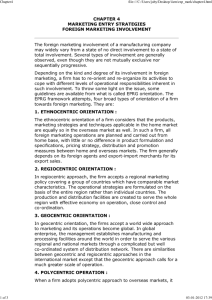

advertisement

“Education in Pursuit of Supply Chain Leadership” dp&c Chapter4 Chapter 4 Designing Channel Networks 4-1 dp&c Chapter4 Learning Objectives • Defining channel networks • Exploring types of supply channel systems • Reviewing channel trading dyads • Detailing the channel network alignment structure • Exploring the reasons for channel networks • Detailing critical channel design considerations • Outlining the channel network design process • Reviewing the channel network design matrix model • Defining supply channel attributes 4-2 dp&c Chapter4 Learning Objectives (cont.) • Reviewing manufacturing methods • Exploring the channel design matrix • Reviewing independent distributor functional advantages • Detailing customer segmentation dimensions • Exploring different network structures and channel characteristics • Making channel network decisions • Facility selection – macro and micro issues • Reviewing different facility location models • Managing channel power and network collaboration 4-3 dp&c Chapter4 Chapter 4 Designing Channel Networks Inventory Defining Channel Management Basics Networks 4-4 dp&c Chapter4 Defining Channel Networks Supply Chain Definition The global network used to deliver products and services from raw materials to end customers through an engineered flow of information, physical distribution, and cash Channel Network Definition An interconnection of organizations which relate to each other through upstream or downstream linkages between the different processes and activities that produce value in the form of products and services to the ultimate customer. 4-5 dp&c Chapter4 Key Characteristics of Channel Networks Channel networks usually consist only of a company's first-tier suppliers and customers A company normally does not form network relationships with all of the different tiers of suppliers and customers found in the supply chain Channel members perceive their relationships as established on a long-term basis The cooperative, often collaborative, relationships that exist are perceived by channel members as an essential component of their continued success in the marketplace 4-6 dp&c Chapter4 Question of Functional Dependence • • • • Is the delivery channel to be characterized as purely transactional, unencumbered by channel dependencies, or is it based on a relational dependence among channel constituents? What are the required capabilities and costs of dealing with each network entity and how are they to be woven together? What is the distribution of power among channel players: who wields the most and who the least power? What are the strengths and weaknesses of the competition and how are existing channels responding to the initiatives of these alternative formats? 4-7 dp&c Chapter4 Types of Supply Channel Systems TransactionBased There is minimal-to-no dependency between channel trading partners. Such systems, in fact, are formed for the performance of an often non-repeated transaction Limited Channel Loose arrangements of businesses that intermittently and opportunistically coalesce with delivery channel specialists in the buying and selling of goods Federated Network Partnerships /Alliances Businesses that acknowledge mutual dependencies and actively seek to integrate individual core competencies, resources, and customer market opportunities on a longterm basis Two or more firms integrate core competencies and resources in the pursuit of an emerging market opportunity 4-8 dp&c Chapter4 Channel Trading Dyads (Pair 1) Requirements Flow 2nd Tier Supplier (Pair 2) Requirements Flow 1st Tier Supplier Materials Flow Manufacturer Materials Flow (Pair 3) Requirements Flow Manufacturer (Pair 4) Requirements Flow Distributor 4-9 Retailer dp&c Chapter4 Supply Chain as a Network Grid Network Ecosystem Channel Node Channel Node Channel Node Channel Node Channel Node Channel Node Channel Node Channel Node Channel Node Channel Node 4-10 Channel Node dp&c Chapter4 Channel Network Alignment Structure Manufacturer Consolidator Store Wholesaler Wholesaler Materials Supplier Materials Supplier Materials Supplier Manufacturer Store Manufacturer Consolidator Regional DC Wholesaler Customer Store Manufacturer Importer Consolidator Materials Supplier Materials Supplier Manufacturer Materials Supplier Manufacturer Direct Channel Network Materials Supplier Manufacturer Secondary Supply Chain Nodes 4-11 dp&c Chapter4 Chapter 4 Designing Channel Networks Inventory Network Management Basics Configurations Definitions 4-12 dp&c Chapter4 Reasons for Channel Networks Customer Service Relocation Requirement to increase customer service levels Moving facilities due to changes in geographic location of demand Flexibility and Scalability Requirement for high levels of distribution channel responsiveness to dynamic demand Product Diversification Creation or acquisition of a new product line Rationalization Reduction of channel costs by consolidating distribution facilities Decentralization Addition of channel facilities to accommodate product decentralization, cost optimization, and other events 4-13 dp&c Chapter4 Critical Channel Design Considerations Facility Role Efficiency/ Responsiveness What is the role of each facility in the channel network? How is efficiency (least-cost) balanced with responsiveness (agile customer response) Facility Location How many and where should facilities be located? Capacity Allocation What are the types and capacities of channel facilities resources need to meet performance goals? Integrative Intensity What is the depth of company ownership of supply and distribution channels? Logistics Costs Logistics costs increase as the number of facilities in the channel increase? 4-14 dp&c Chapter4 Chapter 4 Designing Channel Networks Inventory Channel Network Management Basics Design Process 4-15 dp&c Chapter4 Channel Network Design Process Business Strategy Map Channel Strategy Competition Service Outputs Segment Channel Customer Preferences Configure Channels Channel Positioning Channel Costs Establish New Channels Channel Selection Redefine Existing Channels Channel Power Channel Implementation Channel Conflicts Customer Needs Channel Design Steps Implementation Step Product Choices 4-16 dp&c Chapter4 Channel Network Design Matrix Model Supply Channel Supply Channel Complexity Supply Integrative Intensity Distribution Channel Supplier Intensity Market Penetration Intensity 4-17 Distribution Integrative Intensity Distribution Intensity dp&c Chapter4 Defining Supply Channel Attributes Supply Channel Complexity Describes how many echelons deep in the supply channel a manufacturer or distributor will extend their planning and acquisition of production or finished goods inventories Supply Integrative Intensity Determines how far back in the supply channel a company wants to control product sourcing. Supplier Intensity Determines how the production process choice affects the scope and depth of the partnerships existing with primary and deeper echelons of suppliers 4-18 dp&c Chapter4 Defining Distribution Channel Attributes Market Penetration Intensity Describes how many echelons deep in the delivery network producers or intermediaries must go to deliver goods to the customer Distribution Integrative Intensity Determines the level of integration forward or horizontally a company chooses to pursue in the delivery channel Distribution Intensity Determines the number of intermediaries needed to bring products to the customer 4-19 dp&c Chapter4 Manufacturing Methods Project Job Shop Batch Used to produce a wide variety of large scale, highly unique products associated with a project such as shipbuilding and house construction Associated with make-to-order (MTO) manufacturing environments. Jobs produced to customer order with low production rates using very flexible equipment Similar to the job shop process, but variety is lower and volume is higher. Products are normally built based on standard bills of material and routings Mass involves the manufacture of standardized or products subject to fixed features and options produced in very high batch volumes in a narrow variety Continuous produces a very narrow range of highly standardized, commodity products in high volumes utilizing dedicated equipment 4-20 dp&c Chapter4 Supply Channel Supply Supply Channel Integrative Complexity Intensity Custom/Single Source Standard/Intense Distribution Channel Design Matrix - Example Distribution Channel Supplier Intensity Process Method Market Distribution Penetration Integrative Distribution Intensity Intensity Intensity Low Very Low Very Low Project Low Very High Low Low/ Medium Low Low Job Shop Low High Low Medium Low/ Medium Medium Batch Medium High High High Mass High Medium/ High Medium/ Low Low/ Medium Medium/ High Very High Very High Very High Continuous Very High Low Very High 4-21 dp&c Chapter4 Independent Distributor Functional Advantages Motivation Highly motivated to provide superior service because they are accepting the risk of stocking, storing, and delivering inventories and conducting sales and marketing functions in return for the expectation of reward Specialization An independent channel intermediary is focused solely on performing distribution functions Survival of the Fittest The more successful channel distributors quickly weed out the poor performers, leaving on the most efficient distributor in charge of the market Economies of Scale Pooling of different product lines provides them with a significant advantage over vertically integrated channels which only carry the products of the manufacturing plant 4-22 dp&c Chapter4 Independent Distributor Functional Advantages Market Coverage Ability to appeal to a very wide marketplace stems from their ability to call on a large customer base, often local in origin, with an assortment products and services that meet their individual needs Supplier Independence Channel intermediaries offer their customers what they consider the best products and services without the interference of the manufacturers 4-23 dp&c Chapter4 Customer Segmentation Dimensions Customer Needs Centers on documenting what customers value the most from the array of company offerings. This dimension reveals the most critical value proposition available to the customer Customer Behavior Utilizes technology tools to reveal the experiential world of the customers. The goal is to document how brand and service impact experiences in both consumer and business-to-business contexts from the perspective of the customer Customer Profitability Seeks to divide customers into segments by profitability. This step is concerned with how this information can be used to further long-term customer loyalty and not purely as a way to devise strategies focused on just selling more products 4-24 dp&c Chapter4 Grainger Service Output/Design Matrix Distribution Channel Service Output Market Penetration Intensity Distribution Integrative Intensity Distribution Intensity Bulk-Breaking High Medium Low Spatial Convenience Very High Very High Medium Waiting and Delivey Time Very High Very High Low/ Medium Variety (Assortment) High Very High Low/ Medium 4-25 dp&c Chapter4 Producer Storage with Direct Delivery Producer Inventory Flow Customer Information Flow Customer 4-26 Customer dp&c Chapter4 Producer Storage with Direct Delivery Characteristics Channel Design Attributes Characteristics Market penetration intensity One echelon delivery channel means company totally controls the distribution channel. Producer has direct control over product quantities. Distribution integrative intensity One echelon delivery channel means total logistics control. Distribution intensity No channel intermediaries. Single source distribution. 10 Transaction Flows High cost of performing all channel transaction flows. Normally one or more intermediaries involved to reduce costs. Producer incurs heavy inventory risk. Service Outputs Characteristics Bulk-breaking Unique products or large lot quantities. Ability to minimize inventory costs by centralizing distribution warehouses. Presence of very low carrying costs. Spatial convenience Supply source often far from the customer. Possibly long-lead times for transportation to customer. Waiting and delivery Possible long-lead time wait for product delivery. Transportation costs normally low due to bulk shipments. Variety (assortment) Very low product variety available to the customer. 4-27 dp&c Chapter4 Producer Storage with Drop Ship Producer Order Flow Inventory Flow Distributor/ Retailer Customer Customer 4-28 Customer dp&c Chapter4 Producer Storage with Drop Ship Characteristics Channel Design Attributes Characteristics Market penetration intensity Producer fully responsible for product delivery. Producer has reduced inventory costs due to centralization. Distribution integrative intensity Use of multiple customer-facing (forward) distributors and retailers. Producer retains control of all distribution flows. Distribution intensity Producer pursues an intensive or exclusive distribution model to reach as many customers as possible. 10 Transaction Flows Producer surrenders costs of selling and promoting, pricing, negotiations, order management, customer financing to forward intermediaries. Service Outputs Characteristics Bulk-breaking Offers small lot quantities. Ability to minimize inventory costs by centralizing warehouses and postponement. Spatial convenience Loss of direct contact with the customer. Supply source can be far from the customer. Possibly long-lead times for transportation to customer. Waiting and delivery Possible long-lead time wait for product delivery. Delivery costs normally high due to many low quantity shipments. High information connection to forward distributors and retailers. Variety (assortment) Very low product variety available to the customer. Enables distributors and retailers to increase product variety. 4-29 dp&c Chapter4 Producer with Extended Channel Network Producer Distribution Center #1 Western Region Retailer Customer Retailer Customer Distribution Center #2 Resupply Flow Retailer Customer Retailer Customer 4-30 Retailer Customer Eastern Region Retailer Customer Customer dp&c Chapter4 Producer with Extended Channel Network Characteristics Channel Design Attributes Characteristics Market penetration intensity Deep marketplace penetration using multiple levels of distributors and retailers. Distribution integrative intensity Producer heavily dependent on channel intermediaries for all customer-facing (forward) order management and delivery functions. None to minimal supply/distribution channel ownership Distribution intensity Producer uses a wide multi-echelon network of channel partners to sell and deliver mass produced products. 10 Transaction Flows Producer performs minimal channel transaction flows. Service Outputs Characteristics Bulk-breaking Producer ships in bulk quantities to distributors who perform bulk-break activities. Low inventory costs due to centralized inventories Spatial convenience Total loss of direct contact with the customer. However, channel partners remove geographical distance and shrink customer wait and delivery lead times. High customer convenience. Waiting and delivery Low cost inbound and outbound transportation from producer to distribution partners. High information connection to forward distribution centers. Variety (assortment) Very low product variety available to the customer. Enables distributors and retailers to increase product variety by using other producers. 4-31 dp&c Chapter4 Aggregator with Extended Channel Network Producer Producer Producer Producer Producer Distributor (Aggregator) Producer Producer Inventory Flow Local Distributor Retailer Retailer Retailer Retailer Direct Sales Customer Customer Customer Customer 4-32 Customer Customer Customer dp&c Chapter4 Aggregator with Extended Channel Network Characteristics Channel Design Attributes Characteristics Market penetration intensity Deep marketplace penetration using multiple levels of distributors and retailers. Includes some direct sales. Distribution integrative intensity Distributor has no ownership of backward or forward supply or distribution echelons. Depends on channel partners. Distribution intensity Distributor uses a deep, multi-echelon network to penetrate deep into the marketplace to sell and deliver mass produced products. 10 Transaction Flows Distributor performs channel replenishment transactions and initial inventory ownership. Minimizes risk by passing most transactions functions to downstream channel members. Service Outputs Characteristics Bulk-breaking Engages in significant bulk-break activities. High storage costs. Due to high cost of inventory, channel stock only high-volume items, with slow movers stored upstream in the distribution channel. Spatial convenience Fast-selling items have immediate delivery. Slow sellers must move at slower pace through the distribution channel. Waiting and delivery Low cost inbound but relatively higher cost outbound transportation due to more delivery points and smaller lot sizes to customers and delivery partners. Variety (assortment) High level of product variety by using multiple suppliers. 4-33 dp&c Chapter4 Aggregator with e-Business Network Producer Producer Distributor Slow moving Producer Producer Distributor (Aggregator) Local Distributor Distributor Distributor Inventory Flow Order Flow Channel Resupply e-Sales Drop Ship Direct Ship Retailer Retailer Retailer Direct Sales Customer Customer Customer Customer 4-34 Customer Customer Customer dp&c Chapter4 Aggregator with e-Business Network Characteristics Channel Design Attributes Characteristics Market penetration intensity Deep marketplace penetration using multiple levels of distributors and retailers. Includes direct and e-sales. Distribution integrative intensity Distributor has no ownership of backward or forward supply or distribution echelons. Depends on channel partners. Distribution intensity Requires a complex channel composed of distributors, brokers, jobbers, retailers, direct customer delivery, and e-business to sell and deliver a high level of product assortments. 10 Transaction Flows Most transaction functions performed by channel partners. Manages e-business channel, replenishment to local distributors and retailers, performs direct shipment. Minimizes risk by passing most transactions functions to downstream channel members. Service Outputs Characteristics Bulk-breaking High level of bulk-break and assortment assembly. Stocks only fast sellers, with slow seller dropped shipped using channel partners. Spatial convenience Customers can get immediate delivery at local stores for fast moving items. Slow sellers move at slower pace through the distribution channel. Waiting and delivery High customer service and product availability at retail level. Ebusiness and slow moving sales has a short delivery wait. Distributor has low cost inbound but higher outbound transportation costs due to more delivery points and smaller lot sizes to customers and delivery partners. Variety (assortment) High level of product variety by using multiple suppliers. 4-35 dp&c Chapter4 Comparing Channel Network Options Producer Storage with Direct Delivery Producer Storage with Drop Ship Distribution intensity Low Low High High Very High Customer service level Low Medium High High Very High Product assortment Very Low Low Low High Very High Product availability Low Medium Medium/High High Very High Delivery time Low Low/Medium High High High Very Low Low Medium High Very High Inventory cost High High Medium Medium Low Transportation Very High High Medium Low Low/Medium Channel facilities Very Low Medium Medium/High Medium Low/Medium Performance Attribute Channel complexity Producer with Aggregator Extended with Extended Channel Channel Network Network 4-36 Aggregator with eBusiness Network dp&c Chapter4 Chapter 4 Designing Channel Networks Inventory Management Basics Channel Selection 4-37 dp&c Chapter4 Customer Responsiveness vs. Channel Costs Long Customer Response Time Minimum Channel Size Total Logistics Costs Short Number of Facilities 4-38 dp&c Chapter4 Making Channel Network Decisions Facility Selection Identifying and quantifying all necessary macro (corporate) and micro (local site factors) issues affecting possible channel facility choices Modeling Choices Selection of modeling techniques: statistical charting, simulation, heuristics, optimization, and expert systems Assembling the Network Identifying the geographical areas where proposed channel facilities are to be located Confirming the Network Linking facilities to markets and determining the capacity resource allocation for each channel facility 4-39 dp&c Chapter4 Facility Selection – Macro Issues Corporate objectives translated into markets and competitive positioning Customer service goals Global economic conditions Country-level political stability Government regulations Location of markets Exchange rates and currency risks Local cultural and economic issues and others. 4-40 dp&c Chapter4 Facility Selection – Micro Issues Local taxes, culture, and climate Labor availability, costs, and union strength Cost and availability of utilities Local environmental regulations Government incentives Community resources (police, fire, schools, public transportation, and affordable housing) Proximity to competitors (clustering) to take advantage of a major resource found in the region Proximity to suppliers and customers 4-41 dp&c Chapter4 Facility Selection – Site Issues Facility cost and size Availability of transportation modes Proximity to highway systems Communications infrastructure Local taxes and fees Environmental regulations 4-42 dp&c Chapter4 Factor Rating Method This method utilizes the macro and micro site issue factors. Site issues are selected, weighted by importance, sites selected, rated using the scale, scores are then summed and a recommendation made by the team Example: Site Scores (100 points) Weight Chicago San Diego Decision Issue Weighted Scores Chicago San Diego Labor costs 20.0% 18 25 3.60 5.00 Labor availability 14.0% 95 75 13.30 10.50 Transportation costs 14.0% 20 45 2.80 6.30 Transportation availability 14.0% 95 70 13.30 9.80 Taxes 3.0% 10 10 0.30 0.30 Quality of life 8.0% 75 85 6.00 6.80 Infrastructure costs 7.0% 15 20 1.05 1.40 20.0% 40 45 8.00 9.00 Totals 48.35 49.10 Facilities cost Total 100% 4-43 dp&c Chapter4 Center of Gravity Method Geographical Grid: 1600 Boston 1400 New York 1200 Philadelphia 1000 800 Denver 600 400 Los Angeles 200 0 0 500 1000 4-44 1500 2000 dp&c Chapter4 Center-of-Gravity Method (cont.) Channel Network for ABC Distribution Location 1600 Transportation Quantity/Tons Cost US$/Ton Mile Los Angeles 1400 Denver 1200 Boston New York 1000 Philadelphia $ $ $ $ $ 800 Distance Table 1.25 1.25 1.20 1.20 1.20 SUM Denver Denver Coordinate x Coordinate y Boston Boston 100 2,000.0 350 1,000.0 New York New York 1800 1,000.0 Philadelphia 2,000.0 Philadelphia1650 1450 1,500.0 7,500.0 400 600 1400 1200 1000 Cincinnati Location600 Philadephia New York Boston Denver Los Angeles Distance: 1,477.33 1,744.28 1,972.31LA to Denver 320.16 0.00 Los Angeles 400 1,170.47 1,431.78 1,656.05 0.00 320.16 Denver Angeles LosLos Angeles 531.51 250.00 0.00 1,656.05 1,972.31 Boston 200 282.84 0.00 250.00 1,431.78 1,744.28 New York 0.00 282.84 531.51 1,170.47 1,477.33 Philadelphia0 3,462.15 3,708.90 4,409.87 4,578.46 5,514.07 Distance 500 6,915,631.14 1000 6,897,927.04 1500 5,594,598.88 2000 5,222,320.05 7,997,010.22 Weight Total0 Cost $ 9,612,420.07 $ 8,330,772.99 $ 8,557,545.75 $ 6,959,535.40 $ 6,473,040.42 1043.33 x Location 893.33 y Location 4-45 dp&c Chapter4 Location Break-Even Analysis Product Data for ABC Distribution $250,000 1400 Sump Pumps 120.00 $ 2,000 Product Line Purchase Price Forecast $200,000 $150,000 Channel Network for ABC Distribution Location $ $ Fixed Cost Variable Cost/unit Breakeven Points Los Angles 30,000 75.00 $ $ Chicago 60,000 45.00 $ $ $ Value 105,000 150,000 172,500 Units 1,000 1,600 2,500 Los Anges vs. Chicago Los Anges vs. New York Chicago vs. New York New York 110,000 $ 25.00 $ Los Angles Chicago $100,000 New York $50,000 $0 500 1000 1500 2000 2500 3000 Analysis Location Total Cost Expected Profit Expected Profit % $ $ Los Angles 180,000 $ 60,000 $ 33% New York Chicago 160,000 150,000 $ 80,000 90,000 $ 50% 60% Los Angles 30,000 217,500 Chicago 60,000 172,500 Graph Units 0 $ 2,500 $ $ $ $ $ New York 110,000 172,500 4-46 dp&c Chapter4 Least-Cost-Per-Lane Problem Channel structure, costs, and inventory limits Demand 5,000 units limit DC1 US$2 Warehouse1 US$1 US$5 DC2 5,000 units Store 2 10,000 units Store 3 5,000 units US$1 US$4 20,000 units limit Store1 US$4 Warehouse 2 US$2 US$1 US$3 4-47 US$3 dp&c Chapter4 Least-Cost-Per-Lane Problem (cont.) Channel Lane Solution for item PC1600-01 Total Channel Requirements 20,000 Warehouse 2 Quantity Limit 5,000 Store Costs from Warehouse 1 Store Store 1 Store 2 Store 3 Delivery Cost $ 1 $ 1 $ 2 Quantity 5,000 10,000 5,000 Total cost Total Cost $ 5,000 $ 10,000 $ 10,000 $ 25,000 Store Costs from Warehouse 2 Store Store 1 Store 2 Store 3 Delivery Cost $ 4 $ 3 $ 3 Quantity 5,000 10,000 5,000 Total cost Total Cost $ 20,000 $ 30,000 $ 15,000 $ 65,000 Least Cost $ Warehouse Costs from DC1 Warehouse Warehouse 1 Delivery Cost $ 2 Quantity 5,000 Total Cost $ 10,000 25,000 Warehouse Costs from DC2 Warehouse Warehouse 1 Delivery Cost $ 5 Quantity 15,000 Total Cost $ 75,000 Least Cost $ 85,000 Least Cost Channel Solution 4-48 $110,000 dp&c Chapter4 Least-Cost-Per-Lane Problem – Optimized Demand 5,000 units limit 20,000 units limit DC1 DC2 5,000 units US$2 15,000 units US$1 US$1 Warehouse1 Store1 5,000 units Store 2 10,000 units Store 3 5,000 units US$3 Warehouse 2 4-49 US$3 dp&c Chapter4 Chapter 4 Designing Channel Networks Inventory ChannelBasics Management Implementation 4-50 dp&c Chapter4 Managing Channel Power Reward Power Coercive Power A channel member is rewarded by conforming to a required or suggested behavior. A channel member is punished by nonconformance to a required or suggested behavior Expert Power A channel member possesses a certain expertise in the form of special knowledge, technical expertise, marketing dominance, or customized resources Legitimate Power a dependent channel members feels obligated, ethically, socially, or contractually, to comply with the requirements or policies of another channel member Referent Power A dependent channel member, who values the marketplace recognition, technical expertise, or other attribute possessed by another channel member, seeks identification with the influencing member 4-51 dp&c Chapter4 Impediments to Channel Change Unless there is an overwhelming channel power player, influencing the behavior and policies of a community of independent companies is a complex. Besides constantly changing and recalibrating the strategic and performance targets of each channel member, there are also legal restrictions, contractual commitments, potential relationships with other delivery intermediaries, competitive practices, and marketplace conventions that make change difficult When channel changes are initiated, they are often undertaken by a single player. While a channel master possesses the power, most channels do not have centralized leadership driving and coordinating improvements. Changes are normally seen as local, with no one overseeing the impact on overall channel capabilities, competitive positioning, and customer relations Because channels are opportunistic and voluntary, the operating conventions that do arise over time tend to get petrified. As a result, the changes that are made are often realized on a local level and rarely impact channel design. 4-52 dp&c Chapter4 Assertiveness Impediments to Channel Change Accommodation Collaboration Avoidance Competition Cooperation 4-53 dp&c Chapter4 Ensuring Effective Conflict Management Leadership A dominant channel player or steward that acts as an advocate for change, transforming discordant partners into a unified channel for customer value and joint channel member profitability Integration Networking supply chain partners to share data, search for ways to reduce costs, deepen customer intimacy at each level in the delivery network, and search for ways to rationalize new sources of channel conflict Technologies Use of technologies like POS, CRM and PRM that provide visibility of sell-side data to supply chain members from every source in the delivery network Performance Intelligence Realizing the opportunities found in the marketplace requires looking at the performance of not just one company, but of all the firms comprising the entire end-toend delivery channel 4-54 dp&c Chapter4 Stages of Channel Network Collaboration Stage 4 Stage 3 Stage1 Channel Awareness • Little interaction • Transactional relations • Minor marketplace competition • Channel power not an issue • Channel conflict avoided or non-existent • Relationship easily cancelled Stage 2 Channel Relationships • Identification of channel partners • Search for market synergies • Regions of interdependence • Identification of power and fairness issues • Role definitions become more elaborated • Channel conflict can end early cooperation Channel Cooperation • Mutual benefits identified • Interdependence expands • Contracts and high performance lead to deepening commitment • Goal congruence increases • Cooperation increases • Channel power mutual enhancing • Channel conflict managed by accommodation 4-55 Channel Collaboration • Investment in strong interdependent relationships and norms • Long-term horizon • Power-sharing enhances the competencies of each partner • High mutual dependence • High trust and level of compromise • Parties resolve conflict by engaging in joint problemsolving • Shared values, risks, and strategies dp&c Chapter4 “Education in Pursuit of Supply Chain Leadership” dp&c Chapter4 Chapter 4 End of Session 4-56 dp&c Chapter4