Corporate Financial Management 1

advertisement

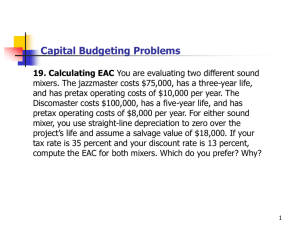

Corporate Financial Click Management to edit Master title style 1 Jan Vlachý <vlachy@atlas.cz> Brigham, E.F., Ehrhardt, M.C. Financial Management: Theory and Practice, 13th Edition Basic Concepts Chapters 1-3 Corporate Financial Management Is the Art/Science of Creating and Maintaining the Value of a Company. Gives a Firm its Common Language. It Consists of Investment Decisions Financing Decisions Managerial Decisions Corporate Financial Management 1 2 Investment Vehicle Model Money × Real Assets Money × Financial Assets Financial Markets The World The Firm Invest- Financments ing Corporate Financial Management Investors Financial Intermed. Financial Markets F I N A N C E Investments The Set of Contracts Model recognises imperfections and includes the assumption of both explicit and implicit contracts, incl. Corporate Organization. Corporate Financial Management 1 3 The Financial Environment Competitive Economic Environment Two-Sided Transactions (Buyer×Seller Equil.) Risk-Return Tradeoff Signalling/ Behavioral Principle <= Market Efficiency (Information, Transactions) Value (How can some people become rich?) New Ideas, Expertise Financial transactions Options create an equilibrium; Real Time Value of Money investments create value Corporate Financial Management 1 4 Accounting, Cash Flows & Taxes Purposes of an Accounting System Reporting the Firm’s Financial Activities to Stakeholders Providing Information to Firm’s Decision Makers Financial Management strives to use and interpret the information Accounting - historical view Finance - current and future Corporate Financial Management 1 5 Limitations of Accounting Why don’t shares trade at Book Val.? Market×Book Value of Assets/Liabs Historical Accounting (depreciation) Inflation (value benchmarks have changed) Liquidity (can it readily be sold?) Time Value of Money (relates to Maturity and Terms) Note: Finance prefers to deal with cash flows in a time perspective. Corporate Financial Management 1 6 Taxes Income Tax Make analyses on after-tax basis For financial decisions, use marginal tax rate (relavant if tax is progressive or unsymmetrical on negative base) Capital Gains Tax Dividend/Interest Income Treatment System Biases (Loss Carry-forwards, Exemptions, Deductions) Corporate Financial Management 1 7 Time Value of Money Chapter 4 Any Present Value has a greater Future Value. ... i.e. People generally prefer having any amount of money at their disposal earlier rather than later. ... i.e. Investors require positive returns as compensation for the inconvenience. Corporate Financial Management 1 8 On Present and Future Values You deposit $1,000 today with a bank that pays 5% interest per year. FV1= PV+r×PV= PV(1+r)= $1,000×1,05= $1,050 (Simple Interest) FV2= FV1(1+r)= PV(1+r)×(1+r)= PV(1+r)2= $1,102.50 (Compound Interest) Discounted Cash Flow Framework FVt= PV(1+r)t Corporate Financial Management 1 PV= FVt / (1+r)t 9 Return, Net Present Value Return of an Investment (Rate of Return, Yield): CashFlow (EndValue BegValue) Return BegValue NPV = Present Value of expected cash flows (+positive-negative) C0 C1 C2 C3 Corporate Financial Management 1 C4 t 10 Practical Issues Distinguish: Realized Return Expected Return (<= Risk) Required Return (<= Unperfect Mkts) Financial securities are usually priced “fairly” (Market Equilibrium). Investment projects (and other entrepreneurial decisions) should bring value, i.e. have positive NPV. Corporate Financial Management 1 11 Valuing Single Cash Flows (Ex.) What is the Future Value of $2,000 invested at 3% per year for five years? What is the Present Value of CZK 10m to be received two years from now if the required return is 4% per year? What is the Expected Return for an investment costing €10,000 today and offering €12,000 in three years? Corporate Financial Management 1 12 Valuing Multiple Cash Flows You can invest $10,000. As a result, you expect to get $2,000, $8,000, and $5,000 over the next three years, respectively. If the required return is 10%, what is the NPV of your investment? t 0 1 2 3 Ct $ -10,000 $ 2,000 $ 8,000 $ 5,000 Total PV: PV(Ct) -10,000.00 1,818.18 6,611.57 3,756.57 $ 2,186.33 What is the return if you know the NPV? Corporate Financial Management 1 13 Annuities Types of Annuity Ordinary Annuity (Payments at end of period) Annuity Due (Payments at beginning of period) Deferred Annuity (First repayment more than one period after drawing) n PVAn PMT t 1 1 1 r t 1 r n 1 PMT n r 1 r FVAn = PVAn(1+r)n; PVAn[due] = PVAn(1+r); PVAn[defd] = PVAn/(1+r)d Corporate Financial Management 1 14 Amortization Schedules A $1,000 loan yielding 8% requires equal payments at the end of the next three yrs. How much principal will be rpd. in Year 2? PMT = $1,000×[.08(1.08)3/(1.083-1)] = $388.03 t Vt-1 It Vt-1 + It PMTt Vt 1 2 3 $1,000.00 $691.97 $359.30 80.00 55.36 28.74 1,080.00 747.33 388.04 -388.03 -388.03 -388.03 691.97 359.30 0.01 P2 = V1 - V2 = |PMT2| - I2 = $332.67 Corporate Financial Management 1 15 Perpetuities Problem 4-27 1 r n 1 PVperp lim PVAn lim PMT n n n r 1 r PMT PMT PMT lim n n r r r 1 r PV = $100 / 7% = $1,428.57 Growth Perpetuities: PMTt = PMT0(1+g)t PVgrowth = PMT1/(r-g) (... r > g) Corporate Financial Management 1 16 Compounding Frequency (1) Compare annual return on deposit with 6% interest paid annually and monthly. FVA = PV×(1 + 6%) = PV×1.06 rA = (FVA-PV) / PV = .06×PV/PV = 6% FVM = PV×(1 + 6%/12)12 = PV×1.00512 = PV×1.0617 rM = (FVM-PV) / PV = 6.17% Corporate Financial Management 1 17 Compounding Frequency (2) Compare the cost of a 6% (nominal rate) loan with monthly and quarterly interest. Nominal Rate×Effective Annual Rate NR = m×rm EAR = (1 + rm)m - 1 EAR M = 1.00512 - 1 = 6.17% EAR Q = 1.0154 - 1 = 6.14% Corporate Financial Management 1 18 Bond and Stock Valuation Chapters 5,7 Main sources of capital for Company Bond: Debt Capital Stock: Equity Capital Claim on fut. cash flows for Investor Bond: Contractual interest and principal payments (or proceeds of sale) Stock: Dividends (theoretically forever) or proceeds of sale Corporate Financial Management 1 19 Valuation Procedure Based on discounted cash flow concept: Estimate expected future cash flows Determine required return (depending on the riskiness of the expected cash flows) Compute the present value Other possibilities: Market price of same or comparable asset Corporate Financial Management 1 20 Features of Bonds/ Stocks Par (Face, Princ.) Value ??? Coupon (Interest) Rate Dividends Coupon Payment Dividend Payment Frequency Frequency Maturity: Original (Issue), N/A Remaining (Residual) Terms of Repayment: N/A Bullet, Sinking Fund, Zero-Coupon (Pure Common/Preferred Discount) Call Provision (Option); Rights (Warrants, Convertibles)... See other Rights; Chapt. 19, Hybrid Junior/Senior Financing Corporate Financial Management 1 21 Bond Valuation t 1 2 3 4 ... 8 9 10 11 12 Ct $ 80 $ 80 $ 80 $ 80 ... $ 80 $ 80 $ 80 $ 80 $1,080 r= 9% PV $ 73.39 $ 67.33 $ 61.77 $ 56.67 ... $ 40.15 $ 36.83 $ 33.79 $ 31.00 $ 383.98 $ 928.39 Corporate Financial Management 1 Problem 5-1 n V t 0 Ct 1 r t For bond w/semi-annual coupons n=24, Ct=$40. To put required return on same basis as annual bond, one should assume EAR = 9% = (1+rS)2 - 1, i.e. rS = \/1.09 1 = 4.4%. 22 Yield to Maturity/ Yield to Call (1) Assume Johnson Co. has a bond with a face value of $1,000 that matures in 12 years, has a coupon rate of 8%, and is currently selling for $928.39. What is the required return to buy the bond (YTM = 9.00%)? Assume it can be called in 10 years at a call price of $1,100. What would be the required return to buy the bond if we knew the option would be excercised (YTC = 9.79%)? Corporate Financial Management 1 23 Yield to Maturity/ Yield to Call (2) Yield to Maturity= Promised Return Yield to Call= Return if Called N=12; PV=-928.39; PMT=80; FV=1,000 => I (YTM) = 9.00% N=10; FV=1,100 => I (YTC) = 9.79% Expected Return= YTM minus Risk Credit (Default) Risk <= Rating Interest Rate Risk/ Reinvestment Risk FX Risk, Liquidity Risk... Corporate Financial Management 1 24 Market Interest Rates/Yield Curve 4 3,5 3 2,5 r 2 1,5 1 0,5 0 0 2 4 6 8 10 12 t Corporate Financial Management 1 25 Stock Valuation Problem Value a share which is expected to pay dividends of $2.72 and $3.10, respectively, over the next two years, and sold thereafter for $48, if the required return is 10%? V=$2.72/(1.1)+$3.10/(1.1)2+$48/(1.1)2= $44.70 But... How did I estimate the market price in 2 years? Let us assume constant dividends of $4.80 after Year 2. Using perpetuity valuation: V2=$4.80/10%= $48 Corporate Financial Management 1 26 Constant Growth Model Dt = D0(1+g)t V = D1/(r-g) (... r > g) e.g. V = $36(1.05)/(13%-5%) = $31.5 e.g. r = $1.30/$21.25 + 6% = 12.12% CG formula can also be used for determining a horizon (terminal) value or for valuing declining growth stock. For erratic or supernormal growth stock, split cash flows into two parts. Corporate Financial Management 1 27 Risk and Return Chapters 6, 7 Risk refers to the chance that some unexpected event would occur. In business, that would mean the decrease of value of the firm, in financial markets any change in the value of financial instruments etc. In other words, actual returns will differ from expected returns. The expected return should therefore compensate an investor for the perceived risk. Corporate Financial Management 1 28 Investments with Risk Economy Prob. T-Bill Eq 1 Eq 2 Problem Gold Bond Recession 0.10 5.0% -25.0% -15.0% 20.0% 10.0% Below avg. 0.20 5.0 -5.0 -5.0 7.0 7.0 Average 0.40 5.0 15.0 10.0 0.0 6.0 Above avg. 0.20 5.0 25.0 20.0 -2.0 5.0 Boom 0.10 5.0 50.0 30.0 -10.0 2.0 1.00 Corporate Financial Management 1 29 Expected Return E(r) = Σwiri E(rEQ1) = .10(-25%) + .20(-5%) + .40(15%) + .20(25%) + .10(50%) = 12.5% Eq 1 Eq 2 Bond T-bill Gold E(r) 12.5% 8.5% 6% 5% 2% Eq 1 has the highest expected return. Is it the best investment? Corporate Financial Management 1 30 Stand-Alone Risk σ = \/Σ(wi(ri-E(r))2 σEQ1 = \/[.10(-25-12.5)2 + .20(-5-12.5)2 + .40(15-12.5)2 + .20(25-12.5)2 + .10(5012.5)2] = 19.4% Volatility σ E(r) T-bill Bond Gold Eq 2 Eq 1 0% 1.9% 7.5% 12.9% 19.4% 5% 6% 2% 8.5% 12.5% Corporate Financial Management 1 31 Probability Distributions Prob. T-bill Eq 2 0 5 8.5 12.5 Corporate Financial Management 1 Eq HT1 Actual Return (%) 32 Portfolio Risk (1) Assume portfolio with 50% invested in Eq 1, and 50% in Gold. Economy Recession Below avg. Average Above avg. Boom Prob. 0.10 0.20 0.40 0.20 0.10 Eq 1 -25.0% -5.0 15.0 25.0 50.0 Gold 20.0% 7.0 0.0 -2.0 -10.0 Port. -2.5% 1.0 7.5 11.5 20.0 E(rP) = 7.25% σP = 6.1% Corporate Financial Management 1 33 Portfolio Risk (2) p (=6.1%) is much lower than: either Eq 1 (19.4%) or Gold (7.5%). average of Eq 1 and Gold (13.5%). The portfolio offers a decent return (average of Eq 1 and Gold returns) with low risk. The key is low (actually negative) correlation between Eq 1 and Gold returns, facilitating diversification. Corporate Financial Management 1 34 Managing Portfolio Risk Systematic and Specific Risk [Law of Large Numbers] (Insurance, Consumer Credit) Equilibrium Theories, e.g. Capital Asset Pricing Model [Sharpe, Lintner] (Equity Markets, Capital Investments) Portfolio Theory [Markowitz] (Market Portfolios), based on function σP=ƒ(w1,w2,w3,..,σ1,σ2,σ3,..,ρ12, ρ13, ρ23,..) Corporate Financial Management 1 35 Effect of Diversification (%) Specific (Diversifiable) Risk 35 Total Risk 20 Systematic Risk 0 10 20 30 Corporate Financial Management 1 40 N 36 Capital Asset Pricing Model In an efficient market, the required return will equal the expected return. efficient market => equilibrium price transactional, informational efficiency efficient market arbitrage An asset’s required return is the sum of the riskless return and an asset-specific risk premium. Beta (β) is a measure of the asset’s market (systematic, undiversifiable) risk. SML: ri = rF + β(rM - rF) Corporate Financial Management 1 37 Beta as a Sensitivity Measure ri = rF + β (rM - rF) ri β=1 0<β<1 rF β=0 45° Corporate Financial Management 1 rM 38 CAPM Utilization Problem Two shares (in the same market) with known rF, βA, βB, rA, looking for rB. rA = rF + βA (rM - rF) rB = rF + βB (rM - rF) 14% = 6% + 1.4(rM-6%) => rM = 11.7% rB = 6% + 1.1(11.7%-6%) = 12.3% Note: The beta of a portfolio equals the weighted average of its component betas (VP bP = VA bA + VB bB + ...) Corporate Financial Management 1 39 Options Chapter 8 Option = Right (Financial and Embedded Options, i.e. Contracts) or Opportunity (Real Options) Financial options are traded contracts, derivatives of Underlying Assets (Equities, FX, Bonds, Commodities, Indices...) Financial Derivatives include Options, Warrants, Forwards, Futures, Swaps, Repos... Financial Derivatives are used primarily for Risk Management (Hedging, Speculation) ... See Chapt. 23 Corporate Financial Management 1 40 Applications Financial Options American vs. European Options Call vs. Put Options Exotic Options (various terms of exercise, caps, floors; exchange options, compound options,...) Embedded Options... Constitute Contracts Real Options... In Business Decisions ... See Chapts. 11,25 Corporate Financial Management 1 41 The Value of Options Intrinsic Value (would the option be executed if nothing changed till excercise date?) = ƒ(p; r; t) ...usually easy to assess; can be used for designing option strategies Time Value = ƒ(t; ) ...calculated by means of models (using market equilibrium assumption and replication) Intrinsic Value (Call Option) Total Value (Call Option) V V out-of-the-money in-the-money S p at-the-money Corporate Financial Management 1 p Time Value 42 Using the Replication Principle Call Option: S = $40, p = $32, d = $16 or u = $64 at time t; rt = 2%. d: Option out of the money, i.e. Vd = 0 u: Uption in the money, i.e. Vu = 64 - 40 = $24 Income structure can be replicated with N forward transactions. These must have zero value if underlying asset costs $16, and must therefored be issued with forward price F = $16. Their present value is VF = p - F/(1+rt) = $16.31. Value of N forward transactions at settlement if underlying asset costs u is Vu = N(u - F). To replicate u = 64 Vu = 24, N = 24/(64-16) = 0.5. The option value is thus VC = 0.5×16.31 = $8,16. Corporate Financial Management 1 43 Numerical Model (Binomial, CRR) Call Option S = 1 100; p = 1 000; r = 5%; 4 periods 1 215,51 F = 1 100; N = 1 115,51 VF = 1157,63 - 1100e-0,25×5% 1 157,63 = 71,29 71,29 VC = N VF = 71,29 1 102,50 43,99 1 102,50 2,50 F = 1 000 N = (u - S)/(u - d) = 1 050,00 1 050,00 27,14 1,52 2,50/102,5 = 0,0244 1 000,00 1 000,00 1 000,00 V = 1050 - 1000e-0,25×5% = F 16,74 0,93 0,00 62,42 952,38 952,38 VC = N VF = 1,52 0,56 0,00 907,03 0,00 907,03 0,00 863,84 0,00 N = 0 => VC = 0 Corporate Financial Management 1 822,70 0,00 44 Analytical Model (Black-Scholes) VC = p N(d1) - S e-rt N(d2) d1 = [ln(p/S) + (2/2) t] / ( t) d2 = d1 - t p= $500; S= $510; r= 3%; t= 3months (=0,25); =20% d1 = [ln(500/510)+(0,04/2)×0,25]/(0,2×0,5) = -0,0730 d2 = -0,0730 - 0,2×0,5 = -0,1730 N(d1) = N(-0,0730) = 0,4709; N(d2) = N(-0,1730) = 0,4313 (cummulative distribution function for a standardised normal random variable) VC = 500×0,4709 - 510×e-20%×0,25×0,4313 = $17,12 VP = VC - p + Se-rt = 17,12-500+510×e-3%×0,25 = $23,31 (using putcall parity) Corporate Financial Management 1 45 Cost of Capital Chapter 9 Cost of Capital = Required Return for Capital Budgeting Project 2 possible approaches Use CAPM Firm Value = Equity Value + Debt Value. In a perfect market, a company cannot affect its value by changing the way it is financed - it just influences the distribution of risks and returns between different classes of investors. Corporate Financial Management 1 46 Risk/Return of Real Assets CAPM can be extended to include real assets (i.e. capital budgeting projects) Pure Play Method (Finding singleproduct companies in the same line of business as project being evaluated) Accounting Beta Method (Regression of return of assets against average return on assets in the whole market) Corporate Financial Management 1 47 Weighted Average Cost of Capital WACC = (1-L)re + L(1-T)rd L = D/(D+E) ... Leverage T ... Marginal Income tax Rate Always based on opportunity, not historical costs and values! After-tax cost must be used for all components! Correct risk assumptions have to be made for individual projects! Corporate Financial Management 1 48 WACC Problems 9-4, 9-7 r = $3.6 / $70 = 5.14% c = $3.6 / ($70×(1-5%)) = 5.41% WACC = 30%×6%×(1-40%)+ 5%×5.8%+ 65%×12% = 9.17% Corporate Financial Management 1 49 Component Cost of Equity Ways to estimate required return: DCF Method CAPM Approach (b of equity, not project!) Bond Yield + Risk Premium Method Equity for new projects may come from retained earnings or new issue. New issues incur flotation costs. In this case, the component cost of capital is higher than required return. Corporate Financial Management 1 50 Application of DCF Method QST stock is trading at $30 a share. QST will pay a $3 dividend at the end of the year and expects 5% annual growth. Costs of flotation amount to 10%. What is the required return and cost for new equity? r = D1/V + g = $3/$30 + 5% = 15% Vnet = V(1-F) = $30(1-10%) = $30×90% = $27 re = D1/[V(1-F)] + g = $3/[$30(1-10%)] + 5% = 16.1% Corporate Financial Management 1 51 Risk, Leverage, Beta and WACC Operating Leverage: influences rA, i.e. both rE and rD <=> an increase in operating risk increases bA and WACC. Financial Leverage: in efficient markets, an increase should increase bd, but leave bA and WACC unchanged. (1-TL)bA = L(1-T)bD + (1-L)bE (= portfolio) Assuming low risk of debt, it is possible to approximate bA = bE (1-L)/(1-TL) ... on Leverage more in Chapt. 15 Corporate Financial Management 1 52 Distinguish Risks Operating (Business) Risk (depends on structure of firm’s assets, not structure of financing) <= Operating Leverage Financial Risk (based on firm’s capital structure) <= Fin. Leverage Profit Shldr. Return Units Sold Corporate Financial Management 1 L=0 L = 50% Co. Return 53 Basics of Capital Budgeting Chapter 10 Generate ideas Estimate the expected future cash flows from the project. Assess the risk and determine a required return (cost of capital, hurdle rate, discount rate). Compute present value of cash flows; if project has a positive NPV, it creates value => should be accepted. Alt.: Find market price or compare with similar asset Corporate Financial Management 1 54 Types of Projects Capital budgeting projects include: New products and new businesses Maintenance projects Cost saving/ revenue enhancement Capacity expansion Projects required by regulation/ policy Independent/Exclusive Projects Conventional/Nonnormal Cash Flows Corporate Financial Management 1 55 Alternative Budgeting Measures Net Present Value Internal Rate of Return (=Expected Rtrn) Profitability Index Modified IRR (includes cost of capital) Payback ... ignores time value of money and cash flows beyond payback Discounted Payback Corporate Financial Management 1 56 Investment Criteria Problem Year 0 1 2 3 4 CF -70,000 30,000 30,000 30,000 20,000 DCF -70,000 27,273 24,793 22,539 13,660 PB = 2 + (10,000/30,000) = 2.3 years DPB = 2 + (17,934/22,539) = 2.8 years NPV = ΣDCF = $18.266 PI = ΣDCF[1-4] / |CF0| = 1.26 IRR = 22.24% MIRR = (129,230/70,000)1/4 - 1 = 16.56% Corporate Financial Management 1 57 Issues IRR brings same results as NPV with independent and conventional projects only Unequal lives of exclusive projects, e.g. replacement projects ... use common horizon calculation or Equivalent Annual Annuities (EAA = NPV[r(1+r)n/(1+r)n-1]) It is realistic to assume some kind of capital budget constraint ... use artificially high discount rate or capital rationing (e.g. ranking by Profitability Index) Corporate Financial Management 1 58 Estimating Cash Flows Chapter 11 Cash flow income (includes e.g. depreciation, ignores time value) Measure on incremental (marginal) basis Only future expenditures/revenues are relevant (avoid sunk costs) Include taxes; not financing costs (they are reflected in cost of capital) Corporate Financial Management 1 59 Types of Budgeting Cash Flows Net Initial Investment Outlay new assets purchase, old assets sale, increase in net working capital Net Operating Cash Flow Nonoperating Cash Flows overhauls, changes in working capital Net Salvage (Termination) Value Tax Adjustment (Capitalizing×Expensing) Corporate Financial Management 1 60 Est. Cash Flows Corporate Financial Management 1 Problems 11-1,2,3 61 Budgeting Cash Flows Problem 11-9 NPV= - 7,160 + 2,000/1.15 + 2,384/1.152 + 1,968/1.13 + 1,744/1.154 + 1,712/1.155 + 3,232/1.156 = $921.36 Note: Different remaining lives, working capital investment Corporate Financial Management 1 62 Analyzing Risk Market Risk Measured by b (see CAPM) impacts discount rate Stand-Alone Risk Break-even Analysis Sensitivity Analysis Scenario Analysis Monte Carlo Simulation Corporate Financial Management 1 63 Simple Example Project costs $100,000, expected sales 1,000 units, price $80/unit, cash op. exp. $40/unit, 5-year life, fully amortized, terminal value $10,000. Cap. cost 12%, tax rate 25%. What is its NPV? V = -I + [N×(P-U)×(1-T)+D×T][((1+r)n-1) /r(1+r)n] + [F×(1-T)]/(1+r)5 = -100,000 + [30,000+5,000]×3.60 + 7,500/1.76 = $ 30,423 Corporate Financial Management 1 64 Break-even Analysis (Sales) V = -I + [N×(P-U)×(1-T)+D×T]×3.60 + [F×(1T)]/(1+r)5 What N* would result in V = 0? -I + [N*×(P-U)×(1-T)+D×T]×3.60 + [F×(1T)]/(1+r)5 = 0 N* = [(100,000-7,500/1,76)/3.60-5,000]/30 = 720 pcs. i.e. the project breaks even at 720 units sold. Usually easier to use numerical iteration. Corporate Financial Management 1 65 Sensitivity Analysis (Price) V = -I + [N×(P-U)×(1-T)+D×T]×3.60 + [F×(1-T)]/(1+r)5 V/P = [N×(1-T)]×3.60 = 750×3.60 = $ 2,700 i.e. a price cut of $1 will result in a project value decrease by $ 2,700. Almost always easier to use numerical simulation. Corporate Financial Management 1 66 Scenario Analysis (Sales, U.Cost) Scenario Unit Sales Unit Cost NPV Worst Case 850 Most Likely 1,000 Best Case 1,100 45 40 38 2,711 30,423 47,185 Corporate Financial Management 1 67 Real Options Flexibility to adjust plans based on newly acquired information may increase NPV. Growth/development options Contraction/abandonment options Investment timing options Exchange options Valuation methods: Closed-form (analogy w/B-S)... rare Decision trees Monte Carlo ... further reading in Chapt. 25 Corporate Financial Management 1 68 Financial Planning Chapter 12 Pro-Forma Financial Statements Forecast the amount of external financing that will be required Evaluate the impact that changes in the operating plan have on the value of the firm Set appropriate targets for compensation plans Corporate Financial Management 1 69 Steps in Financial Forecasting Forecast sales Project the assets needed to support sales Project internally generated funds Project outside funds needed Decide how to raise funds See effects of plan on ratios and stock price Corporate Financial Management 1 70 Additional Funds Needed Problem Cash $360 Accts. pay. $1,200 Accruals 600 Accounts rec. 2,400 S.-Term Loan 800 Inventory 1,800 Total CL $2,600 Total CA $4,560 L-T debt 1,000 Net FA 3,000 Equity 3,960 Total assets $7,560 Tot. liab.&eq. $7,560 Sales = $12,000; M = NI/Sales = 6%; P = D/NI = 25%. Corporate Financial Management 1 71 Key Assumptions Operating at full capacity last year. Each type of asset grows proportionally with sales. Payables and accruals (i.e. current liabilities) grow proportionally with sales. Existing profit margin (6%) and payout (25%) will be maintained. Sales are expected to increase by $3 million. (%S = 25%) Corporate Financial Management 1 72 Graphical Illustration Assets Assets = 0.63 × Sales 9,450 7,560 0 Assets = (A/S)×Sales = 0.63($3,000) = $1,890 12,000 15,000 Sales A/S = $7,560/$12,000 = 0.63 = $9,450/$15,000 (i.e. Capital Intensity Ratio remains unchanged) Corporate Financial Management 1 73 Calculating AFN AFN = Required Increase in Assets Spontaneous Increase in Liabilities Increase in Retained Earnings AFN= A×(ΔS/S0)- L*×(ΔS/S0)- M×S1(1-P) = $7,560×25% - $1,800×25% 6%×$15,000×75% = $1,890-$450-$675 = $765,000 Corporate Financial Management 1 74 Projected Balance Sheet Cash $450 Accts. pay. $1,500 Accruals 750 Accounts rec. 3,000 S.-Term Loan 1,565 Inventory 2,250 Total CL $3,815 Total CA $5,700 L-T debt 1,000 Net FA 3,750 Equity 4,635 Total assets $9,450 Tot. liab.&eq. $9,450 DR0=3,600/7,560=48%; DR1=4,815/9,450=51% CR0=4,560/2,600=1.75; CR1=5,700/3,815=1.49 Corporate Financial Management 1 75 Corp. Valuation & Governance Chapter 13 Corporate Valuation Model (×Dividend Growth Model) Based on Free Cash Flow Estimation (instead of dividends) Can be used when dividends are not paid (e.g. startups, subunits of firm) 1. Estimate the Value of Operations (discount FCF = NOPAT – Required Net Operating Working Capital) 2. Add Value of Nonoperating Assets and Growth Options Corporate Financial Management 1 76 Value Based Management Value-based Management involves the systematic use of the corporate valuation model to evaluate a company‘s decisions. Value drivers: Growth rate of sales Operating profitability (NOPAT/Sales) Capital requirements (Operating Capital/Sales) WACC Company creates value when EROIC (i.e. NOPAT/Capital) > WACC Corporate Financial Management 1 77 Corporate Governance Shareholder wealth may be adversely influenced by management behavior (agency problem) Corporate governance is a set of laws, rules and procedures influencing managers in a way that maximizes the firm‘s intrinsic value. Monitoring Litigation Threat of removal Compensation plans Hostile takeovers (avoid managerial entrenchment) Corporate Financial Management 1 78