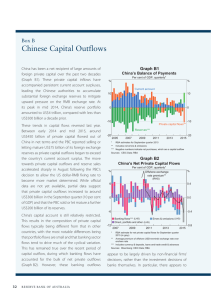

power point slides

advertisement

The China Challenge Daniel R. Joseph The China Learning Curve China: The Current View Surveys show 80+% of foreign companies earning a profit Amidst the success, also still much… • Failure: Shutting down and moving out • Struggling: Losses, management turmoil, etc. • Stuck in the mud: Now that we’re there, we can’t seem to grow/expand/make money. Companies transitioning business in China • • • • From sourcing to selling in China Selling through agents but now considering direct From exporting to making locally Considering M&A to accelerate growth The Bar is rising: China is part of the strategic plan • Not just global companies are involved • Used to be many companies were dragged into China by circumstances; now, more and more are actively plotting how to be there The Challenge of China Emerging markets are new: It used to be only global giants were active in emerging markets; even then, not often deeply involved. China is the first major emerging economy to become integral to supply chains and growth strategies. Economic Frontier: Managers have had no choice but to treat China like a frontier; to hack their way through the jungle. Many have made it through, rarely without getting stuck in the mud or thrown off track for a while. Many fell off a cliff or got lost in the quick sand. Take a step back in order to move forward: Some times it helps to step back and look at the bigger picture to best position oneself to move forward Critical Differences, Killer Mistakes: Learn the critical differences (culture, economic structure, business environment) in order to avoid the killer mistakes (management and strategy) Knowledge Map: Critical Differences and Killer Mistakes Local Conditions: History • Political System • Economic Structure • Business Environment • Culture Killer Mistakes • • • Strategy Partner/Key Person Management Tactical Execution: • Mkt dev • Sourcing • Mfg/Ops • Legal • HR • Banking • Other Planning • • Anticipate events Assess future course Chinese Culture Key Cultural Attributes Hierarchical Chinese culture has a strong sense of hierarchy. Culture is pervasive. It shows itself throughout the various levels and aspects of society, from the home to the office to the halls of government. Hierarchical Lack of social mobility: China is traditionally a very hierarchical society. Those on top stay on top. Those on the bottom stay on the bottom. Rank and position are important: Although social mobility is increasing in China as the country liberalizes, the culture retains a strong sense of hierarchy. Rank and position are very important. People expect a clearly defined hierarchy: Chinese people are accustomed to working with a clearly defined hierarchy and tend to desire such an arrangement if it isn't present. Leaders are different: In hierarchical societies people tend to see leaders as being elite, special, and above the common man. That distance between leader and subordinate can be an impediment to developing a good team environment. Hierarchical Chinese culture has an authoritarian approach to leadership. Chinese culture is changing. Like many things in China, its culture is changing, which is an extremely important aspect of understanding China. Leadership is transforming from authoritarian to more empowering. Changing approach to leadership in China Authoritarian Leadership Authoritarian leadership: The Chinese leadership style is very authoritarian. Leaders have all the power and prerogative. Subordinates are expected to simply submit. A positive work environment: One challenge is to ensure that your operation in China has a positive work environment in which issues such as discipline and criticism are handled in an acceptable fashion. A team-oriented environment: The greater challenge is ensuring that you are hiring the best candidates and getting the best out of everyone, as opposed to an environment in which all ideas and decisions have to emanate from one person who is primarily concerned with protecting his position. Rule of Law Weak adherence to the rule of law: A common characteristic of developing countries is weak adherence to the rule of law. China is no exception. Not just a government problem: Discussion of rule of law problems usually focuses on politicians, the government, and the courts. But the problem is deeper and broader than that. Corruption involves government officials. IP violators are often businesses and individuals. It is individuals who disregard driving rules. All of these issues reflect the same factor—weak adherence to the rule of law as a pervasive cultural attribute. Businesses are managed by rules: Processes, procedures, work instructions, and the like are rule-based concepts that are necessary to manage a business. Adherence to such “rules” can also be loose in a society with weak adherence to the rule of law. Beyond accounting for problems like IP violations and corruption, managers in China have to adapt to being in an environment where rule-based behavior in general is weaker. Static World View A static world: In less developed countries, life is the same for each generation. Nothing changes. Static expectations: When people don’t see change, they don’t develop the awareness that people can change the world or shape their lives. Static thinking: People who aren’t in the habit of trying to change or control events in their life don’t develop habits such as taking the initiative, planning, foresight, and trying to What if life never avoid future obstacles. changes generation Static vs. dynamic world view: This cultural mindset is evident not only in China but across after generation? all less developed societies. It is part of the cultural pattern that differentiates developed societies from less developed ones. It can be said that developed societies have a “dynamic world view” in which people can change the world and shape their future and less developed societies have a “static world view” in which change is not possible. Static vs. Dynamic Culture MAJOR CULTURAL ATTRIBUTES LESS DEVELOPED SOCIETY ATTRIBUTE DEVELOPED SOCIETY Static People don’t believe in change because nothing has ever changed. Fate and Future Dynamic Man can change the world and shape his own future/destiny. Hierarchy Social position is fixed. Those on top stay on top, those on the bottom stay on the bottom. Authoritarian Leaders can’t be challenged and as such aren’t accountable so they tend to be harsh, heavy-handed, authoritarian. Societal Structure Social mobility Anyone can get rich or be president; movement up and down social ladder. Empowering Leaders are accountable to those they lead. Balanced, participatory, more team-oriented approach. Weak (Might makes right) No limits on leaders means no rules. Rule of law doesn’t develop at any level of society. Rule of Law Leadership Strong (Fair competition) Leaders are bound by rules and so is everyone else. Static vs. Dynamic Culture (cont.) MAJOR CULTURAL ATTRIBUTES (cont.) LESS DEVELOPED SOCIETY ATTRIBUTE DEVELOPED SOCIETY Weak and formal Not very adept at working together without formal hierarchy, responsibilities, etc. Cooperation Strong and informal Accustomed to informal working relationships with loose and flexible responsibilities. Politics and loyalty Hierarchy and lack of accountability means the only way to get ahead is via politics and loyalty. Good enough is best Not trying to change future and so don’t develop the mindset (planning, foresight, analysis) necessary to do well or improve in these areas. Unimaginative If you can’t change the world you can’t see a new way of doing things. No imagination hence no creativity. Accountability & Advancement Merit Accountability and fair competition means people have to earn what they get. Be the best Search for improvement leads to methods for better quality and efficiency. Quality & Efficiency Creativity Imaginative Essence of shaping your destiny is finding a new way or idea, which leads to creativity. Management Principles Culture: Leadership, trust, accountability, initiative, etc. Planning: Process: Performance: Be as thorough as possible in addressing issues upfront. Make sure everyone knows how work will be done Measuring key indicators is your best way of creating visibility. Clarity: Visibility: Reinforcement: Discuss everything in detail. Leave nothing to chance. Know as much about what is happening as possible. Don’t expect immediate change. You have to reinforce your ideas. Back to Basics Own the system and culture Use the system to build the culture Actively work to develop the management system and culture you want. The right system will shape the culture. Keep it simple. Staff is likely less experienced. Shaping your corporate culture Tactical Techniques Tactical Principles Strategic Principles Credit Issues Key Topics Cross Border Transactions “You can’t get your money out of China”: This sentiment is frequently repeated relative to China and reflects the experience of foreign companies in China going back many years. Much has changed: In fact, much has changed in this regard such that the reputation is not nearly as deserved as in the past. Case #1: Repatriation of profits • The rules for repatriating profits from China are more complicated than in developed countries. • The rules include a stipulation that 10% of earnings per year be retained up to a certain amount (50% of your registered capital). • This means that you might have to limit dividends for repatriation to 90% of net income in some years. Cross Border Transactions Case #1: Repatriation of profits (continued) • For many companies this is not important as they use their profits to finance growth in China • In the past, even if a company met the requirements, it seemed the authorities would always find a reason to withhold approval or make it difficult to complete the transaction. • In recent years most foreign companies report that, if they meet the requirements, they don’t have difficulty obtaining approval to complete the transaction. This is likely to be at least partially due to China’s huge foreign reserves which means that China has enough FX to send some abroad. Cross Border Transactions Case #2: Selling product sourced in China • Many foreign companies that have been sourcing in China now find that they can sell the China-sourced products in China • Because some companies did not sell in China previously, they do not have an entity in China that is licensed to sell products, i.e., a WOFE or JV. • Companies in this situation would like to be able to drop ship from the supplier to the customer and either receive payment overseas or receive payment in China and then, after paying the supplier, bring the margin back home. THIS IS NOT ALLOWED! • If you are sourcing in China and want to start selling in China, you will have to either export the product and then re-export it back to China or you will have to establish an entity in China that can buy and sell products (WOFE or JV). Cross Border Transactions Case #3: Intercompany Loans • Due to foreign exchange restrictions and capital controls, intercompany loans between a foreign parent or sister company and a Chinese subsidiary are difficult to execute. • Such loans have to be approved by SAFE (State Administration of Foreign Exchange) and therefore must be structured in a very formal way, i.e., including interest rate, duration, etc. • Intercompany loans can also be difficult due to requirements relative to the form and amount of registered capital that must be injected into a company in China • It is important to ensure that a company is adequately capitalized upon formation in China and that liquidity needs are planned for thoroughly Bank Drafts (or “Notes” or “Acceptances”) Support domestic trade in China: Notes are issued by a bank on behalf of a client and in favor of a beneficiary, normally to support a trade transaction Assignable: Can be and often are assigned to another party (a supplier who receives one uses it to pay one of their suppliers) Maturities: Typical maturities are 90 to 180 days, though some are longer in duration. Credit Risk: From a credit point of view, it is the issuing Bank who is on the line to pay the beneficiary. As long as the issuing bank is one of China's major banks, there should be no problem in collecting Bank Drafts (or “Notes” or “Acceptances”) Discounting: Discounting market is not fully developed; it is important to know whether a particular note, based on its terms and the issuing bank, can be discounted and at what rate. Banking Regs spur use: Bank Notes have become particularly common in the last few years as Chinese banks and companies try to work their way around banking policies and regulations. • Chinese banks package the notes and sell them to wealth management clients which allows the banks to move the obligations off their books • Chinese regulators have warned banks relative to the notes and adjusted some rules, mainly to protect bank balance sheets • So far issuance of bank notes does not seem to have waned very much. Offshore RMB Market Gradual approach: Similar to most aspects of its liberalization program, China is taking a gradual approach to the internationalization of the RMB. July, 2010 really started: There have been many small steps. Basically the program really took off in in July 2010 and has been gradually broadening since then. Hong Kong is the center: The offshore market was initially located only in HK. Singapore, Taiwan, and London are becoming trading centers as well. Volume in HK remains the highest by far. Offshore RMB Market MAJOR CHANGES Trade: Trade in goods and services in and out of China can be settled in RMB. Trade finance methods are available in both onshore and offshore markets. Accounts: RMB accounts can be opened outside of China, primarily in Hong Kong (HK) but also in other jurisdictions. Foreign companies do not need to have a legal entity established in China (or HK) in order to open an offshore RMB account. Capital Markets: A capital market (bonds, equities, etc.), referred to as the “Dim Sum” market, has developed to permit RMB held offshore to be invested. Channels exist to raise CNH in HK and use it in the mainland. Hedging products are also available and under development. Exchange rates: CNH is freely traded in HK, although the exchange rate has so far mostly tracked that of CNY which is controlled by the Chinese government. Offshore RMB Market IMPACT ON FOREIGN COMPANIES Sourcing: Companies sourcing from China often receive discounts for paying in RMB because suppliers benefit from lower administrative and financing costs and less exchange rate risk. Exporting: Exporters in China might find that accepting RMB is either an advantage or a requirement for obtaining business. Hedging FX Risk: Due to the lack of restrictions in HK, as opposed to China, hedging CNH will be easier than CNY. Credit: For large corporations, issuing bonds in HK is a welcome addition to the existing, limited credit options in China. For more information… www.chinalearningcurve.com