Document 10790181

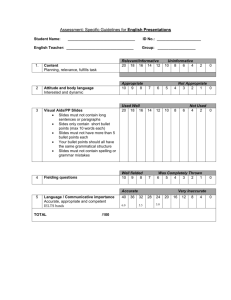

advertisement