ch13

advertisement

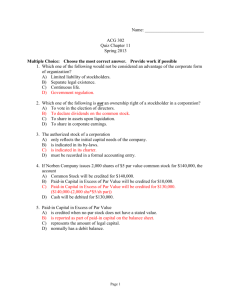

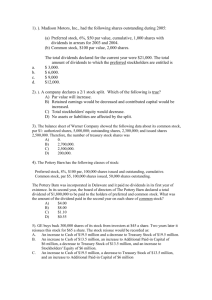

StIce | StIce |Skousen Equity Financing Chapter 13 Intermediate Accounting 16E Prepared by: Sarita Sheth | Santa Monica College COPYRIGHT © 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. Learning Objectives 1. Identify the rights associated with ownership of common and referred stock. 2. Record the issuance of stock for cash, on a subscription basis, and in exchange for non-cash assets or for services. 3. Use both the cost and par value methods to account for stock repurchases. 4. Account for the issuance of stock rights and warrants. Learning Objectives 5. Compute the compensation expense associated with the granting of employee stock options. 6. Determine which equity-related items should be reported in the balance sheet as liabilities. 7. Distinguish between stock conversions that require a reduction in retained earnings and those that do not. 8. List the factors that impact the Retained Earnings balance. Learning Objectives 9. Properly record cash dividends, property dividends, and stock splits. 10. Explain the background of unrealized gains and losses recorded as part of accumulated other comprehensive income, and list the major types of equity reserves found in foreign balance sheets. 11. Prepare a statement of changes in stockholders’ equity. Time Line of Issues: Owner’s Equity ISSUE preferred or common stock PAY cash dividends INCREASE shares outstanding through stock dividends and stock splits GRANT options to officers and employees Time Line of Issues: Owners’ Equity REPURCHASE shares of stock CONVERT other securities into shares of common stock REPORT performance to current and potential investors Nature and Classifications of Paid-In Capital • A corporation is a legal artificial entity separate from its owners. • Individuals contribute capital for which the corporation issues certificates making them stockholders. • The board of directors are elected by the stockholders and they are in charge of overseeing the long run plan for the organization. Common Stock • • Common Stock (CS)- when a corporation is formed, the single class of stock typically issued. Owners of common stock have these basic rights: 1. To vote in the election of directors and in the determination of certain corporate policies. 2. Preemptive right- to maintain one’s proportional inerest in the corporation through purchase of additional common stock if and when it is issued. Par or Stated Value • Par Value- historically was equal to the market value of the shares at issuance. • Today, most stocks have a nominal par value or no par value. • Stated value- stocks with no-par that for financial reporting purposes acts like a par value. Preferred Stock • Rights given up by preferred stockholders (PS): 1. Voting- in most PS are not allowed to vote for the board of directors. 2. Sharing in success- Cash dividends received by PS are usually fixed in amount. If the firm does extremely well, their dividend amount is not adjusted. Preferred Stock • Rights enjoyed by preferred stockholders: 1. Cash dividend preference- PS are entitled to receive their full cash dividend before any cash dividends are paid to CS. 2. Liquidation preference- In the even of bankruptcy, PS are entitled to have their investments repaid before CS. Types of Preferred Stock Has the right to receive Cumulative accumulated dividends before any dividends may be paid to common stockholders. Dividends on cumulative preferred stock that are passed are referred to as dividends in arrears. NonCumulative Has no right to “passed” dividends. Participating Has claim to a portion of common dividends after receiving preferred dividends. Types of Preferred Stock Convertible Callable Redeemable Permits the holder to exchange preferred stock for common stock. Permits the issuing company to redeem the preferred stock. Permits the holder to redeem The stock—usually with some restrictions. Issuance of Capital Stock • The issuance of stock for cash is recorded by a debit to Cash and a credit to Capital Stock for the par value. • When the amount of cash received for the stock is more than the par value, the excess is recorded as a credit to additional paid-in capital or paid in capital in excess of par. Capital Stock Issued for Cash Goode Corporation issued 4,000 shares of $1 par common stock on April 1, 2006, for $45,000 cash. Apr. 1 Cash 45,000 Common Stock Paid-In Capital in Excess of Par 4,000 41,000 Capital Stock Issued for Cash Goode Corporation issued 4,000 shares of no par common stock without a stated value on April 1, 2006, for $45,000 cash. Apr. 1 Cash Common Stock 45,000 45,000 Capital Stock sold on Subscription On November 1, 2006, a firm received subscriptions for 5,000 shares of $1 par common at $12.50 per share with 50% down, balance due in 60 days Nov. 1 CS Subscription Receivable 62,500 Common Stock Subscribed 5,000 Paid-In Capital in Excess of Par 57,500 Nov. 1 Cash 31,250 Common Stock Subscription Receivable 31,250 Capital Stock Sold on Subscription On December 9, received balance due on one-half of subscribers and issued stock to fully paid subscribers, 2,500 shares. Dec. 9 Cash Common Stock Subscription Receivable Dec. 9 Common Stock Subscribed Common Stock 15,625 15,625 2,500 2,500 Capital Stock Issued for Consideration Other than Cash AC Company issues 200 shares of $0.50 par value common stock in return for land. The company’s stock is currently selling for $50 per share. Dec. 5 Land 10,000 Common Stock Paid-In Capital in Excess of Par 100 9,900 Capital Stock Issued for Consideration Other than Cash Assume that the land has a readily determinable market price of $12,000, but AC Company’s common stock has no established fair market value. Dec. 5 Land 12,000 Common Stock 100 Paid-In Capital in Excess of Par 11,900 Reasons Companies Repurchase Stock 1. Provide shares for incentive compensation and employee savings plans. 2. Obtain shares needed to satisfy requests by holders of convertible securities. 3. Reduce the amount of equity relative to the amount of debt. 4. Invest excess cash temporarily. Reasons Companies Repurchase Stock (cont.) 5. Remove some shares from the open market in order to protect against a hostile takeover. 6. Improve per-share earnings by reducing the number of shares outstanding and returning inefficiently used assets to shareholders. 7. Display confidence that the stock is currently undervalued by the market. Treasury Stock • • • • Stock issued by a corporation but subsequently reacquired by the corporation and held for possible future reissuance or retirement. Reported as a contra-equity account, not as an asset. Does not create a gain or loss on reacquisition, reissuance, or retirement. May decrease Retained Earnings, but cannot increase it. Treasury Stock Issued 10,000, $1 par value shares at $15 per share Cost Method Cash Common Stock. Paid-In Capital in Excess of Par 150,000 10,000 140,000 Par Value Method Cash Common Stock. Paid-In Capital in Excess of Par 150,000 10,000 140,000 Treasury Stock Required 1,000 shares at $40 per share. Cost Method Treasury Stock Cash 40,000 40,000 Par Value Method Treasury Stock Paid-In Capital in Excess of Par Retained Earnings Cash 1,000 14,000 25,000 40,000 Treasury Stock Retired remaining 300 shares of treasury stock. Cost Method Common Stock 300 Paid-in Capital in Excess of Par 4,200 Retained Earnings 7,500 Treasury Stock 12,000 Par Value Method Common Stock Treasury Stock 300 300 Stop and Think After looking at this comparison on page 791 in your book, why do you think so few companies use the pare value method? Stock Rights, Warrants, and Options • Stock rights- Issued to existing shareholders to permit them to maintain their proportionate ownership interests when new shares are to be issued. • Stock warrants- Sold by the corporation for cash, generally in conjunction with the issuance of another security. • Stock options- Granted to officers or employees, usually as part of a compensation plan. Stock Warrants Stewart Co. sells 1,000 shares of $50 par preferred stock for $58 per share. Stewart Co. gives the purchaser detachable warrants enabling the holders to subscribe to 1,000 shares of $2 par common stock for $25 per share. Immediately following the issuance of the stock, the warrants are selling for $3, and the fair market value of a preferred share without the warrant attached is $57. Stock Warrants Value Total assigned to = issue warrants price x Market value of warrants Market Market value of + value of security warrants without warrants Value $3 = $2,900 assigned = $58,000 x $57 + $3 to warrants Stock Warrants The entry on Stewart’s book to record the sale of the preferred stock with detachable warrants is: Cash 58,000 Preferred Stock, $50 par Paid-In Capital in Excess of Par--Preferred Stock Common Stock Warrants 50,000 5,100 2,900 Stock Warrants If the warrants were exercised: Common Stock Warrants 2,900 Cash 25,000 CS, $2 par Paid-In Capital Excess of Par-CS 2,900 25,900 If the warrants were allowed to expire: Common Stock Warrants 2,900 Paid-In Capital Excess of Par-CS 2,900 Stock Based Compensation No Yes All employees eligible? No Shares offered equally? Compensatory Plan No Grant and Measurement dates same? Reasonable exercise period? No Yes Exercise Prices » Market Price? Non-compensatory Plan Yes No Number of shares and Exercise Price known? No Yes Record shares issued when stock is purchased. Determine compensation expense; amortize over period employee is to provide service. Determine actual expense; amortize over remaining period employee is to provide service. Record shares issued when stock is purchased. Adjust for Unearned Compensation, if any. Estimate compensation expense; amortize over period employee is to provide service. 3 3 Stock Based Compensation The company estimates a grant date value of $10 for each of the employee stock options. The total fair value of the options granted is $100,000. Compensation cost is allocated over three years from January 1, 2006 (the grant date) to January 1, 2009 (the vesting date). Dec 31, 2006 Compensation Expense 33,333 Paid-In Capital from Stock Options 33,333 $100,000 ÷ 3 Similar entries would be made in 2007 and 2008. Stock Based Compensation On 12/31, 2009, all 10,000 of the options are exercised to purchase Neff’s no-par common stock. Cash 500,000 Paid-In Capital from Stock Options 100,000 CS, no par 600,000 On 12/31, 2009, if the options had been allowed to expired: Paid-In Capital from Stock Options 600,000 Pain-In Capital from Expired Options 600,000 Stop and Think Assume that Neff’s managers are greedy, unscrupulous scoundrels. Which one of the following might Neff’s performance based stock options plan cause Neff’s management (the ones who are receiving the stock options) to do? Stock Conversions Case 1 On December 31, 2008, 1,000 shares of preferred stock (par $50) are exchanged for 4,000 shares of common stock (par $1) Dec 31, 2008 Preferred Stock, $50 par 50,000 Paid-In Capital in Excess of ParPreferred CS, $1 10,000 CS, $1 par Paid-In Capital in Excess of Par-Common 4,000 56,000 Stock Conversions Case 2 On December 31, 2008, 1,000 shares of preferred stock (par $50) are exchanged for 4,000 shares of common stock (par $20) Dec 31, 2008 Preferred Stock, $50 par Paid-In Capital in Excess of ParPreferred Retained Earnings CS, $1 par 50,000 10,000 20,000 4,000 Factors Affecting Retained Earnings •Error corrections •Some changes in accounting principle •Net income •Quasi-reorganizations Retained Earnings Increases Factors Affecting Retained Earnings Decreases •Error corrections •Prior period adjustments •Treasury stock •Net loss •Some changes in accounting principles •Cash and stock Retained dividends Earnings Accounting for Dividends • Declaration date- The date the corporation’s board of directors formally declares a dividend will be paid. • Date of record- The date on which stockholders of record are identified as those who will receive a dividend. • Date of payment- The date when the dividend is actually distributed to stockholders. Cash Dividends ABC Corporation declares a $100,000 dividend; the following journal entries should be made: Declaration Date Dividends (Retained Earnings) 100,000 Dividends Payable 100,000 Payment Date Dividends Payable Cash 100,000 100,000 Property Dividends • Property dividends- a distribution to stockholders that is payable in some asset other than cash. Bigler Corporation owns 100,000 shares in Tri-State Oil Co, carrying value $2,700,000, current market value $3,000,000, or $30 per share. There are 1,000,000 shares of Bigler stock outstanding. A dividend of 1/10 of a share of Tri-State Oil Co. is declared for each share of Bigler stock outstanding. Property Dividends Declaration of Dividend Dividend (or Retained Earnings) 3,000,000 Property Dividends Payable 2,700,000 Gain on Distribution of Property Dividend 300,000 Payment of Dividend Property Dividends Payable 2,700,000 Investment in Tri-State Oil Co. 2,700,000 Stock Dividends • Small – Less than 20-25% of the outstanding shares. – Debit Retained Earnings for the MARKET value of the shares. • Large – Greater than 20-25% of the shares outstanding. – Debit Retained Earnings for the PAR value of the shares. Stock Dividend: Example 1 Assume the following about Gean, Inc.: •Common stock ($2 par, 10,000 shares outstanding) $20,000 •Additional paid-in capital $24,200 •Retained earnings •Stock dividend declared shares $12,500 1,500 Because 1,500 shares represent 15% of the Is this a large orofa small stock dividend?? •Market price outstanding stock, itstock is a small stock dividend. Stock Dividend: Example 1 Declaration Date Retained Earnings 15,000 Stock Dividends Distributable 3,000 Paid-In Capital in Excess of Par 12,000 Issuance Date Stock Dividends Distributable Common Stock 3,000 3,000 Stock Dividend: Example 2 Assume the following about Gimili, Inc.: •Common stock ($5 par, 20,000 shares outstanding) $100,000 •Additional paid-in capital $100,000 •Retained earnings •Stock dividend declared shares $52,000 10,000 50% =ofLarge •Market price stockDividend Stock Dividend: Example 2 Declaration Date Retained Earnings 50,000 Stock Dividends Distributable 50,000 Issuance Date Stock Dividends Distributable 50,000 Common Stock 50,000 Stop and Think You are hired as an accounting consultant by a company that is considering issuing either a 20% stock dividend or a 25% stock dividend. From an accounting standpoint, which would you recommend? Liquidating Dividends • Liquidating dividend- a return to stockholders of a portion of contributed capital. Stubbs Corp declared and paid a cash dividend ($10 cash dividend) totaling $100,000 and a partial liquidating dividend for $50,000. Declaration Date Dividends (Retained Earnings) 100,000 Paid in Capital in Excess of Par 50,000 Dividends Payable 150,000 Payment Date Dividends Payable 150,000 Cash 150,000 Unrealized Gains and Losses for Available-for-Sale Securities KendellAvailable-for-Sale had net income of $1,350. were Other securities items that impacted net are: not purchased withincome the immediate Unrealized gain (loss) on availableintention to resell, but are not goingsecurities to be held for the long-term. for-sale $100 (Increase) Decrease in minimum pension liability (60 ) Unrealized gain (loss) on derivative instruments (20 ) Foreign currency translation adjustment, increase (decrease) in stockholders’ equity 300 Unrealized Gains and Losses for Available-for-Sale Securities Net income $1,350 Other comprehensive income: Unrealized gain on available-forsale securities 60 Increase in minimum pension liability (36 ) Unrealized loss on derivative instruments (12 ) Foreign current transaction adjustments 180 Comprehensive income $1,542 Disclosures Related to the Equity Section • Capital stock may be: – Authorized but unissued. – Subscribed for and held for issuance pending receipt of cash for the full amount of the subscription price. – Outstanding in the hands of stockholders. – Reacquired and held by the corporation for subsequent reissuance. – Canceled by appropriate corporate action.