No-Arbitrage Testing with Single Factor

advertisement

No-Arbitrage Testing with Single Factor

Presented by Meg Cheng

Motivation

• No-arbitrage condition is one of the most popular

assumptions in the area of asset pricing.

• If changes in the price of the asset are driven by some

underlying factors, the excess return should be consist of all

the prices of the associated underlying factors risks.

• To be free from any model specification, nonparametric

estimation method is adopted to recover the embedded

information directly from the data.

Bond Pricing Theory

Suppose the economy can be driven by a state variable X,

defined in a stochastic differential equation:

dX (t ) x ( x)dt x ( x)dW

Consider the dynamics of an asset price at current time t

of a claim to terminal payoff P(T) at some future date T

as follows:

dP(t ) ( x)dt ( x)dW

By Ito’s lemma,

1

( x) Pt Px x Pxx x2

2

( x) Px x

Now, consider another asset price w/ terminal payoff as P*(T),

within the same framework, we can write this dynamic process

as

dP* * ( X )dt * ( X )dW

1 * 2

*

*

*

() Pt Px x Pxx x

2

* () Px* x

If we want to make a portfolio Z to hedge against the factor

risk with these two assets, then portfolio Z can be represented

as follows:

Z P * P *

dZ dP *dP *

[ * * ]dt [ * * ]dW

where and * are portfolio weights on each asset

Let

*

*

,

*

*

Then portfolio Z becomes a risk free asset.

Hence, the drift term of dZ should be equal to risk-free rate r.

i.e.

* *

r

*

r * r

( x)

*

Notice that if the underlying market is arbitrage free, this

relationship holds for any arbitrary asset. This addresses

our null hypothesis.

i.e.

1(x)= 2(x)= …=P(x)

Hypothesis testing

We choose short rate as the factor, and use the three-month

yield to maturity as the proxy for the short rate.

Suppose we have P different assets to be estimated, and each one

of them follows:

dPi

Xdt ai ( x)dt bi ( x)dW (t ) i 1, 2,..., P

Pi

ai (.) and bi (.) are local constants.

Given each x, we can use gaussian process to describe the above

diffusion process.

Under the alternative hypothesis:

L1 (a( x), b( x)) log( f i [ai ( x), bi ( x)]) K h ( X x)

n

i

(a, b) arg max L1 (a( x), b( x))

a ,b

where

a( x) ai ( x) i 1,2,..., P

b( x) {bi ( x) i 1,2,..., P}

f i () is Gaussian density function

K h () is kernel function

Under the null hypothesis:

If no-arbitrage restriction holds, the expression below is true

for any arbitrary asset:

r * r

... ( x)

*

So that given each x, the risk premium of each asset should be

proportional to its diffusion term with a constant term across all

assets.

dPi

Xdt [c( x)bi( x)]dt bi( x)dW , i 1, 2,..., P

Pi

Hence, the likelihood function under the null:

L0 (b( x), c( x)) F (b( x), c( x)) K h ( X x)

n

(b, c) arg max L0 (b( x), c( x))

c(x) is a constant across all the assets

F(.) is multivariate gaussian density function

b( x) {bi( x), i 1,2,..., P}

Data

• We use weekly values for the annualized zero-coupon yields

with six different maturities (0.5, 1, 2, 3, 5, 10 years).

• Generally speaking, almost each bond/security comes w/

coupons or dividends, except treasury bills.

• Since there is no generally accepted “best” practice for extracting

zero coupon prices from coupon bonds, we construct our data by

four methods: 1.

Smoothed Fama-Bliss

2.

Unsmoothed Fama-Bliss

3.

McCulloch-Kwon

4.

Nelson-Siegel

•To test our null hypothesis, we propose to use empirical

Likelihood Ratio (LR) test, since we’ve already constructed

likelihood both under the alternative and the null.

•We interpolate all the estimates associated with the chosen grids

to compute the likelihood at each observation.

•To get LR test statistics distribution under the null hypothesis,

We adopt stationary bootstrap method proposed by Romano

(1994).

The procedures are described as follows:

1. We use first order Euler approximation to fit the model

under the null, i.e.

dPi

[ X cˆ( X )bˆi( X )] bˆi( X )ˆti i 1,2,..., P

Pi

Since we don’t literally have maximum likelihood estimated

on every data point, there still exists some dependence in time

in the residuals extracted from the above.

2. Have all the residuals estimated from each asset into a matrix

by columns and denote it by Y (NxP).

3. Let i be i.i.d. random variable generated from Uniform

Distribution U(N).

4. Generate Bi,m={Yi, Yi+1, …,Yi+m-1}’ , the block consisting of

m rows starting from Yi, and the r.v. m is drawn from geometric

distribution (1-q)m-1q for m=1,2,…N. where qR(0,1).

5. Repeat step 3 and 4, stack each block matrix end to end,

till the number of columns and rows of the newly generated Y*

are equal to Y.

6. Put Y* back to the Euler euqation to get the new LHS.

7. Implement local MLE both under the null and the alternative.

8. Replicate step3~step7 for sufficiently enough time (around

1,000), then the statistics distribution will then be constructed.

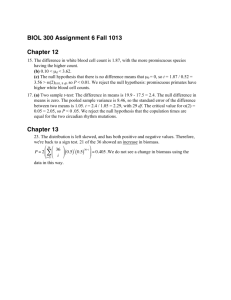

Nelson-Siegel

3

3

2

2

1

1

lamda

lamda

Unsmooth Fama-Bliss

0

-1

-2

-1

0

5

10

15

short rate %

Mculloch-Kwon

-2

20

6

0

5

10

15

short rate %

Smooth Fama-Bliss

20

4

4

2

2

lamda

lamda

0

0

0

-2

-2

-4

-4

0

5

10

15

short rate %

20

0

5

10

15

short rate %

20

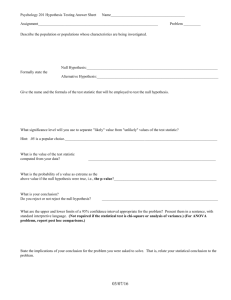

0.8

autocovariance

autocovariance

1

0.5

0

-0.5

0

100

200

lags

300

0.4

0.2

0

-0.2

400

0

100

200

lags

300

400

0

100

200

lags

300

400

0.8

autocovariance

1.5

autocovariance

0.6

1

0.5

0

-0.5

0.6

0.4

0.2

0

-0.2

0

100

200

lags

300

400

Nelson-Siegel

10

50

8

40

frequency

frequency

Unsmooth Fama-Bliss

6

4

2

0

30

20

10

0

500

statistics

Mculloch-Kwon

0

1000

60

0

500

statistics

Smooth Fama-Bliss

1000

50

40

frequency

frequency

40

20

30

20

10

0

0

200

400

600

statistics

800

0

0

500

1000

statistics

1500

Unsmooth Fama-Bliss

Nelson-Siegel

L(1)

-8345

-8162

L(0)

-8474

-8318

T*=L(1)-L(0)

129

156

No. of replications

100

500

Prob.>T*

67%

73%

Mculloch-Kwon

Smooth Fama-Bliss

L(1)

-6035

-8138

L(0)

-6289

-8228

T*=L(1)-L(0)

254

90

No. of replications

600

500

Prob.>T*

33%

69%

Conclusion:

So far, based on our result, the hypothesis of

no-arbitrage condition tested with six different

yields to maturities is not rejected.

Put in another way, the no-arbitrage restriction

may still holds in U.S. Treasury Bill and Bond market.