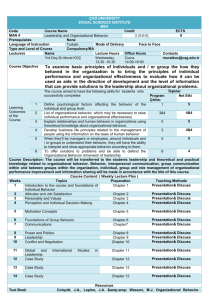

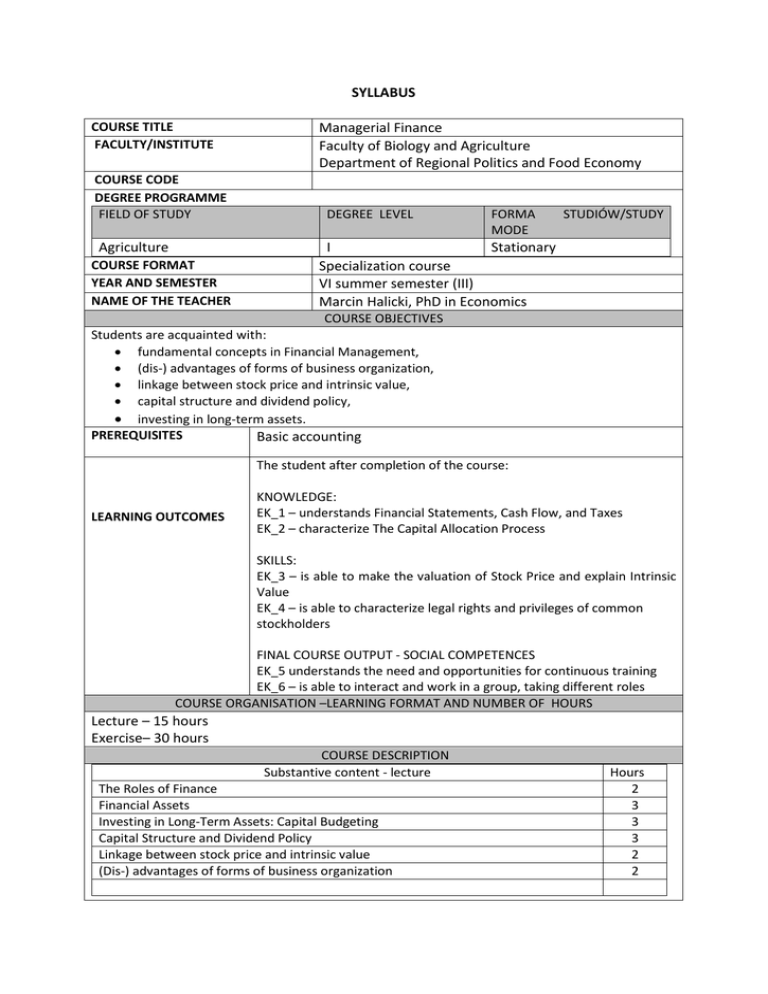

SYLLABUS COURSE TITLE Managerial Finance Faculty/Institute

advertisement

SYLLABUS COURSE TITLE FACULTY/INSTITUTE COURSE CODE DEGREE PROGRAMME FIELD OF STUDY Agriculture COURSE FORMAT YEAR AND SEMESTER NAME OF THE TEACHER Managerial Finance Faculty of Biology and Agriculture Department of Regional Politics and Food Economy DEGREE LEVEL FORMA MODE STUDIÓW/STUDY I Stationary Specialization course VI summer semester (III) Marcin Halicki, PhD in Economics COURSE OBJECTIVES Students are acquainted with: fundamental concepts in Financial Management, (dis-) advantages of forms of business organization, linkage between stock price and intrinsic value, capital structure and dividend policy, investing in long-term assets. PREREQUISITES Basic accounting The student after completion of the course: LEARNING OUTCOMES KNOWLEDGE: EK_1 – understands Financial Statements, Cash Flow, and Taxes EK_2 – characterize The Capital Allocation Process SKILLS: EK_3 – is able to make the valuation of Stock Price and explain Intrinsic Value EK_4 – is able to characterize legal rights and privileges of common stockholders FINAL COURSE OUTPUT - SOCIAL COMPETENCES EK_5 understands the need and opportunities for continuous training EK_6 – is able to interact and work in a group, taking different roles COURSE ORGANISATION –LEARNING FORMAT AND NUMBER OF HOURS Lecture – 15 hours Exercise– 30 hours COURSE DESCRIPTION Substantive content - lecture The Roles of Finance Financial Assets Investing in Long-Term Assets: Capital Budgeting Capital Structure and Dividend Policy Linkage between stock price and intrinsic value (Dis-) advantages of forms of business organization Hours 2 3 3 3 2 2 Total hours Substantive kontent - exercise Fundamental Concepts in Financial Management Financial Assets Investing in Long-Term Assets Capital Budgeting Capital Structure and Dividend Policy Working Capital Distributions to Shareholders: Dividends and Share Repurchases The Cost of Capital Cash Flow Estimation and Risk Analysis Derivatives and Risk Management Total hours 15 3 3 2 4 3 3 5 2 2 3 30 lecture and multimedia presentation; discussion; auditorium exercise; REQUIREMENTS AND Final degree is based on test with open questions (The course ASSESSMENTS is to pass with a note) GRADING SYSTEM Learning Grading system outcomes EK_1, test with open questions EK_2 EK_3 exercise EK_4 test with open questions, exercise EK_5 long observation EK_6 long observation TOTAL STUDENT WORKLOAD Activity Hours NEEDED TO ACHIEVE Lecture 15 EXPECTED LEARNING Exercise 30 OUTCOMES EXPRESSED Prepare to exercise 15 IN TIME AND ECTS CREDIT Participation in the consultation 10 POINTS Prepare to test 30 Participation in the test 2 total hours / ECTS amount 102/4 total hours / ECTS in the framing of 57/2 lessons with demanding attendance of teachers and students total hours / ECTS in the framing of lessons with practical character LANGUAGE OF INSTRUCTION English INTERNSHIP PRIMARY OR REQUIRED BOOKS/READINGS: MATERIALS METHODS OF INSTRUCTION Brigham, E.F.; Houston, J.F., Fundamentals of Financial Management, South Western Cengage Learning, 12th edition (13 th available), 2009 Brealey R.A., Myers S.C., Allen F., Principles of corporate finance, Maidenhead : McGraw-Hill Education, 2014 Malden M., Financial management, Financial Management Association International - Wiley-Blackwell, 2000 SUPPLEMENTAL OR OPTIONAL BOOKS/READINGS: Berk J., DeMarzo P., Corporate finance, Boston, Pearson, 2014