Chapters 15-19

advertisement

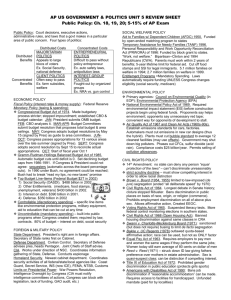

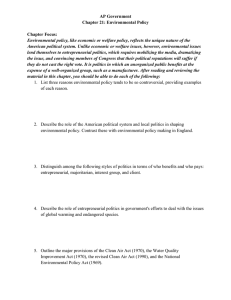

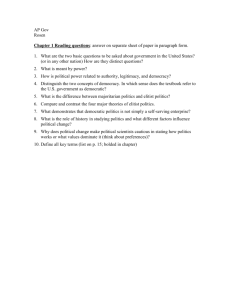

Policy Making, Budget, Social Welfare, Civil Liberties, and Civil Rights Chapter 15 - 19 The Policy Making Process: Setting the Agenda The Legitimate Scope of Government Action Grows with time and tradition Less discussion about whether something is government’s responsibility Crisis leads to increased government action Increased public support Groups Influence of a small number of a group on government policy Change in society can be reflected in change in groups Institutions Greater effects on policies from courts, bureaucracy, Senate Media Cause and effect of placing items before the Senate Making a Decision Costs and Benefits of Proposed Policy (cost –benefit analysis) Perception of costs (any burden that a group must bear) and benefits (any satisfaction that a group will enjoy) Legitimacy of benefits Changing beneficiaries change view of deserving/undeserving Making a Decision, cont. Are benefits wide spread throughout society? Widely–distributed costs: income tax, Social Security tax, farm subsidies Narrowly-concentrated costs: factory air emission standards, higher capital gains taxes Widely-distributed benefits: Social Security benefits, national security, clean air, federal highways Narrowly-concentrated benefits: farm subsidies, tariffs, exemption from antitrust legislation Majoritarian Politics Widely Distributed Benefits, Widely Distributed Costs Majoritarian issues make appeals to large blocs of voters Controversial due to costs not necessarily to ideology Not dominated by interest groups as most people benefit Can easily become ‘sacred cow’ (Social Security) Interest Group Politics Narrowly Concentrated Benefits, Narrowly Concentrated Costs Tend to be fought out by organized interest groups the 2 sides ‘pitted’ against each other Client Politics Concentrated Benefits, Distributed Costs Recipient group has motivation to organize “Pork barrel” politics: projects of special interest attached to other legislation “Logrolling” attachments of many pork barrel projects together Cost payers are often unaware of paying for benefit of a few Entrepreneurial Politics Distributed Benefits, Concentrated Costs Safety/environmental policies Policy entrepreneurs: pull together legislative majority on small interest issues Small group of payees often resent position The Case of Business Rules imposed by government to achieve a desired goal Relationship between wealth and power Can be used to buy influence Politicians and business leaders have similar class and thus similar beliefs Politicians need to listen to corporations to induce them to keep investments and thus the economy growing Manipulation of agencies (Reagan, Papa Bush understaffing FTC and Antitrust Division) Explosion of corporate mergers-business claims that with strong international competition, must consolidate in order to compete in the marketplace The Case of Business, cont. Legislation can be a threat to business Policies in exchange for votes Majoritarian Politics Anti-trust legislation Interest-Group Politics Conflicts and demands can extend pass legislation Client Politics Agencies created to meet needs of small group Price-supports created The Case of Business, cont. Entrepreneurial Politics Dramatization of an issue create public outcry Clever use of media can heal spread the issue Effectiveness of policies Impost specific standards with strict timetables Regulate many different – do not confront a single, unified opponent “public interest” lobby Sympathetic allies in the media Groups can use federal courts for pressure on regulatory agencies The Case of Business, cont. Economic Regulation Government control of behavior of business in marketplace Interstate Commerce Act, 1887 Sherman Antitrust Act, 1890 Federal Trade Commission, 1914 Stock Market Regulations Social Regulation Government controls to correct ill side effects of capitalism Worker safety regulations, environmental, child labor laws Perceptions, Beliefs, Interests, and Values Arguments in favor of regulation Prevents unhealthy monopolies and oligopolies as existed in the Industrial Revolution Protects consumers from unsafe and unhealthy products Protects consumers from unsafe practices Protects people from unsafe working conditions Protects those who lack strong voice in government Arguments against regulation Not needed-market forces will compel businesses to work for the benefit of consumers Regulation is inefficient Regulation kills jobs Regulation increases prices Regulations have become increasingly unreasonable Deregulation: Cutting back on Government Regulation Airlines Civil Aeronautics Board controlled rates and fares before 1978 Congressional legislation in 1978 led to phasing out of CAB and allowed airlines to set rates/fares Some airlines bankrupt Some smaller cities lost service (unprofitable) Some concern that corners cut (safety/service) More people traveling than ever Deregulation: Cutting back on Government Regulation Banking and Savings Loans Regulation had controlled interest rates, types of financial activities that banks (S&Ls) could engage in FDIC and FSLIC government insurance programs Since 1980s have deregulated; several collapses that government had to cover costs of (FDIC, etc.) Deregulation: Cutting back on Government Regulation Arguments in Favor of Deregulation Lower prices for consumers due to increased competition Produces more efficiency Arguments against Deregulation Endangers public safety and health (FDA, airlines, etc.) Cutthroat competition leads to more bankruptcy States step up with regulation which makes business more complicated due to varying regulations Economic Policy Economic Health Voting patterns and economic conditions are tied together at national level What politicians try to do Temptation for short-term economic goals in order to gain votes Government uses money to influence elections Government doesn’t always know how to produce economic outcomes and goals Economic choices can reflect partisan ideology Democrats seem to worry more about unemployment Republicans seem to worry more about inflation Economic Theories and Political Needs Monetarism: inflation is when too much money chases too few goods; recession occurs when not enough money – government often tries policies that make matter worse. Government needs to have a steady increase in the money supply (Friedman) Keynesianism: economy based on spending – government needs to artificially stimulate economy (when necessary); Great Depression Planning: government should plan some part of national economy (ie. controlling prices and wages –Galbraith) Economic Theories and Political Needs, cont. Supply-side Tax Cuts: less government interference, more incentive for money to work down to workers; companies cut costs (Laffer, Roberts) Ideology and Theory All theories have political consequences Conservatives tend toward monetarism over supply side Liberals tend toward Keynesian Reaganomics: monetarism, supply-side tax cuts, domestic budget cutting The Machinery of Economic Policy Making President faces organizations in economic matters Council of Economic Advisors (CEA) Part of troika Established 1946 Impartial group of experts responsible for forecasting economic trends Advocate of professional economist Office of Management and Budget (OMB) Part of troika Established 1921 Made part of the executive office, 1939 Renamed in 1970; originally Bureau of the Budget Prepare estimates of what will be spent by Federal Agencies Legislative proposals of agencies are in line with President’s wishes The Machinery of Economic Policy Making, cont. Fiscal Policies – taxing and spending considerations Conducted by Congress and the President Overseen by Treasury Department Budget Matters The Machinery of Economic Policy Making, cont. Monetary Policies – regulation of money supply Federal Reserve Board regulates (1913) Buying and selling government securities Regulating money supply Reserve requirements Discount interest rates Adjusting discount Interest Rates Congress Spending Money Besides economic health, influence from voters and interest groups Voters continually want lower taxes; lower government spending – but increased spending on government programs Where it goes (roughly) Direct benefit payments to individuals: 45% National defense: 15% Interest Payments: 14% Grants to state and local governments: 15% Spending Money, cont. Entitlements Automatically spent (without annual review) Social Security, Medicare, federal pensions, debt, etc. Account for 2/3 of federal budget – can we eliminate them? The Budget Process Executive Branch Agencies prepare estimates of budget needs and present to OMB, account is typically based upon previous year plus inflation OMB reviews and makes recommendations to the President President reviews OMB recommendations Troika Chairman of the Council of Economic Advisors (CEA) Director of OMB Secretary of the Treasury President submits budget to Congress The Budget Process, cont. Congress CBO created as part of Congressional Budget Act of 1974 CBO provides an independent analysis of President’s budget (check on OMB) Roles of Budget, Ways and Means, and Appropriations Committee Input and lobbying from agencies Majority vote needed in both houses The Budget Process, cont. Political Influences Political party differences Interest Group/PAC influence Iron Triangles Public Opinion Back to the President Sign or veto entire bill (budget) Congress can override veto with 2/3 vote from both houses The Budget Process, cont. Deficit Spending Budget deficit: incurred when government expenditures exceed income during a one year period National debt accumulation of past budget deficits Current debt ~$9 trillion (9,000,000,000,000) Role of Balanced Budget Amendment Some believe Congress should not overspend Some believe it would decrease ability to deal with economic crisis (ie. Great Depression, inflation) Levying Taxes Goal for taxes Burden rather low All pay something Progressive 1986: Tax Reform Act – closed some loopholes Rise of the Income Tax First peacetime income tax was struck down by the Supreme Court as being unconstitutional 16th Amendment: 1913, income taxes are now constitutional Initially, only a small number of high-income people paid taxes Taxation of WWII did not end after War Majoritarian Politics could set in and voters could vote for politicians who would only tax the wealthy Loop-hole interest groups (client politics) Levying Taxes, cont. The Politics of Tax Reform Majoritarian politics resurfaced in demand for fairness Loop-holes attacked as tax expenditures; subsidies to particular groups Some see lower tax rates as key to spurring economic growth Politically volatile (both Bushes had tax cuts) Rough Percentages Individual income taxes (progressive taxes) ~ 45% of federal revenue Social insurance taxes (regressive taxes) ~36% of federal revenue (BUT is supposed to be in trust fund) Borrowing ~20% of federal revenue Red = States with no income tax Chapter 17: Social Welfare Overview of Welfare Politics in the United States Who Benefits? Americans view question as who deserves to benefit Change in view of deserving and undeserving poor What is each person’s ‘fair share’ of national income Many prefer to offer ‘services’ rather than money Establishment of US welfare state compared to other countries Overview of Welfare Politics in the United States, cont. Welfare as a reflection of federalism Reinterpretation of the Constitution led to increased welfare (1930s) State could run programs if desired (most had some) Many programs being given back to states Ability to experiment Reduces federal bureaucracy grants The Four Laws in Brief 1. Social Security Act of 1935 1. 2. Roosevelt wanted to be reelected, took concept from Huey Long Plan met popular demands within the framework of popular beliefs and constitutional understandings 1. Insurance program for the unemployed and elderly to which workers could contribute 2. Assistance program for the blind, dependent children, elderly 3. Federal government to use taxing powers, states to administer The Four Laws in Brief 2. Economic Opportunity Act of 1964 1. Provided services 1. 2. 3. 4. 5. Job Corps Literacy Programs Youth Corps Work-study program for college students Community Action Program (CAP) 3. Medicare Act of 1964 1. 2. 3. Only for those eligible for Social Security Cover hospital expenses, not doctors bills Congress changed the original bill to include Medicaid added for the poor, and payment of doctors bills for Medicare The Four Laws in Brief 4. Family Assistance Plan of 1969 1. 2. 3. 4. Assistance to families with Dependent Children (AFDC) became controversial as the number of welfare mothers grow rapidly in the 1960s Many arguments and ideas about the pros/cons of AFDC Nixon pushed Family Assistance Plan (FAP) which would have drastically changed welfare concepts – would have established a national income which nobody would be allowed to fall White the House passed it, the Senate did not – killing it Cash Government Subsidies AFDC Farmer Subsidies Tax Incentives Home mortgage Tariffs Tax credits Credit Subsidies Student loans VET loans Benefit-in-kind subsidies Food stamps Medicaid Medicare Purpose of subsidies is often to encourage behavior: most subsidies go to people in the top half of the nation’s income distribution and to the corps Two Kinds of Welfare Politics 1. Majoritarian Politics 1. 2. Costs and benefits widely distributed, beneficiaries believe that their benefits will exceed their costs and if political elites believe that it is legitimate Social Security and Medicare are NOT Insurance programs – what recipients receive far outweighs what they contributed 1. Congress has had to raise taxes to cover costs 2. Americans are living longer 3. Cost of health care has drastically risen 3. Majoritarian programs threaten massive budget deficits 1. Social Security: in 1935, 42 workers to 1 recipient by 2020, only 2 workers to 1 recipient (now ~3:1) 2. Client Politics 1. 2. Costs widely distributed, benefits concentrated (AFDC) Many stress these welfare programs are examples of social skills, yet most subsidies/programs benefit more Americans Toward a New Welfare Politics Costs How to continue programs when costs and recipients have increased Looking to continue Social Security Congress has increased regulations and restrictions on Medicare charges Legitimacy If Congress wants to keep building programs, they have to develop the “legitimacy” of the recipients Rework programs to meet public expectations Family Support Act of 1988 requires states to establish paternity and to collect childsupport payments and to enroll parents in job-training and placement programs Increased emphasis on services (ie. Head Start) Toward a New Welfare Politics, cont. The Family Issue Repackaging recipients and reasons The Homeless Disagreement regarding numbers and causes, therefore ineffectual policies Toward a New Welfare Politics, cont. Political Issue Both parties emphasize reform Clinton: end welfare as we know it Contract with America, 1996: Republican led Accomplishments: Ended federal entitlement status of various programs Limited welfare payments to no more than 5 years Food stamp recipients must work Prohibited aliens (legal or illegal) from receiving various benefits Teen mothers must live with parents and attend school to receive benefits Question of Social Net Chapter 18: Civil Liberties Quick note: Civil Liberties are the basic freedoms such as speech and religion Civil Rights are protections against discriminatory treatment. The Politics of Civil Liberties Bill of Rights as important limitation on popular rule Non-citizens may not vote, serve on juries, stay in US unconditionally, or hold certain jobs Civil Liberties and Rights come from Constitution Bill of Rights Amendments Legislation Civil Rights Act, 1964, 1968 Voting Rights Act, 1965 Court Decisions Brown vs. Board of Education Roe v. Wade How Liberties Become Issues Rights in Conflict Same pattern as interest-group politics Not absolute; infringement upon the rights of others Balancing test: courts balance individual rights and liberties with society’s need for order/stability Entrepreneurial Politics Arouse the public to take action against the rights and liberties claimed by political or religious dissidents Principles that are in conflict with one another (cultural conflicts) Americanism has traditional sense of values and habits of Anglo-Saxon protestants Immigration brings different cultures/values Freedom of Speech Free speech is of utmost importance (especially political speech) Preferred position is for government to virtually never restrict Freedom Speech and National Security Sedition Acts Historically could be mere criticism of government Smith Act, 1940: advocate overthrow of government Question of Federal and State jurisdictions Clear and Present Danger Schenck v. US, 1919 Eminent threat to society Prior restraint-blocking before given What is speech? Court has held that there are three forms of speaking and writing that are not covered Libel (written) – defames the character of another personal Slander (oral libel) Must be malicious Obscenity – difficulty establishing what is obscene Symbolic Speech Connected between speech and illegal action Somewhere between speech and action; generally protected Texas v. Johnson, 1989 – flag burning as a protected form of speech US v. O’Brien, 1968 – draft card burning not a protected form of speech Who is a Person? Are corporations, interest group and children covered as well? Yes! Students are under authority of schools – cannot impede the educational mission of the school But students still have some rights…. Freedom of Religion Congress shall make no law prohibiting the free exercise of religion Can observe whatever religion you want as long as nobody is harmed Cannot violate laws Freedom of Religion, cont. Congress shall make no law respecting an establishment of religion-establishment clause Supreme Court has interpreted as a ‘wall’ between church and state (Jefferson first said) First such interpretation in 1947 Controversial rulings/decisions Original intent was that there would be no state-sponsored religion “Accomodationist View” government should allow a certain degree of church/state blending “Separationist View” no blending of church and state Freedom of Religion, cont. Lemon v. Kurtzmanestablished 3 part test to determine violation of establishment clause Nonsecular (religious) purpose Advances or inhibits religion Excessive entanglement with government Freedom of Religion, cont. Key rulings (‘school’ refers to public, not private schools) Engle v. Vitale, 1962 – no state sponsored recited prayer in school Abbington v. Schemp, 1963 – no devotional bible reading in school Moment of silence in school is constitutional Epperson v. Arkansas, 1968 – states may not prohibit the teaching of evolution States may not require the posting of the 10 commandments in schools Religious release time for students is constitutional Freedom of Religion, cont. Practices that have been restricted Polygamy (Reynolds v. US) Not vaccinating children of Christian Scientists before entering school Not paying social security taxes (Amish) Wearing a Jewish skullcap in the military Practices that have been permitted Not saluting flag in school (Jehovah’s Witness case) Covering up New Hampshire state motto (Live Free or Die) on car license plate (Jehovah’s Witness plate) Not sending children to school after 8th grade (Amish) Animal sacrifice (Santeria case) Crime and Due Process The Exclusionary Rule Evidence gathered outside of Constitution is invalid Applies mainly to the 4th and 5th amendments Search and Seizure Search warrant – probable cause; must be specific Already being lawfully arrested You Things in plain view Things or places under your immediate control Testing for Drugs and Aids Drug testing more established Fear of sexual harassment with AIDS testing (primary target: homosexuals) Crime and Due Process, cont. Rights of Accused Counsel Gideon v. Wainwright States must provide legal help for those who cannot afford it Speedy and public Trial Trial by jury Majority of cases settled through plea bargaining Miranda Warning – reminder of silence and counsel Miranda v. Arizona Although the confessed and the victim identified him (rape-kidnapping) conviction was overthrown because he was not informed that he could remain silent The Exclusionary Rule Illegally evidence may not be used in court Established in Mapp v. Ohio, 1961 Critics claim it lets criminals ‘off the hook’ Effects of Federalism Modifying effect of the 14th Amendment Due process and equal protection clauses applied to states Assembly Petition Religion Search and seizure Self-incrimination Double jeopardy Right to counsel Right to bring/confront witnesses Protection against cruel/unusual punishment Effects of Federalism, cont. Standards for nationalization of 14th Amendment All provisions of the Bill of Rights, EXCEPT 2,3,7, and 10 Amendments and grand jury of 5 have been federalized The Palko Test (from Palko v. Connecticut) any freedom/right that is essential to liberty must be upheld by states No exhaustive listing of liberties/rights because of 9th Amendment Privacy Griswold v. Connecticut, 1965 Life, Liberty, Property and Due Process Equal Protection Court Cases: Brown, Baker v. Carr, UC vs. Bakke Property rights versus public welfare States may impose limits on property rights Police powers to protect public welfare (meat inspection, child labor laws, etc.) States may exercise right of eminent domain (take private property for public good) Supreme Court has now ruled that local governments may take private property for PRIVATE developments Life, Liberty, Property and Due Process, cont. Due process of law – 5th and 14th Amendments prohibit government from denying life, liberty, or property without due process of law. Two types of due process: Procedural – must be fair use procedures Observe Bill of Rights Provide reasonable notice Provide chance to be heard Substantive The laws that allow government to take must be fair Distinction: a law prohibits possession of narcotics (substantive) and police must generally obtain a warrant before conducting a search (procedural) Cases: Mapp, Gideon, Miranda Civil Rights – Chapter 19 Protection against Discrimination The Black Predicament Historical Restriction of Rights Perceived costs of granting rights Interest group component of Majoritarian politics 16% of the population Campaign in the Courts 14th Amendment – due process, equal protection Plessy v. Ferguson, 1896 Separate but equal Jim Crow Laws Brown v. Board of Education, 1954 Separate is inherently unequal Implementation of class action suit Role of social science in constitutional decision Desegregation versus integration Desegregation versus integration Northern schools reflected living patterns/social divisions Court rejection of student preference of school Swann v. CMS, 1976 established that violation must show intent to segregate and that remedies are not ‘choice’ Campaign by Congress and President Civil War Amendments: 13, 14, 15 to protect blacks from state government Change in Congress reflected change in public opinion Civil Rights movement grew in 1950s and 1960s as violent actions of white separatists caused moral reaction Assassination of Kennedy helped build support for policies of Johnson Civil Rights Act of 1964 – banned discrimination in places of public accommodation (upheld Heart of Atlanta Motel v. US) based upon Congress’ power to regulate interstate commerce Civil Rights Act of 1968 –banned housing discrimination Barriers to Voting 15th Amendment banned voting discrimination on basis of race States imposed white primaries (unconstitutional 1944) States imposed poll tax (banned by 24th Amendment) States imposed literacy test (banned by Voting Rights Act) States imposed grandfather clause (declared unconstitutional) Voting Rights Act of 1965 Applied to areas with history of voting discrimination Suspend literacy tests Empowered federal officials to register voters and then ensure voting (ie with federal marshals) Empowered federal officials to count ballots Prohibited states from changing election procedures without permission from federal government Led to huge increase in black turnout and increase in black elected officials Number of Black Southern Legislators, 1868-1900 and 1960-1992 Women and Equal Rights Same goal, different arguments Seneca Falls Convention, 1848 Struggle for suffrage, 19th Amendment, 1920 Many early feminists were also abolitionists Equal Rights Amendment Many thought would pass quickly in 1972 Role of NOW Congress extended time Became hugely controversial – draft, legal protections, etc. Not passed Abortion State decision until 1973 Roe v. Wade, 1973 Supreme Court decided that the 5th and 14th Amendments imply a right to privacy (Griswold v. Connecticut) Some limitations Controversy over when life begins Women and Equal Rights, cont. Other legal issues Title VII of Civil Rights Act prohibited employment discrimination on the basis of sex Title IX of Education Act of 1972 prohibited gender discrimination in federally subsidized education programs, including athletics Women and the Economy Economic status seen as important as legal status Legislation Government funded day care Child support enforcement Pregnancy leave Comparable worth Affirmative Action Burdens of racism and sexism can be overcome only by taking race or sex into account in designing remedies Quotas or opportunities Courts review quota systems – compelling justifications Quotas cant be used without showing rules are needed to correct past of present pattern of discrimination Must identify the actual practices that had discriminatory impact Hiring and firing are two separate issues Compensatory action – helping disadvantaged people ‘catch up’ Preferential treatment – giving preference Reverse discrimination UC Regents v. Bakke, 1978: states may allow race to be taken into account as ONE factor for admission decisions