Exchange rate

advertisement

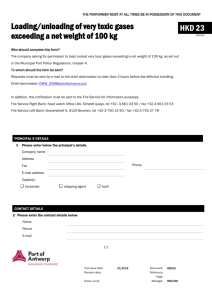

Economics Chapter 7 Exchange rate Currencies Major currencies USA: US Dollar [Code: USD; Sign: $] British: Pound sterling [Code: GBP; Sign: £] Europe: Euro [Code: EUR; Sign:€] China: Renminbi [Code: RMB; Sign: ¥] Hong Kong Dollar [Code: HKD; Sign: $] Japanese yen [Code: JPY; Sign: ¥] Exchange rate Exchange rate the price at which two currencies are exchange the price of a foreign currency in terms of the local currency, or vice versa convertibility rate Exchange rate Expression (assume USD and HKD) 1. The exchange rate of USD US$ 1 can be converted into HK$ 7.8 HKD/USD = 7.8 / 1 = 7.8 Exchange rate Expression (assume USD and HKD) 2. The exchange rate of HKD 1 HK$ 1 can be converted into US$ 7.8 1 USD/HKD = 7.8 Floating exchange rate Exchange rate is Free-floating Depends on market demand and supply Appreciation A rise in exchange rate Depreciation A fall in exchange rate Appreciation USD Euro Date 1 April 2011 1 May 2011 US$1 equals € 0.7 € 0.8 The USD appreciates relative to the EUR HKD JPY Date 1 April 2011 HK$1 equals ¥10.40 1 May 2011 ¥11.00 The HKD appreciates relative to the JPY Depreciation USD Euro €1 equals Date 1 April 2011 US$ 1 May 2011 US$ 1 = 0.7 1 = 0.8 US$1.43 US$1,25 The EUR depreciates relative to the USD HKD JPY Date 1 April 2011 1 May 2011 JP¥1 equals 1 HK$ = HK$0.096 10.40 1 HK$ = HK$0.091 11 The JPY depreciates relative to the HKD Floating exchange rate Appreciation: exchange rate Depreciation: exchange rate • There is only one exchange rate between two currencies. • Appreciation of one currency = Depreciation of the other Linked exchange rate system in HK Since 1983 HKD linked with USD at a fixed exchange rate Aim: To maintain stability of the exchange rate between HKD and USD Exchange rate: US$1:HK$7.75–7.85 Controlled by the HKSAR Gov’t (HKMA) Brief history of linked exchange rates system in HK: History of Hong Kong's Exchange Rate System • Period Exchange rate regime 1863–1935 Silver Standard December 1935 Sterling exchange –June 1972 July 1972 –November 1974 Fixed exchange rate against the US dollar November 1974 –October 1983 Free floating 1983–Present Linked exchange rate system Features Silver dollars as legal tender •Standard exchange rate:£1:HK$16 (December 1935– November 1967) •£1:HK$14.55 (November 1967–June 1972) •Exchange rate:US$1:HK$5.650 (June 1972–February 1973) •US$1:HK$5.085 (February 1973–November 1974) •Exchange rates on selected days:US$1:HK$4.965 (25 November 1974) •US$1:HK$9.600 (24 September 1983) •US$1:HK$7.80 (1983–1998) (for issue and redemption of Certificates of Indebtedness) •US$1:HK$7.75 (1998–2005) (The HKMA undertakes to convert the HK dollars in licensed banks’ clearing accounts maintained with the HKMA into US dollars at the fixed exchange rate of HK$7.75 to US$1. The rate has been moving to 7.80 by 1 pip each calendar day starting from 1 April 1999 ending 12 August 2000.) •US$1:HK$7.75–7.85 (May 2005 onwards) HKMA set up upper and lower guaranteed limit since 18 May 2005 Source: http://en.wikipedia.org/wiki/Hong_Kong_dollar Linked exchange rate system in HK Revaluation Originally, HKMA fixed the rate at US$1:HK$7.8 If HKMA set the rate at US$1:HK$6 (meaning that less HK dollar can be bought by US$1) (value of HK dollar increases) the rate of HKD against USD rises The government re-pegs exchange rate at a higher level Linked exchange rate system in HK Devaluation Originally, HKMA fixed the rate at US$1:HK$7.8 If HKMA set the rate at US$1:HK$9 (meaning that more HK dollar can be bought by US$1) (value of HK dollar decreases) the rate of HKD against USD falls The government re-pegs exchange rate at a lower level Difference: Exchange rate system Floating Fixed Exchange rate is determined by Market Government Increase Appreciation Revaluation Decrease Depreciation Devaluation USA China Exchange rate of local currency against foreign currency Example countries Linked exchange rate system in HK Strong reserves support A currency board system HK monetary base is support by USD Maintain the exchange rate when issuing banknotes Linked exchange rate system in HK Operation The bank is going to issue $7,800,000 banknotes It needs to pay USD of equivalent value (US$ 1 : HK$7.8) to HKMA to buy Certificate of Indebtedness [CIs] (負責證明書) As a support for banknotes issued In this case, the bank pays US$1 million to HKMA US$ 1: HK$7.8 Certificates of Indebtedness HKMA * In reverse, banks return HKD & CIs to the HKMA and get back the USD. Linked exchange rate system in HK Exchange rates change with the USD Under the linked exchange rate system, the exchange rates of the HKD against other foreign currencies change with the USD. Date US$1 equals (EUR/USD) US$1 equals (Linked exchange rate system, HKD/USD) 1 April 2011 € 0.7 HK$ 7.8 HK$ 0.7 = HK$11.14 1 May 2011 € 0.8 HK$ 7.8 HK$ USD appreciates against EUR Fixed Euro 1 equals (HKD/EUR) 7.8 7.8 0.8 = HK$9.75 EUR depreciates against HKD, (i.e. HKD appreciates against EUR) Against other currencies if USD appreciation HKD appreciation (against other currencies) if USD depreciation HKD depreciation (against other currencies) HK people suffer from RMB appreciation Exchange rates change with the USD RMB appreciates against USD since 1994 Since 2006, exchange rose quickly USD depreciation is faster HKD is linked to USD, so HKD follows USD and depreciates against RMB sharply Meaning that HK people needs to pay more HKD to buy products from the mainland Before that, HK people went shopping in the mainland Nowadays, mainland visitor come to HK for shopping RMB annual average middle exchange rate from USD and HKD (1 foreign currency unit to RMB) year US dollar HK dollar 1996 8.3142 1.07510 1997 8.2898 1.07090 1998 8.2791 1.06880 1999 8.2783 1.06660 2000 8.2784 1.06180 2001 8.2770 1.06080 2002 8.2770 1.06070 2003 8.2770 1.06240 2004 8.2768 1.06230 2005 8.1917 1.05300 2006 7.9718 1.02620 2007 7.6040 0.97459 2008 6.9451 0.8919 2009 6.8310 0.8812 Source: http://en.wikipedia.org/wiki/List_of_Renminbi_exchange_rates Balance of payment (BOP) account Definition The record of an economy’s receipts and payments arising from external transactions BOP account of HK For a specific time period Economic transactions between HK residents and non-residents Balance of payment (BOP) account Components of the BOP account: Current account (經常帳) Capital and finance account (資本及金融帳) BOP account Current account All external transactions not included in capital & financial account Capital and financial account International purchases or sales of assets Capital transfers Balance of payment (BOP) account Current account: 1. Goods (visible trade) Net receipt brought by merchandise trade (商品貿易) Receipt: Exports of goods, e.g. garments, jewellery… Payment: Imports of goods, e.g. rice, cars… Balance of visible trade = Total exports of goods – Total imports of goods Types of BOT: Trade deficit (貿易赤字) Exports < Imports BOT < 0 Balance BOT (貿易平衡) Exports = Imports BOT = 0 Trade surplus (貿易盈餘) Exports > Imports BOT > 0 Balance of payment (BOP) account Current account: 2. Services (invisible trade) Net receipt brought by services Receipt: Exports of services, e.g. local airline… Payment: Imports of services, e.g. World Cup broadcasting… Balance of invisible trade = Total exports of services – Total imports of services Balance of payment (BOP) account Current account: Factor income Net income from abraod All forms of investment income 3. Dividends Interest from deposit Net income from abroad = Factor income from abroad – Factor income paid abroad 4. Current transfers Unilateral (單向) transfer of goods and capital No economic value being received in return For example: donations, remittances 匯款 Balance of payment (BOP) account Current account balance: Total balance of the 4 components: Visible trade Invisible trade Factor income Current transfer Current account balance = Balance of (Goods + Services + Factor income + Current transfer) Balance of payment (BOP) account Given the following table, calculate the current account balance of HK: Components Value ($ million) Exports of goods 500 Imports of goods 200 Exports of services 350 Imports of services 100 Dividends from USA company 50 Compensation to employees in Europe 80 Donation to Japan 120 Current account balance = ( $500 - $200 + $350 - $100 + $50 - $80 - $120 ) million = $400 million Think about: In your own consideration: Types of services/facilities Frequently use Seldom use Never use 1. Education 2. Housing 3. Medicine and health (including hospital services) 4. Social welfare 5. Culture and entertainment (e.g. libraries, sports facilities) 6. Transportation Do you think the gov’t should increase subsidies in the above items for you? Public expenditure (公共開支) Types of expenditure Functions : Examples Education : 9-yr free education… Support : wages of civil servants… Social welfare : C.S.S.A…. Health : medical services… Infrastructure : transportation, water supply… Security : police, law affairs… Housing : Public housing… Economic : postal, airport… Environment and food: Environment protection Community and external affairs: culture, sports… Government revenue Types of revenue Taxation Direct tax Indirect tax Fee of selling of services Medical services Water supply Application of ID card… Fines / Penalties from punishment of illegality Selling of land Taxation Adam Smith’s principles of taxation Equity Taxation should be fair. Taxes are directly proportion to people’s income, i.e. those who earn more income need to pay higher tax Certainty Clearly define the responsibilities to taxpayers Clear tax calculation method Clear tax payment deadline Clear modes of payment (in person / online / PPS / credit card…) Taxation Adam Smith’s principles of taxation Convenience Deadline & payment method: convenient to taxpayers Allow enough time for payment E.g. Salary tax in Hong Kong: May: Submission of Tax Return – Individual October: Notification of tax payment January: First installment April: Secondary installment Economy Cost of tax collection should be kept minimum. Online / PPS tax payment Cost of tax collection Tax base (稅基) The tax base of an economic territory means activities (e.g. buying car, taking flight overseas) revenue (e.g. salaries, profits) assets (e.g. properties, cars) on which taxes are charged. The government’s scope of taxation. Broader the tax base more people need to pay tax more source of taxation more stable tax revenue Classification of tax By tax burden Direct tax Indirect tax By tax rate Progressive tax Proportional tax Regressive tax Classification by tax burden Direct tax The tax burden cannot be shifted to others by taxpayers. Examples: Salaries tax Profits tax Charges directly on the salary Charges directly on profit-making firms Property tax Charges directly on rental income earned from land or properties. Classification by tax burden Indirect tax The tax burden can be shifted to others by taxpayers Examples: Duties (應課稅品) Liquors (酒類) Tobacco (煙草) Hydrocarbon (燃油) Methyl alcohol (甲醇) Rates (差餉) Betting duty (博彩稅) Stamp duty (印花稅) First registration tax (汽車首次登記稅) Classification by tax burden Indirect tax How is the tax burden shifted? Examples: Duties: Tobacco Gov’t charges tax on tobacco traders Tobacco traders raise the price of cigarettes Consumers need to pay more for the cigarettes i.e. The tax burden is shifted to consumers through increase in price all kinds of sales taxes are indirect tax Tax base: Direct tax vs. Indirect tax Direct tax Levied on companies and salaried workers Only tax on profit or income earning Number of taxpayers is limited Even worse if no profit or salary Tax base is narrow Indirect tax Imposed on taxable goods and services Tax on anyone who made consumption Number of taxpayers is large Tax base is broader Tax base (稅基) Which of the following can broaden (擴闊) the tax base of Hong Kong? (1) (2) (3) A. B. C. D. Greatly decrease the basic tax allowance of the salaries tax. Impose a general sales tax. Increase the current indirect tax rate. (2) only (1) and (2) only (2) and (3) only (1), (2) and (3) Answer: B Stable tax revenue: Direct tax vs. Indirect tax Gov’t revenue fluctuates with economic cycles (經濟週期) Direct tax During economic recession (經濟衰退) During the time of economic boom (經濟繁榮) Companies: Low profit Workers: Low salaries Therefore, gov’t has less profit and salaries taxes Greatly increase in tax revenue Tax revenue is not stable Indirect tax No matter what the time is, people need to consume Tax revenue is relatively more stable Tax rate and tax revenue: Why is there smuggling (走私)? Suppose the gov’t wants to raise tax revenue Way to achieve: tax rate (e.g. duty on tobacco) Traders shift the tax burden to consumer People needs to pay more To avoid higher price, consumers buy smuggled cigarettes incentive of smuggling market Finally, lower tax revenue gained Conclusion Higher tax rate illegal activities: smuggling and tax evasion (逃稅) tax revenue cost to fight crime Tax rate and tax revenue Laffer Curve (textbook p.189) Two extremes (e.g. salaries tax): Optimum level (t*) 0% tax rate No tax revenue 100% tax rate All income paid for tax (i.e. no personal income) No one will work No tax revenue If current tax rate < t*, tax rate tax revenue If current tax rate > t*, tax rate tax revenue Tax revenue ($) To tax revenue Increase tax rate if tax rate < t* Decrease tax rate if tax rate > t* 0 t* Tax 100 rate (%) Classification by tax rate Basic terms Taxable income Tax rate Tax payment Basic calculation 𝑇𝑎𝑥 𝑝𝑎𝑦𝑚𝑒𝑛𝑡 𝑇𝑎𝑥𝑎𝑏𝑙𝑒 𝑖𝑛𝑐𝑜𝑚𝑒 𝑥 100% Tax rate = Taxable income = Total income – Tax allowance – Tax deduction e.g. parent, children… e.g. donation, study fee… Classification by tax rate Calculate the tax rates on each person at different scheme. Mr. Lee Mr. Chan Miss Wong Tax scheme Income ($) Tax payment ($) Income ($) Tax payment ($) Income ($) Tax payment ($) A 10,000 1,000 100,000 2,200 1,000,000 12,000 B 10,000 1,000 100,000 10,000 1,000,000 100,000 C 10,000 1,000 100,000 15,000 1,000,000 200,000 Tax scheme Mr. Lee Mr. Chan Miss Wong Types A 10% 2.2% 1.2% Regressive B 10% 10% 10% Proportional C 10% 15% 20% Progressive Classification by tax rate Progressive tax (累進稅) Higher the taxable income, higher the tax rate. When taxable income increases, the tax rate increases. Taxable income ($) Tax payment ($) Tax rate (%) Mr. A 100,000 5,000 5 Mr. B 200,000 20,000 10 Mr. C 300,000 45,000 15 Classification by tax rate Progressive tax Relationship between Taxable income Tax rate Tax rate (%) 15 10 5 Taxable income ($) 0 100,000 200,000 300,000 Classification by tax rate Progressive tax Relationship between Taxable income Tax payment Tax payment ($) 45,000 20,000 5,000 Taxable income ($) 0 100,000 200,000 300,000 Classification by tax rate Proportional tax (比例稅) No matter the taxable income is, the same tax rate. When taxable income increases or decreases, the tax rate remains unchanged. Taxable income ($) Tax payment ($) Tax rate (%) Mr. A 100,000 5,000 5 Mr. B 200,000 10,000 5 Mr. C 300,000 20,000 5 Classification by tax rate Proportional tax Relationship between Taxable income Tax rate Tax rate (%) 5 Taxable income ($) 0 100,000 200,000 300,000 Classification by tax rate Proportional tax Relationship between Taxable income Tax payment Tax payment ($) 15,000 10,000 5000 Taxable income ($) 0 100,000 200,000 300,000 Classification by tax rate Regressive tax (累退稅) Higher the taxable income, lower the tax rate. When taxable income increases, the tax rate decreases. Taxable income ($) Tax payment ($) Tax rate (%) Mr. A 100,000 12,000 12 Mr. B 200,000 20,000 10 Mr. C 300,000 24,000 8 Classification by tax rate Progressive tax Relationship between Taxable income Tax rate Tax rate (%) 12 10 8 Taxable income ($) 0 100,000 200,000 300,000 Classification by tax rate Progressive tax Relationship between Taxable income Tax payment Tax payment ($) 24,000 20,000 12,000 Taxable income ($) 0 100,000 200,000 300,000 Indirect taxes are regressive taxes Duty on tobacco ($1.706 per cigarettes) Suppose 3 persons consume 1000 cigarettes per year. Their income and tax payment on cigarettes are list below. To simplify calculation, assume tax on each cigarette = $2 Taxable income ($) Tax payment ($) Tax rate (%) Mr. A 60,000 2,000 3.33 Mr. B 180,000 2,000 1.11 Mr. C 1,000,000 2,000 0.2 Mr. A, with the least taxable income, pays the highest tax rate. Mr. C, with the most taxable income, pays the lowest tax rate. It is a regressive tax. Hong Kong tax system Types Direct taxes Indirect taxes Classification by tax rate Items Description Progressive Salaries tax Ordinary salary earners pay a progressive tax Proportional 1. Profit tax 2. Property tax 3. Salaries tax (standard rate) Profit tax rate - limited companies: 16.5% - other companies: 15% Property tax rate: 15% of balance after deduction of 20% rental income Standard tax rate of the salary tax: 15% Duties Taxes imposed on goods: - Hydrocarbon oil - Alcoholic beverage - Methyl alcohol - Tobacco Regressive Calculation of salaries tax Mr. A’s monthly salary in fiscal year 2010/11 = $40,000 Annual salary = $40,000 x 12 = $480,000 Personal allowance = $108,000 Assume no other deductions Then, taxable income = $480,000 - $108,000 = $372,000 Net Chargeable Income ($) Rate Tax Remaining 372,000 On the First 40,000 2% 800 332,000 On the Next 40,000 7% 2,800 292,000 Sub-total On the Next 80,000 40,000 Sub-total Remainder 12% 120,000 252,000 Total 3,600 4,800 8,400 17% 42,840 51,240 252,000 Calculation of salaries tax Mr. B’s monthly salary in fiscal year 2010/11 = $20,000 Annual salary = $20,000 x 12 = $240000 Personal allowance = $108,000 Assume no other deductions Then, taxable income = $240,000 - $108,000 = $132,000 Net Chargeable Income ($) Rate Tax Remaining 132,000 On the First 40,000 2% 800 92,000 On the Next 40,000 7% 2,800 52,000 Sub-total On the Next 80,000 40,000 Sub-total Remainder 12% 120,000 12,000 Total 3,600 4,800 8,400 17% 2,040 10,440 12,000 Calculation of salaries tax Mr. C’s monthly salary in fiscal year 2010/11 = $12,000 Annual salary = $12,000 x 12 = $144,000 Personal allowance = $108,000 Assume no other deductions Then, taxable income = $144,000 - $108,000 = $36,000 Net Chargeable Income ($) Rate Tax Remaining 36,000 On the First 36,000 2% 720 0 On the Next 0 7% 0 0 Sub-total On the Next 720 0 Sub-total Remainder 0 0 Total 12% 0 720 17% 0 720 0 Calculation of salaries tax Annual income ($) Tax payment ($) Tax rate (%) Mr. A 480,000 51,240 10.68 Mr. B 240,000 10,440 4.35 Mr. C 144,000 720 0.5 Mr. A: Higher the salary Higher the tax rate Mr. C: Lower the salary Lower the tax rate Salaries tax is a progressive tax. Calculation of salaries tax (high income) Mr. D’s monthly salary in fiscal year 2010/11 = $80,000 Annual salary = $80,000 x 12 = $960,000 Personal allowance = $108,000 Assume no other deductions Then, taxable income = $960,000 - $108,000 = $852,000 Net Chargeable Income ($) Rate Tax Remaining 852,000 On the First 40,000 2% 800 92,000 On the Next 40,000 7% 2,800 52,000 Sub-total On the Next 80,000 40,000 Sub-total Remainder 12% 120,000 732,000 Total 3,600 4,800 8,400 17% 124,440 208,440 12,000 Calculation of salaries tax (high income) Mr. D’s annual salary in fiscal year 2010/11 = $960,000 By usual calculation, tax payment = $208,440 Tax rate = Since tax rate > standard tax rate (15%) Standard tax rate will be charged Actual tax payment = $960,000 x 15% = $144,000 $208,440 𝑥100% $960,000 = 21.71% Calculation of salaries tax (low income) Mr. E’s monthly salary in fiscal year 2010/11 = $6,000 Annual salary = $6,000 x 12 = $72,000 Personal allowance = $108,000 Assume no other deductions Then, taxable income = $0, because annual income < personal allowance No need to pay salaries tax The structure of salaries tax in HK Tax rate (%) Progressive tax Proportional tax Standard tax rate A 0 Tax allowance B Income ($) The effects of tax on income redistribution 1. Narrow the gap between the rich and the poor The government’s revenue and expenditure Tax revenue from Expenditure the taxpayers who earn taxable salaries the companies which gain profit provide inexpensive or free services for the poor or low income earners subsidies for the unemployed or low income groups Progress income tax Higher income earners pay higher a tax rate. Lower income earners pay lower a tax rate. The effects of tax on income redistribution 2. Salaries tax be adjusted A more equal income distribution Increase the basic tax allowance A. Personal allowance Dependent children Dependent parents/grandparents maintained by you More low income earners can be excluded from paying tax The effects of tax on income redistribution 2. Salaries tax be adjusted A more equal income distribution Decrease the tax rates of all tax bands b. That is, tax rate of the first three bands of $40,000 taxable income Lower tax burden of the middle class More low and middle classes pay less tax burden. The effects of tax on income redistribution 2. Salaries tax be adjusted A more equal income distribution Increase the standard tax rate c. Very higher income earners pay a standard tax rate Increase in standard tax rate will affect high income groups only More tax revenue can be collected from the high income groups The effects of tax on income redistribution 3. Goods and Services Tax (GST) Suppose 20% GST is charged on buying a book ($100). Therefore, $20 is the tax payment. To a low income (income = $200) buyer, tax rate = = 10% To a high income (income = $40,000) buyer tax rate = $20 𝑥100% $200 $20 𝑥100% $40,000 = 0.05% GST is a regressive tax, more uneven income distribution. Argument of imposing GST in HK For Broaden the tax base Many examples from foreign countries, e.g. Japan, U.S.A. Reasonable to “buy more goods, pay more tax” Fair tax system. All people need to pay GST. Against Increase tax burden Worry of increase in tax rate High cost of tax calculation High cost of tax collection P Qd , lower consumption lower GDP Destroy the simple tax system of HK Income disparity