Transfer of Mortgage

advertisement

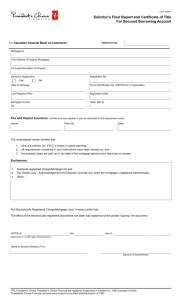

The Problem of Foreclosure Titles In NSP Acquisitions Why The Title of the Foreclosure Sale Buyer Is Often Defective How Can We Deal With the Problem? Securitization Flow Chart and Structure Transfer of Promissory Note Negotiable instrument under Article 3 of the UCC Transferred by: • Endorsement • Delivery of the instrument • Acceptance of delivery • Negotiation = Endorsement + Delivery + Acceptance Transfer of Mortgage Mortgage is a real estate instrument Subject to the statute of frauds Must comply local real estate law Transferred by: • Written assignment • Delivery of the instrument • Acceptance of delivery • Recording of transferred mortgage • “Assignment” = Written Transfer/Assignment + Delivery + Acceptance + Recording Notarization Requirements Most state laws require “strict” compliance Signer must admit, by oath or affirmation, in the PRESENCE of notary to having voluntarily signed the document, and signer’s capacity Signer must make the OATH or AFFIRMATION before signing Must identify the signer by a federal or state issued photographic ID Penalties include civil and criminal Felony in most states to take a false acknowledgement Document is invalid with improper notarization The Alphabet Problem With Securitized Transfers The loan closed in the name of the Broker/Lender Broker is funded by Warehouse Line of Credit Warehouse Lender then sells paper to a Special Investment Vehicle (SIV) SIV then sells paper the Sponsor/Depositor Sponsor or Depositor then transfers to Trust How Many Transfers A-Transfer: Consumer to Broker B-Transfer: Broker to Warehouse Lender C-Transfer: Warehouse Lender to SIV D-Transfer: SIV to the Depositor or Sponsor E-Transfer: Depositor or Sponsor to Trust How Many Documents Four assignments and deliveries and acceptances of the Mortgage Four endorsements and deliveries of the Note Eight separate notarizations Eight UCC-1 financing statements Four recordings Four filing and transfer fees The Allonge A paper attached to a negotiable note Purpose is to provide written endorsement Only used when back of negotiable instrument is FULL (no room) No need for notarization Simple signature and title sufficient, as with endorsement on note Similar ABCDE Problem With the Mortgage Instrument A. Consumer must sign and deliver to Broker B. Broker must assign and deliver to the Warehouse Lender C. Warehouse Lender must assign and deliver to the SIV D. SIV must assign and deliver to the Depositor E. Depositor must assign and deliver to the Trust And all these assignments must be recorded! Who Holds the Bearer Paper and Mortgages for the Trust? Normally a third-party bank that provides document custody services to the trust Provides trailing document filings Provides custody chambers for all members Executes assignments for members Execute endorsements for members Executes deliveries and acceptances Provide on-line document status certifications What Does Trust Really Hold? Electronic data with loan numbers & collateral descriptions Electronic image of the original deed of trust Electronic image of the original mortgage note Rights in the documents by way of UCC-1 financing statements and the pooling & servicing agreements The 3d-Party Outsource Providers Fidelity National Default Services First American National Default Services National Default Exchange, LP (Barrett Burke Owned Entity) Promiss Default Solutions (McCalla Raymer Owned Entity) National Trustee Services (Morris Schneider Owned Entity) LOGS Financial Services (Gerald Shapiro Owned Entity) What Do the Outsource Providers Do for the Servicers? Create Assignments Create Allonges Create Endorsements Sign documents as if they were the VP or Secretary of a Bank, SIV, Depositor, Sponsor or the Trust Notarize these documents Create Lost Note Affidavits Create Lost Assignment Affidavits Create Lost Allonge Affidavits Draft court pleadings and notices Draft default correspondence, reports, etc. How to Identify a Defective Endorsement or Allonge Allonge can never be used to transfer a mortgage Allonge can never be used if there is enough room on the original mortgage note for the written endorsement Note is endorsed and not assigned Date of the endorsement is before or after the date of the registration of trust And much more … Defective Endorsements Notary is from Dakota County, Minnesota Notary is from Hennepin County, Minnesota Notary is from Jacksonville, Florida Signor’s company has no offices in notary’s state Date of endorsement and date of notarization are different Signor’s name is stamped – not written in script Signor claims to have signing authority but no authority attached What About the Mortgages? Assignments and delivery follow same model as with the notes MERS is used to avoid registration of each assignment with local register of deeds MERS claims no beneficial interest in the note MERS claims no ownership rights in note or mortgage MERS claims it is nominee for true owner MERS delegates signing authority to all MERS members to sign documents as officers of MERS MERS does not supervise any of it’s designated signors MERS is not registered as a foreign corporation in most states How Does Trust Establish Lawful Ownership? Unbroken chain of note endorsements and acceptances from A to B, B to C, C to D, and D to E Unbroken chain of mortgage assignments and deliveries and acceptances from A to B, B to C, C to D, and D to E Unbroken chain of UCC-1 financing filings throughout the chain Unbroken chain of recorded mortgage assignments But What Is Filed In a Typical Foreclosure? Complaint alleging that the borrower (A) executed a note and mortgage in favor of the plaintiff (E) Note and mortgage from borrower (A) to originating lender (B) attached Sometimes a purported mortgage assignment from (B) to (E) attached, also purporting to assign the note This assignment always defective, often not recorded The Paper Trail and The Lack of Truth in Labeling Electronic data Fake dates & forged signatures False notarizations False assignments Fake endorsements Fraudulent lost note affidavits Recreated documents & records Allonges and more Is the Trust Really Secured? MAYBE – But it would be very difficult for any securitized trust to produce a valid set of original and unbroken assignments and endorsements Even if the trust produces ALL of the required documents, there is still the issue of the legality of the role of MERS on all required documents for recording Questions? David Wiechel Telephone 937-765-4546 Email dwiechel@woh.rr.com 111 East Cecil Street Springfield, OH 45504