Wind Power (Dr. Randy Swisher)

advertisement

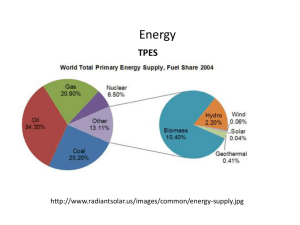

Wind Energy Technology: A Global Opportunity for our Environment, Economic Development and Energy Security Randall Swisher Executive Director (Retired) American Wind Energy Association Presentation Overview ● Electric Industry Basics ● Wind Technology Basics ● A Brief History ● Wind’s Current Market Status ● What is Wind’s Potential? ● What are the Challenges? Electric Industry Basics Sources of U.S. Electricity 2008 Share of Net Generation by Energy Source* ● ● ● ● ● ● ● Coal: Natural Gas: Nuclear: Hydropower: Wind: Petroleum: Other: 48.5% 21.3% 19.7% 6.1% 1.4% 1.1% 1.9% What role does each play? Regional differences? Operational characteristics? *Source: U.S. Energy Information Administration What is the common characteristic of these generating sources? Power System Operations • Supply and demand must match at all times • Demand and supply are both variable and uncertain. • Grid operators hold generation in reserve: • Regulation reserves • Load-following reserves • Contingency reserves • Reserves are shared for all sources of variability Wind Technology Basics What’s Inside a Nacelle? Advances in Power Electronics ● Modern wind turbines are equipped with power electronics. ● They process over 200 types of data, from wind speeds and oil temperature to voltage dips on the grid. ● An entire wind farm can be monitored from a laptop. Economies of Scale Drive Down Wind Cost 20 Years of Wind Technology Development Rotor (Meter) KW Total Cost Cost/kW MWh 1981 10 25 $65 $2,600 45 1985 17 100 $165 $1,650 220 1990 27 225 $300 $1,333 550 1996 40 550 $580 $1,050 1,480 1999 50 750 $730 $950 2,200 2000 71 1,650 $1,300 $790 5,600 Bottom Line: 1981-2000 = 124x the energy, 20x the cost; Today’s Turbines are Big! ● Hub Height: 60-100 meters (197-328 feet) ● Rotor Diameter: 70-100 meters (230-328 feet) ● Total Weight of Turbine: 230 - 340 tons How big is a V80 2.0 MW This picture shows how big a V80 2.0 MW is compared with a Boeing 747 JUMBO JET How much Electricity does a 1.5 MW Wind Turbine Produce? ● A 1.5 Megawatt (MW) wind turbine should generate about 5 million kWh annually.* ● Using national averages, that is equivalent to the electric needs of about 500 homes. *35% capacity factor Power in the Wind 2 (W/m ) = 1/2 x air density x swept rotor area x (wind speed)3 A V3 Density = P/(RxT) P - pressure (Pa) R - specific gas constant (287 J/kgK) T - air temperature (K) kg/m3 Area = r2 m2 Instantaneous Speed (not mean speed) m/s Bottom Line: 12 mph wind has 70% more power than 10 mph wind The Wind Industry: A Brief History In the 1980s, the U.S. led the World in Wind Technology ● The first successful windfarms were established in 1981 in California ● Many U.S. turbine manufacturers were established in the early 80s ● By 1989, the U.S. was home to 90% of the world’s installed wind capacity – almost all in California But We Turned our Backs on the Opportunity ● The DOE Wind R&D budget was cut 90% through the 1980s ● The wind investment tax credit was abruptly ended in 1986 • Most U.S. turbine manufacturers went out of business • No new U.S. wind market emerged until 1997 – Iowa and Minnesota Europe Took the Lead in the 1990s ● Strong market incentives in Denmark, Germany and Spain led to a thriving turbine manufacturing industry • Germany was the largest single market until 2008 • This European leadership made possible wind’s current competitiveness Today, the Global Industry has Three Key Markets ● Europe – 66,000 MW (end of 2008) • Most manufacturers based in Europe ● North America – 27,500 MW • The U.S. is now the largest single market, and all major global companies want to participate ● Asia – 25,000 MW • Chinese market growing most quickly, and establishing a strong manufacturing base 2009 Market The U.S. Wind Market Today Outlook U.S. is World Leader in Wind Power With over 31,OOO MW, the U.S. is now the #1 wind energy producer in the world U.S. Leads World in Installed Wind Capacity • The U.S. overtook Germany in 2008 with the most installed wind power capacity Source: AWEA Record Breaking Installation and Growth 25,000 MW Annual Additions 20,000 MW Cumulative Capacity Ten year annual average growth rate of 29% 15,000 MW 2008 Installed: 8,545 MW 2008 Total: 25,400 MW 10,000 MW 5,000 MW Source: AWEA Percentage of Generation Added by Year Wind is #2 source for past four years • 8,558 MW added in 2008 • 42% of all new generating facilities added in 2008 were wind power plants U.S. Wind Power Capacity (MW) Washington 1,375 Oregon 1,067 California 2,517 Montana 272 North Maine Minnesota Dakota 47 1,752 VT 714 Idaho 6 NH South 75 25 Wisconsin Dakota New York MA 395 Wyoming 187 832 Michigan RI 5 676 129 1 Iowa Penn. Nebraska NJ 2,790 361 Ohio 73 Indiana 8 Utah 7 Illinois 131 Colorado WV 20 915 Kansas 1,068 330 815 Missouri 163 Tennessee Oklahoma Under 100 MW 29 New Mexico 708 100 MW-500 MW 497 Over 1,000 MW Texas 7,116 Alaska 3 Hawaii 63 Source: AWEA, January 2009 Total 25,170 MW Market Drivers Contributing to Wind’s Growth ● ● ● ● ● ● Economics - Wind competes well in many regions Federal and State Policies Wind’s Environmental Benefits The New Energy Economy - Jobs Public Support Other major generation sources constrained • Coal’s carbon risk • Gas price volatility • Nuclear capital costs/perceived risk Wind Power is Cost-Competitive Estimated Capital Cost of New Generation Source: FERC, Increasing Costs in Electric Markets, 2008 Cost of Energy: Standard & Poor’s, 2007 $130 $120 $110 Cost of Energy ($/MWh) $100 $90 $80 $70 $60 $50 $40 $30 $20 $10 $0 Coal (PC) Coal (PC) w/CCS Coal (IGCC) Coal (IGCC) w/CCS Natural Gas (CC) Natural Gas (CC) w/ CCS Nuclear Wind Interconnection Queues Are Clogged with Wind Projects: Nearly 300 GW! Nameplate Capacity (GW) 350 Entered Queue in 2008 Total in Queue at end of 2008 300 250 200 150 100 50 0 Wind Natural Gas Coal Nuclear 2008 Wind Market Report; LBL Solar Other Growing the Wind Industry: What’s the Potential? 20% Wind Energy by 2030 The U.S. possesses sufficient and affordable wind resources to obtain at least 20% of its electricity from wind by the year 2030. U.S. Department of Energy, May 2008 20% Wind Energy by 2030 Wind capacity has already doubled in the past three years 8,300 MW -- 42% of new U.S. capacity -- added in 2008 Job Projections Under 20% Report • Over 500,000 total jobs would be supported by the wind industry Source: U.S. DOE, 20% Wind Energy by 2030 CO2 Reductions From Electricity Sector 4,500 4,000 3,500 3,000 2,500 2,000 1,500 No New Wind Scenario CO2 emissions 20% Wind Scenario CO2 emissions USCAP path to 80% below today’s levels by 2050 1,000 500 0 2006 2010 2014 2018 2022 2026 2030 Source: U.S. DOE, 20% Wind Energy by 2030 Challenges to Achieving Wind’s Potential Key Barriers to Achieving 20% Wind 1. Immediate Need to fix the financial system 2. Need for long-term stable federal policy 3. Need for transmission infrastructure Lack of Stable Policy Inhibits Investment ● Need a stable long-term federal policy • Long-term federal production tax credit (PTC) • Federal renewable energy standard (RES) • Climate policy Transmission Infrastructure ● The lack of transmission infrastructure is the single greatest long-term strategic constraint facing the wind industry. ● There is a growing recognition of this barrier by policymakers Green Power Superhighways • Link areas with vast supplies of renewables to areas of high electricity demand green power superhighways • Improve grid operations What do you do when the wind doesn’t blow? ● Wind is an energy resource, not a capacity resource ● Take the wind when it blows, rely on the utility’s hundreds of other power plants when it doesn’t ● As wind takes a larger role, the electric system will add more flexible resources . . . • Demand-response • Efficient gas-fired turbines • Incremental hydro • Energy storage ● And it will consolidate control areas and use generating resources more efficiently ● Storage is not necessary to reach 20% wind Strong Winds are on the Horizon The Future Looks Bright for Wind Power ● For additional information: www.awea.org rswisher@awea.org