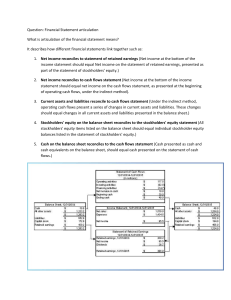

STOCKHOLDERS' EQUITY - Drexel University

advertisement

Accounting Matters! STUDY OBJECTIVES After studying this chapter, you should understand: What accounting is Monetary unit & economic entity assumptions Uses and users of accounting The accounting equation Ethics as a fundamental business concept How business transactions affect the accounting equation GAAP Basic financial statements STUDY OBJECTIVE 1 WHAT IS ACCOUNTING? Accounting is an information system that identifies, records, and communicates the economic events (transactions) of an organization to interested users. THE ACCOUNTING PROCESS Communication Identification Recording Accounting Reports Prepare accounting reports Select economic events (transactions) Record, classify and summarize SOFTBYTE Annual Report Analyze and interpret for users STUDY OBJECTIVE 2 USERS AND USES OF ACCOUNTING Internal Users Marketing managers Production supervisors Finance directors Company officers Investors Creditors Tax authorities Regulatory agencies Customers Labor unions External Users QUESTIONS ASKED BY INTERNAL USERS Is cash sufficient to pay bills? Can we afford to give employee pay raises this year? What is the cost of manufacturing each unit of product? Which product line is the most profitable? QUESTIONS ASKED BY INTERNAL USERS Is the company earning satisfactory income? How does the company compare in size and profitability with its competitors? What do we do if they catch us? Will the company be able to pay its debts as they come due? STUDY OBJECTIVE 3 ETHICS: A FUNDAMENTAL BUSINESS CONCEPT ETHICS: A set of standards by which one’s actions are deemed right or wrong, honest or dishonest. STUDY OBJECTIVE 3 ETHICS: A FUNDAMENTAL BUSINESS CONCEPT Steps for solving an ethical dilemma: 1. Recognize an ethical situation and the issues involved. 2. Identify the principal elements of the situation 3. Identify alternatives: weigh the impact on stakeholders STUDY OBJECTIVE 4 GAAP (Generally Accepted Accounting Principles) What is GAAP? A set of standards generally accepted and universally practiced by accountants 1. Indicates how economic events are reported 2. Generated by the Financial Accounting Standards Board (FASB) and Securities & Exchange Commission (SEC) STUDY OBJECTIVE 5 BASIC ACCOUNTING ASSUMPTIONS MONETARY UNIT ASSUMPTION ECONOMIC ENTITY ASSUMPTION Only transaction data that can be expressed in terms of money is included in the accounting records. An economic entity includes any organization or unit in society. The unit of measure (the dollar in the USA) is assumed to remain constant in value All activities of an entity are kept separate from the activities of its owners and other economic entities. BUSINESS ENTERPRISES A business owned by one person is generally a proprietorship. A business owned by two or more persons associated as partners is a partnership. A business organized as a separate legal entity under state corporation law and having ownership divided into transferable shares of stock is a corporation. STUDY OBJECTIVE 6 THE BASIC ACCOUNTING EQUATION Assets resources owned by a business = Liabilities claims against those assets Stockholders’ + Equity owners’ residual claim on total assets REVIEW QUESTION THE BASIC ACCOUNTING EQUATION As of December 31, 2006, Tetrick Company has assets of $3,500 and stockholders’ equity of $2,000. What are the liabilities for Tetrick Company as of December 31, 2006? Answer: $1,500 Assets – Liabilities = Stockholders’ Equity $3,500 = Liabilities + $2,000 Liabilities = $1,500 STOCKHOLDERS’ EQUITY Stockholders’ equity is equal to total assets minus total liabilities. It is also referred to as residual equity. There are two general categories of stockholders’ equity: PAID-IN CAPITAL and RETAINED EARNINGS PAID-IN CAPITAL Paid in Capital represents the total amount invested by stockholders in a corporation. Stockholders invest cash or other assets in exchange for common or preferred stock. RETAINED EARNINGS Retained earnings represents cumulative profits (or losses) retained in the business over time. Three items make up the balance in retained earnings: REVENUES EXPENSES DIVIDENDS REVENUES Revenues are the gross increases in stockholders’ equity from engaging in business activities entered into for the purpose of earning income. Revenues result from sales of merchandise, performance of services, rental of property, or lending of money. EXPENSES Expenses are the decreases in stockholders’ equity that result from operating the business. They are the cost of assets consumed or services used in the process of earning revenue. Examples are: utility expense, rent expense, supplies expense, tax expense, insurance expense, depreciation expense. DIVIDENDS When a company is successful, it generates Net Income. Dividends: the distribution of cash or other assets to stockholders that are available as a result of Net Income. Dividends are NOT considered an expense of the corporation. INCREASES & DECREASES IN STOCKHOLDERS’ EQUITY Increases Decreases Investments by stockholders Dividends to stockholders Stockholders’ Equity Revenues Expenses REVIEW QUESTION STOCKHOLDERS’ EQUITY Rebecca Sherrick, Inc., had a stockholders’ equity balance of $164,000 at the beginning of the period. At the end of the period, the stockholders’ equity balance was $198,000. Assuming no additional investment or distributions During the period, what is the net income for the period? Beginning balance Add: investments net income ($198,000-$164,000) $164,000 0 $34,000 Less: dividends 0 Ending balance $198,000 STUDY OBJECTIVE 7 HOW BUSINESS TRANSACTIONS AFFECT THE ACCOUNTING EQUATION • Every transaction must have a dual effect on the accounting equation. Thus, if an asset is increased, there must be a corresponding: 1. Decrease in another asset, or 2. Increase in a liability, or 3. Increase in stockholders’ equity TRANSACTION IDENTIFICATION PROCESS Purchase Answer Pay rent computer telephone Is the financial position (assets, liabilities, and stockholders’ equity) of the company changed? Yes No Yes Record Don’t Record Record TRANSACTION ANALYSIS TRANSACTION 1 Ray and Barbara Neal open Softbyte, Inc., a programming company by investing $15,000 in exchange for common stock. Assets = Liabilities + Stockholders Equity Common Cash Stock +15000 +15000 There is an increase in the asset cash, $15,000, and an equal increase in the equity common stock. TRANSACTION ANALYSIS TRANSACTION 2 Softbyte purchases computer equipment for $7,000 cash Assets Cash + Supplies Old Bal. $15,000 (2) -7000 New Bal. $8,000 + = Liabilities + + Equipment + +7000 $7,000 $15,000 Accounts = Payable + = Stockholders’ Equity Common Stock $15,000 + $15,000 $15,000 Cash is decreased $7,000, and the asset Equipment is increased $7,000. After transaction #2, total assets =total liabilities + equity. TRANSACTION ANALYSIS TRANSACTION 3 Softbyte purchases for $1,600 of supplies from Acme Supply. The supplies will last several months. Softbyte will pay the bill next month. Assets Old Bal. (3) New Bal. Cash + $8,000 $8,000 + Supplies = + +1600 $1,600 + $16,600 Equipment = $7,000 $7,000 = Liabilities + Accounts Payable + Stockholders’ Equity Common Stock $15,000 +1600 $1,600 + $15,000 $16,600 The asset Supplies is increased $1,600, and the liability Accounts Payable is increased by the same amount. TRANSACTION ANALYSIS TRANSACTION 4 Softbyte receives $1,200 cash from customers, for providing programming services. Assets + Old Bal. Cash $8,000 Supplies + $1,600 Equipment = $7,000 Liabilities + Accounts Payable + $1,600 New Bal. $9,200 + $1,600 + $7,000 = $1,600 + $17,800 (4) = Stockholders Equity Retained Common Earnings Stock $15,000 $16,200 $17,800 +1,200 Cash is increased $1,200, and retained earnings is increased $1,200. (Retained earnings is indirectly increased because revenue is increased). +1,200 STUDY OBJECTIVE 8 BASIC FINANCIAL STATEMENTS After all transactions for the period are recorded, financial data is summarized and that summary data is used to generate the basic financial statements Balance Sheet Statement of Cash Flows Income Statement Statement of Retained Earnings FINANCIAL STATEMENTS SOFTBYTE, INC. Income Statement For the Month Ended September 30, 2006 Revenues Service revenue Expenses Salaries expense Rent expense Advertising expense Utilities expense Total expenses Net income $ 4,700 $ 900 600 250 200 1,950 2,750 Net income of $2,750 will be added to retained earnings. FINANCIAL STATEMENTS SOFTBYTE, INC. Statement of Retained Earnings For the Month Ended September 30, 2006 Retained earnings, September 1 Add: Net income Less: Dividends Retained earnings, September 30 $ –0– 2,750 2,750 1,300 $ 1450 Dividends of $1,300 is deducted from retained earnings. The net change in retained earnings for the period is $1,450. FINANCIAL STATEMENTS SOFTBYTE, INC. Balance Sheet September 30, 2006 Assets Cash Accounts receivable Supplies Equipment Total assets $ 8,050 1,400 1,600 7,000 $ 18,050 Liabilities and Owner’s Equity Liabilities Accounts payable Stockholders’ Equity Common Stock Retained Earnings Total liabilities and owner’s equity $ 1,600 $15,000 $1,450 16,450 $ 18,050 Cash of $8,050 will be shown in the statement of cash flows. FINANCIAL STATEMENTS SOFTBYTE, INC. Statement of Cash Flows For the Month Ended September 30, 2006 Cash flows from operating activities Cash receipts from revenues Cash payments for expenses Net cash provided by operating activities Cash flows from investing activities Purchase of equipment Cash flows from financing activities Sale of common stock Payment of cash dividends Net cash provided by financing activities Net increase in cash Cash at the beginning of the period Cash at the end of the period $ 3,300 (1,950) 1,350 (7,000) $ 15,000 (1,300) 13,700 8,050 –0– $ 8,050 Cash of $8,050 on the balance sheet and statement of cash flows is shown as the final total of the cash column of the Summary of Transactions.