Loan Insurance

advertisement

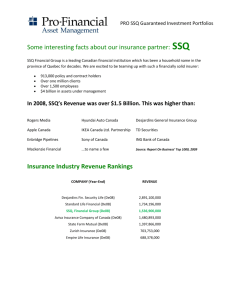

SSQ Financial Group We have GOLD at SSQ…Guaranteed! Agenda • • • • Who is SSQ? Product portfolio Sweet spots Reward program 2 SSQ Financial Group – At a glance • A major Canadian financial institution with more than: – One million clients – 1,900 employees – $10 billion in assets under management – $3 billion in premium income • Presence in four sectors of activity: – – – – Individual insurance Investment and retirement Group life and health insurance General insurance 3 Financial Stability SSQ Manulife Sun Life Great West Life Industrial Alliance ROE 2011 ROE 2010* ROE 2009* ROE 2008* ROE 2007* 11.3% 15.9% 13.8% 11.3% 13.7% 0.2% ( 7.3%) 5.2% 1.8% 18.4% ( 2.2%) 10.2% 3.4% 5.1% 14.3% 17.6% 14.8% 13.8% 12.7% 20.7% 4.7% 12.8% 11.9% 4.0% 15.2% * According to generally accepted accounting principles in Canada (GAAP) 4 SSQ Ranks 6th among Canadian LifeCos Market Share (%) Premium Growth (%) 1 Great West 23.8% 0.89% 2 Sun Life 17.7% 7.28% 3 Manulife 16.9% -2.75% 4 Industrial Alliance 7.0% 6.50% 5 DFS 7.0% 6.83% 6 SSQ Life 3.6% 35.25% Based on 2011 financial results, data by MSA Research 5 Our Lines of Business Premiums 2011 ($M) Group insurance 1,298 Investment and retirement 1,027 General Insurance (Auto and Home) 219 Individual Insurance 151 2,695 6 Expansion across Canada • Offices in Vancouver, Calgary, Toronto, Montreal, Québec and Halifax • 2010 : Acquisition of SSQ Place in North York 110 Sheppard Avenue East, Suite 500 Toronto, ON M2N 6Y8 7 Why should you be looking at SSQ? • Our stability & financial strength (A-)* • Our innovative and competitive investment & insurance products • Our commitment across Canada • Our service • Our professional team *A.M. Best 8 Our Dedicated Sales Team 9 Term insurance Issue ages End Coverage type Rate bands Preferred risks T10 18-75 85 Individual Multi-Life Joint first to die 250K + T20 18-65 85 Individual Multi-Life Joint first to die Joint last to die $25,000 – $99,999 $100,000 – $249,999 $250,000 – $499,999 $500,000 – $999,999 1M+ T70 18-60 70 Individual Multi-Life 10 Term insurance • Preferred risks (250K) – NS1, NS2, NS3, NS4, S1, S2 • Renewable (T10, T20) and convertible • Indexation privilege – T10 – Automatic increase for first 5 years: 30%, 25%, 20%, 15%, 10% • Extreme Disability Benefit (EDB) included – 50% payable in advance 11 Additional benefits • Accidental death and dismemberment (AD&D) • Monthly income in case of disability • Child rider • Waiver of premium in case of disability • Benefit in case of fracture 12 Term 10 with indexation option Class 3 - Male, 40, NS, $275K * Rank Company Premium 1 T10 A $234.75 2 T10 B $248.25 3 T10 C $249.00 4 T10 D $250.75 5 T10 E $250.75 6 T10 SSQ Insurance $251.00 6 T10 Index. SSQ Insurance $251.00 * LifeGuide, August 7, 2012, including policy fee 13 Term 10 with indexation option Class 3 – Male, 40, NS, $275K * age amount premium max. increase 40 $275,000 $251.00 30% 41 $357,000 $303.80 25% 42 $426,250 $347.80 20% 43 $481,250 $383.00 15% 44 $522,500 $393.72 10% 45 $550,000 $410.50 - Class 3 - Male, 45, NS, $550K * age amount premium 45 $550,000 $603.00 * LifeGuide, August 7, 2012, including policy fee 14 Critical Illness insurance 15 Critical Illness insurance Plans Policy types Base – 3 illnesses Enhanced – 25 illnesses Child – 28 illnesses Individual, Multi-life Issue ages T10, T75, T100: 18-65 T20: 18-55 T100-20 pay: 18-50 Child - T75, T100, T100-20 pay: 30 days-17 Rate bands $25,000 - $99,999 $100,000 - $249,999 $250,000 - $2,000,000 4 conditions 10% up to $50,000 Additional benefit Assistance benefit Second medical opinion, medical referral, psychological assistance, legal assistance etc. 16 Critical illness insurance • Riders – Refund of premiums • ROP upon death = 100% (all plans) • ROP at expiry = 100% at age 75 (T10, T20, T75) • ROP upon cancellation = 100% after 20 years or at age 55 (T75, T100, T100-20 pay) – Children’s endorsement – 15 illnesses • Additional benefits – Waiver of premium – Fracture 17 Product positioning • Very competitive T10 and T20 – LifeGuide 18 Universal Life 19 Loan Insurance 20 Loan Insurance • Life, credit disability and CI package • Term life insurance is core coverage • Additional benefits: – Total Disability rider – CI Rider – Waiver of premium in case of total disability 21 Loan Insurance • Term life insurance – Face amount options • Level • Decreasing to 50% of initial amount – Renewable for 5 year terms after initial term – Convertible – Built-in guaranteed insurability feature • 25% of initial insurance amount (max $100,000) • Up to age 60 – Extreme Disability Benefit (EDB) included • 50% payable in advance 22 Loan Insurance • Total disability rider – Eligibility • Employed 25 hours or more per week, 8 months per year – Issue ages • 18 to 55 – End of coverage • Age 60 (65 if disabled) – Monthly indemnity • Up to 1.5% of life amount, max. $3,500 23 Loan Insurance • Total disability rider – Benefit period • 2 or 5 years – Guaranteed insurability • Increase proportional to life increase, exercised simultaneously • Age 55 or less • Monthly indemnity: up to 1.5% of life amount, max. $3,500 24 Loan Insurance • Total disability rider – Assistance benefit • Second medical opinion, medical referral, psychological assistance, legal assistance etc. – Claims • Proof of loan required 25 Loan Insurance • CI Rider – 3 illnesses: cancer, heart attack, stroke – Issue ages • 18 to 55 – End of coverage • Age 85 – Lump sum • $20,000 – Assistance benefit 26 Loan Insurance • CI Rider – 3 illnesses: cancer, heart attack, stroke – Issue ages • 18 to 55 – End of coverage • Age 85 – Lump sum • $20,000 – Assistance benefit 27 Product positioning • All-in-one solution: life, credit disability and CI conveniently packaged • Competitive pricing – specifically level insurance amounts, terms 20, 25, 30 and 35 • Alternative to bank products • Covers line of credit, commercial loans 28 Commission FYC Loan Insurance 10 Loan Insurance 15 Years 2 + 40% Loan Insurance 20 Loan Insurance 25 45% 3% 40% 3% Loan Insurance 30 Loan Insurance 35 Disability rider CI rider 29 Whole Life 30 Whole Life is strongest area of growth Annualized premium market share by product Q4 - 2011 Q4 - 2012 7% Source: LIMRA 31 Persistent high sales of Whole Life Premium growth by product 32 Source: LIMRA Product features Type of policy Whole life 20 Entry age Individual Multi-life Individual Whole life Multi-life 100 Joint 1st-to-die Term 100 Joint 2nd-to-die Rate bands Cash Paid-up values values Year 10 0 to 75 $10,000 - $49,999 $50,000 - $99,999 $100,000 - $249,999 $250,000 and over Year 10 none 33 Product strengths • Choice of 3 guaranteed products - 20 Pay, Life Pay WL100 & T100 • Generous cash values and paid-up values – starting at year 10 • Lifetime renewal commissions – 2% • Built-in Extreme Disability Benefit (EDB) • Additional Benefits: AD&D, MI, Child Rider, WP, Fracture benefit 34 EDB– unique to SSQ Extreme disability means that the insured is in a state of total and irrecoverable disability as a result of which the insured is wholly unable to work, and that this condition has been declared permanent by a physician. • No extra cost • 50 % of the sum insured up to a max. of $250,000 • Payable before age 60 35 Lifetime commissions WL 20 FYC Years 2-5 Years 6-10 Years 11+ 50% 5% 2% 2% (up to year 20) WL 100 50% 5% 2% 2% Term 100 50% 5% 2% 2% 36 Marketing documents 37 WL 100 with Cash values Male, 45, NS, $250,000, Regular Premium Year 10 Year 15 Year 20 A $2,585.00 $0 $0 $0 B $2,857.13 $0 $0 $0 SSQ Insurance $2,915.00 $21,750 $37,000 $54,250 C $3,017.50 $4,875 $12,625 $24,188 D $3,017.50 $12,225 $28,100 $49,600 E $3,077.50 $10,150 $39,025 $67,900 F $3,157.50 $0 $0 G $3,117.50 $15,655 $30,113 $48,325 H $3,227.63 $12,250 $31,500 $53,750 I $3,435.00 $20,283 $46,705 $66,525 Source: LifeGuide March 27 2013 $0 38 WL 100 with Paid-up values Male, 45, NS, $250,000, Regular Premium Year 10 Year 15 Year 20 A $2,585.00 $0 $0 $91,121 B $2,857.13 $28,001 $42,002 $56,003 SSQ Insurance $2,915.00 $78,250 $109,750 $134,000 C $3,017.50 $0 $0 $49,500 D $3,017.50 $10,795 $64,773 $118,750 E $3,077.50 $23,000 $76,250 $116,250 F $3,157.50 $31,575 $47,363 $63,150 G $3,117.50 $36,498 $61,593 $87,723 H $3,227.63 $48,821 $98,620 $135,299 I $3,435.00 $69,749 $136,812 $166,047 Source: LifeGuide March 27 2013 39 WL 20 with Cash Values Male, 45, NS, $250,000, Regular Premium Year 10 Year 15 Year 20 A $3,802.50 $0 $0 $0 B $4,487.50 $1,750 $13,000 $38,500 C $4,502.50 $9,763 $25,535 $63,115 D $4,540.00 $33,488 $66,975 $89,300 E $4,605.00 $12,188 $36,563 $97,500 SSQ Insurance $4,655.00 $30,500 $54,500 $83,750 F $4,685.88 $7,678 $26,885 $59,210 G $5,045.00 $12,275 $34,250 $68,700 H $5,045.00 $9,750 $18,938 $32,250 Source: LifeGuide March 27 2013 40 WL 20 with Paid-up values Male, 45, NS, $250,000, Regular Premium Year 10 Year 15 Year 20 A $3,802.50 $0 $0 $250,000 B $4,487.50 $12,500 $67,750 $250,000 C $4,502.50 $0 $0 $250,000 D $4,540.00 $125,000 $187,500 $250,000 E $4,605.00 $25,000 $125,000 $250,000 SSQ Insurance $4,655.00 $109,500 $162,000 $250,000 F $4,685.88 $30,598 $84,171 $250,000 G $5,045.00 $25,000 $100,000 $250,000 H $5,045.00 $0 $0 $250,000 Source: LifeGuide March 27 2013 41 Term 100 positioning Male, 45, NS, $250,000, Regular Premium A $2,432.50 B $2,585.00 C $2,715.00 D $2,722.50 SSQ Insurance $2,760.00 E $2,805.00 F $2,845.00 G $2,885.00 Source: LifeGuide March 27 2013 42 Par products vs. SSQ non-par (CV) WL- 100 Male, 45, NS, $250,000, Regular Premium Year 10 Year 15 Year 20 SSQ Insurance $2,915.00 $21,750 $37,000 $54,250 A $3,409.30 $14,590 $24,133 $34,335 B $4,482.84 $10,842 $33,075 $66,680 C $4,658.22 $7,547 $23,121 $64,868 D $6,891.84 $17,062 $52,050 $104,935 Source: LifeGuide March 1, 2013 43 SSQ non-par vs. Par products (Paid-up) WL- 100 Male, 45, NS, $250,000, Regular Premium Year 10 Year 15 Year 20 SSQ Insurance $2,915.00 $78,250 $109,750 $134,000 A $3,409.30 $50,843 $68,957 $81,193 B $4,482.84 $16,205 $47,972 $105,520 C $4,658.22 $14,159 $38,729 $98,137 D $6,891.84 $28,640 $81,723 $174,749 Source: LifeGuide March 1, 2013 44 45 46 SSQ’s Merit Plan for Advisors Life & Health insurance: $1 in NFYC = 40 sales credits ASTRA Funds: $1 in sales* = 1 sales credit *Pro-rated contracts 1 Million credits = $1,600 Over 5 Million credits = $20,000 January 1st to December 31st, 2013 47 SSQ Financial Group Spring Roadshow 2013 May 15 & 16 Join us for our professional development luncheon from 12-2pm and meet our CEO, Mr. René Hamel! And that's not all! Do not miss out on the opportunity to hear from our special guest speaker, Jim Ruta, a leading insurance expert, deliver his newest presentation and share his extensive insurance industry expertise. This presentation will qualify for CE credits. Gain a new perspective to maximize your business opportunities. Mark your calendar! Mississauga May 15 Delta Meadowvale Hotel Richmond Hill May 16 Sheraton Parkway Hotel 48