ACC202_Chapter_7_notes

advertisement

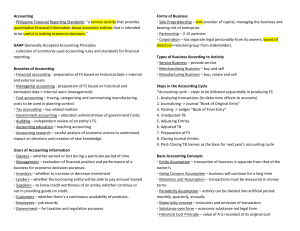

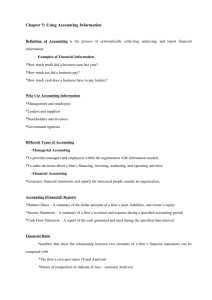

Chapter 7 notes Objectives of Financial Reporting: 1. Useful to those making investment and credit decisions 2. Helpful in assessing future cash flow 3. Identifying assets and liabilities and their changes Qualitative characteristics of Accounting Information: 1. Relevance a. Can affect decisions with either predictive or feedback value 2. Reliability a. Free of errors and bias 3. Comparability a. Accounting information among different companies can be meaningfully compared 4. Consistency a. A company needs to use the same accounting principles and methods from year to year Assumptions: 1. Monetary Unit Assumption a. Everything has been assigned a value in dollars. Anything that can not be expressed in terms of dollar value will not be included 2. Economic Entity Assumption a. The activities of the entity be kept separate and distinct from the activities of the owner and of all other economic entities 3. Time Period Assumption a. The economic life of a business can be divided into artificial time periods 4. Going Concern Assumption a. Always assumes that any company will continue in operation long enough to carry out its existing objectives. Therefore company assets will not be valued at their fire-sale value Principles: 1. Revenue Recognition principle: a. Revenue is recognized when earned (all the necessary tasks have been completed under the contract) even though sometime payment has not been received yet. 2. Matching principle: a. Resources consumed (expenses recognized) in order to generate revenue must be matched against the revenue earned 3. Full Disclosure Principle: a. Companies must disclose circumstances and events that make a difference to financial statement users. Information disclosed includes data and event descriptions 4. Cost Principle: a. Because the acquisition cost of an asset is most reliable (objectively measured) and relevant (representing the price paid) base data for any asset, companies should record assets at their cost. 5. Materiality Principle: a. Material means it is likely to influence the decision of a reasonably prudent investor or creditor b. Immaterial means its inclusion or omission has no impact on a decision maker. c. If an item is immaterial, GAAP does not have to be followed 6. Conservatism: a. When in doubt, choose the method that will be least likely to overstate assets and income Page 305 to 307, the book presents the different components of a classified balance sheet and a classified income statement. Starting from page 308, we will learn how to analyze financial information. There are three categories of financial ratios: 1. Liquidity ratios ------ short term in nature 2. Profitability ratios ------- How profitable a company is regarding its operations 3. Solvency ratios -------- Long-term in nature