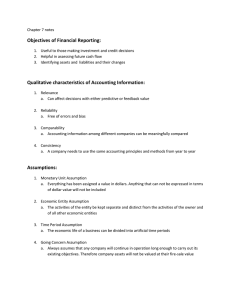

Accounting Concepts The going concern concept A business is presumed to be healthy and likely to continue in business for the foreseeable future unless the opposite is known to be true. Otherwise we would have to value stock at what we could sell it for now rather than at cost. The cost (or historical cost) concept What is the value of an asset? The amount paid for it or the amount it would sell for? Different people would say different things , depending on their interest. The only valuation which is acceptable to everybody is the cost price. There are exceptions to this: for instance, buildings can be revalued. The money measurement concept Things which cannot have a specific value assigned to them cannot be taken into account in the books. Consequently we cannot record in the books the value of the skills of the workforce, or of low morale. The business/Separate entity concept A business is separate and distinct from its owners and the accounts only show the affairs of the business, not he owner. N.B. whilst this is true in accounting, it is not always so in law. The realization concept Profit is realized (earned) at the moment that possession of the goods passes from the seller to the buyer. The dual aspect concept There are two aspects to every transaction. For example, if I pay my friend the $10 I owe her, the two effects are: I have $10 less in cash I owe $10 less in debts. Both of these aspects need recording; hence we have the double-entry system The accruals concept This is the one that tells us that when we calculate profit, we should deduct the value of expenses incurred (used up) rather than simply the payments made. Also applies to items of revenue. The materiality concept If I buy a box of staples then the cost of this will be deducted from this year’s gross profit, regardless of whether or not I use up all the individual staples before the end of the year. An individual staple would be regarded as immaterial (or not worth worrying about). Whether an item is material or immaterial depends on the size of the firm, e.g $50 worth of petrol might be immaterial to a large plc, but very material to a small business. The prudence (or conservatism) concept This states that profits should never be anticipated but provision should be made for an anticipated loss in asset values. If there is an alternative choice of values for an asset, the lower should be used. The consistency concept Once a firm has chosen a particular method in accounting, it should adhere to that method in the future, so as to allow for the most meaningful comparisons on a year-by-year basis. Only when there are compelling reasons should a change be adopted, and that change should be reported.