UNIT 2: THEORY BASE ACCOUNTING.

advertisement

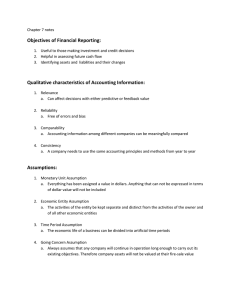

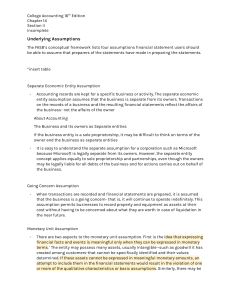

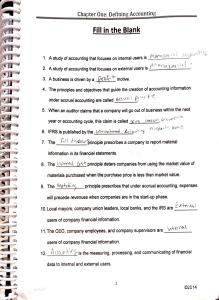

UNIT 2: THEORY BASE ACCOUNTING. VERY SHORT ANSWER TYPE QUESTIONS: Q1: What do you mean by basic accounting assumptions? Q2: What is the money measurement concept? Q.3: Explain brief, “Materiality convention”. Q.4: When should revenue be recognized? Q.5: Define the meaning accounting standards. Q.6: Define the term Principle. Q.7: Differentiate between accounting standards and accounting principles. Q.8: Explain the accounting entity assumption. Q.9: Why is periodicity assumption necessary for preparing the financial statements? Q.10: What are the exceptions to the general rule of revenue recognition? SHORT ANSWER TYPE QUESTIONS: Q.1: Explain the meaning and significance of concepts & conventions in Accounting. Q.2: Why it is necessary for accountants to make going concern assumption? Q3: What are the exceptions of basic principles of Accounting? Q4: Explain the effect of going concern and periodicity assumptions on financial Statements. Q5: What is matching concept? Why should a business concern follow this concept? Discuss. Q6: Explain the effect of revenue recognition principle and matching principle on financial statements. Q.7: Discuss the concept-based on the premise ‘do not anticipate profits but provide for all losses’. Q8: Explain the principle of full disclosure and its uses and significance. Q9: What do you understand by accounting standards? Explain. Q10: Distinguish between money measurement concept and going concern concept of accounting. LONG ANSWER TYPE QUESTIONS: Q1: Why is it important to adopt a consistent basis for the preparation of financial statements? Explain. Q2: Explain the constraints that require the accounting principles to be modified? Q3: Why do accounting principles emphasis’ the use of historical cost as a basis for measuring assets? Q.4: In accounting sole proprietor and his business are treated not as one but as different entities. Why? Q.5: What is the monetary unit assumption? Does it hold well when the prices are not stable? Q.6: What is meant by Cash base accounting? What are its advantages and disadvantages? Q.7: What is meant by Accrual base accounting? What are its advantages and disadvantages? Q.8: What are the objectives of Accounting Standards? Who is responsible for issuing Accounting Standards in India? Q.9: Shakeel, a consultant, during the financial year 2009-2010 earned Rs 400000.Out of which he received Rs 350000. He incurred an expense of Rs 170000, out of which Rs 40000 are outstanding. He also received consultancy fee relating to previous year Rs 45000 and also paid Rs 20000 expenses of last year. Determine his income as per cash basis of accounting. Q.10: Shahid, a consultant, during the financial year 2009-2010 earned Rs 600000.Out of which he received Rs 550000. He incurred an expense of Rs 150000, out of which Rs 40000 are outstanding. He also received consultancy fee relating to previous year Rs 45000 and also paid Rs 50000 expenses of last year. Determine his income as per Accrual basis of accounting.