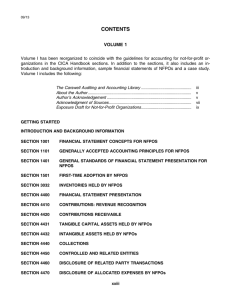

Chapter Eighteen

Accounting and

Reporting for

Private Not-forProfit Entities

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Not-for-Profit Organizations

General Characteristics

They receive contributions from donors who do not

expect a return of equal financial value

Their operating purpose is not providing goods and

services for profit

They do not have ownership interests as do for- profits

May be governmental or private

Charitable

Educational

Civic organizations

Political parties

Trade organizations

18-2

Learning Objective 18-1

Understand the basic composition

of financial statements produced for a

private not-for-profit entity.

18-3

Not-for-Profit Organizations

Several basic goals form the framework for

generally accepted accounting principles for private

not-for-profit entities, including:

1. Financial statements should focus on the entity as

a whole.

2. Reporting requirements for private not-for-profit

entities should be similar to those applied by forprofit businesses unless critical differences exist in

the nature of the transactions or the

informational needs of financial statement users.

18-4

Not-for-Profit Organizations

FASB Statement (SFAS) 116, “Accounting for

Contributions Received and Contributions Made,”

established guidelines for determining when and

how donations should be recognized and reported.

FASB Statement 117, “Financial Statements of Notfor-Profit Organizations,” specified the required

content and format for financial statements

distributed by these organizations.

18-5

Learning Objective 18-2

Describe the differences in assets that are

unrestricted, temporarily restricted, or

permanently restricted and explain

the method of reporting these categories.

18-6

Financial Reporting

Three critical differences exist between private not-forprofit and for-profit businesses.

1) Donations received by private entities are

transactions that have no counterpart in commercial

businesses.

2) The private entities’ donations often have donorimposed restrictions.

3) No single figure describes performance as effectively

as net income does for commercial entities.

18-7

Learning Objective 18-3

Explain the purpose and

construction of a statement

of functional expenses.

18-8

Statement of Functional Expense

Statement provides a detailed analysis of expenses by

function and object.

Columns represent functions followed by supporting

services.

Categories are the same as those reported on the

statement of activities and column totals agree with

the operating expenses on that statement.

Rows list expenses according to their nature.

Allocation of joint fund-raising & program service

costs is permitted only when certain criteria are met.

18-9

Learning Objective 18-4

Report the various types of

contributions that a private

not-for-profit entity can

receive.

18-10

Accounting for Contributions

Contributions, unconditional transfers of cash or other

resources, are recorded as support at fair value in the

period received.

Restricted gifts are not the same as conditional gifts.

Donors of restricted contributions specify how they are to

be used. These gifts are recognized as temporarily or

permanently restricted assets when a promise is received.

Conditional promises that require a future action before

asset will be transferred from the donor are not

recognized until conditions are met.

18-11

Accounting for Contributions

Donations of works of art and historical treasures are

generally not recognized, but disclosure is required.

Exchanges, such as member dues, are treated as

accrual revenue.

Contributed services are recognized as revenue if one of

two conditions is met:

1. The service creates or enhances a nonfinancial asset,

OR

2. The services are specialized and would have had to be

purchased otherwise.

18-12

Learning Objective 18-5

Understand the impact of a

tax-exempt status.

18-13

Tax-Exempt Status

Not-for-profits may not have to pay federal income taxes

under the following sections of the Internal Revenue Code:

Section 501(c)(3), Section 501(c)(4), Section 501(c)(6)

Exempt from federal taxes.

Often exempt from state taxes.

Donors receive reduction in their taxable income.

Non-profit postal permit reduces the cost of postage.

Cannot engage in political campaign activity.

A not-for-profit must file a Form 990, Return of

Organization Exempt from Income Tax.

18-14

Learning Objective 18-6

Account for both mergers and

acquisitions of not-for-profit

entities.

18-15

Acquisitions

In an Acquisition, one organization obtains control

over another.

Acquired accounts are reported at fair value.

If total acquisition value is greater than the total

value of identifiable assets and liabilities, excess is

reported as goodwill.

If future operations are expected to by primarily

supported by contributions, the excess value is

reported as a reduction in net assets.

18-16

Mergers

A merger occurs when two or more not-forprofit entities form a new not-for-profit and turn

control over to a newly created governing board.

The carryover method is applied in reporting for

mergers.

In a merger, the newly formed not-for-profit

records all accounts at their previous book

values as of the date of the merger.

18-17

Learning Objective 18-7

Describe the unique aspects

of accounting for health care

entities.

18-18

Accounting for

Health Care Organizations

Health Care expenditures account for 17.6% of our Gross

Domestic Product, much of which is paid by third-party

payors.

From a financial reporting perspective, these

organizations have no need to compute and report net

income.

However, readers of the financial statements need a way

to measure the efficiency of the entity’s operations.

FASB requires the reporting of a “performance

indicator” to show operational success or failure.

18-19

Accounting for

Patient Service Revenues

Third-party payors, insurance companies, Medicare,

and Medicaid, not the patient, pay some or all of the cost

of medical services received.

Bad debts and fee reductions for health care providers

can be significantly higher than for other kinds of

businesses.

Entities initially record revenue at standard rates.

Amounts that the entity does not expect to collect is

reported in a manner that best reflects the activities

(contra-revenue or bad debt expense).

18-20

Contractual Agreements with

Third-Party Payors

Insurance companies and Medicare establish

contractual arrangements with health care providers

stipulating rates to be paid for specific services.

The entity must write off the difference in the

amount a patient is charged and the amount the

payor will pay in a contractual adjustment account.

For matching purposes, these reductions must be

recognized in the same period that the patient

service revenue is earned.

18-21