Attachment:Dashboard Diagnostics 20100120

advertisement

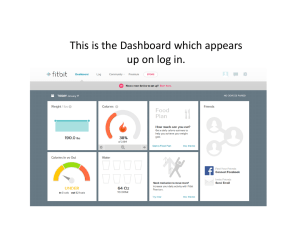

Portfolio Analysis: Dashboard Diagnostics “Moving The Cheese” January 20, 2010 Presented by: Mark Robertson Founder and Managing Partner – www.manifestinvesting.com Dashboard Diagnostics Club History & Characteristics Club Name: “Anonymous” (Cheese Movers) Location: Midwest # of Members: 16 (Ladies) Founded: 1994 The group includes a retired banker, a nurse, retailer, small business owner, dietician, physician’s assistant, teacher and a lawyer ... The genesis of the club is a quest for learning. The ladies wanted to learn more about investing and the world of finance without involving their husbands or stock brokers. 2 Dashboard Diagnostics Club Long-Term Performance (5-Year Returns) 3 Dashboard Diagnostics Current Dashboard (Report Card) 4 Dashboard Diagnostics 1. Return Expectations ... PAR 0% 5% 10% 15% With MIPAR at 8.6%, our target range for the overall portfolio PAR is 13.6-18.6%. Our objectives will include the “hunt” for some higher return candidates. 5 20% Dashboard Diagnostics 2. Quality ... Quality 50 55 60 65 70 75 80 85 As is the case with the typical Better Investing-based investment club, the overall average quality is relatively high (77.7) and the club holds many blue chip companies in its portfolio. The financial strength and EPS Stability ratings are also quite high. 6 90 Dashboard Diagnostics 3. Forecasted Sales Growth ... Sales Growth 3% 5% 7% 9% 11% 13% We pay attention to overall forecasted sales growth for purposes of size diversification. One of the most powerful portfolio design and management parameters is to have enough growth ... aiming for 10-12% as a portfolio average. 7 15% Dashboard Diagnostics Forecasted Sales Growth (Size Diversification) ... 25% 25% Small (>12%) Medium Large (<7%) 50% The general target for size diversification is 25% Large, 50% Medium and 25% Small. Hmmm. We can’t get much closer. 8 Dashboard Diagnostics 14% Financials Energy Healthcare Staples Communications Technology Discretionary Industrials Cash 1% 8% 0% 31% 21% In du C om m D is H un Tec cr M ea Fin h e i U S c at E n t ol ne lth anc er str tili ion tap ati c o o t i i ia r ls als ies ary les ns gy gy are als Opportunity Map & Sector Diversification ... 17% 0% 5% 10% 0% 8% 15% Source: www.manifestinvesting.com/dashboard/1835 9 Dashboard Diagnostics 10 Dashboard Diagnostics 11 Dashboard Diagnostics Medco Health (MHS) Sales Growth Forecast = 8.0% 12 Dashboard Diagnostics Medco Health (MHS) Net Margin Forecast = 2.1% (Value Line is using 2.5%) 13 Dashboard Diagnostics Medco Health (MHS) Projected Average P/E = 20x (based on VL, M*, S&P, SSG ...) 14 Dashboard Diagnostics Medco Health (MHS) 15 Dashboard Diagnostics Medco Health (MHS) ? 16 Dashboard Diagnostics Sell Medco (MHS) and Accumulate 14.87 shares of Strayer (STRA) to bring the holding up to 50 shares and approx 7% of total assets. 17 Dashboard Diagnostics Criteria: PAR = 13.6-19%, Sales Growth > 10%, Quality >70 CASPI > 90 (CAPS All-Stars % Expected to Outperform) 18 Dashboard Diagnostics Jinpan Intl* (JST) 19 Dashboard Diagnostics Techne (TECH) 20 Dashboard Diagnostics Buy 150 shares of Jinpan Intl* (JST) ... Raising the portfolio PAR to 11% and maintaining quality and overall sales growth. 21 Dashboard Diagnostics Think Results. Impact. Before and After. Bigger Picture. Before. After. The sale of MHS and the addition of JST moves the overall portfolio PAR and average sales growth forecast in the right direction. Think cadence and steady discipline. 22 Dashboard Diagnostics Morningstar Wide Moat Leaders (WMW) 23 Dashboard Diagnostics Bivio dozen (1/20/2010) www.manifestinvesting.com/dashboard/12218 Published monthly, the bivio dozen is a listing of the top 1% of all stocks covered by MANIFEST – based on a combination of PAR and Quality. 24