Document

advertisement

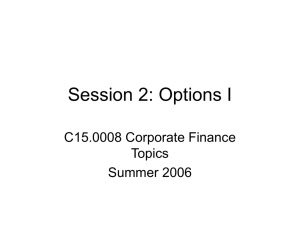

Option Basics Professor XXXXX Course Name / Number Economic Benefits Provided by Options Derivative securities are instruments that derive their value from the value of other assets. Derivatives include options, futures, and swaps. Options and other derivative securities have several important economic functions: – Help bring about more efficient allocation of risk – Save transactions costs…sometimes it is cheaper to trade a derivative than its underlying asset. – Permit investments strategies that would not otherwise be possible 2 Options Vocabulary Long position • The buyer of an option has a long position, and has the ability to exercise the option. Short position • The seller (or writer) of an option has a short position, and must fulfill the contract if the buyer exercises. • As compensation, the seller receives the option premium. Generally, neither trader has any connection to the underlying firm. 3 Options trade on an exchange (such as CBOE) or in the over-the-counter market. Options Vocabulary Call option • Gives the holder the right to purchase an asset at a specified price on or before a certain date Put option • Gives the holder the right to sell as asset at a specified price on or before a certain date Strike price or exercise price: the price specified for purchase or sale in an option contract American or European option 4 • American options allow holders to exercise at any point prior to expiration. • European options allow holders to exercise only on the expiration date. Moneyness of Options S = current stock price X = strike price 5 Call Put S>X In-the-money Out-of-the-money S=X At-the-money At-the-money S<X Out-of-the-money In-the-money Option Quotations • Option quotations specify the per share price for an option contract, which is a contract to buy or sell 100 shares of the underlying stock. – CBOE options expire on the third Saturday of the expiration month. General Expires Strike Electric 6 Call Put 46.31 March 45 4.00 2.38 46.31 June 45 5.88 3.88 46.31 March 50 1.50 5.25 46.31 June 50 3.50 6.50 In-the-money calls Out-of-the-money puts In-the-money puts Out-of-the-money calls Intrinsic and Time Value of Options 7 Intrinsic value • For in the money options: the difference between the current price of the underlying asset and the strike price • For out of the money options: the intrinsic value is zero Time value • The difference between the option’s intrinsic value and its market price (premium) • Consider the March call with $45 strike price from previous table: – Intrinsic value = $46.31 - $45 = $1.31 – Time value considers the size of the option’s premium: $4 - $1.31 = $2.69. Payoff Diagrams Show the value of an option, or the value at expiration Y-axis plots exercise value or “intrinsic value.” X-axis plots price of underlying asset. Long and short positions Use payoff diagrams for: 8 Gross and net positions (the net positions subtract the option premium) Payoff: the price of the option at expiration date Long Call Option Payoffs Payoff at Expiration x = $50, premium = $5 Gross payoff slope = 1 -5 50 Net payoff 9 55 stock price Short Call Option Payoffs x = $50, premium = $5 Payoff at expiration +5 10 50 Gross payoff 55 stock price Net payoff slope = -1 • Both long and short positions have zero net payoff at a price of $55. – At a price of $45, the buyer loses $5, the seller gains $5. – At a price of $65, the buyer gains $10, the seller loses $10. Long Put Option Payoffs x = 50, premium = $4 50 Payoff at expiration 46 11 Gross payoff Price of stock -4 46 50 Net payoff Short Put Option Payoffs Payoff at expiration x = 50, premium = $4 12 Net payoff 4 46 50 Gross payoff -50 Stock price Portfolios of Options Look at payoff diagrams for combinations of options rather than just one. Diagrams show the range of potential strategies made possible by options. Some positions, in combination with other positions, can be a form of portfolio insurance. An example: a portfolio that allows an investor to speculate on the volatility (or lack thereof) of a stock rather than betting on which direction it will move 13 Long Straddle Call x = 60, premium = $5, Put x = 60, premium = $4 Gross payoff Net payoff 60 51 14 69 -9 • Buy a put and a call of the same stock at the same strike price and the same expiration date. – Profits come with large price changes in either direction, so a straddle represents a volatility position. – Positive net payoff results if the price rises above $69 or falls below $51. Short Straddle Call x = 60, premium = $5, Put x = 60, premium = $4 +9 51 69 60 Net payoff Gross payoff 15 • Sell a put and a call of the same stock at the same strike price and the same expiration date. – Provides opposite payoffs of the long straddle. – Profits result if the stock price stays between $51 and $69. Other Option Portfolio Payoffs Now look at portfolios containing options, stocks, and bonds. Looking at these payoffs will help lead us to an important option pricing relationship: put-call parity. Construct portfolios that include options, stocks and bonds. Stock and put options 16 Bond and call options Payoff at expiration Gross Payoff of Stock + Put $X = strike price of put x x 17 Stock price • This position allows an investor to profit if stock price rises above $X. • If stock price falls below $X the portfolio provides protection in that the put option allows the investor to sell at a price no lower than $X. Payoff at expiration Gross Payoff of Bond + Call $X = strike price of call and face value of bond x x 18 stock price • The bond assures a minimum payoff of $X Thisallows payoff the one identical! • The call fordiagram a higherand payoff if thebefore stock are price rises Put-Call Parity Future payoffs of “stock+put” are identical to payoffs of “bond+call” provided. – – – – – Put and call have same exercise price and expiration date. The underlying stock pays no dividends during the life of the options. Put and call are European options. Bond is risk-free, zero-coupon, FV = strike (X). Bond matures when options expire. If two assets, A and B, have the same future payoffs with certainty, then they should sell for the same price now. 19 Price of put + price of stock = Price of call + price of bond P+S=C+B P + S = C + PV(X) Using Put-Call Parity Put-call parity relationship can be used in: – Finding arbitrage opportunities – Corporate finance applications Using put-call parity, we can construct synthetic positions • • • • Long put: P = C + PV(X) – S Long stock: S = C + PV(X) – P Short stock: -S = - C - PV(X) + P Long call: C = S + P – PV(X) In these equations “+” means “buy” and “-” means “sell” or “short sell.” 20 For example, the first line shows that buying a put is equivalent to simultaneously buying a call and a bond and shorting the stock. Put-Call Parity and Arbitrage Assumptions • Stock price = $46; call price (X = $45) $5. • Options expire in 3 months. • Risk-free rate for 3-month T-bill is 5%. P+ =C ++ B ($45/(1.05).25) P +S$46 = $5 P = $3.45 What if the 3-month put option with X = $45 actually sells for $4 rather than $3.45? The put is overpriced, so you want to sell it. 21 To offset the risk you must buy a synthetic put: P = B + C – S. Put-Call Parity Arbitrage Sell a put for $4, buy a bond for $44.45, buy a call for $5, and short the stock for $46. If stock price is Short put Long bond Long call Short Stock Net value is 35 -10 45 0 -35 0 40 -5 45 0 -40 0 45 0 45 0 -45 0 50 0 45 5 -50 0 55 0 45 10 -55 0 Risk-free profit of $0.55 because we sold one real put and bought one “synthetic put” with identical risk. 22 Put-Call Parity Corporate Finance Applications P-C parity offers alternative ways to get something done financially if the most obvious approach is blocked. • An example… • Netscape went public at $26/share, but price immediately rose into the mid $50s. – In pre-IPO phase, Times-Mirror bought 2 million shares of Netscape at $2 per share. – In exchange for the good price, TM agreed not to sell their Netscape shares for two years. What problem does TM face once Netscape has gone public? 23 Times-Mirror and Netscape TM would like to sell their NSCP shares but they can’t…or can they? 1. Issued bond with face value equal to one Netscape share. 2. TM held the option to pay back investors one Netscape share when the bonds matured (a put option). 3. Investors held the option to demand one Netscape share from TM in exchange for par value (a call option). 24 d. Net transaction: -B – P + C….but this just equals –S, a synthetic sale of stock ! Factors Affecting Option Prices (holding other factors equal) 25 Price of underlying asset • Asset price and call price are positively related. • Asset price and put price are negatively related. Time to expiration • More time usually makes options more valuable. Strike price • Higher X means higher put price; lower X means higher call price. Interest rate • Calls: higher “r” means higher call value • Puts: higher “r” reduces put value Volatility and Option Prices Suppose a stock now worth $40 might increase or decrease in value by $10. Call option with X = $40 will pay $10 or $0 Now suppose a stock worth $40 might increase or decrease in value by $20. Call option with X = $40 will pay $20 or $0 The 2nd call option is more valuable…upside is better, downside the same as the 1st option. 26 Binomial Option Pricing An extremely flexible tool for valuing all types of options, real and financial – Presumes stock price moves either up or down in discrete steps over a given time interval – Derives an option price using the principle of “no arbitrage” a. Find a hedged portfolio Portfolio of stock and call options that gives a constant payoff in the future regardless of whether the stock goes up or down 27 Mixture of stock and options in this portfolio is called hedge ratio. Calculating Binomial Option Prices b. If the hedged portfolio offers risk-free payoff, determine the portfolio’s current value by discounting future payoff at the risk-free rate. c. Once we know the value of the portfolio, can separate this value into its component pieces. • The value of the stock and the value of the option Three step procedure 28 • Step 1: Create a risk-free portfolio. • Step 2: Calculate the present value of the portfolio. • Step 3: Determine the price of the option. An Example Stock price now Price in one year $60 $50 $40 Assume: rf = 5% 29 Determine price of 1-year call option with x = $50. Step 1 Calculate option’s payoffs for each possible future stock price. – - If stock goes to $60, option pays off $10. – If stock goes to $40, option pays off $0. Determine the composition of the hedged portfolio…start by assuming it contains one share of stock and “h” call options. 30 • Portfolio value = 1 share + h options • If stock goes up, portfolio will pay: • $60 + $10 x h. • If stock goes down, portfolio will pay: • $40 + $0 x h. Step 1 To determine the composition of the hedged portfolio, find the number of options that equates the payoffs: • $60 + $10h = $40 + $0h h = -2 Hedged portfolio is long one share of stock and short two call options. Determine the exact dollar payoff of the hedged portfolio: • $60 + $10h = $40 + $0h 31 Payoff = $40 Thus, one stock plus two short call options replicates the payoffs of a one-year, risk-free bond with a face value of $40. Steps 2 and 3 Determine present value of hedged portfolio: • Payoff = $40 • rf = 5% PV = $40/1.05 = $38.10 Separate the current value of the portfolio into its component parts: • $50 of this value is the current price of the stock. • The difference between $38.10 and $50 is the revenue received for the two call options sold. • $50 – 2 x call price = $38.10 Call price = $5.95 32 A More Reasonable Approach 60 57.50 55 50 52.50 55 52.50 50 47.50 50 47.50 45 45 42.50 40 3 months 3 months 3 months 3 months 33 4 periods, 3 months each Option Basics Options: contracts that grant the buyer the right to buy or sell stock at a fixed price. Options provide real economic benefit to society. Put-call parity establishes a link between market prices of calls, puts, shares, and bonds. Factors that affect option prices: underlying price, time to maturity, strike price, interest rate and volatility.