Options 2

advertisement

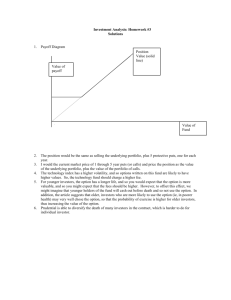

Session 2: Options I C15.0008 Corporate Finance Topics Summer 2006 Outline • • • • Call and put options The law of one price Put-call parity Binomial valuation Options, Options Everywhere! • Compensation—employee stock options • Investment/hedging—exchange traded and OTC options on stocks, indexes, bonds, currencies, commodities, etc., exotics • Embedded options—callable bonds, convertible bonds, convertible preferred stock, mortgagebacked securities • Equity and debt as options on the firm • Real options—projects as options Example.. Options The right, but not the obligation to buy (call) or sell (put) an asset at a fixed price on or before a given date. Terminology: Strike/Exercise Price Expiration Date American/European In-/At-/Out-of-the-Money An Equity Call Option • Notation: C(S,E,t) • Definition: the right to purchase one share of stock (S), at the exercise price (E), at or before expiration (t periods to expiration). Where Do Options Come From? • Publicly-traded equity options are not issued by the corresponding companies • An options transaction is simply a transaction between 2 individuals (the buyer, who is long the option, and the writer, who is short the option) • Exercising the option has no effect on the company (on shares outstanding or cash flow), only on the counterparty Numerical example • Call option • Put option Option Values at Expiration • At expiration date T, the underlying (stock) has market price ST • A call option with exercise price E has intrinsic value (“payoff to holder”) ST E if ST E payoff max( 0, ST E ) if ST E 0 • A put option with exercise price E has intrinsic value (“payoff to holder”) E ST payoff 0 if ST E if ST E max( 0, E ST ) Call Option Payoffs Long Call Short Call Payoff Payoff E ST E ST Put Option Payoffs Long Put Short Put Payoff Payoff E E E ST E ST Other Relevant Payoffs Risk-Free Zero Coupon Bond Maturity T, Face Amount E Stock Payoff Payoff E ST ST The Law of One Price • If 2 securities/portfolios have the same payoff then they must have the same price • Why? Otherwise it would be possible to make an arbitrage profit – Sell the expensive portfolio, buy the cheap portfolio – The payoffs in the future cancel, but the strategy generates a positive cash flow today (a money machine) Put-Call Parity Stock + Put Payoff Payoff = E E ST E ST E ST Call +Bond Payoff = E ST Payoff E Put-Call Parity Payoffs: Stock + Put = Call + Bond Prices: Stock + Put = Call + Bond Stock = Call – Put + Bond S = C – P + PV(E) Introduction to binomial trees What is an Option Worth? Binomial Valuation Consider a world in which the stock can take on only 2 possible values at the expiration date of the option. In this world, the option payoff will also have 2 possible values. This payoff can be replicated by a portfolio of stock and risk-free bonds. Consequently, the value of the option must be the value of the replicating portfolio. Payoffs Stock Bond (rF=2%) 137 100 102 100 73 Call (E=105) 32 C 102 1-year call option, S=100, E=105, rF=2% (annual) 1 step per year Can the call option payoffs be replicated? 0 Replicating Strategy Buy ½ share of stock, borrow $35.78 (at the risk-free rate). Cost (1/2)100 - 35.78 = 14.22 Payoff (½)137 - (1.02) 35.78 = 32 The value of the option is $14.22! Payoff (½)73 - (1.02) 35.78 = 0 Solving for the Replicating Strategy The call option is equivalent to a levered position in the stock (i.e., a position in the stock financed by borrowing). 137 H - 1.02 B = 32 73 H - 1.02 B = 0 H (delta) = ½ = (C+ - C-)/(S+ - S-) B = (S+ H - C+ )/(1+ rF) = 35.78 Note: the value is (apparently) independent of probabilities and preferences! Multi-Period Replication 156.25 Stock 125 Call (E=105) C+ 100 100 51.25 80 0 C- 64 0 1-year call option, S=100, E=105, rF=1% (semi-annual) 2 steps per year Solving Backwards • Start at the end of the tree with each 1-step binomial model and solve for the call value 1 period before the end 156.25 51.25 C+ 125 100 rF = 1% 0 • Solution: H = 0.911, B = 90.21 C+ = 23.68 • C- = 0 (obviously?!) The Answer • Use these call values to solve the first 1-step binomial model 125 23.68 rF = 1% 100 80 0 • Solution: H = 0.526, B = 41.68 C = 10.94 • The multi-period replicating strategy has no intermediate cash flows Building The Tree S++ S+ = uS S+ S- = dS S+- S S++ = uuS S-- = ddS SS-- S+- = S-+ = duS = S The Tree! u =1.25, d = 0.8 156.25 125 100 100 80 64 Binomial Replication • The idea of binomial valuation via replication is incredibly general. • If you can write down a binomial asset value tree, then any (derivative) asset whose payoffs can be written on this tree can be valued by replicating the payoffs using the original asset and a risk-free, zero-coupon bond. An American Put Option What is the value of a 1-year put option with exercise price 105 on a stock with current price 100? The option can only be exercised now, in 6 months time, or at expiration. = 31.5573% rF = 1% (per 6-month period) Multi-Period Replication 156.25 Stock 125 Put (E=105) P+ 100 100 0 80 5 P- 64 41 Solving Backwards 156.25 125 0 P+ rF = 1% 100 5 H = -0.089, B = -13.75 P+ = 2.64 100 80 5 P- 64 rF = 1% 41 ------- 25!! H = -1, B = -103.96 P- = 23.96 The put is worth more dead (exercised) than alive! The Answer 125 2.64 rF = 1% 100 80 25.00 H = -0.497, B = -64.11 P = 14.42 Assignments • Reading – RWJ: Chapters 8.1, 8.4, 22.12, 23.2, 23.4 – Problems: 22.11, 22.20, 22.23, 23.3, 23.4, 23.5 • Problem sets – Problem Set 1 due in 1 week