Chapter 14 Advanced Techniques for Profit Maximization

advertisement

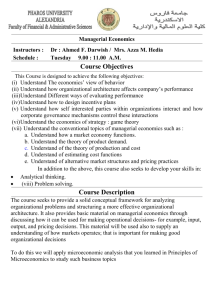

Managerial Economics eighth edition Thomas Maurice Chapter 14 Advanced Techniques for Profit Maximization The McGraw-Hill Series 2 Managerial Economics Advanced Techniques for Profit Maximization • Multiplant firms • Cost-plus pricing • Multiple markets • Price discrimination • Multiple products • Strategic entry deterrence 2 The McGraw-Hill Series 3 Managerial Economics Multiple Plants • If a firm produces in 2 plants, A & B • Allocate production so MCA = MCB • Optimal total output is that for which MR = MCT • For profit-maximization, allocate total output so that MR = MCT = MCA = MCB 3 The McGraw-Hill Series 4 Managerial Economics A Multiplant Firm 4 The McGraw-Hill Series (Figure 14.1) 5 Managerial Economics Cost-Plus Pricing • Common technique for pricing when firms do not wish to estimate demand & cost conditions to apply the MR = MC rule for profit-maximization • Price charged represents a markup (margin) over average cost: P = (1 + m)ATC Where m is the markup on unit cost 5 The McGraw-Hill Series 6 Managerial Economics Cost-Plus Pricing • Does not usually produce profitmaximizing price • Fails to incorporate information on demand & marginal revenue • Uses average, not marginal, cost 6 The McGraw-Hill Series 7 Managerial Economics Practical Problems with Cost-Plus Pricing (Figure 14.3) 7 The McGraw-Hill Series 8 Managerial Economics Cost-Plus Pricing (Constant Costs) • Yields profit-maximizing price when optimal markup, m*, is applied to AVC: P = (1 + m*)AVC • And optimal markup is chosen according to the following relation: 1 m 1 E Where E* is price elasticity at profit-maximizing point of firm’s demand 8 The McGraw-Hill Series 9 Managerial Economics Cost-Plus Pricing (Constant Costs) • When demand is linear & costs are constant (SMC = AVC), profitmaximizing value for E* is: A E 1 0.5( AVC A ) Where A is price-intercept of linear demand curve & AVC is constant 9 The McGraw-Hill Series 10 Managerial Economics Multiple Markets • If a firm sells in two markets, 1 & 2 • Allocate output (sales) so MR1 = MR2 • Optimal total output is that for which MRT = MC • For profit-maximization, allocate sales of total output so that MRT = MC = MR1 = MR2 10 The McGraw-Hill Series 11 Managerial Economics Price Discrimination • Method in which firms charge different groups of customers different prices for the same good or service 11 The McGraw-Hill Series 12 Managerial Economics Deriving Total Marginal Revenue (Figure 14.4) 12 The McGraw-Hill Series 13 Managerial Economics Profit-Maximization with Two Markets (Figure 14.5) 13 The McGraw-Hill Series 14 Managerial Economics Multiple Products • Related in consumption • For two products, X & Y, produce & sell levels of output for which MRX = MCX and MRY = MCY • MRX is a function not only of QX but also of QY (as is MRY) -- conditions must be satisfied simultaneously 14 The McGraw-Hill Series 15 Managerial Economics Multiple Products • Related in production as substitutes • For two products, X & Y, allocate production facility so that MRPX = MRPY • Optimal level of facility usage in the long run is where MRPT = MC • For profit-maximization: MRPT = MC = MRPX = MRPY 15 The McGraw-Hill Series 16 Managerial Economics Multiple Products • Related in production as complements • To maximize profit, set joint marginal revenue equal to marginal cost: MRJ = MC • If profit-maximizing level of joint production exceeds output where MRJ kinks, units beyond zero MR are disposed of rather than sold • Profit-maximizing prices are found using demand functions for the two goods 16 The McGraw-Hill Series 17 Managerial Economics Profit-Maximizing Allocation of Production Facilities (Figure 14.7) 17 The McGraw-Hill Series 18 Managerial Economics Profit-Maximization with Joint Products (Figure 14.9) 18 The McGraw-Hill Series 19 Managerial Economics Strategic Entry Deterrence • Established firm(s) makes strategic moves designed to discourage or prevent entry of new firm(s) into a market • Two types of strategic moves • Limit pricing • Capacity expansion 19 The McGraw-Hill Series 20 Managerial Economics Limit Pricing • Established firm(s) commits to setting price below profitmaximizing level to prevent entry • Under certain circumstances, an oligopolist (or monopolist), may make a credible commitment to charge a lower price forever 20 The McGraw-Hill Series 21 Managerial Economics Limit Pricing: Entry Deterred (Figure 14.11) 21 The McGraw-Hill Series 22 Managerial Economics Limit Pricing: Entry Occurs (Figure 14.12) 22 The McGraw-Hill Series 23 Managerial Economics Capacity Expansion • Established firm(s) can make the threat of a price cut credible by irreversibly increasing plant capacity • When increasing capacity results in lower marginal costs of production, the established firm’s best response to entry of a new firm may be to increase its own level of production • Requires established firm to cut its price to sell extra output 23 The McGraw-Hill Series 24 Managerial Economics Excess Capacity Barrier to Entry (Figure 14.13) 24 The McGraw-Hill Series 25 Managerial Economics Excess Capacity Barrier to Entry (Figure 14.13) 25 The McGraw-Hill Series