File

advertisement

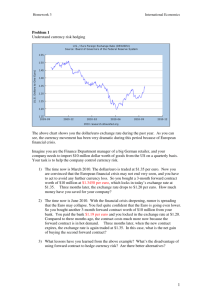

Running head: CASE STUDY 2 1 Case Study 2: Exacta, s. a. Stanley J. Cochran & Allan Murdock MGMT 575 – Financial Analysis and Management 2 October 28, 2012 Mohamed Elaodiy Southwestern College Professional Studies Running head: CASE STUDY 2 2 Abstract Exacta, s. a. is a French company that is considering expanding into the United States. Most of the products they make are sold in the European Union but their business in the U.S. is growing. Exacta makes precision machine tools and part of the production from the U.S. will be exported. Exacta plans to build the plant in South Carolina with a total invest of $380 million. The expected date for the start of production will be in the year 2012. Exacta expects revenues to be around $420 million with an operating net profit around $52 million per year. The CEO M. B. Bardot is concerned about the large investment being a risk if the dollar falls compared to the euro. Exacta must look at this project to make sure it is good project and they must look at protecting their investment against the possibility of the value of the dollar falling compared to the euro. Running head: CASE STUDY 2 3 Mini Case 2: Exacta, s. a. Exacta is a French company that is expanding into the United States market by putting a company in South Carolina. The investment will take $380 million with expected revenues of $420 million. Exacta expects to make around $52 million in net profits from producing precision machine tools. Exacta has been exporting around $320 million to the U. S. already. The CEO M. B. Bardot is concerned about the potential loss of revenue if the value of the dollar were to fall compared to the euro. About two-thirds of the revenue will come from within the U. S. and onethird will be exported. Exacta’s leadership is excited about the project but they are also worried about the currency exchange rate risks. M. Pangloss, the financial director, has reassured the leadership that they have considered the problems related to the difference in currency. Exacta can look at various ways to protect the company from losing money because of the dollar falling relative to the euro. Exacta can look at different ways of hedging to protect them from any potential possess. Risks of Exchange Rates The CEO of Exacta is worried about losing money due to the exchange rate of the euro compared to the dollar. Exacta having a company in the U.S. must decide to bill customers in dollars or euro’s. Exacta is concerned that if the value of the dollar decreases compared to the euro they could end up losing profits. There are actions the Exacta can take to hedge off any exchange rate problems. The company must look at how the dollar has performed against the euro and see if inflation has an impact or the bottom line. It is important when investing the capital at the beginning of the project to make sure that when building in the U.S. that the exchange rate does not end up costing the company more than projected. Running head: CASE STUDY 2 4 When the project to build the facility in South Carolina starts Exacta can hedge their losses by entering into a forward contract for up to one year and set the exchange rate for the difference the dollar is compared to the euro. This will help Exacta control the cost of building the South Carolina plant. A forward contract is the set price you agree to pay for dollars compared to euros at a later date (Brealey, Myers & Allen, 2011, p 677). The company may choose to buy the money with the forward contract to help eliminate any risks. Spot Market Exacta should look at the exchange rate and evaluate if the company should make arrangements for hedging their risks of financial loses. First Exacta needs to look at the current exchange rate and evaluate the difference of today’s price on the spot exchange compared to the futures exchange rates. Exacta can compare the euro against the dollar by using the forward annual discount rate formula of 4 x (spot rate/12 month forward rate -1). From Brealey, Myers & Allen, the table on page 677, table 27.1 we can get the spot rate and the 12 month forward rate and see the difference of the euro and see how much the market changes. From the chart we know the spot rate is 1.4201 and the 12 month rate is 1.4207. 4 x (1.4201/1.4207-1) = -0.0014. This shows that there is very little change over the full 12 months, and if the dollar over 12 months is this low, then Exacta can offset almost any exchange rate risks by purchasing a 12 month forward contract. If we look at the past years performance of change of the dollar against the euro we can see where there is more of a change. The chart below shows this past years performance of the dollar against the euro. Running head: CASE STUDY 2 5 Chart: ("X-rates currency calculator," 2012) From October 30, 2011 it was 1.4145 and on October 27, 2012 it was 1.2939. Using the formula we see 4*(1.4145/1.2939-1) = .0037% change. This gives more reasons to protect form the currency risks. Hedging the Risks Sudden exchange rate changes can cause a company to lose a lot of profits. The offset any potential losses the company must consider hedging the currency risks associated with foreign markets. Hedging against currency losses means buying protection from potential changes in the spot exchange market. This is like buying insurance to cover any future losses for the company. This insurance allows the company to concentrate on other aspects of running a Running head: CASE STUDY 2 6 business. It allows them to concentrate on the main business, it does not cost much, and the exchange market is efficient (Brealey, Myers & Allen, 2011, p 687). Conclusion Exacta S.A. should hedge against the loan to insure that they are getting the value of their investment in the currency exchange that will take place in the future. Using a forward contract will help against any loss in the economy of the U.S., if the economy would go into a recession or have a natural disaster that could destroy the facilities. Leveraging against the risk associated with any occurrence that Exacta S.A. cannot control will relieve the amount of loss that can be incurred. Hedging at any risk is essential when doing business in other countries. Nothing is ever guaranteed when starting a project that will have a large investment to be made. (Brealy, Myers & Allen, 2011) Running head: CASE STUDY 2 Works Citied: Brealey, R. A., Myers, S. C., & Allen, F. (2011). Principles of corporate finance. (10 ed.). New York, NY: McGraw-Hill. X-rates currency calculator. (2012, October 29). Retrieved from http://www.xrates.com/graph/?from=EUR&to=USD&amount=1.00 7