ncci-050814 - Insurance Information Institute

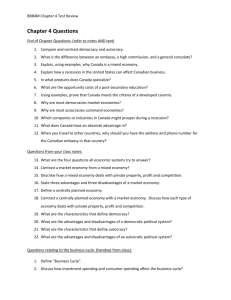

advertisement

The Rough and Tumble Recovery How the Great Recession Upset the Workers Comp Apple Cart NCCI Annual Issues Symposium Orlando, FL May 8, 2014 Download at www.iii.org/presentations Robert P. Hartwig, Ph.D., CPCU, President & Economist Insurance Information Institute 110 William Street New York, NY 10038 Tel: 212.346.5520 Cell: 917.453.1885 bobh@iii.org www.iii.org P/C Insurance Industry Financial Overview 2013: Best Year in the Post-Crisis Era Lower CATs, Strong Markets Workers Comp Improvement Helped Too 2 $63,784 $35,074 $19,456 $3,043 $28,672 $35,204 $62,496 Net income in 2013 was up substantially (+81.9%) from 2012 $44,155 $38,501 $30,029 $20,559 $20,598 $10,870 $3,046 $10,000 $19,316 $20,000 $5,840 $30,000 $14,178 $40,000 $21,865 $50,000 $30,773 $60,000 2013 ROAS was 10.3% $36,819 $70,000 2005 ROE*= 9.6% 2006 ROE = 12.7% 2007 ROE = 10.9% 2008 ROE = 0.1% 2009 ROE = 5.0% 2010 ROE = 6.6% 2011 ROAS1 = 3.5% 2012 ROAS1 = 6.1% 2013 ROAS1 = 10.3% $24,404 $80,000 $65,777 P/C Net Income After Taxes 1991–2013 ($ Millions) $0 -$10,000 -$6,970 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 •ROE figures are GAAP; 1Return on avg. surplus. Excluding Mortgage & Financial Guaranty insurers yields a 9.8% ROAS in 2013, 6.3% ROAS in 2012, 4.7% ROAS for 2011, 7.6% for 2010 and 7.4% for 2009. Sources: A.M. Best, ISO, Insurance Information Institute 13 Profitability Peaks & Troughs in the P/C Insurance Industry, 1975 – 2013* ROE 25% 1977:19.0% 1987:17.3% 20% 2006:12.7% 1997:11.6% 2013: 9.8 % 15% 9 Years 10% 5% 2011: 4.7% 0% 1975: 2.4% 1984: 1.8% 1992: 4.5% 2001: -1.2% 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 -5% *Profitability = P/C insurer ROEs. 2011-13 figures are estimates based on ROAS data. Note: Data for 2008-2013 exclude mortgage and financial guaranty insurers. Source: Insurance Information Institute; NAIC, ISO, A.M. Best. P/C Insurance Industry Combined Ratio, 2001–2013* As Recently as 2001, Insurers Paid Out Nearly $1.16 for Every $1 in Earned Premiums Heavy Use of Reinsurance Lowered Net Losses Relatively Low CAT Losses, Reserve Releases Relatively Low CAT Losses, Reserve Releases 120 115.8 110 Best Combined Ratio Since 1949 (87.6) Cyclical Deterioration Higher CAT Losses, Shrinking Reserve Releases, Toll of Soft Market Avg. CAT Losses, More Reserve Releases 107.5 Sandy Impacts Lower CAT Losses 106.3 101.0 100.8 100.1 99.3 98.4 100 102.4 100.8 96.7 95.7 92.6 90 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 * Excludes Mortgage & Financial Guaranty insurers 2008--2012. Including M&FG, 2008=105.1, 2009=100.7, 2010=102.4, 2011=108.1; 2012:=103.2; 2013: = 96.1. Sources: A.M. Best, ISO. 5 Underwriting Gain (Loss) 1975–2013* ($ Billions) $35 $25 Underwriting profit in 2013 totaled $15.5B Cumulative underwriting deficit from 1975 through 2013 is $493B $15 $5 -$5 -$15 -$25 High cat losses in 2011 led to the highest underwriting loss since 2002 -$35 -$45 -$55 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 Large Underwriting Losses Are NOT Sustainable in Current Investment Environment * Includes mortgage and financial guaranty insurers in all years. Sources: A.M. Best, ISO; Insurance Information Institute. Policyholder Surplus, 2006:Q4–2013:Q4 ($ Billions) Drop due to near-record 2011 CAT losses 2007:Q3 Pre-Crisis Peak $700 $653.3 $650 $624.4 $614.0 $607.7 $600 $559.2 $521.8$517.9$515.6 $512.8 $505.0 $496.6 $487.1 $478.5 $490.8 $463.0 13:Q4 13:Q3 13:Q2 13:Q1 12:Q4 12:Q3 12:Q2 12:Q1 11:Q4 10:Q4 10:Q3 10:Q2 10:Q1 09:Q4 09:Q1 08:Q4 08:Q3 08:Q2 08:Q1 07:Q4 07:Q3 07:Q2 07:Q1 06:Q4 11:Q3 Surplus as of 12/31/13 stood at a record high $653.3B $437.1 11:Q2 $450 11:Q1 $455.6 $400 $550.3 $538.6 $511.5 09:Q3 $500 $559.1 $544.8 $540.7 $530.5 09:Q2 $550 $583.5$586.9 $570.7 $567.8 $566.5 The industry now has $1 of surplus for every $0.73 of NPW, close to the strongest claims-paying status in its history. 2010:Q1 data includes $22.5B of paid-in capital from a holding company parent for one insurer’s investment in a non-insurance business . Sources: ISO, A.M .Best. The P/C insurance industry entered 2014 in very strong financial condition. 7 Net Premium Growth (All P/C Lines): Annual Change, 1971—2014F (Percent) 1975-78 1984-87 25% 2000-03 Net Written Premiums Fell 0.7% in 2007 (First Decline Since 1943) by 2.0% in 2008, and 4.2% in 2009, the First 3Year Decline Since 1930-33. 20% 2014F: 4.0% 15% 2013: 4.6% 2012: +4.3% 10% 5% 0% 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 -5% Shaded areas denote “hard market” periods Sources: A.M. Best (historical and forecast), ISO, Insurance Information Institute. 8 Direct Premiums Written: Workers’ Comp Percent Change by State, 2007-2012* -10.2 -10.8 -11.6 TX MD -5.4 PA NM -4.7 VA -9.7 -3.9 IL AK -3.6 MN -9.2 -2.7 MI US -2.5 NJ -9.1 -1.8 WI VT -1.1 IN NH -0.3 0.2 CA NE 0.8 CT KS NY SD 4.0 12.4 18.8 21.7 IA -6.8 Only 5 states showed positive growth in the workers comp line from 2007 – 2012, the result of large job and payroll losses and a soft market. Even through 2013, fewer than half the states will have recouped DPW losses 27.9 30 25 20 15 10 5 0 -5 -10 -15 -20 -25 -30 OK Pecent change (%) Top 25 States *Excludes monopolistic fund states: ND, OH, WA, WY as well as WV, which transitioned to a competitive structure during this period. Sources: SNL Financial LC.; Insurance Information Institute. 9 Direct Premiums Written: Worker’s Comp Percent Change by State, 2007-2012* *Excludes monopolistic fund states: ND, OH, WA, WY as well as WV, which transitioned to a competitive structure during this period. Sources: SNL Financial LC.; Insurance Information Institute. NV DE HI FL OR UT AZ -49.1 -43.4 -38.3 -35.1 -33.9 -26.0 KY MO AL SC NC ME LA ID AR GA MS RI MA DC States with the poorest performing economies also produced the most negative net change in premiums of the past 5 years -31.8 -25.5 CO -27.4 -24.6 MT -21.9 -20.8 -19.9 -18.3 -17.8 -16.9 -16.6 -16.0 -15.9 -15.5 -15.4 -14.3 -12.9 -12.1 -10 -15 -20 -25 -30 -35 -40 -45 -50 -55 -60 TN Pecent change (%) Bottom 25 States 10 Winners, Losers and the “Great Recession” Reshuffling the Workers Comp Exposure Deck 11 Labor Force Participation Rate, Jan. 2002—April 2014* Labor Force Participation as a % of Population 68 Labor force participation continues to shrink despite a falling unemployment rate 67 66 65 64 Large numbers of people are exiting (or not returning to the labor force) 63 62 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 *Defined as the percentage of working age persons in the population who are employed or actively seeking work. Note: Recessions indicated by gray shaded columns. Sources: US Bureau of Labor Statistics at http://www.bls.gov/data/; National Bureau of Economic Research (recession dates); Insurance Information Institute. '14 12 Labor Force Participation Rate by Gender, 1948—2013 (Percent) 86.6% or working age men participated in the labor force in 1948 compared to 32.7% or women 100% 90% By 2013, the labor force participation rate for men had declined to 69.7% while the participation rate for women had risen to 57.2% 80% 70% 60% 50% 40% 30% 20% 10% Men Women By 2013, 57.2% of working age women participated in the labor force, up from 32.7% in 1948 but down from its all time high of 60.0% in 1999 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 0% Sources: U.S. Bureau of Labor Statistics; Insurance Information Institute. 14 Gender Wage Gap: Ratio of Median Annual Earnings of Women to Men, 1955 – 2012* Full-Time, Year-Round Workers In 2012, women earned 76.5% of what men earned on an annual basis (Percent) 80% 75% 70% In 1955, women earned 63.9% of what men earned 65% 60% 55% But by 1975, women were earning just 58.8% of what men earned Over the next 20+ years the gender gap narrowed substantially but reached a plateau of about 77% of men’s earnings where it remains today 50% 55 60 65 70 75 80 85 90 95 00 01 02 03 04 05 06 07 08 09 10 11 12 *Latest available. Sources: U.S. Bureau of Labor Statistics; Insurance Information Institute. 15 Unemployment Rates by Gender and Education: 2006, 2010 and 2013 Unemployment Rate (%) 2006 2010 2013 Men were hit harder and continue to do worse than women in the job market. Women are likely to do better than men for the indefinite future. 16% Workers lacking a college degree suffer from much higher rates of unemployment 13.9% 14% 11.5% 12% 10% 9.6% 8% 10.5% 7.6% 7.4% 9.7% 8.6% 7.1% 7.9% 5.9% 6% 4.6% 4% 4.6% 4.6% 4.1% 6.0% 5.0% 2.2% 2% 0% All Men Women Source: U.S. Bureau of Labor Statistics; Insurance Information Institute. Less than HS HS Diploma, Diploma No College Bachelor's Degree or Higher 17 Labor Force Participation Rate by Age: 2006, 2010 and 2013 7.9% 7.4% 10% 6.4% 19.2% 32.1% 18.0% 20% 17.0% 30% 31.5% 81.0% 74.6% Labor force participation rates have increased for older workers 29.0% 40% 34.4% 50% 35.0% 43.7% 60% 63.2% 70% 64.7% 80% 66.2% 90% 82.2% 2013 82.9% 2010 82.0% 2006 71.4% Labor force participation rates remain below prerecession levels for young and middleage workers Labor Force Participation Rate (%) 0% All 16-19 20-24 25-54 65-69 70-74 75+ Age Source: U.S. Bureau of Labor Statistics; Insurance Information Institute. 18 Labor Force Participation Rates for Workers Age 62-74 by Gender and Education* A worker with an professional or doctoral degree is twice as likely likely to be working Participation Rate Women Men 65% 70% 60% 49% 50% 39% 40% 30% 52% 32% 25% A worker with a bachelors degree is about 50% more likely to be working 20% 10% 0% HS Diploma Bachelors Degree Professional Degree or Doctorate Better educated workers are far more likely to work in their 60s and 70s *Data are for 2009-10. Source: Gary Burtless, Brookings Institution and The Economist, April 24, 2014. 19 Unemployment Rates by Age and Race: 2006, 2010 and 2013 Unemployment among younger workers remains a chronic problem 6.5% 4.0% 8.7% 9.1% 12.5% 16.0% 9.0% 5.2% 5% 4.6% 10% 9.6% 15% 7.4% 20% 10.0% 15.3% 25% 18.0% 30% 13.5% 2013 22.9% 2010 24.9% 2006 Unemployment among some minority groups remains far above prerecession levels 13.1% Unemployment Rate (%) 0% All 16-19 16-24 Source: U.S. Bureau of Labor Statistics; Insurance Information Institute. Black or African American Hispanic or Latino White 20 The BIG Picture Labor Market Trends RECOVERY MODE The Last Job Lost During the Recession Was Recouped in March Where Do the Economy and Workers Comp Go From Here? 21 US Real GDP Growth* -7% 5.0% -0.3% The remainder of 2014 into 2015 are expected to see a modest acceleration in growth -8.9% 2000 2001 2002 2003 2004 2005 2006 07:1Q 07:2Q 07:3Q 07:4Q 08:1Q 08:2Q 08:3Q 08:4Q 09:1Q 09:2Q 09:3Q 09:4Q 10:1Q 10:2Q 10:3Q 10:4Q 11:1Q 11:2Q 11:3Q 11:4Q 12:1Q 12:2Q 12:3Q 12:4Q 13:1Q 13:2Q 13:3Q 13:4Q 14:1Q 14:2Q 14:3Q 14:4Q 15:1Q 15:2Q 15:3Q 15:4Q -9% -5.3% -5% Recession began in Dec. 2007. Economic toll of credit crunch, housing slump, labor market contraction was severe -3.7% -3% -1.8% -1% 2.3% 2.2% 2.6% 2.4% 0.1% 2.5% 1.3% 4.1% 2.0% 1.3% 3.1% 0.4% 1.1% 2.5% 4.1% 2.4% 0.1% 3.0% 3.0% 3.1% 3.0% 3.0% 3.0% 2.9% 1% 1.4% 3% 1.3% 5% The Q4:2008 decline was the steepest since the Q1:1982 drop of 6.8% 1.1% 1.8% 2.5% 3.6% 3.1% 2.7% 0.5% 3.6% 3.0% 1.7% 7% 4.1% Real GDP Growth (%) Demand for Insurance Should Increase in 2014/15 as GDP Growth Accelerates Modestly and Gradually Benefits the Economy Broadly * Estimates/Forecasts from Blue Chip Economic Indicators. Source: US Department of Commerce, Blue Economic Indicators 4/14; Insurance Information Institute. 23 Unemployment and Underemployment Rates: Still Too High, But Falling January 2000 through April 2014, Seasonally Adjusted (%) 18 "Headline" Unemployment Rate U-3 16 Unemployment + Underemployment Rate U-6 14 12 U-6 went from 8.0% in March 2007 to 17.5% in October 2009; Stood at 12.3% in Apr. 2014. 8% to 10% is “normal.” 10 8 “Headline” unemployment was 6.3% in April 2014. 4% to 6% is “normal.” 6 4 2 Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Stubbornly high unemployment and underemployment constrain overall economic growth, but the job market is now clearly improving. Source: US Bureau of Labor Statistics; Insurance Information Institute. 24 US Unemployment Rate Forecast 2007:Q1 to 2015:Q4F* 8% 7% 6% 5% Unemployment peaked at 10% in late 2009. 9.3% 9.6% 10.0% 9.7% 9.6% 9.6% 9.6% 8.9% 9.1% 9.1% 8.7% 8.3% 8.2% 8.0% 7.8% 7.7% 7.6% 7.3% 7.0% 6.7% 6.5% 6.4% 6.2% 6.1% 6.0% 5.9% 5.8% 9% Jobless figures have been revised slightly downwards for 2014/15 8.1% 10% 4.5% 4.5% 4.6% 4.8% 4.9% 5.4% 6.1% 6.9% 11% Rising unemployment eroded payrolls and WC’s exposure base. Unemployment forecasts have been revised slightly downwards. Optimistic scenarios put the unemployment as low as 6.0% by Q4 of this year. 07:Q1 07:Q2 07:Q3 07:Q4 08:Q1 08:Q2 08:Q3 08:Q4 09:Q1 09:Q2 09:Q3 09:Q4 10:Q1 10:Q2 10:Q3 10:Q4 11:Q1 11:Q2 11:Q3 11:Q4 12:Q1 12:Q2 12:Q3 12:Q4 13:Q1 13:Q2 13:Q3 13:Q4 14:Q1 14:Q2 14:Q3 14:Q4 15:Q1 15:Q2 15:Q3 15:Q4 4% * = actual; = forecasts Sources: US Bureau of Labor Statistics; Blue Chip Economic Indicators (4/14 edition); Insurance Information Institute. 25 (600) (800) (1,000) Monthly losses in Dec. 08–Mar. 09 were the largest in the post-WW II period -426 -422 -486 (400) -776 -693 -821 -698 -810 -801 (200) -38 -294 -272 -232 -141 -271 -15 -232 -115 -106 -221 -215 -206 -261 -258 -71 32 64 81 55 231 170 400 113 192 94 110 120 117 107 199 149 94 72 223 231 320 166 186 219 125 268 177 191 222 364 228 246 102 131 75 172 136 159 255 211 215 219 263 164 188 222 201 170 180 153 247 272 86 166 201 202 273 20 3 3 0 52 126 57 52 200 Jan-07 Feb-07 Mar-07 Apr-07 May-07 Jun-07 Jul-07 Aug-07 Sep-07 Oct-07 Nov-07 Dec-07 Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 Monthly Change in Private Employment January 2007 through April 2014 (Thousands, Seasonally Adjusted) 600 Jobs Created 2013: 2.368 Mill 2012: 2.294 Mill 2011: 2.400 Mill 2010: 1.277 Mill Source: US Bureau of Labor Statistics: http://www.bls.gov/ces/home.htm; Insurance Information Institute 842,000 jobs created so far in 2014 273,000 private sector jobs were created in April. In March 2014, the last of the jobs lost in the Great Recession were recovered Private Employers Added 9.18 million Jobs Since Jan. 2010 After Having Shed 5.01 Million Jobs in 2009 and 3.76 Million in 2008 (State and Local Governments Have Shed Hundreds of Thousands of Jobs) 26 Cumulative Change in Private Employment: Dec. 2007—Apr. 2014 -0.163 -0.384 -0.599 -0.805 -1.066 -1.324 -1.746 -2.232 -3.008 -3.701 -4.522 -5.220 -6.030 -6.831 -7.125 -7.551 -7.823 -8.055 -8.196 -8.467 -8.482 -8.714 -8.694 -8.732 -8.619 -8.427 -8.333 -8.223 -8.103 -7.986 -7.879 -7.680 -7.531 -7.437 -7.365 -7.142 -6.911 -6.591 -6.425 -6.239 -6.020 -5.895 -5.627 -5.450 -5.259 -5.037 -4.673 -4.445 -4.199 -4.097 -3.966 -3.891 -3.719 -3.583 -3.424 -3.169 -2.958 -2.743 -2.524 -2.261 -2.097 -1.909 -1.687 -1.486 -1.316 -1.136 -0.983 -0.736 -0.464 -0.378 -0.212 -2 Cumulative job losses peaked at 8.765 million in February 2010 -4 Apr-14 Dec-13 Aug-13 Apr-13 Dec-12 Aug-12 Apr-12 Dec-11 Aug-11 Apr-11 Dec-10 Aug-10 Apr-10 Dec-09 Aug-09 Apr-09 Dec-08 -10 Dec-07 -8 Aug-08 It took more than 6 ½ years (79 months) to recover all of the private sector jobs lost in the Great Recession -6 Apr-08 0 0.055 0.058 -0.057 Millions 2 -0.011 0.191 0.464 Pvt. employment hit 116.4 million in April 2014— 580,000 above its pre-crisis peak of 115.8 million December 2007 through April 2014 (Millions) Private Employers Added 9.18 million Jobs Since Jan. 2010 After Having Shed 4.98 Million Jobs in 2009 and 3.80 Million in 2008 (State and Local Governments Have Shed Hundreds of Thousands of Jobs) Source: US Bureau of Labor Statistics: http://www.bls.gov/ces/home.htm; Insurance Information Institute 27 10.0 8.0 6.0 4.0 2.0 0.0 -2.0 0.020 -0.018 0.095 0.287 0.381 0.491 0.611 0.728 0.835 1.034 1.183 1.277 1.349 1.572 1.803 2.123 2.289 2.475 2.694 2.819 3.087 3.264 3.455 3.677 4.041 4.269 4.515 4.617 4.748 4.823 4.995 5.131 5.290 5.545 5.756 5.971 6.190 6.453 12.0 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 Job gains and pay increases have added more than $750 billion to payrolls since Jan. 2010 Source: US Bureau of Labor Statistics: http://www.bls.gov/ces/home.htm; Insurance Information Institute 6.805 7.027 7.228 7.398 7.578 7.731 7.978 8.250 8.336 8.502 8.703 8.905 9.178 6.617 Cumulative Change in Private Sector Employment: Jan. 2010—Apr. 2014 (Millions) Cumulative job gains through Apr. 2014 totaled 9.18 million Private Employers Added 9.18 million Jobs Since Jan. 2010 After Having Shed 4.98 Million Jobs in 2009 and 3.80 Million in 2008 (State and Local Governments Have Shed Hundreds of Thousands of Jobs) 28 Nonfarm Payroll (Wages and Salaries): Quarterly, 2005–2014:Q1 Billions $7,500 Latest (2014:Q1) was $7.29 trillion, a new peak--$1.04 trillion above 2009 trough $7,250 $7,000 $6,750 Prior Peak was 2008:Q1 at $6.60 trillion $6,500 Payrolls are 16.6% above their 2009 trough and up 3.6% over the past year $6,250 $6,000 $5,750 Recent trough (2009:Q3) was $6.25 trillion, down 5.3% from prior peak 05:Q1 05:Q2 05:Q3 05:Q4 06:Q1 06:Q2 06:Q3 06:Q4 07:Q1 07:Q2 07:Q3 07:Q4 08:Q1 08:Q2 08:Q3 08:Q4 09:Q1 09:Q2 09:Q3 09:Q4 10:Q1 10:Q2 10:Q3 10:Q4 11:Q1 11:Q2 11:Q3 11:Q4 12:Q1 12:Q2 12:Q3 12:Q4 13:Q1 13:Q2 13:Q3 13:Q4 14:Q1 $5,500 Note: Recession indicated by gray shaded column. Data are seasonally adjusted annual rates. Sources: http://research.stlouisfed.org/fred2/series/WASCUR; National Bureau of Economic Research (recession dates); Insurance Information Institute. 29 Net Change in Government Employment: Jan. 2010—Apr. 2014 State government employment fell by 1.5% since the end of 2009 but is recovering while Federal employment is down by 5.3% and deteriorating (Thousands) 0 -100 -79 -200 -300 -400 -380 -500 -600 -152 Local government employment shrank by 380,000 from Jan. 2010 through Apr. 2014, accounting for 62% of all government job losses, negatively impacting WC exposures for those cities and counties that insure privately -611 -700 Total Local State Source: US Bureau of Labor Statistics http://www.bls.gov/data/#employment; Insurance Information Institute Federal 30 Unemployment Rates by State, March 2014: Highest 25 States* 6.2 6.3 6.3 6.3 6.1 6 6.3 6.6 6.7 6.7 6.7 6.7 6.9 6.9 6.9 7.0 7.0 7.2 7.3 7.5 7.5 7.6 8.1 8.4 8.5 8 7.9 Unemployment Rate (%) 8.7 10 7.0 In March, 21 states had over-themonth unemployment rate decreases, 17 states and the District of Columbia had increases, and 12 states had no change. Residual impacts of the housing collapse, weak economies are holding back several states 4 2 *Provisional figures for March 2014, seasonally adjusted. Sources: US Bureau of Labor Statistics; Insurance Information Institute. FL M A N C W A C O O H K A O TN M L A R U S O Y N R A T G A N M C J N Z A I M IL C A K Y M S D C V N R I 0 31 Unemployment Rates by State, March 2014: Lowest 25 States* 3.4 3.7 3.7 2.6 3 4.0 4 4.1 4.5 4.5 4.5 4.5 4.8 4.9 5.1 5.5 5.9 5.9 5.9 5.9 5.5 5.2 5.0 5 6.0 6 5.6 Unemployment Rate (%) 6.1 7 4.9 In March, 21 states had over-themonth unemployment rate decreases, 17 states and the District of Columbia had increases, and 12 states had no change. Energyfueled employment boom in ND 2 1 0 WV PA DE IN ME WI MD SC TX ID MT VA KS OK MN HI IA LA NH UT WY NE SD VT ND *Provisional figures for March 2014, seasonally adjusted. Sources: US Bureau of Labor Statistics; Insurance Information Institute. 32 Payroll vs. Workers Comp Net Written Premiums, 1990-2013P Payroll Base* $Billions $7,000 $6,000 7/90-3/91 WC NWP $Billions Wage & Salary Disbursements 3/01-11/01 WC NPW 12/07-6/09 $45 WC premium volume dropped two years before the recession began $40 $5,000 $4,000 $3,000 $50 WC net premiums written were down $14B or 29.3% to $33.8B in 2010 after peaking at $47.8B in 2005 $2,000 $35 $30 $25 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Continued Payroll Growth and Rate Gains Suggest WC NWP Will Grow Again in 2014; +8.6% Growth Estimated for 2013 *Private employment; Shaded areas indicate recessions. WC premiums for 2012 are I.I.I. estimate based YTD 2013 actuals. Sources: NBER (recessions); Federal Reserve Bank of St. Louis at http://research.stlouisfed.org/fred2/series/WASCUR ; NCCI; I.I.I. 33 POSITIVE LABOR MARKET DEVELOPMENTS Key Factors Driving Workers Compensation Exposure 34 Business Bankruptcy Filings, 1980-2013 1980-82 1980-87 1990-91 2000-01 2006-09 90,000 80,000 40,000 30,000 20,000 10,000 0 58.6% 88.7% 10.3% 13.0% 208.9% 2013 bankruptcies totaled 33,212, down 17.1% from 2012—the fourth consecutive year of decline. Business bankruptcies more than tripled during the financial crisis. 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 50,000 43,694 48,125 70,000 60,000 69,300 62,436 64,004 71,277 81,235 82,446 63,853 63,235 64,853 71,549 70,643 62,304 52,374 51,959 53,549 54,027 44,367 37,884 35,472 40,099 38,540 35,037 34,317 39,201 19,695 28,322 43,546 60,837 56,282 47,806 40,075 33,212 % Change Surrounding Recessions Significant Exposure Implications for All Commercial Lines as Business Bankruptcies Begin to Decline Sources: American Bankruptcy Institute (1980-2012) at http://www.abiworld.org/AM/AMTemplate.cfm?Section=Home&TEMPLATE=/CM/ContentDisplay.cfm&CONTENTID=61633; 2013 data from United States Courts at http://news.uscourts.gov; Insurance Information Institute. 35 Mass Layoff Announcements, Jan. 2002—May 2013* 3,500 Mass layoff announcements peaked at more than 3,000 per month in Feb. 2009 3,000 There were 1,301 mass layoffs announced in May 2013, similar to precrisis levels 2,500 2,000 1,500 1,000 500 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 *BLS discontinued series effective May 2013. Data are seasonally adjusted. Note: Recessions indicated by gray shaded columns. Sources: US Bureau of Labor Statistics at http://www.bls.gov/mls/; National Bureau of Economic Research (recession dates); Insurance Information Institute. '13 36 Average Weekly Hours of All Private Workers, Mar. 2006—Apr. 2014 (Hours Worked) 34.8 34.7 34.6 34.5 34.4 34.3 Hours worked plunged during the recession, impacting payroll exposures 34.2 34.1 34.0 33.9 Hours worked totaled 34.5 per week in April, just shy of the 34.6 hours typically worked before the “Great Recession” 33.8 33.7 33.6 33.5 '06 '07 '08 '09 '10 '11 '12 '13 '14 *Seasonally adjusted Note: Recessions indicated by gray shaded columns. Sources: US Bureau of Labor Statistics at http://www.bls.gov/data/#employment; National Bureau of Economic Research (recession dates); Insurance Information Institute. 37 Average Hourly Wage of All Private Workers, Mar. 2006—Apr. 2014 (Hourly Wage) $30.00 $25.00 $20.00 $15.00 The average hourly wage was $24.31 in Apr. 2013, up 14.4% from $21.25 when the recession began in Dec. 2007 $10.00 Wage gains continued during the recession, despite massive job losses $5.00 $0.00 '06 '07 '08 '09 '10 '11 '12 '13 '14 *Seasonally adjusted Note: Recessions indicated by gray shaded columns. Sources: US Bureau of Labor Statistics at http://www.bls.gov/data/#employment; National Bureau of Economic Research (recession dates); Insurance Information Institute. 38 ADVERSE LONG-TERM LABOR MARKET DEVELOPMENTS Key Factors Harming Workers Compensation Exposure and the Overall Economy 39 Labor Force Participation Rate, Jan. 2002—April 2014* Labor Force Participation as a % of Population 68 Labor force participation continues to shrink despite a falling unemployment rate 67 66 65 64 Large numbers of people are exiting (or not returning to the labor force) 63 62 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 *Defined as the percentage of working age persons in the population who are employed or actively seeking work. Note: Recessions indicated by gray shaded columns. Sources: US Bureau of Labor Statistics at http://www.bls.gov/data/; National Bureau of Economic Research (recession dates); Insurance Information Institute. '14 40 Number of “Discouraged Workers,” Jan. 2002—April 2013 Thousands 1,400 1,300 1,200 1,100 1,000 900 800 700 600 500 400 300 200 100 0 '94 “Discouraged Workers” are people who have searched for work for so long in vain that they actually stop searching and drop out of the labor force Large numbers of people are exiting (or not returning to) the labor force There were 783,000 discouraged workers in Apr. 2014 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 In recent good times, the number of discouraged workers ranged from 200,000-400,000 (1995-2000) or from 300,000-500,000 (2002-2007). Notes: Recessions indicated by gray shaded columns. Data are seasonally adjusted. Sources: Bureau of Labor Statistics http://www.bls.gov/news.release/empsit.a.htm ; NBER (recession dates); Ins. Info. Inst. 41 Change in Number of Discouraged Workers: Apr. 2013 vs. Apr. 2014 (Percent Change) 0% -2% -1.6% -4% -6% -8% -10% -12% -14% -16% -6.2% The number of discouraged workers fell by 52,000 over the past year to 783,000, a decline of 6.2% -18% -20% Overall Men remain much more discouraged about their job prospects -8.5% -12.7% Younger workers remain more discouraged than older workers 16 to 24 25 to 54 AGE -13.0% -18.0% 55+ Men Women GENDER Source: US Bureau of Labor Statistics at http://www.bls.gov/cps/tables.htm#pnilf_m; Insurance Information Institute. 42 Discouraged Workers by Gender (as of April 2014) The overwhelming majority of discouraged workers are male, for a variety of reasons Male = 488,000 Female = 295,000 Reasons for Lower Female Discouragement Rate •Less likely to work in heavily impacted industries such as construction 38% 62% •More likely to retrain •More likely to retrain quickly •Better educated TOTAL = 783,000 Source: Bureau of Labor Statistics: at http://www.bls.gov/web/empsit/cpseea38.htm; Insurance Information Institute. Men account for 62% of discouraged workers today, up from 59% a year ago 43 CONSTRUCTION, MANUFACTURING & ENERGY OUTLOOK Key Sectors Critical to the Economy and the P/C Insurance Industry 45 Value of New Private Construction: Residential & Nonresidential, 2003-2013* Billions of Dollars New Construction peaks at $911.8. in 2006 Trough in 2010 at $500.6B, after plunging 55.1% ($411.2B) $1,000 $900 $800 $15.0 2013: Value of new pvt. construction hits $667.5B, up 33% from the 2010 trough but still 27% below 2006 peak $613.7 $700 $600 $500 $311.5 $298.1 $400 $300 $261.8 Non Residential Residential $200 $100 $356.0 $238.8 $0 03 04 05 06 07 08 09 10 11 12 13* Private Construction Activity Is Moving in a Positive Direction though Remains Well Below Pre-Crisis Peak; Residential Dominates *2013 figure is a seasonally adjusted annual rate as of December. Sources: US Department of Commerce; Insurance Information Institute. 46 Value of Private Construction Put in Place, by Segment, March 2014 vs. March 2013* Growth (%) 40% 30.4% 30% 20% 12.5% 10% Led by the Residential Construction, Lodging and Communication segments, Private sector construction activity is rising after plunging during the 33.5% “Great Recession.” 19.8% 16.0% 13.5% 8.6% 10.7% 9.3% 2.8% 2.1% 7.9% 0% -3.2% -10% -20% -19.0% Manufacturing Power Communication Transportation Amusement & Rec. Religious Educational Health Care Commercial Office Lodging Total Nonresidential Residential Total Private Construction -30% Private Construction Activity is Up in Most Segments, Including the Key Residential Construction Sector; Bodes Well for the Remainder of 2014 *seasonally adjusted Source: U.S. Census Bureau, http://www.census.gov/construction/c30/c30index.html ; Insurance Information Institute. 47 New Private Housing Starts, 1990-2019F 1.9 1.7 1.5 1.3 1.1 0.9 0.7 0.5 New home starts plunged 72% from 2005-2009; A net annual decline of 1.49 million units, lowest since records began in 1959 1.31 1.44 1.50 1.51 1.50 2.1 0.55 0.59 0.61 0.78 0.92 1.08 1.19 1.01 1.20 1.29 1.46 1.35 1.48 1.47 1.62 1.64 1.57 1.60 1.71 1.85 1.96 2.07 1.80 1.36 0.91 Job growth, low inventories of existing homes, low mortgage rates and demographics should continue to stimulate new home construction for several more years (Millions of Units) 0.3 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13F14F15F16F17F18F19F Insurers Are Continue to See Meaningful Exposure Growth in the Wake of the “Great Recession” Associated with Home Construction: Construction Risk Exposure, Surety, Commercial Auto; Potent Driver of Workers Comp Exposure Source: U.S. Department of Commerce; Blue Chip Economic Indicators (4/14 and 3/13); Insurance Information Institute. 48 Value of New Federal, State and Local Government Construction: 2003-2014* ($ Billions) $350 Austerity Reigns Construction across all levels of government peaked at $314.9B in 2009 Govt. construction is still shrinking, down $52.0B or 16.5% since 2009 peak $308.7 $314.9 $289.1 $300 $304.0 $286.4 $279.0 $271.4 $255.4 $250 $216.1 $220.2 2003 2004 $262.9 $234.2 $200 $150 $100 $50 $0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014* Government Construction Spending Peaked in 2009, Helped by Stimulus Spending, but Continues to Contract As State/Local Governments Grapple with Deficits and Federal Sequestration Takes Hold *2014 figure is a seasonally adjusted annual rate as of March; http://www.census.gov/construction/c30/historical_data.html Sources: US Department of Commerce; Insurance Information Institute. 49 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 2/30/2 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-12 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 (Thousands) 6,100 6,000 5,900 5,800 5,700 5,600 5,500 5,581 5,522 5,542 5,554 5,527 5,512 5,497 5,519 5,499 5,501 5,497 5,468 5,435 5,478 5,485 5,497 5,524 5,530 5,547 5,546 5,583 5,576 5,577 5,612 5,629 5,644 5,640 5,636 5,615 5,622 5,627 5,630 5,633 5,649 5,673 5,711 5,735 5,783 5,799 5,792 5,791 5,801 5,804 5,805 5,822 5,830 5,849 5,876 5,927 5,927 5,968 6,000 Construction Employment, Jan. 2010—April 2014* Construction employment is +565,000 above Jan. 2011 (+10.4%) trough 5,400 Construction and manufacturing employment constitute 1/3 of all payroll exposure. *Seasonally adjusted. Sources: US Bureau of Labor Statistics at http://data.bls.gov; Insurance Information Institute. 50 Construction Employment, Jan. 2003–April 2014 (Thousands) Construction employment as of Apr. 2014 totaled 6.0 million, an increase of 565,000 jobs or 10.4% from the Jan. 2011 trough Construction employment peaked at 7.726 million in April 2006 8,000 7,500 Gap between prerecession construction peak and today: 1.7 million jobs 7,000 The “Great Recession” and housing bust destroyed 2.3 million constructions jobs 6,500 6,000 Construction employment troughed at 5.435 million in Jan. 2011, after a loss of 2.291 million jobs, a 29.7% plunge from the April 2006 peak 5,500 5,000 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 The Construction Sector Could Be a Growth Leader in 2014 as the Housing Market, Private Investment and Govt. Spending Recover. WC Insurers Will Benefit. Note: Recession indicated by gray shaded column. Sources: U.S. Bureau of Labor Statistics; Insurance Information Institute. 51 MANUFACTURING SECTOR A Potent Driver of Jobs, Workers Comp Payroll Exposure America’s Manufacturing Renaissance 52 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 2/30/2 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 4/31/2 12,250 12,000 11,750 11,500 11,460 11,460 11,466 11,497 11,531 11,539 11,558 11,548 11,554 11,555 11,577 11,590 11,624 11,662 11,682 11,707 11,715 11,724 11,747 11,760 11,762 11,770 11,769 11,797 11,841 11,870 11,910 11,920 11,926 11,935 11,957 11,943 11,925 11,931 11,938 11,951 11,965 11,988 11,984 11,977 11,972 11,965 11,948 11,963 11,993 12,011 12,046 12,053 12,061 12,081 12,088 12,100 Manufacturing Employment, Jan. 2010—April 2014* (Thousands) Since Jan 2010, manufacturing employment is up (+640,000 or +5.6%) and still growing. 11,250 Manufacturing employment is a surprising source of strength in the economy. Employment in the sector is at a multi-year high. *Seasonally adjusted. Sources: US Bureau of Labor Statistics at http://data.bls.gov; Insurance Information Institute. 53 Dollar Value* of Manufacturers’ Shipments Monthly, Jan. 1992—Mar. 2014 $ Millions $500,000 The value of Manufacturing Shipments in Mar. 2014 was $494.9B—a new record high. $400,000 $300,000 Ja n92 Ja n9 Ja 3 n94 Ja n95 Ja n9 Ja 6 n97 Ja n9 Ja 8 n99 Ja n00 Ja n 01 Ja n 0 Ja 2 n 03 Ja n 0 Ja 4 n 05 Ja n 0 Ja 6 n 07 Ja n 0 Ja 8 n 09 Ja n 1 Ja 0 n 1 12 1 -J a 13 n -J an 14 -J an $200,000 Monthly shipments in Mar. 2014 exceeded the pre-crisis (July 2008) peak. Manufacturing is energy-intensive and growth leads to gains in many commercial exposures: WC, Commercial Auto, Marine, Property, and various Liability Coverages. * Seasonally adjusted; Data published May 2, 2014. Source: U.S. Census Bureau, Full Report on Manufacturers’ Shipments, Inventories, and Orders, http://www.census.gov/manufacturing/m3/ 54 55 45 40 51.4 52.5 52.5 51.8 52.2 53.1 54.1 51.9 53.3 54.1 52.5 50.2 50.5 50.7 51.6 51.7 49.9 50.2 53.1 54.2 51.3 50.7 49.0 50.9 55.4 55.7 56.2 56.4 57.0 56.5 51.3 53.2 53.7 54.9 50 58.3 57.1 60.4 59.6 57.8 55.3 55.1 55.2 55.3 56.9 58.2 58.5 60.8 61.4 59.7 59.7 54.2 55.8 60 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 ISM Manufacturing Index (Values > 50 Indicate Expansion) January 2010 through April 2014 65 Manufacturing continues to expand in 2014 The manufacturing sector expanded for 50 of the 52 months from Jan. 2010 through April 2014. Pace of recovery has been uneven due to economic turbulence in the U.S., Europe and China Source: Institute for Supply Management at http://www.ism.ws/ismreport/mfgrob.cfm; Insurance Information Institute. 55 Manufacturing Growth for Selected Sectors, 2014 vs. 2013* Growth (%) Non-Durables: +0.1% Durables: +3.5% 5.3% 6% 2% 3.7% 3.5% 4% 4.9% 4.3% 4.0% 3.9% 2.9% 1.8% 1.7% 0.1% 0% -2% Textile Products Plastics & Rubber Chemical Petroleum & Coal Food Products Non-Durable Mfg. Transportation Equip. Computers & Electronics Electrical Equip. -3.8% Machinery Fabricated Metals Primary Metals Wood Products All Manufacturing -6% Durable Mfg. Manufacturing of durable goods was stronger than nondurables in 2013 -4% -0.5% -0.9% -1.1% Manufacturing Is Expanding—Albeit Slowly—Across a Number of Sectors that Will Contribute to Growth in Insurable Exposures Including: WC, Commercial Property, Commercial Auto and Many Liability Coverages *Seasonally adjusted; Date are YTD comparing data through March 2014 to the same period in 2013. Source: U.S. Census Bureau, Full Report on Manufacturers’ Shipments, Inventories, and Orders, http://www.census.gov/manufacturing/m3/ 56 Business Investment: Expected to Accelerate, Fueling Commercial Exposure Growth Accelerating business investment will be a potent driver of commercial property and liability insurance exposures and should drive employment and WC payroll exposures as well (with a lag) 9% 8% 7.8% 6.3% 7% 6% 4.9% 5% 4% 3% 2.5% 2% 1% 0% 2013 2014F Source: IHS Global Insights as of Jan. 13, 2014; Insurance Information Institute. 2015F 2016F 57 12 Industries for the Next 10 Years: Insurance Solutions Needed Health Care Health Sciences Energy (Traditional) Alternative Energy Petrochemical Agriculture Natural Resources Technology (incl. Biotechnology) Many industries are poised for growth, though insurers’ ability to capitalize on these industries varies widely Light Manufacturing Insourced Manufacturing Export-Oriented Industries Shipping (Rail, Marine, Trucking, Pipelines) 58 ENERGY SECTOR America’s Energy Boom Is Potentially the Most Transformative Economic Force in the Country Today Workers Comp and Commercial Insurers in General Will Generate Billions in Premiums as Exposures Mushroom 59 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 2/30/2 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 220 210 200 190 180 170 160 156.4 156.4 156.7 157.6 158.7 157.8 158.0 159.5 160.0 161.5 161.2 161.2 163.1 164.4 166.6 169.3 170.1 171.0 172.5 173.6 176.3 178.2 178.5 180.9 181.9 183.1 184.8 185.2 185.7 186.8 187.6 188.0 188.0 188.2 190.0 191.7 191.9 193.4 192.4 192.6 193.1 193.3 195.0 196.5 199.7 200.6 203.0 204.1 205.3 207.8 207.8 208.9 Oil & Gas Extraction Employment, Jan. 2010—April 2014* (Thousands) Oil and gas extraction employment is up 33.6% since Jan. 2010 as the energy sector booms. Domestic energy production is essential to any robust economic recovery in the US. *Seasonally adjusted Sources: US Bureau of Labor Statistics at http://data.bls.gov; Insurance Information Institute. Highest since Aug. 1986 150 60 U.S. Natural Gas Production, 2000-2013 Trillions of Cubic Ft. per Year 28 25.3 25.6 26 24.0 24 22 20 20.2 20.6 19.9 20.0 19.5 21.1 18.9 19.4 21.6 22.4 20.2 18 The U.S. is already the world’s largest natural gas producer— recently overtaking Russia. This is a potent driver of commercial insurance exposures 16 14 12 10 00 01 02 03 04 05 06 07 08 09 10 11 Source: Energy Information Administration, Short-Term Energy Outlook (April 8, 2014) , Insurance Information Institute. 12 13 U.S. Crude Oil Production, 2005-2015P Millions of Barrels per Day 10 Crude oil production in the U.S. is expected to increase by 82.6% from 2008 through 2015—and could overtake Saudi Arabia as the world’s largest oil producer 9 8 7 6 5.19 5.09 5.08 5.00 2005 2006 2007 2008 9.13 8.37 7.44 6.49 5.35 5.47 5.65 2009 2010 2011 5 4 3 2 1 0 2012 2013 2014F 2015F Source: Energy Information Administration, Short-Term Energy Outlook (April 8, 2014) , Insurance Information Institute. Employment Trends in the Healthcare Industry Health Sector Employment Will Continue to Outpace Increasing Opportunities for Workers Comp Insurers 63 U.S. Health Care Expenditures, 1965–2022F $ Billions $5,000 $4,000 $3,000 $2,000 $1,000 $0 From 1965 through 2013, US health care expenditures had increased by 69 fold. Population growth over the same period increased by a factor of just 1.6. By 2022, health spending will have increased 119 fold. 65 $42.0 66 $46.3 67 $51.8 68 $58.8 69 $66.2 70 $74.9 71 $83.2 72 $93.1 73 $103.4 74 $117.2 75 $133.6 76 $153.0 77 $174.0 $195.5 78 $221.7 79 $255.8 80 $296.7 81 $334.7 82 $369.0 83 $406.5 84 $444.6 85 $476.9 86 $519.1 87 $581.7 88 $647.5 89 $724.3 90 $791.5 91 $857.9 92 $921.5 93 $972.7 94 $1,027.4 95 $1,081.8 96 $1,142.6 97 $1,208.9 98 $1,286.5 99 $1,377.2 00 $1,493.3 01 $1,638.0 02 $1,775.4 03 $1,901.6 04 $2,030.5 05 $2,163.3 06 $2,298.3 07 $2,406.6 08 $2,501.2 09 $2,600.0 10 $2,700.7 11 $2,806.6 12 $2,914.7 13 $3,093.2 14 $3,273.4 15 $3,458.3 16 $3,660.4 17 $3,889.1 18 $4,142.4 19 $4,416.2 20 $4,702.0 21 $5,008.8 22 $6,000 Healthcare is a labor intensive industry. Spending will rise from $3 trillion today to $5 trillion in 2022 U.S. health care expenditures have been on a relentless climb for most of the past half century, far outstripping population growth, inflation of GDP growth Sources: Centers for Medicare & Medicaid Services, Office of the Actuary at http://www.cms.gov/Research-Statistics-Data-and-Systems/StatisticsTrends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected.html accessed 3/14/14; Insurance Information Institute. 65 Rate of Health Care Expenditure Increase Compared to Population, CPI and GDP 8000% Health care expenditures increased 68 fold since 1965—about 3 times the pace of GDP growth 1965: $42.0 Bill 2013: $2,914.7 Bill 6839.8% 7000% 1965: $719.1 Bill 6000% 2013: $16,797.5 Bill 5000% 4000% 3000% 1965: 194.3 Mill 2235.9% 2013: 317.0 Mill 2000% 1000% 650.7% 63.1% 0% Population Source: Insurance Information Institute research. CPI GDP Health Care Expenditures 66 National Health Care Expenditures as a Share of GDP, 1965 – 2022F* % of GDP 20% 18% 16% Health care expenditures as a share of GDP rose from 5.8% in 1965 to 18.0% in 2013 and are expected to reach 19.9% of GDP by 2022 2022 19.9% 2010: 17.9% 14% 12% 10% 1990: 12.5% 8% 6% 2% 0% 1965 5.8% Since 2009, heath expenditures as a % of GDP have flattened out at about 18%--the question is why and will it last? 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 4% 1980: 9.2% 2000: 13.8% Sources: Centers for Medicare & Medicaid Services, Office of the Actuary at http://www.cms.gov/Research-Statistics-Data-and-Systems/StatisticsTrends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected.html accessed 3/14/14; Insurance Information Institute. Medical Cost Inflation vs. Overall CPI, 1995 - 2013 Though moderating, medical inflation will continue to exceed inflation in the overall economy 5% 4% 3% 2% 1% Average Annual Growth Average Healthcare: 3.8% Total Nonfarm: 2.4% 0% Change in Medical CPI CPI-All Items -1% 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 Sources: Med CPI from US Bureau of Labor Statistics, WC med severity from NCCI based on NCCI states. 10 11 12 13 Projected Number of People with No Health Insurance, 2013—2022* Millions By 2018 the number of people under age 65 without insurance is expected to drop by 25 million (~45%) 65 55 55 44 45 37 35 30 31 2018F 2022F 25 15 5 2013E 2014F 2015F The projected decline in the uninsured population is very sensitive to the enrollment rate under the Affordable Care Act *Under age 65. Sources: Centers for Medicare & Medicaid Services, Office of the Actuary at http://www.cms.gov/Research-Statistics-Data-and-Systems/StatisticsTrends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected.html accessed 3/14/14; Insurance Information Institute. 69 Growth in Health Professions, 1991-2013 (Percent Annual Change) Average Annual Growth Average Healthcare: 2.5% Total Nonfarm: 1.0% 7.0 5.0 3.0 1.0 -1.0 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1993 1992 -5.0 1991 -3.0 1994 The U.S. economy lost more than 8 million jobs during the Great Health care Recession, but health sector Total nonfarm employment expanded Healthcare employment has continued to grow in good times and bad - including the Great Recession. Sources: Bureau of Labor Statistics, Insurance Information Institute. 70 Occupations Ranked by Projected Percentage Growth, 2012-2022F (%) 28.1 Healthcare Support 21.5 21.4 20.9 Healthcare Practitioners Construction Personal Care and Service 18 17.2 Computer and Math Social Service 12.5 12.5 11.1 10.8 10.7 10.1 9.6 9.4 8.6 7.9 7.3 7.3 7.2 7 6.8 Business & Financial Groundskeeping/Janitorial Education All Occupations Legal Life, Phys and Social Science Repair Food Preparation Transportation Fire, Police, Etc. Architects and Engineers Sales Management Arts and Media Administrative Support Production Farming Healthcare professions are expected to grow at 2 to nearly 3 times employment growth overall 0.8 -3.4 Source: Bureau of Labor Statistics, Insurance Information Institute. 71 Growth in Healthcare Profession by Skill Level, 2012 – 2022F (Thousands of Jobs) 2,000 2,196 3,242 +425,000 +24.0% 1,771 3,000 2,492 2,893 4,000 +750,000 +30.1% 3,590 5,000 +697,000 +24.1% 5,005 6,000 +1.015 Mill +20.3% 6,020 7,000 Nearly 3 million new healthcare jobs are projected through 2022! 1,000 0 Practitioners, including RNs Technicians, including LPNs 2012 Source: Bureau of Labor Statistics, Insurance Information Institute. Aides Other 2022 72 INVESTMENTS: THE NEW REALITY Investment Performance is a Key Driver of Profitability Low Yields Have an Especially Large Influence on Profitability of Long-Tailed Lines Like WC 73 Property/Casualty Insurance Industry Investment Income: 2000–20131 ($ Billions) $60 $54.6 $52.3 $50 $40 $51.2 $49.5 $49.2 $47.1 $38.9 $38.7 $37.1 $36.7 01 02 $39.6 $47.6 $48.0 $47.4 12 13 Investment earnings are running below their 2007 pre-crisis peak $30 00 03 04 05 06 07 08 09 10 11 Investment Income Fell in 2012 and 2013 Due to Persistently Low Interest Rates, Putting Additional Pressure on (Re) Insurance Pricing 1 Investment gains consist primarily of interest and stock dividends... Sources: ISO; Insurance Information Institute. Property/Casualty Insurance Industry Investment Gain: 1994–20131 ($ Billions) $70 $64.0 $59.4 $55.7 $58.0 $56.9 $52.3 $51.9 $60 $47.2 $42.8 $50 $48.9 $45.3 $44.4 $40 $35.4 $58.8 $56.2 $54.2 $53.4 $39.2 $36.0 $31.7 $30 $20 Investment gains in 2013 were their highest in the post-crisis era $10 $0 94 95 96 97 98 99 00 01 02 03 04 05* 06 07 08 09 10 11 12 13 Investment Income Continued to Fall in 2013 Due to Low Interest Rates but Realized Investment Gains Were Up Sharply; The Financial Crisis Caused Investment Gains to Fall by 50% in 2008 1 Investment gains consist primarily of interest, stock dividends and realized capital gains and losses. * 2005 figure includes special one-time dividend of $3.2B; Sources: ISO; Insurance Information Institute. $11.43 $6.18 -$7.90 -$19.81 -$5 -$10 -$15 -$20 -$25 $7.04 $5.85 $8.92 $3.52 $9.70 $9.13 -$1.21 $6.63 $6.61 Realized capital gains were up sharply as equity markets rallied $16.21 $13.02 $10.81 $9.24 $6.00 $1.66 $9.82 $9.89 $4.81 $20 $15 $10 $5 $0 $2.88 ($ Billions) $18.02 P/C Insurer Net Realized Capital Gains/Losses, 1990-2013 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 Insurers Posted Net Realized Capital Gains in 2010 - 2013 Following Two Years of Realized Losses During the Financial Crisis. Realized Capital Losses Were the Primary Cause of 2008/2009’s Large Drop in Profits and ROE Sources: A.M. Best, ISO, Insurance Information Institute. 76 U.S. Treasury Security Yields: A Long Downward Trend, 1990–2014* 9% Yields on 10-Year U.S. Treasury Notes have been essentially below 5% for a full decade. 8% 7% 6% U.S. Treasury yields plunged to historic lows in 2013. Only longer-term yields have rebounded. 5% 4% 3% 2% 1% 0% Recession 2-Yr Yield 10-Yr Yield '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 Since roughly 80% of P/C bond/cash investments are in 10-year or shorter durations, most P/C insurer portfolios will have low-yielding bonds for years to come. *Monthly, constant maturity, nominal rates, through March 2014. Sources: Federal Reserve Bank at http://www.federalreserve.gov/releases/h15/data.htm. National Bureau of Economic Research (recession dates); Insurance Information Institute. 77 Treasury Yield Curves: Pre-Crisis (July 2007) vs. March 2014 6% 5% 4% 3% 2% 4.82% 4.96% 5.04% 4.96% 4.82% 4.82% Treasury yield curve remains near its most depressed level in at least 45 years. Investment income is falling as a result. Even as the Fed “tapers” rates are unlikely to return to pre-crisis levels anytime soon 4.88% 5.00% 4.93% 5.00% 3.35% 5.19% 3.62% 2.72% 2.23% 1.64% 0.82% 1% 0.40% 0.05% 0.05% 0.08% 0.13% 1M 3M 6M 1Y March 2014 Yield Curve Pre-Crisis (July 2007) 0% 2Y 3Y 5Y 7Y 10Y 20Y 30Y The Fed Is Actively Signaling that it Is Determined to Keep Rates Low Until Unemployment Drops Below 6.5% or Until Inflation Expectations Exceed 2.5%; Low Rates Add to Pricing Pressure for Insurers. Source: Federal Reserve Board of Governors; Insurance Information Institute. 78 Distribution of Bond Maturities, P/C Insurance Industry, 2003-2013 2013 16.5% 2012 16.6% 2011 14.9% 41.2% 27.3% 10.4% 6.2% 2010 16.0% 39.5% 27.1% 11.2% 6.2% 2009 15.6% 2008 15.7% 2007 15.2% 30.0% 2006 16.0% 2005 38.8% 29.3% 9.8% 5.7% 27.6% 9.8% 5.7% 40.4% 36.4% 29.0% 12.7% 8.1% 33.8% 12.9% 8.1% 29.5% 34.1% 13.1% 7.4% 16.0% 28.8% 34.1% 13.6% 7.6% 2004 15.4% 29.2% 2003 14.4% 29.8% 32.4% 31.2% 11.9% 7.1% Under 1 year 1-5 years 5-10 years 10-20 years over 20 years 32.5% 31.3% 15.4% 15.4% 7.6% 9.2% 20% these years 40%has been 60% 80% longer maturities 100% The0% main shift over from bonds with to bonds with shorter maturities. The industry first trimmed its holdings of over-10-year bonds (from 24.6% in 2003 to 15.5% in 2012) and then trimmed bonds in the 5-10-year category (from 31.3% in 2003 to 27.6% in 2012) . Falling average maturity of the P/C industry’s bond portfolio is contributing to a drop in investment income along with lower yields. Sources: SNL Financial; Insurance Information Institute. 79 Reduction in Combined Ratio Necessary to Offset 1% Decline in Investment Yield to Maintain Constant ROE, by Line* s ne i L -5.7% -5.2% -4.3% -3.7% -3.3% -3.3% -3.1% -2.1% -1.9% -3.6% -2.0% -1.8% 0% -1% -2% -3% -4% -5% -6% -7% -8% -1.8% s ty l e e o p t r a s n i a ro p l Li y rc Su Au s o t P C a / al r e l s s n y n t a t P u M m m m m li P di so s pl rra d e m m m m r r r t e C a e d o o r o o Pe Pv Pe C C C C C Fi W Su M W to u A R a ur s n ei ** e nc -7.3% Lower Investment Earnings Place a Greater Burden on Underwriting and Pricing Discipline *Based on 2008 Invested Assets and Earned Premiums **US domestic reinsurance only Source: A.M. Best; Insurance Information Institute. 80 Outlook for U.S. Treasury Bond Yields Through 2015 Long-term yields should begin to normalize in 2014 but short-term yields will remain very low until 2015 % Yield 4.0 3.5 3.70 3.40 3-Month 5-Year 3.10 10-Year 3.0 2.35 2.5 1.80 2.0 1.5 1.17 0.76 1.0 0.5 2.30 0.50 0.09 0.06 0.10 0.0 2012 2013 2014F 2015F Longer-tail lines like MPL and workers comp will benefit the most from the normalization of yields Source: Federal Reserve Board of Governors (2012-2013), Blue Economic Forecasts (2014-2015 3-month and 10yr; 4/14) Swiss Re (2014-2015, 5-yr yield; 4/14); Insurance Information Institute. 81 LOW YIELDS—A REINSURANCE ASIDE Surge in Alternative Capital Is Fundamentally Transforming Reinsurance Markets 82 Global Reinsurance Capital (Traditional and Alternative), 2007 - 2013 Total reinsurance capital reached a record $540B in 2013, up 58.8% from 2008. Of that, $50B (9.3%) is alternative capacity, up 163% from $19B since 2008 Source: Aon Benfield Reinsurance Market Outlook, April 1, 2014; Insurance Information Institute. Alternative Capacity as a Percentage of Global Property Catastrophe Reinsurance Limit (As of Year End) Alternative Capacity accounted for approximately 14% or $45 billion of the $316 in global property catastrophe reinsurance capital as of mid-2013 (expected to rise to ~15% by year-end 2013) Source: Guy Carpenter Reinsurance Pricing: Rate-on-Line Index by Region, 1990 – 2014* Lower CATs and a flood of new capital has pushed reinsurance pricing down in most regions, including the US *As of Jan. 1. Source: Guy Carpenter Terrorism Update TRIA: An Unqualified Success Expiration or Scaling Back Will Result in Impacts on the Workers Comp Market 86 Loss Distribution by Type of Insurance from Sept. 11 Terrorist Attack ($ 2013) ($ Billions) Other Liability $4.9 (12%) Property Life WTC 1 & 2* $1.2 (3%) $4.4 (11%) Aviation Liability $4.3 (11%) Event Cancellation $1.2 (3%) Aviation Hull $0.6 (2%) Workers Comp $2.2 (6%) Property Other $7.4 (19%) Biz Interruption $13.5 (33%) Total Insured Losses Estimate: $42.9B** *Loss total does not include March 2010 New York City settlement of up to $657.5 million to compensate approximately 10,000 Ground Zero workers or any subsequent settlements. **$32.5 billion in 2001 dollars. Source: Insurance Information Institute. Summary of President’s Working Group Report on TRIA (April 2014) Insurance for terrorism risk is available and affordable Availability/affordability have has not changed appreciably since 2010 Prices for terrorism risk insurance vary considerably depending on the policyholder’s industry and location of risk Prices have declined since TRIA was enacted Take-up rates have improved since adoption of TRIA Overall take-up rate is steady at ~60% (62% in 2013 per Marsh) Effectively 100% for workers compensation Market capacity is currently tightening given uncertainty over TRIA reauthorization The private market does not have the capacity to provide reinsurance for terror risk to the extent currently provided by TRIA In the absence of TRIA, terrorism risk insurance would likely be less available. Coverage that would be available likely would be more costly and/or limited in scope Source: Report of the President’s Working Group on Financial Markets,The Long-Term Availability and Affordability of Insurance for Terrorism Risk, April 2014. 88 Terrorism Risk Insurance Program Industry Is Working Hard for Reauthorization At Least 4 Congressional Hearings in House & Senate 3 House Bills Introduced in 2013 Senate Bill 2244 Introduced in April Increases mandatory recoupment from $27.5B to $37.5B Increase insurer co-share 20% from 15% Senate Banking Committee, 9/25/13 House Financial Services Subcommittee, 11/13/13 89 I.I.I. White Paper (March 2014): Terrorism Risk: A Constant Threat Detailed history of TRIA How TRIA works Assessing the threat of terrorism Terrorism market conditions Global perspective Download at http://www.iii.org/white_papers/ terrorism-risk-a-constantthreat-2014.html 90 Terrorism Insurance Take-up Rates, By Year, 2003-2013 80% 70% 58% 60% 59% 59% 61% 62% 64% 62% 62% 57% 49% 50% 40% 30% TRIA’s high take-up rates, availability and affordability have benefitted businesses, workers and the entire US economy since the program’s enactment 27% 20% 10% 0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 The Take-Up Rate for Workers Compensation is 100% Source: Marsh Global Analytics, 2014 Terrorism Risk Insurance Report, April 2014 and earlier editions. 91 Terrorism Insurance Take-Up Rates by State for 2013* The overall US takeup rate for terrorism coverage was 62% in 2013 and ranged from a low of 41% in Michigan to a high of 84% in Massachusetts (where demand likely increased due to the April 2013 Boston Marathon bombing) *Data for 27 states with sufficient data. Source: Marsh 2014 Terrorism Risk Insurance Report; Insurance Information Institute. 92 Top 3 Key Facts About TRIA 1. TRIA costs taxpayers virtually nothing 2. TRIA as currently structured continues to provide tangible benefits to the U.S. economy in the form of: Terrorism insurance market stability, affordability and availability Smooth functioning of commercial lending activity Employment stimulus 3. TRIA is now clearly a critical part of the U.S. national economic security infrastructure A primary goal of terrorism is to destabilize the U.S. economy Terrorism risk insurance is critical to ensure a swift recovery in the event of future attacks Bottom Line: TRIA is an unambiguous, unmitigated success 93 Insurance Information Institute Online: www.iii.org Thank you for your time and your attention! Twitter: twitter.com/bob_hartwig Download at www.iii.org/presentations 94