Slide 1 - Prudent Investor Advisors

advertisement

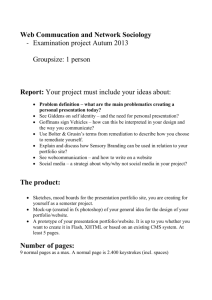

PIA Dimensions 40/60 Portfolio℠ Moderate Portfolio The PIA Dimensions 40/60 Portfolio℠ was constructed for investors with a moderate tolerance for risk. Comprised of 40% equity funds and 60% fixed income funds, the portfolio seeks moderate growth of capital over long time horizons. This portfolio will experience moderate short-term volatility. It is monitored and automatically rebalanced on an annual basis or as needed. Riskier Assets Safer Assets PIA Dimensions 40/60 Portfolio℠ Asset Allocation Domestic Equity International Equity 24% Emerging Market Equity 45% 8% Real Estate 4% 4% Short-Term Fixed Income Marketwide Fixed Income 15% PIA Dimensions 40/60 Portfolio℠ Asset Allocation Symbol Alloca tion Fidelity Spartan 500 Index FUSEX 8% Dimensional US Large Cap Value DFLVX 8% Dimensional US Small Cap Value DFSVX 4% Dimensional US Micro Cap DFSCX 4% Dimensional International Value DFIVX 4% Dimensional Small Cap International Value DISVX 2% Dimensional International Small Company DFISX 2% Dimensional Emerging Markets DFEMX 2% Dimensional Emerging Markets Value DFEVX 2% Dimensional Real Estate Securities DFREX 4% Vanguard Short-Term Treasury VFISX 15% Vanguard Total Bond Market Index VBTSX 45% Fund Name Investment Strategies Underlying the PIA Dimensions Portfolios℠ The PIA Dimensions Portfolios℠, created by Prudent Investor Advisors, LLC, provide participants in 401(k) plans with a full riskbased menu of investment options. The investment strategies underlying all these model portfolios are based on the Nobel prizewinning Modern Portfolio Theory as well as on the Fama/French Three-Factor Financial Economic Model. This approach, grounded in academic research that has withstood rigorous open review for many years, does not rely on analysts’ forecasts or opinions about financial markets, but instead incorporates the key factors that drive the long-run performance of these markets. Many participants in 401(k) plans as well as other investors lack the time or interest to research advanced investment principles. In the absence of such expertise, they may take unintended investment risks. Even experienced investors can find themselves perplexed by unexpected events that occur in financial markets. Compared to conventional broad-based equity market benchmarks, the PIA Dimensions Portfolios℠ focus to a greater extent on small company stocks and value stocks. This emphasis is the result of global evidence that such stocks have above-average expected returns and provide significant diversification benefits when combined with large company stocks and/or growth stocks. This emphasis also incorporates a disciplined and patient style of securities trading, which allows plan participants to reap the benefits of low costs and fees. A plan participant that chooses a PIA Dimensions Portfolio℠ replaces forecasting and guesswork with a disciplined, professional approach that incorporates the benefits of investment theory developed over the past four decades. Selecting a PIA Dimensions Portfolio℠ represents a thoughtful and diversified approach for plan participants. Each PIA Dimensions Portfolio℠ holds more than 12,000 securities from approximately forty-five countries. Worldwide diversification minimizes the potential negative short-term impact that any one company, asset class or country may have on a portfolio’s investment strategy. This reduces overall portfolio risk, allows full exposure to the returns offered by financial markets and limits style drift. No amount of diversification, however, can completely eliminate the potential for investment loss. Date of first use: March 7, 2012 Prudent Investor Advisors, LLC I SEC Registered Investment Advisor