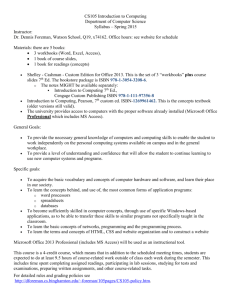

1408032139_293328

CHAPTER 5

Accounting entries for a job costing system

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.1a

Accounting entries for an integrated accounting system

Example

The following are the transactions of AB Ltd for the month of April.

1.

Raw materials of £182 000 were purchased on credit.

2.

Raw materials of £2 000 were returned to the supplier because of defects.

3.

The total of stores requisitions for direct materials issued for the period was £165 000.

4.

The total issues for indirect materials during the period was £10 000.

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.1b

5.

Gross wages of £185 000 were incurred during the period consisting of:

Wages paid to employees £105 000

PAYE due to Inland Revenue

National insurance contributions due

£60 000

£20 000

6.

All the amounts due in transaction 5 were settled by cash during the period.

7.

The allocation of the gross wages for the period was as follows:

Direct wages £145 000

Indirect wages £40 000

8.

The employer’s contribution for national insurance deductions was

£25 000.

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.1c

9.

Indirect factory expenses of £41 000 were incurred during the period.

10.

1Depreciation of factory machinery was £30 000.

11. Overhead expenses charged to jobs by means of factory overhead absorption rates was £140 000 for the period.

12. Nonmanufacturing overhead incurred during the period was £40 000.

13. The cost of jobs completed and transferred to finished goods stock was

£300 000.

9.

The sales value of goods withdrawn from stock and delivered to customers was £400 000 for the period.

10. The cost of goods withdrawn from stock and delivered to customers was

£240 000 for the period.

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.2a

Example

1. Purchase of raw materials

Dr Stores ledger control account

Cr Creditors control account

2. Return of raw materials

Dr Creditors control account

Cr Stores ledger control account

3. Issue of direct materials

Dr Work in progress control account

Cr Stores ledger control account

4. Issue of indirect materials

Dr Factory overhead control account

Cr Stores ledger control account

182 000

2 000

165 000

10 000

182 000

2 000

165 000

10 000

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.2b

1.

Stores ledger control account

Creditors a/c 182 000

Balance b/d

182 000

5 000

2.Creditors a/c 2 000

3.Work in progress a/c 165 000

4.Factory overhead a/c 10 000

Balance c/d 5 000

182 000

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.3a

1. Recording labour costs payable

Dr Wages control account 185 000

Cr Inland Revenue account

Cr National insurance contribution account

20 000

Cr Wages accrued account

60 000

105 000

Note the above accounts will be cleared by crediting cash and debiting each of the accounts.

2. Recording the allocation of labour costs

Dr Work in progress account

Dr Factory overhead control account

Cr Wages control account

185 000

145 000

40 000

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.3b

3.

Recording the employer ’s national insurance contribution

Dr Factory overhead control account

Cr cash/bank

25 000

25 000

Wages control account

5. Wages accrued a/c

5. PAYE tax a/c

5. National Insurance a/c

105 000 7. Work in progress a/c 145 000

60 000 7. Factory overhead a/c 40 000

20 000

185 000

______

185 000

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.4a

1.

Recording the overheads incurred

Dr Factory overhead control account

Cr Expense creditors control account

Cr Provision for depreciation

2.

Recording the allocation of overheads to production

Dr Work in progress control account

Cr Factory overhead control account

71 000

41 000

30 000

140 000

140 000

Note that the balance of the factory overhead account represents the under or over-recovery of overhead that is transferred to the Costing Profit and Loss account.

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.5

1. Recording non-manufacturing overheads incurred

Dr Non-manufacturing overheads account 50 000

Cr Expense creditors

Dr Profit and loss account

Cr Non-manufacturing overheads account

40 000

40 000

40 000

2. Production completed during the period

Dr Finished goods stock account

Cr Work in progress control account

300 000

300 000

3. Recording sales and cost of goods sold

Dr Debtors control account

Cr Sales account

Dr Cost of sales account

Cr Finished goods stock account

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

400 000

400 000

240 000

240 000

5.6a

Contract costing

1.

Contract costing is applied to relatively large cost units which take a long time to complete (e.g. civil engineering projects).

2.

A separate account is maintained for each contract.

• The first section is used to determine cost of sales.

• In the second section cost of sales is compared with sales to derive the profit to date.

• The third section records future expenses and accrued expenses.

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.6b

3. Guidelines for determining profit to date on contracts.

• No profit is taken if the contract is at an early stage.

• Prudence concept applied and losses recorded as

• incurred or anticipated.

• If the contract is near completion a proportion of the profit should be recognized based on the following formula:

Cash received to date

Contract Price

× Estimated profit

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.6c

• Within the 35–85%stage of completion, the following formula is recommended to determine profit to date:

*Notional profit = Value of work certified – Cost of work certified

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.7

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.7

Contract costing example

• The agreed retention rate is 10% of the value of work certified by the contractees ’ architects.

• Contract C is scheduled for handing over to the contractee in the near future, and the site engineer estimates that the extra costs required to complete the contract, in addition to those tabulated above, will total £305 000.

• This amount includes an allowance for plant depreciation, construction services, and for contingencies.

• You are required to prepare a cost account for each of the three contracts and recommend how much profit or loss should be taken up for the year.

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.8

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.9a

Contract costing

Balance sheet entries

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA

5.9b

Cost and Management Accounting: An Introduction, 7 th edition

Colin Drury

ISBN 978-1-40803-213-

9 © 2011 Cengage Learning EMEA