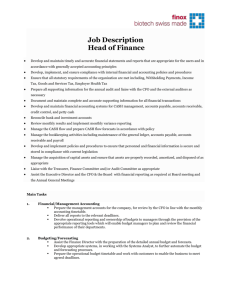

Core Requirement 1 System of Internal Control over financial and

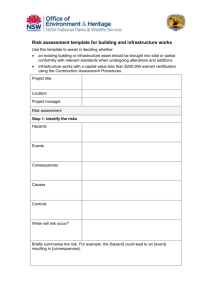

advertisement