Chapter 3

advertisement

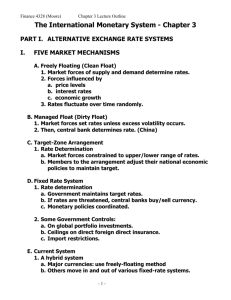

CHAPTER 3 THE INTERNATIONAL MONETARY SYSTEM CHAPTER OVERVIEW I. ALTERNATIVE EXCHANGE RATE SYSTEMS II. A BRIEF HISTORY OF THE INTERNATIONAL MONETARY SYTEM III. THE EUROPEAN MONETARY SYSTEM PART I. ALTERNATIVE EXCHANGE RATE SYSTEMS I. FIVE MARKET MECHANISMS A. Freely Floating (“Clean Float”) 1. Market forces of supply and demand determine rates. ALTERNATIVE EXCHANGE RATE SYSTEMS 2. 3. Forces influenced by a. price levels b. c. interest rates economic growth Rates fluctuate randomly over time. ALTERNATIVE EXCHANGE RATE SYSTEMS B. Managed Float (“Dirty Float”) 1. Market forces set rates unless excess volatility occurs. 2. Then, central bank determines rate. ALTERNATIVE EXCHANGE RATE SYSTEMS C. Target-Zone Arrangement 1. Rate Determination a. Market forces constrained to upper and lower range of rates. b. Members to the arrangement adjust their national economic policies to maintain target. ALTERNATIVE EXCHANGE RATE SYSTEMS: Fixed Rate D. Fixed Rate System 1. Rate determination a. Government maintains target rates. b. If rates threatened, central banks buy/sell currency. c. Monetary policies coordinated. ALTERNATIVE EXCHANGE RATE SYSTEMS E. Current System 1. A hybrid system a. Major currencies: use freely-floating method b. Others move in and out of various fixedrate systems. PART II. A BRIEF HISTORY OF THE INTERNATIONAL MONETARY SYSTEM I. THE USE OF GOLD A. Desirable properties B. In short run: High production costs limit shortrun changes. C. In long run: Commodity money insures stability. A BRIEF HISTORY II. The Classical Gold Standard (1821-1914) A. Major currencies on gold standard. 1. Nations fix the exchange rate in terms of a specific amount of gold. A BRIEF HISTORY 2. Maintenance involved the buying and selling of gold at that price. 3. Disturbances in Price Levels: Would be offset by the price-specie*-flow mechanism. * specie refers to gold coins A BRIEF HISTORY a. Price-specie-flow mechanism adjustments were automatic: 1.) When a balance of payments surplus led to a gold inflow; 2.) Gold inflow led to higher prices which reduced surplus; A BRIEF HISTORY 3.) Gold outflow led to lower prices and increased surplus. A BRIEF HISTORY III. The Gold Exchange Standard (1925-1931) A. Only U.S. and Britain allowed to hold gold reserves. B. Others could hold both gold, dollars or pound reserves. A BRIEF HISTORY C. Currencies devalued in 1931 - led to trade wars. A BRIEF HISTORY D. Bretton Woods Conference - called in order to avoid future protectionist and destructive economic policies A BRIEF HISTORY V. The Bretton Woods System (1946-1971) 1. U.S.$ was key currency; valued at $1 - 1/35 oz. of gold. 2. All currencies linked to that price in a fixed rate system. A BRIEF HISTORY 3. Exchange rates allowed to fluctuate by 1% above or below intially set rates. B. Collapse, 1971 1. Causes: a. U.S. high inflation rate b. U.S.$ depreciated sharply. A BRIEF HISTORY V. Post-Bretton Woods System (1971-Present) A. Smithsonian Agreement, 1971: US$ devalued to 1/38 oz. of gold. By 1973: World on a freely floating exchange rate system. A BRIEF HISTORY B. OPEC and the Oil Crisis (1973-774) 1. OPEC raised oil prices four fold; 2. Exchange rate turmoil resulted; 3. Caused OPEC nations to earn large surplus B-O-P. A BRIEF HISTORY 4. Surpluses recycled to debtor nations which set up debt crisis of 1980’s. C. Dollar Crisis (1977-78) 1. U.S. B-O-P difficulties 2. Result of inconsistent monetary policy in U.S. A BRIEF HISTORY 3. Dollar value falls as confidence shrinks. D. The Rising Dollar (1980-85) 1. U.S. inflation subsides as the Fed raises interest rates 2. Rising rates attracts global capital to U.S. A BRIEF HISTORY 3. Result: Dollar value rises. E. The Sinking Dollar:(1985-87) 1. Dollar revaluated slowly downward; 2. Plaza Agreement (1985) G-5 agree to depress US$ further. A BRIEF HISTORY 3. Louvre Agreement (1987) G-7 agree to support the falling US$. F. Recent History (1988-Present) 1. 1988 US$ stabilized 2. Post-1991 Confidence resulted in stronger dollar 3. 1993-1995 Dollar value falls PART III. THE EUROPEAN MONETARY SYSTEM I. INTRODUCTION A. The European Monetary System (EMS) 1. A target-zone method (1979) 2. Close macroeconomic policy coordination required. THE EUROPEAN MONETARY SYSTEM B. EMS Objective: to provide exchange rate stability to all members by holding exchange rates within specified limits. THE EUROPEAN MONETARY SYSTEM C. European Currency Unit (ECU) a “cocktail” of European currencies with specified weights as the unit of account. THE EUROPEAN MONETARY SYSTEM 1. Exchange rate mechanism (ERM) - each member determines mutually agreed upon central cross rate for its currency. THE EUROPEAN MONETARY SYSTEM 2. Member Pledge: to keep within 15% margin above or below the central rate. THE EUROPEAN MONETARY SYSTEM D. EMS ups and downs 1. Foreign exchange interventions: failed due to lack of support by coordinated monetary policies. THE EUROPEAN MONETARY SYSTEM 2. Currency Crisis of Sept. 1992 a. System broke down b. Britain and Italy forced towithdraw from EMS. THE EUROPEAN MONETARY SYSTEM G. Failure of the EMS: members allowed political priorities to dominate exchange rate policies. THE EUROPEAN MONETARY SYSTEM H. Maastricht Treaty 1. Called for Monetary Union by 1999 (moved to 2002) 2. Established a single currency: the euro THE EUROPEAN MONETARY SYSTEM 3. Calls for creation of a single central EU bank 4. Adopts tough fiscal standards THE EUROPEAN MONETARY SYSTEM I. Costs / Benefits of A Single Currency A. Benefits 1. Reduces cost of doing business 2. Reduces exchange rate risk THE EUROPEAN MONETARY SYSTEM B. Costs 1. Lack of national monetary flexibility.