Intangible Assets

advertisement

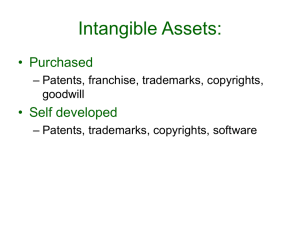

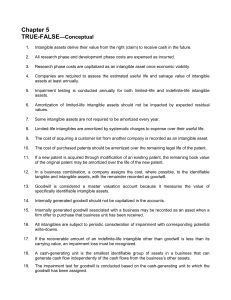

Chapter 6 Intangible Assets 1. Describe the characteristics of intangible assets. 2. Identify the costs to include in the initial valuation of intangible assets. 3. Explain the procedure for amortizing intangible assets. 4. Describe the types of intangible assets. 5. Explain the conceptual issues related to goodwill. 6. Describe the accounting procedures for recording goodwill. 7. Explain the accounting issues related to intangible-asset impairments. 8. Identify the conceptual issues related to research and development costs. 9. Describe the accounting for research and development and similar costs. 10. Indicate the presentation of intangible assets and related items. Intangible Assets Intangible assets are those noncurrent economic resources that are used in the operations of the business but have no physical existence. Patents Copyrights Franchises Intangible Assets Intangible assets are those noncurrent economic resources that are used in the operations of the business but have no physical existence. ® a registered trademark Trademarks Computer software costs Goodwill Intangible Assets Useful life is often difficult to determine. Lack physical substance. Intangible Assets Economic benefits last beyond the current period. Usually acquired for operational use. Intangible Assets Classification Attributes Manner of acquisition Identifiability Exchangeability Period of expected benefit Intangible Assets Accounting At acquisition: record at cost. During use: use the matching principle to allocate cost to expense. At disposition: use the revenue recognition principle to record any gain or loss that might result. Intangible Assets Determination of Cost Record at current cash equivalent cost, including purchase price, transfer, and legal fees. If the asset is acquired through a nonmonetary exchange, cost is - cash paid, plus - the current market value of the noncash consideration given. Intangible Assets Determination of Cost If the asset is created internally, the cost may include - only the costs directly associated with the creation of the intangible asset. Costs classified as R&D must be expensed in the period incurred. - SFAS No. 2 Intangible Assets Amortization of Cost • Intangibles are written off over their useful lives, where the assets have determinable useful lives. • Where the intangibles have indefinite useful lives, they are not amortized. • Acquired intangibles should not be written off at acquisition. Intangible Assets Amortization of Cost Factors to consider when estimating the useful life of an intangible asset: 1. 2. 3. Legal, regulatory, or contractual provisions that place a limit on the maximum economic life. Provisions for renewal or extension of rights or privileges covered by specific intangible assets. Effects of obsolescence, customer demand, competition, rate of technological change, and other economic factors. Continued Intangible Assets Amortization of Cost Factors to consider when estimating the useful life of an intangible asset: 4. Possibility that the economic lives of intangibles may be related to life expectancies of certain groups of employees. 5. Expected actions of competitors, regulatory bodies, and others. Intangible Assets Amortization of Cost Intangible Assets With a Finite Life Are Amortized. The calculation of the amortization of intangible assets follows the same principles as the depreciation of tangible assets. Intangible Assets Amortization of Cost Amortization systematically and rationally allocates the acquisition cost of intangible assets to expense. Acquisition Cost Cost Allocation Expense Intangible Assets Amortization of Cost 1. Select a method based on the pattern of benefits, if not determinable, use the straight line method. 2. Intangible assets do not have a residual value. Intangible Assets Amortization of Cost The entry to record amortization of an intangible asset includes: - a debit to Amortization Expense. - a credit directly to the intangible asset account. Intangible Assets Amortization of Cost A company purchases a patent for $85,000. Patent Cash 85,000 85,000 At year-end the patent is amortized over 10 years (no expected residual value). Amortization Expense (or Factory Overhead) 8,500 Patent (or Accumulated Amortization: Patent) 8,500 Patents An exclusive right recognized by law and registered with the US Patent Office. The holder is allowed to use, manufacture, sell, and control the item, process, or activity without interference or infringement by others. Patents Costs of purchasing patents are capitalized. Costs to research and develop patents are expensed as incurred. Patents are amortized over the shorter of the legal life (20 years) or their useful lives. Legal fees incurred to successfully defend patents are capitalized. Patents Question Batter-Up, Inc. has developed a new device. Patent registration costs consisted of $2,000 in attorney fees and $1,000 in federal registration fees. What is Batter-Up’s amortizable cost? Patents Question Batter-Up, Inc. has developed a new device. Patent registration costs consisted of $2,000 in attorney fees and $1,000 in federal registration fees. What is Batter-Up’s amortizable cost? Batter-Up’s cost for the new patent is $3,000. Patents Question Batter-Up has estimated that the device has a useful life of 5 years. The legal life is 20 years. At the end of year 1, what is Batter-Up’s amortization expense? Patents Question Batter-Up has estimated that the device has a useful life of 5 years. The legal life is 20 years. At the end of year 1, what is Batter-Up’s amortization expense? Use the shorter of useful life or legal life; 5 years. Amortization = Cost ÷ Est. Useful Life = $3,000 ÷ 5 years = $600 Patents Question Prepare the adjusting entry to record BatterUp’s amortization expense for the period. Patents Question Prepare the adjusting entry to record BatterUp’s amortization expense for the period. GENERAL JOURNAL Page: Date Description Amortization Expense Device Patent to record patent amortization for the period PR Debit 15 Credit 600 600 Copyrights A form of protection given by law to authors of literary, musical, artistic, and similar works. Copyright owners have exclusive rights to print, reprint, copy, sell or distribute, perform and record the work. Copyrights • • Copyrights are granted for life of the creator plus 70 years. Copyrights can be sold or assigned, but cannot be renewed. • Copyrights are amortized over their useful life. • Costs of acquiring copyrights are capitalized. • Research and development costs involved are expensed as incurred. Trademarks and Trade Names • A symbol, design, or logo associated with a business. • Trademarks and trade names are renewable indefinitely by the original user in periods of 10 years each. Trademarks and Trade Names • • Costs of acquired trademarks or trade names are capitalized. If trademarks or trade names are developed by the a business, all direct costs (except R&D costs) are capitalized. Franchises and Licenses • A franchise is a contractual agreement under which: The franchisor grants the franchisee: • the right to sell certain products or services, • the right to use certain trademarks or trade names, or • the right to perform certain functions, within a certain geographical area. Franchises and Licenses • • • • A franchise may be for a limited time, for an indefinite time period, or perpetual. The cost of a franchise (for a limited time) is amortized over the franchise term. A franchise (for an unlimited time) is carried at cost and not amortized. Annual payments for a franchise are expensed. Intangible Assets Goodwill Represents the value associated with favorable characteristics of a firm that result in earnings in excess of those expected from identifiable assets of the firm. For many large firms, goodwill is a major reported asset. Intangible Assets Goodwill Goodwill is always present, but is only recorded when one company combines with another company. Goodwill is the excess of the actual purchase price of an acquired firm over the fair market value (FMV) of the identifiable net assets acquired. Intangible Assets Goodwill Example Eddy Company paid $1,000,000 to purchase all of James Company’s assets and assumed James Company liabilities of $200,000. James Company’s assets were appraised at a fair value of $900,000. Goodwill Question What amount of goodwill should be recorded on Eddy Company books? a. $100,000 b. $200,000 c. $300,000 d. $400,000 Goodwill Question What amount of goodwill should be recorded on Eddy Company books? a. $100,000 FMV of Assets Debt Assumed $ b. $200,000 FMV of Net Assets Purchase Price Goodwill $ c. $300,000 d. $400,000 900,000 200,000 700,000 1,000,000 $ 300,000 Goodwill Example Sara Company purchases all the assets of Trevor Company for $790,000 cash and Trevor Company is dissolved. Trevor Company’s identifiable assets had a fair value of $920,000 and its liabilities totaled $200,000. Assets Goodwill Liabilities Cash Individual assets and liabilities actually would be debited or credited. 920,000 70,000 200,000 790,000 Negative Goodwill • • • Fair value of net assets acquired is higher than purchase price of assets. Resulting credit is negative goodwill (badwill). FASB requires that any remaining excess be recognized as an extraordinary gain. Goodwill Write-Off • • • Acquired goodwill has an indefinite life and should not be amortized but is subject to impairment. Impairment test should be performed at least annually. If applicable, loss recorded. Impairments of Intangibles • An impairment occurs when: -- the carrying amount of an asset is not recoverable, and -- a write-off of the impaired amount is needed • To determine the amount of impairment, a recoverability test is used. Impairment Tests Type of Asset • • • • Impairment Tests Property, Plant & Equipment • Limited Live Intangible Recoverability test,then fair value test • Recoverability test, then fair value test • Fair value test • Fair value test on reporting unit, then fair value test on implied goodwill Indefinite-life intangible, other than goodwill Goodwill Impairments: The Recoverability Test Impairment? Sum of expected future net cash flows from use and disposal of asset is less than the carrying amount Sum of expected future net cash flows from use and disposal of asset is equal to or more than the carrying amount Impairment has occurred No impairment Impairments: Measuring Loss Impairment has occurred Determine impairment loss Yes Does an active market exist for the asset? No Use company’s market rate of interest Loss = Carrying amount less Fair value of asset Loss = Carrying amount less present value of expected net cash flows Impairment: Accounting • Loss = Carrying value less Fair value • Amortize new cost basis • Restoration of impairment loss is NOT permitted Impairment Test: Fair Value Test • Compares fair value of intangible asset with assets' carrying amount. • If fair value less than carrying amount, impairment recognized. Impairment of Goodwill • The fair value of the reporting unit should be compared to its carrying amount including goodwill. • The fair value of the goodwill must be determined and compared to its carrying amount. Impairment of Goodwill The Kent Company acquired the Devon Company as a subsidiary several years ago. The Devon Company has a book value of $3.6 million, including goodwill of $400,000. Kent now Company estimates that its fair value is $3 million. If Kent Company allocates $2.7 million of the fair market value to Devon Company’s identifiable assets and liabilities, this means that $300,000 is implied for goodwill. Thus, there has been an impairment loss of $100,000. Impairment of Goodwill Net Assets Goodwill Total Book Value $3,200,000 400,000 $3,600,000 Impairment Loss on Goodwill Goodwill Fair Value $2,700,000 300,000 $3,000,000 100,000 100,000 Research and Development Costs Research -- Planned search or critical investigation aimed at discovery of new knowledge Development -- The translation of research findings or other knowledge into a plan or design for a new product or process or for a significant improvement to an existing product or process whether intended for sale or use Research and Development Costs R&D costs are expensed as incurred. Material R&D costs must be disclosed. Equipment, facilities, and purchased intangibles related to the research should be capitalized . . . . . . if those items have alternative future uses. Research and Development Question Batter-Up, Inc. has developed a new device. Research and development costs totaled $30,000. Patent registration costs consisted of $2,000 in attorney fees and $1,000 in federal registration fees. What is Batter-Up’s amortizable cost? Research and Development Question Batter-Up, Inc. has developed a new device. Research and development costs totaled $30,000. Patent registration costs consisted of $2,000 in attorney fees and $1,000 in federal registration fees. What is Batter-Up’s amortizable cost? Batter-Up’s cost for the new patent is $3,000. The $30,000 R & D cost is expensed as incurred. Computer Software Cost SFAS No. 86 Accounting for the Costs of Computer Software to be Sold, Leased, or Otherwise Marketed All costs incurred to establish the technological feasibility of a computer software product are to be treated as R&D and expensed as incurred. Subsequent costs to obtain product masters are to be capitalized as an intangible asset. Computer Software Cost Amortization Amortization of capitalized computer software costs starts when the product begins to be marketed. Two methods are allowed: -- Revenue method -- Straight-line method Computer Software Cost Disclosures Balance Sheet -- Unamortized computer software product master cost is an asset. Income Statement -- Amortization expense associated with computer software cost. -- R&D expense associated with computer software development cost. Chapter 6 Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc.