International Compensation

advertisement

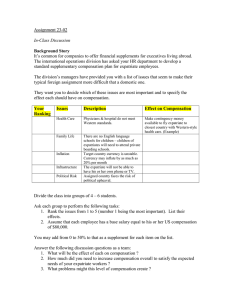

International Compensation Nancy Johnson April 2005 Definitions Host country nationals (HCN) • Local citizens working for a foreign company Expatriates • People working for a company from their native country but in another country Third party nationals • People working for a company with ownership and at a location which is different than their own country Set Expatriate Pay Level Exercise: You are a Compensation Executive with an American Company making $100,000 per year. You are married with a husband and two children. Your company has asked you to live and work in: • • • • • • • London, England Beijing, China Cairo, Egypt Montreal, Canada San Palo, Brazil Sydney, Australia Baghdad, Iraq Describe what factors you would consider in deciding how and what types of factors are important to your relocation? Exchange Rate Financial Currency Inflation Foreign Service Premiums Hazard Premiums Mobility Pay – incentive to change assignment Taxes Fringe Housing allowances Tax Local customs Education Security Extra paid time off to return home Rest & relaxation leave Balance Sheet Approach Standard of living comparable to US • • • • • Ties to US Don’t want to assimilate into local culture Short assignment Return home to US following assignment Income protection Try to stay comparable in housing, goods & services, discretionary income, & taxes Considerations for Other Employees What is the proper role for the balance between HNCs and TCNs? Strategies • Think global, act local • One size fits all Facilitates moving between countries • Think & act globally & locally Legal differences Cultural differences Summary Internal, external & individual equity become far more complicated in international compensation Many more comparisons are made and the change in exchange rate and so forth become far more complicated