Insurance Company Management II

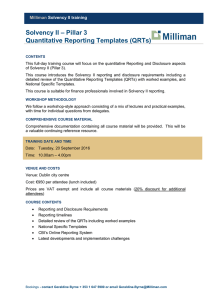

advertisement

Insurance Company Management II PROF. ENRICO PARRETTA; PROF. ALBERTO FLOREANI MODULE I (Professor Enrico Parretta) COURSE AIMS The course aims to teach the student the key elements of governance and strategy implementation in the insurance business. COURSE CONTENT SUMMARY 1. The implementation of strategy in the insurance business From strategy to product, to management processes, to company structure. 2. The elements of governance in the insurance company Governance: principles, regulations and persons involved. The internal audit and risk management units of an insurance company. COURSE PREREQUISITES Students enrolling the course should have an understanding of the fundamental characteristics of the insurance business. INSTRUCTIONAL OBJECTIVES THAT THE STUDENT IS EXPECTED TO ACHIEVE WITH THE COURSE Having thoroughly studied the material, the student is expected: – to be familiar with the main areas of activity of insurance companies, their inter-relationships and their contribution to the chain of value; – to understand how the defined strategy can determine the corporate structure; – to be familiar with the key elements of insurance company governance and therefore, with the second pillar of Solvency 2, with both its theoretical aspects (such as, for example, the ERM Coso) and operational aspects (for example, the activities carried out by the internal audit and risk management units). READING LIST L. SELLERI, Strategia e marketing delle imprese di assicurazione, EDUCatt (pages 15-86). E. PARRETTA, Controllo Interno e Assicurazioni, F. Angeli, 2007 (Chapters II, IV and V). Direttiva Quadro Solvibilità II (2009-138-CE – art. 41-50) and related measures for the implementation of the second level of the governance system. TEACHING METHOD The course will be taught through lectures, with the contribution of external professionals in the in-depth study of certain topics. The instructional material (slides and other documentation) will be made available on the Blackboard page for the course once showed in class. ASSESSMENT METHOD Written test, with possibility of an interview to supplement the grade earned on the written test on request. NOTES Further information can be found on the lecturer's webpage http://www2.unicatt.it/unicattolica/docenti/index.html, or on the Faculty notice board. at MODULE II(Professor Alberto Floreani) COURSE AIMS The course aims to illustrate and study several of the most innovative topics about finance and risk management within insurance companies. COURSE CONTENT SUMMARY 1. The new system of prudential oversight of insurance companies: Solvency 2. Introduction to Solvency II. The first pillar of Solvency 2. The economic balance sheet and the valuation of assets, technical reserves and other liabilities. Own funds. Measurement of risks. The capital requisites for solvency (SCR and MCR). The standard formula and overview of internal models. 2. Measurement and management of financial risks in insurance companies. Measurement and management of equity security price risk. The measurement of equity security price risk in Solvency II. Measurement and management of interest-rate risk. Asset/liability management and classical financial immunisation model. Measurement of interest-rate risk in Solvency II. Overview of other financial risks borne by insurance companies (exchange-rate risk, property price risk, spread risk, and counterparty default risk). 3. Consolidated financial statements for insurance companies according to international accounting principles. The structure of the consolidated financial statements of insurance companies. Reporting and valuation of financial instruments and insurance contracts: current situation and prospects (IAS 39, IFRS 4 and IFRS 9). Non-accounting disclosures: embedded value and measurement of value created by insurance management. COURSE PREREQUISITES Students enrolling the course should have an understanding of the fundamentals of economics and insurance company management. INSTRUCTIONAL OBJECTIVES THAT THE STUDENT IS EXPECTED TO ACHIEVE WITH THE COURSE 1. The new system of prudential oversight of insurance companies: Solvency 2. Having thoroughly studied the material, the student should understand in detail the structure of the first pillar of Solvency 2, and should be capable of understanding its effects on an insurance company's risk management. 2. Measurement and management of financial risks in insurance companies. Having thoroughly studied the material, the student should understand the techniques used for the measurement and management of the main financial risks borne by insurance companies. The student should be familiar with valuedriven asset-liability management techniques and know how to apply them to simple strategies for managing interest-rate risk. 3. Consolidated financial statements for insurance companies according to international accounting principles. Having thoroughly studied the material, the student should understand the structure of the consolidated financial statements of insurance companies and the international accounting principles regarding financial instruments and insurance contracts. READING LIST A. FLOREANI, Appunti delle lezioni, 2014-15, text available on Blackboard. TEACHING METHOD The course will be taught through lectures and exercises. The instructional material (slides and other documentation) will be made available on the Blackboard page for the course. ASSESSMENT METHOD Written an oral test. NOTES Further information can be found on the lecturer's webpage http://www2.unicatt.it/unicattolica/docenti/index.html, or on the Faculty notice board. at