AA3F9 - Activating your university user account

advertisement

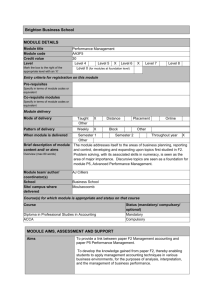

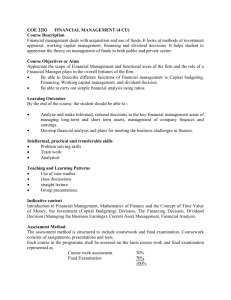

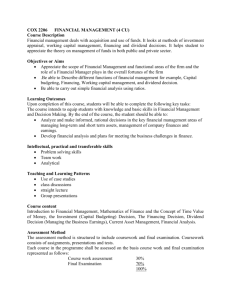

MODULE SPECIFICATION TEMPLATE MODULE DETAILS Module title Module code Credit value Level Mark the box to the right of the appropriate level with an ‘X’ Financial Management AA3F9 30 Level 4 Level 5 X Level 6 Level 0 (for modules at foundation level) Level 7 Level 8 Entry criteria for registration on this module Pre-requisites Specify in terms of module codes or equivalent Co-requisite modules Specify in terms of module codes or equivalent Module delivery Mode of delivery Taught Other X Distance Placement Pattern of delivery Weekly X Block Other Online When module is delivered Semester 1 Semester 2 Throughout year X Other Brief description of module This module is designed to develop the knowledge and skills expected of content and/ or aims a finance manager in relation to investment, financing and dividend policy Overview (max 80 words) decisions. Module team/ author/ Jenny Robertson coordinator(s) School Brighton Business School Site/ campus where Moulsecoomb delivered Course(s) for which module is appropriate and status on that course Course Diploma in Professional Studies in Accounting Status (mandatory/ compulsory/ optional) Mandatory ACCA Compulsory MODULE AIMS, ASSESSMENT AND SUPPORT Aims To introduce the financial environments in which financial decision making takes place and to explore the ideas and practices of finance and financial management To understand the workings of the financial system and evaluate alternative sources of finance and assess investment possibilities To develop the knowledge and skills expected of a finance manager in relation to the investment, financing and dividend policy decisions. Learning outcomes On completion of this module students should be able to: Subject specific: Discuss the role and purpose of the financial management function. Assess and discuss the impact of the economic environment on financial management. Discuss and apply working capital management techniques. Carry out effective investment appraisal. Identify and evaluate alternative sources of business finance. Explain and calculate the cost of capital and the factors which affect it. Discuss and apply principles of business and asset valuations. Explain and apply risk management techniques in business. Cognitive: Content Demonstrate numeracy skills, including the ability to manipulate financial and other numerical data and appreciate the statistical concepts at an appropriate level. Demonstrate skills in the use of communications and information technology. Financial management function: The nature and purpose of financial management. Financial objectives and relationship with corporate strategy. Stakeholders and impact on corporate objectives. Financial and other objectives in not-for-profit organisations. Financial management environment: The nature and role of financial markets and institutions. The treasury function. Working capital management: The nature, elements and importance of working capital. Management of inventories, accounts receivable, accounts payable and cash. Determining working capital needs and funding strategies. Investment appraisal: Non-discounted cash flow techniques. Discounted cash flow (DCF) techniques. Allowing for inflation and taxation in DCF. Adjusting for risk and uncertainty in investment appraisal. Specific investment decisions ( asset replacement, capital rationing). Business finance: Sources of, and raising short-term finance. Sources of, and raising long-term finance. Internal sources of finance and dividend policy. Gearing and capital structure decisions. Finance for small and medium sized entities (SMEs). Cost of capital: Sources of finance and their relative costs. Estimating the cost of equity. Estimating the cost of debt and other capital instruments. Estimating the overall cost of capital. Capital structure theories and practical considerations. Impact of cost of capital on investments. Business valuations: Nature and purpose of the valuation of the business and financial assets. Models for the valuation of shares. The valuation of debt and other financial assets. Efficient market hypothesis (EMH) and practical considerations in the valuation of shares. Risk management: The nature and types of risk and approaches to risk management. Hedging techniques for foreign currency risk. Hedging techniques for interest rate risk. Learning support Indicative Reading: The latest editions of: Arnold, G., Corporate Financial Management, Pearson Atrill, P., Financial Management for Non-specialists, Pearson Lumby, S. & Jones, C., Corporate Finance: Theory and Practice, Cengage McLaney, E. J., Business Finance: Theory and Practice, Pearson Pike, R., Neale, B.& Linsley P., Corporate Finance and Investment, Pearson Watson, D. & Head, A., Corporate Finance: Principles and Practice, Pearson Journals: Accounting and Business Research Journal of Finance Journal of Financial Economics Harvard Business Review Managerial Finance Websites: www.economist.com www.ft.com www.londonstockexchange.co.uk All students benefit from: Studentcentral Online Library Resources (e-journals and e-books) Library facilities Teaching and learning activities Details of teaching and learning activities The module will use a mix of teaching and learning processes. The basis of presentation of new material will be by the use of lectures supported by course notes, student research and seminars/workshops. Students will be given both problem-solving and discursive questions to prepare that will consolidate their understanding of the topics introduced. Student learning will be supported through e-learning with the provision of materials made available through studentcentral. In addition, teaching sessions can be conducted using online resources, and could involve students gathering, for example, financial data from Reuters. Allocation of study hours (indicative) Study hours Where 10 credits = 100 learning hours SCHEDULED This is an indication of the number of hours students can expect to spend in scheduled teaching activities including lectures, seminars, tutorials, project supervision, demonstrations, practical classes and workshops, supervised time in workshops/ studios, fieldwork, and external visits. 44 GUIDED INDEPENDENT STUDY All students are expected to undertake guided independent study which includes wider reading/ practice, follow-up work, the completion of assessment tasks, and revisions. 156 PLACEMENT The placement is a specific type of learning away from the University. It includes work-based learning and study that occurs overseas. TOTAL STUDY HOURS 200 Assessment tasks Details of assessment on this module Coursework: an individual assignment based on a case involving problem solving and some research. This assignment will test the following soft skills: - the student’s computing skills (spreadsheets and word processing) - the student’s understanding and ability to solve a particular accounting problem This assessment will carry a weighting of 25%. Examination: a three hour closed book examination. The examination will carry a weighting of 75%. Types of assessment task1 % weighting Indicative list of summative assessment tasks which lead to the award of credit or which are required for progression. (or indicate if component is pass/fail) WRITTEN Written exam 75% COURSEWORK Written assignment/ essay, report, dissertation, portfolio, project output, set exercise 25% PRACTICAL Oral assessment and presentation, practical skills assessment, set exercise 1 Set exercises, which assess the application of knowledge or analytical, problem-solving or evaluative skills, are included under the type of assessment most appropriate to the particular task. EXAMINATION INFORMATION Area examination board Diploma in Professional Studies in Accounting Refer to Faculty Office for guidance in completing the following sections External examiners Name Position and institution Date appointed Date tenure ends Refer to Studentcentral QUALITY ASSURANCE Date of first approval Only complete where this is not the first version Date of last revision Only complete where this is not the first version Date of approval for this version October 2014 Version number 2 Modules replaced AA209 Specify codes of modules for which this is a replacement Available as free-standing module? Yes No X