PowerPoint PresentationFiltered Water PowerPoint

advertisement

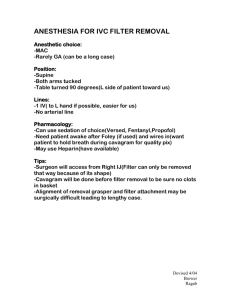

Brita Case March 2006 Brita – Overview Past • Pioneer in water filter technology • Over 10 years of successful sales and market domination Present • “Leaky bucket” and decreasing market share Future • Brita Blue Filters Brita’s success – the “blue-water” decade 1993 - Educational ad campaign on how to use Brita 1988 - First in the market with value proposition of great tasting water “Tap water transformed” 1999 - National distribution (40,000 stores) - Brand awareness 70% - 18% of 103mil households use Brita - 80% of customers still using it one year on - Industry worth $350MM (owned 71%) - 70 competitors failed - Consumer choice limited to tap water or PT Brita created the market for filtered water, aided by shifting consumer values towards safety, health, and great taste Brita’s problems 1999 - 2006 • Brita’s share of the filtered water market was threatened by PUR (exacerbated when they were purchased by P&G) and the emergence of bottled water (1997) • • Strategy 1 Strategy 2 Strategy 3 Strategy 4 Strategy 5 Where does water belong? Bottled Water as the bad guy Leaky Bucket Tap water Turnoffs Bottled Water as the bad guy Re-visited Quit the water business Beverage vs. filter • • Difficult to change people’s behaviour Bottled water taste without the bottle • • • 46% of PT lapsed in a year Gauge & Windows innovation did not succeed • • Revisit filtration when BW is so prevalent Transform the taste of tap • • More convenient Cheaper Brita did not identify their target market and failed to come up with an effective value proposition Target market selection criteria Criteria Tap Traditionalists Weary Tap Satisfied Segment is well defined/identifiable Principled Filtered Fans Affluent Fridge Followers Assertive Self improvers Bottled Water Indulgers All of the segment are well defined. Accessible 1 2 6 4 5 3 Competitor Intensity Highest tap satisfaction index (220) limited room for market entrant High competitive intensity(lots of substitutes) focus convenience & budget FM, other pitchers, refrigerator filter system No room for nonrefrigerator mark entrant Competition from other filtered water options: Refrigerator, FM, PT, and bottled water High-20% of producers control 80% of sales Stability of preferences Want: Tap Water Likely to switch: No Susceptible to innovation: No TSI: 220 Want: Cheap & Convenient Likely to switch: No Susceptible to innovation: No TSI: 171 Want: Filtered Water Likely to switch: No Susceptible to innovation: Yes TSI: 43 Want: Convenient filtered water Likely to switch: No Susceptible to innovation: Yes TSI: 81 Want: Volume, healthy, valueseekers Likely to switch: Yes Susceptible to innovation: Yes TSI: 121 Want: Simplicity and accessibility Likely to switch: No Susceptible to innovation: Maybe TSI: 34 Profit potential Low Low High Medium High Low Target market selection rationale # of 8oz Glasses Per Day Water Consumption 16 14 12 10 8 6 4 2 0 Away from Home At Home 10.33 5.25 5.64 2.815 2.99 Average 4.56 4.45 2.7 2.88 4.01 2.67 Principled Filter Fans Affluent Fridge Followers Assertive Self Improvers Bottled Water Indulgers 2.38 1.64 Tap Traditionalist Weary Tap Satisified 4.14 Primary Source of Water 100 90 80 70 60 50 40 30 20 10 0 Total Filtered Water Bottled Water Tap Water 33.3 21.7 35.4 Tap Traditionalists Weary Tap Satisified 4.3 4.4 67.3 12.1 6.8 75 Principled Filter Fans 90.6 0.8 3.1 Affluent Fridge Followers 75.7 1.9 6.6 Assertive Self Improvers 32.3 26.3 30.7 Bottled Water Indulgers 0.4 84.9 8.1 Target Markets Principled Filter Fans • • • • Current core consumer base High accessibility and profitability Primary source of water : Filtered water Sound bite: Filtered water is healthier than tap Assertive Self-Improvers • Potential new segment • Good accessibility • High growth potential: Lack of penetration & high water consumption • Primary source of water : Filtered water & Tap water • Sound bite: I drink a lot of water – it keeps me healthy Consumer perspective on competitive products Consumer Perception (PT vs. FM) PT 9 8 7 6 5 4 3 2 1 0 Water Quality Entry Cost Ongoing Cost Transportation Faucet Installation Space Usage Volume Maintenance Simplicity Portability Maintenance Simplicity Portability Consumer Perception (BW vs. PT) 10 Bottled Water Pitcher (PT) 8 6 4 2 0 Water Quality Entry Cost Ongoing Cost Transportation Installation Space Usage Volume Brita Blue – Smart Filter The Filter How it Benefits Brita • Helps solve leaky bucket • Increases filter purchases • Differentiates us from competition How it Benefits the Customer • Convenience – Know when to change filter • Safer – Change filter to avoid contaminants The Website How it Benefits Brita • Increases customer interaction • Customer data – demographics • Additional revenue stream How it Benefits the Customer • Drinks water for health – meet daily quota of consumption • Ease of purchase Brita’s Value Proposition Points of Parity Remove Contaminants Water Clarity Points of Differentiation Tastes Better Than Tap Convenience – Color Indicator Website Brita Blue is the most technologically advanced and cutting-edge filter on the market because its colour-change indicator lets you know when a new filter is needed so that you can avoid contaminants and continue enjoying clear, greattasting water. Pricing Considerations New Filter Product Pitcher Faucet Mounted “Traditional” Filter Brita Blue (New Filter) New Price Unchanged Unchanged Unchanged High price high margin Rationale Pitcher Incremental Traditional Brita Blue annual filter Faucet Filter Filter sales Mounted Incremental Traditional Brita Blue annual filter Filter Filer sales $60 $48 $50 $40 $5 $30 $20 $10 $30 $5 $8 $48 $8 Traditional Filter $0 Assumptions: 1. Optimal filter changes occur 6x per year (1/2months) 2. Customer leakage on traditional filter wrt PT= 20% $45 $24 Traditional Filter $30 Methods of Distribution Communication Strategy- Focusing on the 6 M’s Mission - Increase awareness, consideration and purchase of our Brita Blue Smart filter Market - Our existing customers - The Assertive Self-Improvers Message - Brita Blue alerts you to change your filter - Website allows you to track your water consumption Media - TV & print ads - Website Money - To be determined Measurement - Sales of Brita Blue - # subscribed users on the website Decision Making Process Product Promoting Ads Awareness Consideration Affective Ads Provide to Yoga Studios/Gyms Brand-Building Ads Attitude Trial Repeat/ Loyalty Apply push & pull tactics to influence the customer decision making process Product-Promoting Ad Decision Making Process Product Promoting Ads Awareness Consideration Affective Ads Provide to Yoga Studios/Gyms Brand-Building Ads Attitude Trial Repeat/ Loyalty Apply push & pull tactics to influence the customer decision making process Attitudinal & Behavioral Objectives Behavioral Objectives Attitudinal Objectives Think Feel Believe The Brita Blue filter is trustworthy and convenient Do Change Filters Increase filter change frequency and confidence Brita cares about overall well-being and caters to my lifestyle Do Use Website Create Brita Blue account & improve consumption awareness Brita is improving my overall quality of life Don’t Switch Brands Decrease likelihood of brand-switching Risk & Concerns with Marketing Strategy Single Message to Consumers Consumer Price Sensitivity Website Adoption Competitor Innovation • The current marketing plan is focused on sending a single message to consumers regardless of their product choice • Demand elasticity with respect to price is unknown for our target segments (ie. will the more expensive filter fail on the basis of price) • The Assertive self-improvers, despite being diligent, do not indicate a heavy use of the internet. If the segment does not use the website there is room for competitors to displace us • An omnipresent threat in the competitive and fragmented filtered water market, will P&G come up with a more innovative product? Questions? Appendix A: The Website Filter Capacity Days used Cups per Litre 100 L 50 Days 4.23 Cups per Day 8.46 Appendix B