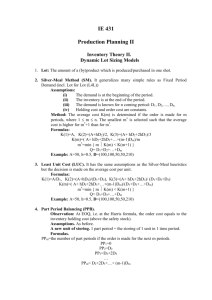

Dynamic Lot Size Models

advertisement

Dynamic Lot Size Models

A Production Engineering Special

presented by the ENM Faculty

Fine print: This is section 7.2 and Appendix 7-A in the text. You

will want to read it!

1

Why would demands fluctuate?

• Material Requirements Planning (MRP) methodology

(planned order releases)

• optimal production lot sizes

• produce to meet contract orders by specified dates

• seasonal demands

• replacement parts

• trends in demands

• shifts in market place (competitor, advertising,

discounts, etc.

• change in sales force

2

The Problem

• A known set of time-varying demands

• Setup or order costs independent of order or lot

size (Q)

• Holding costs proportional to the number of time

periods item is maintained in inventory

• What order quantities or production lot sizes will

minimize order + holding cost over the planning

horizon?

3

Methods for dealing with “lumpy” demands

A set of lumpy demands

(D1, D2, …,Dn)

• Production Smoothing

• Use EOQ (assumes constant demand)

• Simple rules

– fixed period demand

– period order quantity

– lot for lot reordering

• Heuristic rules

– Silver-Meal method

– least unit cost

– part period balancing (PPB)

• Wagner-Whitin algorithm

• Transportation Problem

4

Some Assumptions

• Demands, Dj, are known for periods j =1, …n

• Demand Dj must be satisfied in period j and available

at the start of the period

• Replenishments arrive at the beginning of a period

• No quantity discounts

• Unit costs do not change over planning horizon

• no shortages permitted

• lead-times are known and constant

• entire order quantity arrives at the same time

• items are independent of one another

• carrying costs applies only to inventory carried over

from one time period to another

5

Using EOQ

Wk1

Wk2

Wk3

Wk4

Wk5

Wk6

Wk7

Wk8

Wk9

Wk10

42

42

32

12

26

112

45

14

76

38

• Setup cost is $132

• Holding costs are $.60 per item per week

Total demand 439

D 43.9, K 132 / h .6

(2)(132)(43.9)

Q

139

.6

6

Using EOQ

Q

End

Inv

Wk1

Wk2

Wk3

Wk4

Wk5

Wk6

Wk7

Wk8

Wk9

Wk10

42

139

42

0

32

0

12

0

26

139

112

0

45

139

14

0

76

0

38

139

97

55

23

11

124

12

106

92

16

117

Sum =

653

• Total Setup cost is $132 x 4 = $528

• Total Holding costs are $.60 x (653-117) = $321.60

• Total cost = $849.60

7

Fixed Period Demand

(D1, D2, …,Dn)

Rule: Order m months worth of demands.

Example: m = 3

1st order quantity: D1 + D2 + D3

2nd order quantity: D4 + D5 + D6

8

Fixed Period Demand

Q

End Inv

Wk1

Wk2

Wk3

Wk4

Wk5

Wk6

Wk7

Wk8

Wk9

Wk10

42

42

32

12

26

112

45

14

76

38

84

44

138

59

114

42

12

112

14

38

• M = 2; cost = 5 x 132 + 218 x .60 = $790.80

Q

End Inv

Wk1

Wk2

Wk3

Wk4

Wk5

Wk6

Wk7

Wk8

Wk9

Wk10

42

42

32

12

26

112

45

14

76

38

128

114

38

0

154

112

285

70

38

26

0

173

• M = 5; cost = 2 x 132 + 699 x .60 = $683.40

9

Period Order Quantity (POQ)

(D1, D2, …,Dn)

1.

2.

3.

4.

Establish an average lot size - L.

Determine the average demand - Davg

Set m = L / Davg

Order in period j, Dj+1 , Dj+2 , …,Dj+m

Example:

demands

1

19

Davg = 120 / 6 = 20

2

14

week

3

21

4

25

5

18

6

23

If L = 40 then m = 40 / 20 = 2

order: D1 + D2 , D3+ D4 , D5 + D6

10

Period Order Quantity (POQ) (D1, D2, …,Dn)

1 L = 150 (perhaps breakpoint for quantity discounting)

2. Davg = 43.9 44

3. Set m = L / Davg = 150 / 44 = 3.4 3

Q

End Inv

Wk1

Wk2

Wk3

Wk4

Wk5

Wk6

Wk7

Wk8

Wk9

Wk10

42

42

32

12

26

112

45

14

76

38

116

74

150

32

0

138

135

112

0

90

38

14

0

0

cost =4 x 132 + 460 x .60 = $804.00

11

Lot for Lot (L4L)

(D1, D2, …,Dn)

Set order quantity equal to Dj

That is, order for each period , the expected demands.

Wk1 Wk2 Wk3 Wk4 Wk5 Wk6 Wk7 Wk8 Wk9 Wk10

Q

End Inv

42

42

0

42

42

0

32

32

0

12

12

0

26

26

0

112

112

0

45

45

0

14

14

0

76

76

0

38

38

0

cost = 10 x 132 = $1,320

Note that holding costs are zero!

12

Silver-Meal Heuristic

• Try to minimize average cost per period

• costs includes ordering (set-up) (K) and holding

cost (h).

• Assume K and h are constant over the planning

horizon.

• assume holding costs occur at the end of the

period

• assume quantity needed in a period is used at the

beginning of the period

13

Silver-Meal Heuristic (D1, D2, …,Dn) Continue until

Order quantity is then D1 + D2 + … + Dm

cost / period

starts increasing

Order period

Ordering cost

Holding cost

Cost / period

One period

K

0

K/1

Two periods

K

hD2

(K+hD2) / 2

Three periods

K

hD2 + 2hD3

(K+ hD2 +

2hD3) / 3

Four periods

K

hD2 + 2hD3 +

3hD4

(K+ hD2 +

2hD3 + 3hD4)

/4

14

m

Silver-Meal Heuristic

Example: K = $90 ; h = 1.20 per unit per month

Month

Demands

1

20

2

30

3

23

4

19

5

32

6

28

Order Period Ordering cost Holding Cost Avg cost / period

one month

90

two months

90

1.2(30) = 36

126 / 2 = 63

three months

90

1.2(30)

+2.4(23)=91.2

181.2 / 3 = 60.4

Four months

90

90

91.2 + 3.6 (19)

= 159.6

M=3

249.6 / 4 = 62.4

Order quantity = 20 + 30 + 23 = 73

15

Repeat for next order

Example: K = $90 ; h = 1.20 per unit per month

Month

Demands

1

20

2

30

3

23

4

19

5

32

6

28

Order Period Ordering cost Holding Cost Avg cost / period

one month

90

90

two months

90

1.2(32) = 38.4

three months

90

1.2(32)

+2.4(28)=105.6

128.4 / 2 = 64.2

M=2

195.6 / 3 = 65.2

Order quantity = 19 + 32 = 51

16

Least Unit Cost Heuristic

Compute average cost per unit demanded rather

average cost per period.

Order period

Ordering cost

Holding cost

Cost / unit

One period

K

0

K / D1

Two periods

K

hD2

(K+hD2) / (D1

+ D2)

Three periods

K

hD2 + 2hD3

Four periods

K

hD2 + 2hD3 +

3hD4

(K+ hD2 +

2hD3) / (D1 +

D2 + D3)

(K+ hD2 +

2hD3 + 3hD4) /

(D1+D2+D3+D)

17

Example: K = $90 ; h = 1.20 per unit per month

Month

Demands

Order Period

1

20

2

30

Ordering cost

3

23

4

19

Holding Cost

5

32

6

28

Avg cost / unit

one month

90

two months

90

1.2(30) = 36

126/ 50 = 2.52

three months

90

1.2(30)

+2.4(23)=91.2

181.2 / 73 = 2.48

Four months

90

90/20 = 4.50

91.2 + 3.6 (19)

= 159.6

M=3

249.6 / 92 = 2.71

Order quantity = 20 + 30 + 23 = 73

18

Part Period Balancing (PPB)

Attempts to minimize the sum of the variable cost for all lots.

Definition:

Part period = one unit held in inventory for one period

PPm = part period for m periods

PP1 = 0

PP2 = D2

PP3 = D2 + 2D3

PPm = D2 + 2D3 + … + (m-1) Dm

19

Continued Part Period Balancing (PPB)

Inventory holding cost = h (PPm)

Find m so that K h(PPm) or PPm

K/h

Order quantity = Q = D1 + D2 + … + Dm

20

Example problem continued

Example: K = $90 ; h = 1.20 per unit per month

Month

Demands

1

20

2

30

3

23

4

19

5

32

6

28

K / h = 90 / 1.2 = 75

PP1 = 0

PP2 = 30

PP3 = (30) +2(23)= 76 stop!

Q1 = 20 + 30 + 23 = 73

Starting month 4:

PP1 = 0

PP2 = (32)

PP3 =32 + 2 (28) = 88 stop

Q2 = 19 + 32 + 28 = 79

21

An Old Favorite

Wk1 Wk2 Wk3 Wk4 Wk5 Wk6 Wk7 Wk8 Wk9 Wk10

42

42

32

12

26

112

PPm K/h = 132 / .6 = 220

pp1 = 0

pp2 = 42

Pp3 = 42 + (2) 32 = 106

pp4 = pp3 + 3(12) = 142

pp5 = pp4 + 4(26) = 246

Q1 = 42 + 42 + 32 + 12 + 26 = 154

45

14

76

38

pp1 = 0

pp2 = 45

pp3 = 45 + (2) 14 = 73

pp4 = 73 + 3(76) = 301

Q6 = 112 + 45 + 14 + 76 = 247

Q10 = 38

Wk1 Wk2 Wk3 Wk4 Wk5 Wk6 Wk7 Wk8 Wk9 Wk10

42

154

112

42

32

12

26

70

38

26

0

112

247

135

45

14

76

90

76

0

38

38

0

22

cost =3 x 132 + 328 x .60 = $724.20

Our Feature Presentation

The Wagner-Whitin Algorithm

The Whole Thing!

The Big Enchilada

23

The General Problem

n

Min

C (Q ) h I

t 1

t

t

t

t

subject to :

I t I t 1 Qt Dt

t 1, 2,..., n

Qt , I t 0,1, 2,3,...

Qt = production or order quantity in period t

It = inventory at the end of period t

Ct(Qt) = cost of production in period t

ht(It) = holding cost from period t to t+1

24

The Linear Problem

n

Min

K

t 1

t

ct Qt ht I t

subject to :

I t I t 1 Qt Dt

t 1, 2,..., n

Qt , I t 0,1, 2,3,...

Qt = production or order quantity in period t

It = inventory at the end of period t

Kt = fixed cost of production in period t

Ct = cost of production in period t

ht = holding cost per unit carried from period t to t+1

25

A Simpler Problem?

n

Min

K

t 1

t

cQt h I t

subject to :

I t I t 1 Qt Dt

t 1, 2,..., n

Qt , I t 0,1, 2,3,...

n

Min

K

t 1

h It

t

n

since

cQ

t 1

t

n

n

t 1

t 1

c Qt c Dt

26

n

Min

K

t 1

t

h It

subject to :

I t I t 1 Qt Dt

t 1, 2,..., n

Qt , I t 0,1, 2,3,...

Property 1: A replenishment only takes place when

the inventory level is zero. Therefore

Qk = 0, or Dk or Dk + Dk+1 or … or Dk + Dk+1 + … + Dn

It-1 Qt = 0

Property 2: There is an upper limit to how far before a

period j we would include its requirements, Dj in a

replenishment quantity. That is, the carrying costs

become so high that it is less expensive to have a second

replenishment occur.

27

A Wagner-Whitin Example

The Maka Parte Company makes parts for General Motors

automobiles. One part they make is a vulcanized tri-solenoid

distributor. A primary component used in the manufacture of

this distributor is a silicon computer chip. This chip is purchased

from a vendor - Outspeak Corp. Ordering costs are $70 and holding

costs are $ .5 per item per month. Demands for the next six months

based upon an exponential smoothing model with seasonal effects are:

Nov

120

Dec

80

Jan

94

Feb

78

Mar

86

Apr

110

28

A Wagner-Whitin Example

n = 6 (Apr)

Q6 = 110;

f = $70

n = 5 (Mar/Apr)

Q5 = 86, 196

f5(86) = 70 + 70 =140

f5(196) = 70 + .5 (110) = 125

Order Cost = $70

Holding cost = .5

Nov Dec Jan Feb Mar Apr

120 80 94 78 86 110

n = 4 (Feb/Mar/Apr)

Q4 = 78, 164, 274

f4(78) = 70 + 125 = 195

f4(164) = 70 + .5 (86) + 70 = 183

f4(274) = 70 + .5(86) + 1.00 (110) = 223

29

A Wagner-Whitin Example

Order Cost = $70

Holding cost = .5

Nov Dec Jan Feb Mar Apr

120 80 94 78 86 110

n = 3 (Jan/Feb/Mar/Apr)

Q3 = 94, 172, 258, 368

f3(94) = 70 + 183 = 253

f3(172) = 70 + .5 (78) + 125 = 234

f3(258) = 70 + .5(78) + 1.00 (86) + 70 = 265

f3(368) = 70 + .5(78) + 1.00 (86) + 1.5(110) = 360

30

A Wagner-Whitin Example

Order Cost = $70

Holding cost = .5

Nov Dec Jan Feb Mar Apr

120 80 94 78 86 110

n = 2 (Dec/Jan/Feb/Mar/Apr)

Q2 = 80, 174, 252, 338, 448

f2(80) = 70 + 234 = 304

f2(174) = 70 + .5 (94) + 183 = 300

f2(252) = 70 + .5(94) + 1.00 (78) + 125 = 320

f2(338) = 70 + .5(94) + 1.00 (78) + 1.5(86) + 70 = 394

f2(448) = 70 + .5(94) + 1.00 (78) + 1.5(86) + 2(110) = 544

31

A Wagner-Whitin Example

Order Cost = $70 Holding cost = .5

Nov Dec Jan Feb Mar Apr

n = 1 (Nov/Dec/Jan/Feb/Mar/Apr)

120 80 94 78 86 110

Q1 = 120, 200, 294, 372, 458, 568

f1(120) = 70 + 300 = 370

f1(200) = 70 + .5 (80) + 234 = 344

f1(294) = 70 + .5(80) + 1.00 (94) + 183 = 387

f1(372) = 70 + .5(80) + 1.00 (94) + 1.5(78) + 125 = 446

f1(458) = 70 + .5(80) + 1.00 (94) + 1.5(78) + 2(86)+70= 563

f1(568) = 70 + .5(80) + 1.00 (94)

+ 1.5(78) + 2(86) + 2.5(110) = 768

Q1 = 200;

Q3 = 172;

Q5 = 196 ; Cost = $344

32

Capacity Constraints

n

Min

C (Q ) h I

t 1

t

t

t

t

subject to :

Qt Pt

I t I t 1 Qt Dt

t 1, 2,..., n

Qt , I t 0,1, 2,3,...

33

Why isn’t Wagner-Whitin used more frequently?

• relatively complex

• needs a well-defined ending point

• all information out to end point needed even to

compute initial quantity

• within MRP systems using rolling schedules, the

solution will keep changing

• the assumption that replenishments can be made

only at discrete intervals

• computational requirements

34

No Fixed Cost

n

Min

c Q h I

t 1

t

t

t

t

subject to :

Qt Pt

t 1, 2,..., n

I t I t 1 Qt Dt

35

The Transportation Problem

n

n

Min z ctj xtj

t 1 j t

where ctj ct ht 1 ht 2 ... h j 1

subject to:

n

x

j t

tj

j

x

t 1

ij

Pt

t 1, 2,..., n

Dj

j 1, 2,..., n

xtj = number of units produced in month t

to satisfy month j demands

36

The Example

Month

Shift

March

R

O

R

O

R

O

R

O

R

O

R

O

April

May

June

July

August

Demands

March April

10

12

M

M

M

M

M

M

M

M

M

M

16

12

14

11

13

M

M

M

M

M

M

M

M

24

May

June

July

14

16

13

15

12

14

M

M

M

M

M

M

16

16

18

15

17

14

16

13

15

M

M

M

M

24

18

20

17

19

16

18

15

17

14

16

M

M

16

August Dum supply prod

cost

20

0

16

10

22

0

6

12

19

0

15

11

21

0

5

13

18

0

17

12

20

0

6

14

17

0

16

13

19

0

6

15

16

0

18

14

18

0

8

16

15

0

12

15

17

0

5

17

24

10

130

h = $2 per unit per month

37

What can we conclude from all of this?

• Most heuristics outperform EOQ

• the Silver-Meal heuristic incurs an average cost

penalty relative to Wagner-Whitin of less than 1

percent.

• Significant costs penalties using Silver-Meal will

incur if

– demand pattern drops rapidly over several periods

– when there are a large number of periods having no

demand

38

Can we have some

really neat

homework

problems? Huh?

Text: Chapter 7: problems 13, 14, 17, 18, 19, 22

39

Safety Stock

When demand or lead-time is random (or both), then safety stock

may be established as a “hedge” against uncertain demands.

For the deterministic case: R = D L

For the stochastic case:

R = LTDavg + s where

LTD = a random variable, the lead-time demand,

LTDavg = average lead-time demand and s is the safety stock.

40

Safety Stock based on Fill Rate

Shortage probability

Pr{LTD > R) = p

R

LTDavg

LTD

s

Fill rate criterion: set s = z STD

where STD = standard deviation of the lead-time demand distribution

then

R = LTDavg + z STD

41

But I need to know when

demands are lumpy, don’t I?

Compute the variability coefficient,

v=

variance of demand per period

square of average demand per period

n

V

n Dt2

t 1

1

F

I

DJ

G

H K

2

n

t

If V < .25 , use EOQ with Davg

else use a DLS method

t 1

42