bank liability products

advertisement

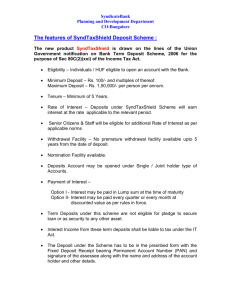

BANK LIABILITY PRODUCTS CONTENTS Savings A/c Current A/c Modes of operation Term Deposit NRE/NRO/FCNR SAFE DEPOSIT ASSET AND LIABILITY In households, we store our excess money with banks 9ref next fig.). Sometime one of us might need money which we might not have. We then approach a bank for borrowing money. Thus for lending us money bank charges some additional percentage of money along with the principal amount. Banks don’t have their own money and so they lend from the deposited money. The money deposited which lies with the bank earns another interest, paid from the borrowers interest expense. Therefore the deposited money is the banks liability as interest is paid on that sum to the depositor. On the other hand the loaned out money becomes the asset for the bank and earns interest. HOW BANKS CREATE MONEY LIABILITY ASSET Bank Your / Depositors money Deposit interest Borrowers loan Loan interest TYPES OF LIABILITY Demand liabilities are repayable on demand. Savings bank, current are examples Of demand liability. Time liabilities are liabilities which are repayable after a specified period. Term deposits are such. ACCOUNTS FOR SAVINGS Minor account Age above 10yrs Account to be opened with association of a guardian School ID required Operation needs to be done by the guardian till minor attain 13 yrs of age Joint Account Account opened by two people or more Operation as either equally, or survivor, former, both jointly Bank doesn't have right to set-off Stop payment can be made by any of the holders HUF The primary holder is the karta HUF special PAN card is required for a/c opening While the karta is supreme the major male coparceners are also allowed to operate Partnership firm a/c: This a/c is opened to share profits of a business done by all or any one of them. All partners need to operate account jointly Demise of a partner will bring to closure Limited Companies: Can open a/c as a legal entity in form of public, private or govt. Authorized signatories are critical here Death of any opening member does not lead to stopping operations Trust Account The trust deed needs to be examined to understand the powers of the trustees Insolvency of a member of the trust is not insolvency of the trust itself All members need to operate jointly Opening The account should be opened with the signatures of three persons ie: presidents/ secretary / treasury where in presidents sig. is essential. Fund can be with any bank approved by the registrar Accounts account of co-operative societies for govt. and public bodies The main functions are: paying, receiving, collecting, and remitting money on behalf of the govt. dept There are no overdraft facicliities HOW INTEREST IN SAVINGS IN ACCOUNT IS CALCULATED Prevailing rate of interest: The rate of interest at present is 3.5%. Interest calculation method: Savings bank accounts are low cost running accounts opened for saving purpose. In savings bank a/c interest is calculated on monthly products. Product is the amount on which interest is calculated. In SB a/c, product for a particular month is the minimum balance between 10th and last day of the month. The formula for calculating interest is: Product X Rate of Interest ------------------------------ = INTEREST 12 X 100 MODE OF OPERATION An Account may be operated in the names of an individual in his/her own name or two or more persons in their joint names Bank may send relevant material through courier or post from time to time to the mailing address furnished by the Customer The Customer is / are expected to examine the entries in the Account statement on receipt, The Customer shall maintain the Account with a minimum balance as prescribed by Bank Customers who attain the age of 60 years are required to declare so to avail the benefits offered Transfer of account should be followed with given request All account details should be safely maintained by the ACCOUNT OPERATING INSTRUMENTS Checks and drafts Debit and credit cards Phone and internet banking ECS, standing instruction MT,TT,TC CURRENT ACCOUNT DEPOSITS Opened for business purpose. May be required to maintain a minimum balance No interest is paid. It needs a higher minimum balance to be maintained as compared to the savings account. No restriction for withdrawals. Charges are collected for cheque book. DORMANT ACCOUNTS Banks may classify an Account as an inactive if there are no customer-induced transactions for 12 months in the Account. Dormant if there are no customer-induced transactions for 24 months in the account. Customer induced transactions includes: Transactions through cheque,Cash or cheque deposit.Withdrawal or deposit through ATM.Transaction through internet.Transaction by standing instruction, ECS and EFT.Inward/Outward bill.Mandate for crediting interest earned on Fixed deposit to Savings Bank Account. DIFFERENCE BETWEEN CURRENT & SB Current account Savings account Business purpose Charges collected for cheque book Higher minimum balance charges Saving purpose Charges not collected for cheque book Lower minimum balance charges No folio charges Folio charges are applied TERM DEPOSITS Deposits repayable after expiry of a fixed period say from 07 days to 120 months are classified as term deposits. Term Deposits are also called FDs and are repayable after the expiry of the specified term varying from 7 days to 120 months. FDs are repayable only after the specified term; therefore they are not as liquid as savings deposits. Therefore, the rate of interest paid on FDs is higher than the rate of interest on savings deposits. The period is agreed upon by the Bank and the customer at the time of deposit and may be varied by mutual consent. The rate of interest is left to the banks discretion. Banks fix rates based on their operational costs, however based on guidelines from RBI. There is no restriction to accept deposits in odd amounts. Accounts can be opened in the name of individuals, joint names, business units like partnership firms, corporate (Private and Public) societies, trust, clubs etc. TERM DEPOSITS AVAILABLE Short term Fixed term Reinvestment deposit Recurring deposit Flexi Fixed deposit • Standard fixed products •Deposit can be kept up to 120 months. •Compound interest. Principal and interest paid on maturity. •Fixed amount is deposited with monthly frequency. Penalty is charged for defaulted installment. •TDS not applicable on interest earned. Should be linked with operative account. Automatic sweep in & sweep out facility. NRE/NRO/FCNR DEPOSIT SAFE DEPOSIT LOCKERS It is a facility provided by banks to their customers for safe keeping of valuables , documents etc. A locker rent charge is to be paid by the locker owner and there are two keys available one of which will be with the banker the other with the owner. RBI permits banks to take actions against non payment of rent or locker remaining un-operational for a considerable period of time. RBI also instruct banks to open lockers classifying the risk profile of the customer based on KYC. There may be more than one owner for joint lockers owners. LOCKER RENTS