Accnt 1050 -- Fall 95 -- GDuke Introduction to Financial Accounting

advertisement

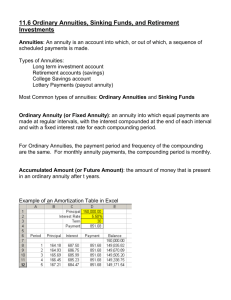

Appendix-1 Appendix – Compound Interest: Concepts and Applications FINANCIAL ACCOUNTING AN INTRODUCTION TO CONCEPTS, METHODS, AND USES 10th Edition Clyde P. Stickney and Roman L. Weil Appendix-2 Learning Objectives 1. Begin to master compound interest concepts of future value, present value, present discounted value of single sums and annuities, discount rates, and internal rates of return on cash flows. 2. Apply those concepts to problems of finding the single payment or, for annuities, the amount for a series of payments required to meet a specific objective. 3. Begin using perpetuity growth models in valuation analysis. 4. Learn how to find the interest rate to satisfy a stated set of conditions. 5. Begin to learn how to construct a problem from a description of a business situation. Appendix-3 Appendix Outline 1. Compound interest concepts 2. Future value concepts 3. Present value concepts 4. Nominal and effective rates 5. Annuities a. Ordinary annuities or annuities in arrears b. Annuities due 6. Perpetuities 7. Implicit interest rates: finding internal rates of return Appendix Summary Appendix-4 1. Compound interest concepts A dollar to be received in the future is not the same as a dollar presently held, because of: Risk -- you may not get paid Inflation -- the purchasing power of money may decline Opportunity cost -- cash received today can be invested and turn a positive return Compound interest concepts (a.k.a. present value or time value of money or discounted cash flow) are mathematical methods of ascribing value to a future cash flow recognizing that a future cash payment is not as valuable as the same amount received earlier. Appendix-5 1.a. Compound interest concepts All three factors--risk, inflation and opportunity cost-can be captured in a single number, the interest rate. That is, the interest rate contains a component to compensate for risk and inflation and alternative opportunities for investment. The time value of future cash flows can be measured by the amount of interest the cash flow would earn at an appropriate rate of interest. Also, interest earned accumulates and earns interest itself -- this is called compound interest. Appendix-6 1.b. Compound interest example Consider a $10,000 loan at 12% interest for one year. Simple interest would be 12% divided by 12 months or 1% per month. One percent of $10,000 is $100 so the interest would be $100 per month or $1,200 for the year or $11,200 in total including the principle. If you were entitled to the interest each month, you could withdraw the interest. If you did not, then that interest itself has time value and should earn further interest. The total cost of the loan under monthly compounding of the interest is $11,268.25. (You will learn how to compute this value in the next section). This is a small increase, $68.25, but it is an increase and could be significant for long periods or high interest rates. Appendix-7 2. Future value concepts The future value of one dollar is the amount to which it will grow at a given interest rate compounded for a specified number of periods. The future value of P dollars is P time the future value of one dollar. The future value F is considered the equivalent in value of the present value P because the F will not be received until some time in the future. Appendix-8 2. Future value concepts (cont) P dollars invested at r percent interest will grow to P(1+r) at the end of the first period. If this amount, P(1+r), continues to earn r percent interest, the at the end of the second period it will be P(1+r)(1+r) which is P(1+r)2. In like manner, it will grow to P(1+r)3 in 3 periods And in general it will grow after n periods to the future value Fn given by: Fn = P(1+r)n where P is the principle r is the rate of interest and n is the number of periods Appendix-9 2. Future value (example) Consider a certificate of deposit, CD, which pays a nominal rate of 6% per year compounded monthly. You invest $5,000. How much will your CD be worth when it matures in one year? Fn = P(1+r)n since the CD compounds monthly, r = 6% /12months = 0.5 % per month n = 1 year * 12months = 12 periods Fn = $5000(1.005)12 = 5000(1.061678) = $5308.39 which is a little better than 6% simple interest. Thus, your CD will earn $308.39 on $5000. Appendix-10 3. Present value concepts Present value is the reverse of future value. If the future value of x dollars is y; then the present value of y dollars is x. Present value answers the question, how much must be invested to grow at r rate of interest compounded for n periods. The present value P is considered the equivalent in value of the future value F because the F will not be received until some time in the future. Appendix-11 3. Present value concepts P dollars invested at r percent interest for n periods will grow to P(1+r) n. Recall that the future value is given by: Fn = P(1+r)n Solving for P gives the equation for the present value: Fn P n (1 r ) where P is the principle r is the rate of interest and n is the number of periods Appendix-12 3. Present value example You hold a bond which pays no interest but will pay $10,000 upon maturity in three years. You need cash now, so you try to sell the bond. A bank says that they can’t pay you $10,000 because money has time value, but that they will pay you the present value discounted at 9% compounded annually. How much is the bank offering you? P = Fn (1+r)-n = 10000 (1.09)-3 = 10000/1.295 = $7,722 Thus, the bank will pay you $7,772 for your $10,000 bond. Is this a good price? Appendix-13 4. Nominal and effective rates By convention and subject to some federal regulations, many interest rates are stated as an annual rate and do not include the effects of compounding. This rate is called the nominal rate of interest. The rate which includes the effects of compounding is called the effective rate. As we saw in an earlier example, 12% per year nominal rate of interest compounded monthly actually yields 12.68% return because of compounding effects. Nominal rates are given for simplicity and are almost always stated as an annual rate for purposes of comparing different alternative rates. Appendix-14 4. Effect of compounding periods What difference does the compounding period make if the nominal rate is the same? Consider the following loans all with a 12% nominal or annualized rate of interest: Compound Period compounded annually compounded quarterly compounded monthly compounded weekly compounded daily compounded every minute compounded continuously number of periodic rate periods of interest 1 12 4 3 12 1 52 0.2307 365 0.0329 525600 0.0000228 ----- effective rate 12.0000 12.5509 12.6825 12.7341 12.7475 12.7497 12.7497 Yield increases as the compounding period is shortened Appendix-15 5. Annuities An annuity is a series of equal payments, one per period equally spaced through time. Examples include monthly rental payments, semiannual corporate bond coupon payments and mortgage payments. Mathematically, an annuity can be solved as the sum of individual compound interest problems. If time periods are not equally spaced or if the amounts vary, then the series of payments is not an annuity. Appendix-16 5. Annuities (cont) Annuity concepts are important in the accounting for bonds and leases. The present value of an annuity is its present day cash value -- conceptually you can sell or buy an annuity for this value. The future value of an annuity is the amount to which payments will grow if invested an left to compound. The non-discounted value of an annuity is the sum of the payments which is the number of payments times the payment amount. Annuities are of two types: Ordinary annuities, or Annuities due. Appendix-17 5.a. Ordinary annuities Ordinary annuities payments are due at the end of each period. Consider an ordinary annuity of $100 per period for five periods: The payments are made at the end of each period. Coupon payments on a bond are ordinary annuities; payment is made after the period. Appendix-18 5.a. Ordinary annuities -- example Consider the same ordinary annuity of $100 per period for five periods: What is the present value if the appropriate rate of interest is 7%? This can be solved by several methods: Present value tables Computers or calculator Formula Appendix-19 5.a. Ordinary annuities -- example One good way to understand annuities is to work the problem as five separate present value problems and then add the results: PVannuity = PV1 + PV2 + PV3 + PV4 + PV5 = 100(1.07)-1 +100(1.07)-2 +100(1.07)-3 +100(1.07)-4 +100(1.07)-5 = 100/(1.07) +100/(1.145) +100/(1.225) +100/(1.311) +100/(1.403) = 93.46 + 87.34 + 81.63 + 76.29 + 72.30 = $410.02 Thus, the non-discounted value of the annuity is the sum of the payments ($500), but the value discounted at 7% is $410.02. Appendix-20 5.b. Annuities due Annuities due payments are due at the beginning of each period. Consider an annuity due of $100 per period for five periods: The payments are made at the beginning of each period. A monthly rent payment is an annuity due; you pay in advance of usage. Appendix-21 5.b. Annuities due -- example This problem is similar to the ordinary annuity except that all payments are moved forward by one period. The first payment is received immediately so it is not discounted. Note that using zero to designate the present makes the formula work: PVannuity = PV0 + PV1 + PV2 + PV3 + PV4 = 100(1.07)-0 +100(1.07)-1 +100(1.07)-2 +100(1.07)-3 +100(1.07)-4 = 100/(1) +100/(1.07) +100/(1.145) +100/(1.225) +100/(1.311) = 100 + 93.46 + 87.34 + 81.63 + 76.29 = $437.72 Notice that the present value of the annuity due is exactly 1.07 times the present value of the ordinary annuity. Appendix-22 5.c. Mathematical reconciliation An annuity due is the same as an ordinary annuity with each payment shifted forward one period. Since the annuity due is received earlier and money has time value, the annuity due is more valuable. Since each payment is shifted by one period, you can adjust from an annuity due to an ordinary annuity (or back) by the following formula: annuity due = (1+r)*ordinary annuity Appendix-23 6. Perpetuities Perpetuities are annuities that last forever. There are few real perpetuities, but they give good insight into annuities. The present value of a perpetuity is: Pperpetuity=A*(1+1/r) Examples of perpetuities include some Canadian and some British government bonds. Appendix-24 7. Implicit interest rates The present value of a lump sum problem has four components: P, the present value F, the future value r, the rate of interest and n, the number of periods Which are related by the formula: Fn = P(1+r)n Any three of the components determines the fourth, or you can solve for any component if you know the other three. Appendix-25 7. Implicit interest rates (cont) In implicit interest rate problems, we solve for the interest rate. That is, given a P, V and the number of periods, the r which makes the equation balance is know as the implicit interest rate, a.k.a. the internal rate of return. There is often no direct solution to these types of problems, instead, the solution is reached through iterative mathematical methods. Appendix-26 Appendix Summary This appendix introduces compound interest problems and the related problems of present value, discounted cash flows and time value of money. The applications of present value and future value of both an annuity and a lump sum are introduced. Perpetuities and implicit interest rates are introduced. These methods are very valuable to the accountant in valuing liabilities.