Save

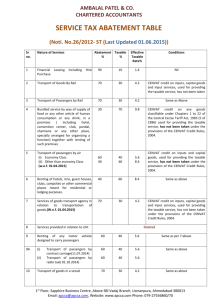

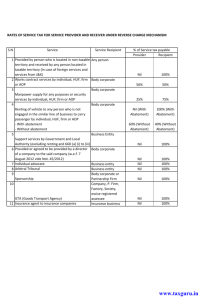

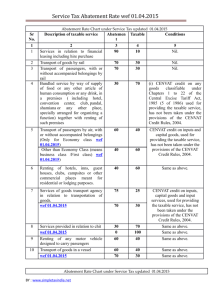

advertisement

FAQ on Reverse Charge, Abatement, Negative List, Place of Provision of service Posted In Service Tax | Articles | No Comments » Rajeev Kumar Gupta Service Tax –Key Points Introduction Service tax is a tax levied by the government on service providers on certain service transactions, but is actually borne by the customers. It is categorized under Indirect Tax and came into existence under the Finance Act, 1994. The service provider pays the tax and recovers it from the customer with certain exceptions. Service Tax was earlier levied on a specified list of services, but in the 2012 budget, its scope was increased. Services provided by air-conditioned restaurants and short term accommodation provided by hotels, inns, etc. were also included in the list of services. It is charged to the individual service providers on cash basis, and to companies on accrual basis. This tax is payable only when the value of services provided in a financial year is more than Rs 10 lakh. This tax is not applicable in the state of Jammu & Kashmir. Reverse Charge Q. What is Reverse Charge? Generally, Service tax is payable by person providing the service who actually collect the tax and pays to government. But Section 68(2) introduced and makes provision for reverse charge i.e. making person receiving the service, liable to pay tax. Provision can be made that part of tax will be paid by service receiver and part by service provider or entire by Service Receiver. Provisions relating to reverse charge are contained in Notification No. 30/2012-ST dated 206-2012. See Appendix 2 for tax of the Notification and which amend from time to time. Q. How to book Cenvat Credit on Service Tax paid on reverse charge basis? In case of an input service where service tax is paid on reverse charge by the recipient of the service, the CENVAT credit in respect of such input service shall allowed on or after the day on which: - payment is made on the value of input service and - Service tax paid or payable as indicated in invoice referred in Rule 9. Even if Service Provider is liable for payment of service tax in certain portion ie partial reverse charge then Cenvat Credit can be availed on entire input w.r.t.334/1/2012 Q Cenvat credit cannot be used to pay tax by service receiver. Service tax as to be paid by cash only i.e. GAR-7 challan. What are the services under reverse charge? ♣ Under Partial Reverse Charge (Proportional / Joint) 1. Renting of motor vehicles 2. Manpower supply & security services 3. Works contracts ♣ Under Full Reverse Charge (100%) 1. 2. 3. 4. 5. 6. 7. 8. Insurance related services by agents Goods Transportation By Road Sponsorship Arbitral tribunals Legal services Company director’s services Services provided by Government / local authority excluding specified services Services provided by persons located in non-taxable territory to persons located in taxable territory. Abatement Q What is abatement? Q Abatement means that service tax is paid on specified % of amount mentioned on the invoice. Input credit cannot availed. What are the rates of Abatement? Taxable Service Partial abatement / Composition Scheme Conditions No Cenvat 10% of amount charged Credit. Invoice Accommodation (Abatement Scheme, should be booking service by inclusive of though really it is tour operator composition scheme) cost of accommodation Air Travel Agent Relevant Notification/Rule Sr. No. 11(ii) of Notification No. 26/2012-ST dated 20-6-2012. Option to pay service tax at flat rate on ‘basic fare’ @ 0.6% in case of No restriction domestic booking and Rule 6(7) of on availment of 1.2% in case of Service Tax Rules Cenvat credit international booking – plus education cess (Composition Scheme) Bundled service by Tax on 70% of amount Cenvat credit way of supply of charged including fair of input Sr. No. 4 of Notification No. food or any other article of human consumption or any drink, in a premises ( including hotel, convention center, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises value of goods and services supplied by service receiver (to service provider) under same or different contract services and 26/2012-ST dated capital goods is 20-6-2012 available. Cenvat credit on food items (covered under Chapters 1 to (Composition Scheme) 22 of CETA) not available. Cenvat credit of other inputs is available. Chit related services Sr. No. 8 of Tax on 70% of amount No Cenvat Notification No. charged (Abatement Credit allowed 26/2012-ST dated Scheme) 20-6-2012. Financial leasing and hire purchase Tax on lease management fee, No restriction processing fee, on availment of documentation charges Cenvat Credit and administrative fee plus 10% of interest Sr. No. 1 of Notification No. 26/2012-ST dated 20-6-2012 Construction of a complex, building, civil structure or a part thereof, intended for a sale to a buyer, wholly or partly, if value of land is included in the amount charged from the service receiver Tax on 25% of amount charged including fair market value of all goods and services supplied by recipient (termed as Abatement Scheme – actually it is composition scheme) Sr No. 12 of Notification No. 26/2012-ST dated 20-6-2012 Cenvat credit of input services and capital goods can be taken but not of input goods At slab rates prescribed under rule 6(7B)on No restriction Foreign Currency – total gross amount of Rule 6(7B) of on availment of sale and purchase currency exchanged Service Tax Rules Cenvat Credit (Optional Composition Scheme) Value is difference between buying or No restriction Foreign Currency – selling rate and RBI on availment of sale and purchase reference rate (Normal Cenvat Credit Scheme of valuation) Life Insurance Rule 2B of Service Tax (Determination of Value) Rules 3% of net premium No restriction (excluding investment Rule 6(7A) of on availment of or savings part, if such Service Tax Rules Cenvat Credit amount is informed to policy holder) – If not so informed, 3% in first year and 1.5% in subsequent years(Composition Scheme) Lottery ticket promotion Rs. 7,000 or Rs. 11,000 per Rs. 10 lakhs of No restriction Rule 6(7C) of tickets printed by State on availment of Service Tax Rules lottery (Composition Cenvat Credit Scheme) Outdoor caterer Cenvat credit of input services and capital goods is available. Tax on 60% amount Cenvat credit excluding State Vat on food items (Composition Scheme) (covered under (Till 1-7-2012, it was Chapters 1 to 50%) 22 of CETA) not available. Cenvat credit of other inputs is available. Rule 2C of Service Tax (Determination of Value) Rules Tax payable on 40% of Renting of motor amount No Cenvat vehicle designed to charged (Abatement credit available carry passengers Scheme) Sr. No. 9 of Notification No. 26/2012-ST dated 20-6-2012 Restaurant service Cenvat credit of input services and capital goods is available. Tax on 40% amount Cenvat credit excluding State Vat of excise duty (Composition Scheme) on food items (Till 1-7-2012, it was (covered under 30%) Chapters 1 to 22 of CETA) not available. Cenvat credit of other inputs is available. Rule 2C of Service Tax (Determination of Value) Rules Renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or Tax payable on 60% of amount charged (Abatement Scheme) (Till 1-7-2012, the tax payable was on 50% amount). Sr. No. 6 of Notification No. 26/2012-ST dated 20-6-2012 Cenvat Credit of input services allowable but no Cenvat credit of inputs lodging purposes Tour operator – Package tours (“package tour” means a tour wherein transportation, accommodation for stay, food, tourist guide, entry to monuments and other similar services in relation to tour are provided by the tour operator as part of the package tour to the person undertaking the tour). and capital goods No Cenvat credit available. Tax is payable on 25% of gross amount Bill to be charged (Abatement inclusive of all Scheme) charges for the tour. Tour operator – providing services solely of arranging or booking accommodation for Tax is payable on 10% any person in of amount charged relation to a tour (If (Abatement Scheme) Bill includes cost of accommodation) Tour operator – Other than package tours and other than service of booking Tax is payable on 40% accommodation of amount charged where Bill includes (Abatement Scheme) cost of accommodation Sr. No. 11(i) of Notification No. 26/2012-ST dated 20-6-2012 No Cenvat credit available. Bill to be inclusive of charges for such accommodation Sr. No. 11(ii) of Notification No. 26/2012-ST dated 20-6-2012 No Cenvat credit available. Sr. No. 11(iii) of Notification No. Bill to be 26/2012-ST dated inclusive of all 20-6-2012 charges for the tour Transport of goods by rail Sr. No. 2 of Tax payable on 30% of No restriction Notification No. amount charged on availment of 26/2012-ST dated (Abatement Scheme) Cenvat Credit 20-6-2012 Transport of goods by road by Goods Transport Agency (GTA) No Cenvat Tax payable on 25% of Credit available amount charged (Certificate (Abatement Scheme) should be taken from the GTA Sr. No. 7 of Notification No. 26/2012-ST dated 20-6-2012 that he has not availed Cenvat credit, as tax is payable by service receiver under reverse charge – this headache was not there earlier) Transport of goods in a vessel from one port in India to another Tax payable on 50% of No Cenvat amount charged Credit (Abatement Scheme) available) Sr. No. 10 of Notification No. 26/2012-ST dated 20-6-2012 Transport of passengers by air Cenvat Credit of input services Tax payable on 40% of allowable but amount charged no Cenvat (Abatement Scheme) credit of inputs and capital goods Sr. No. 5 of Notification No. 26/2012-ST dated 20-6-2012 Transport of passengers by rail Sr. No. 3 of Tax payable on 30% of No restriction Notification No. amount charged on availment of 26/2012-ST dated (Abatement Scheme) Cenvat Credit 20-6-2012 Cenvat credit of input services and capital goods is available. Cenvat credit of excise duty on goods, the property of Tax on 25% of amount which is charged including fair transferred is market value of all not available. goods and services Cenvat credit supplied by recipient of other inputs (termed as Abatement (like Scheme – actually it is consumables) composition scheme) is available Tax on value of service calculated as per rule 2A(i) or Tax on 25%/40%/60% of gross amount charged as specified in rule 2A(ii) (Composition Scheme) Works Contract Service Rule 2A of Service Tax (Determination of Value) Rules Negative List Q What is negative list? List of services on which service tax is specifically exempted under section 66D Q What is the services covered in negative list? A- Advertisement (except on radio & T.V.) B- Bridges C- Cabs (means transportation of passengers) D- Diplomatic mission E- Electricity F- Funeral (includes transportation of deceased) G- Goods Transportation H- House Residential I- Interest J- Jhule (Rides) K- Kheti (agriculture) L- Lottery M- Manufacture Q- Qualification (education) R- RBI S- Sarkar (government) T- Trading of Goods Place of Provision of service (POPOS) Q What is place of provision of service? It is to seen that service is provided in Taxable Territory or Non Taxable Territory. For this place of provision of service is to be identified There are 13 Rules to identify POPOS Q What are the rules for identifying POPOS? Rule Basis POPOS 3 General Shall be place of service receiver 4 Performance based service Shall be place where service is performed 5 Immovable Property related Shall be place where immovable service property is located 6 Event based service Shall be the place where event is performed 7 Services provided at more than one location (overrides Rules 4,5 & 6) Shall be the taxable territory where the greatest proportion of the service is provided 8 Situations where place of provision of service outside the taxable territory, however service Shall be Taxable Territory provider and recipient located in taxable territory Specified services such as: 9 Intermediary services Online information & database access or retrieval Shall be the place of service provider services Banking Hiring of means of transport (up to 1 month) Transportation of goods 10 – By road i.e. GTA Shall be the place of destination of goods – By other modes except mail or courier Passenger transportation services 11 Rule 14 Where a service falls under more than one rule then the rule which appears later shall be applicable Place where the passenger embarks on the conveyance for a continuous journey 12 Services provided on board a conveyance First scheduled point of departure of that conveyance of a journey 14 Where a service falls under more than one rule then the rule which appears later shall be applicable (Author is associated with Rajeev Gupta & Co and can be contacted at Mobile No: 9810644840 or via email on rkg_delhica@yahoo.co.in) - See more at: http://taxguru.in/service-tax/faq-reverse-charge-abatement-negative-list-placeprovision-service.html#sthash.2X2KyHPm.dpuf